By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Home Price Increase Slowing Down

The housing market is one of the most important economic sectors for a variety of reasons. The home is usually the biggest investment and store of value that a person has. The whole process of building, selling, furnishing and maintaining a home creates jobs. A healthy housing market begets a healthy economy. Lately, there has been quite a bit of good news for the home buyer as mortgage rates have been falling. Now, it seems that average home prices are at least stabilizing and in many markets the prices have been coming down quickly as well. This is despite some chronic issues in the market such as labor shortages and more expensive materials.

Wealth Taxes

The latest offering from Bernie Sanders is a proposal for an 8% tax on "wealth." This approach has been favored by many politicians over the years as it seems a logical way to raise revenue for the government and a logical way to improve the financial position of those not considered wealthy. The problem is these efforts rarely have the desired impact. The definition of "wealth" is trickier than it would seem as people can be considered wealthy from cash, their investments, land, intangible assets and the like. Then, there is the matter of incentives. Taxing income motivates people to make less money or to find ways to store their money in ways it can't be taxed. Most of the efforts to tax wealth directly have been distorting and disappointing if the real goal is to raise revenue or to improve the financial position of those who are not wealthy.

Markets Reacting to Impeachment Decision

At this point, it is considered unlikely that Trump will be impeached as the Republicans are not supporting the idea and they continue to hold sway in the Senate. It is not even clear that all Democrats want to take this step, but the latest revelations regarding Ukraine have pushed even the reluctant to move in the direction of impeachment. The fear is this process will heighten tensions beyond the acrimonious level they are currently at and this will make any progress on any front nearly impossible. The chances for the USMCA have faded and so have the chances for an infrastructure effort or really much of anything as all energy will be devoted to this fight—just as it was with the attempts to impeach Presidents Richard Nixon and Bill Clinton.

Short Items of Interest—Global Economy

Will Maduro Get the Support He Requires?

The only things keeping the President Maduro regime afloat in Venezuela are the massive loans and grants that have been coming from Russia and China. Billions of dollars have been committed to Maduro, but both of these nations are facing economic challenges of their own and have virtually nothing to gain from supporting Maduro other than an opportunity to irritate the U.S. Is that political gain worth the outlay of funds that could be used domestically in China and Russia still worth it? It looks increasingly unlikely that these efforts will continue. That really would spell the end of the Venezuelan government.

Asia is Big Winner in Trade War

As the U.S. continues to impose round after round of tariffs on the Chinese and the Chinese retaliate against the U.S., there has been an urgent need to develop new supply chains for business around the world. The majority of these have focused on emerging markets in Asia. Trade between the U.S. and Vietnam is up 33%, trade between Bangladesh and the U.S. is up 13%, and trade between the U.S. and China is down by 16%.

Japan and South Korea at Odds

The trade war that few are talking about is between Japan and South Korea, but it has drastically altered trade patterns as well. The South Korean government is now offering major incentives to domestic companies that elect to shift their supply chains away from Japan and towards domestic companies.

Why Is the Trade and Tariff War Slowing the Global Economy?

The global data has been trending down for the last few months and there have been few bright spots to point to outside the U.S. Even the U.S. economy has been showing signs of fatigue, but at least it has not slipped into a recession as have the economies in Europe (Germany, Italy, Spain and likely France and the U.K. before long). Japan is still in the doldrums and Chinese growth is hovering at 6%. The U.S. has slowed from that 3% pace in Q1 to somewhere in the 2% area. In almost every conversation regarding this slowdown, the reason for the reversal has been the trade war and specifically the tariff battle between the U.S. and China. It is obvious enough that these trade disputes would affect the U.S. and China, and they have to some degree. Chinese growth is down to just over 6%. That is essentially recession in a country that still needs to generate some 1.3 million jobs a month just to keep pace with population growth. The U.S. has been impacted as well—especially those sectors that export to China (such as farmers) and those that depend on goods from China for either the retail community or as intermediate goods for the industrial sector. What is a little less obvious is the impact this trade battle has had on other nations. Why is Germany or Japan or Brazil confronting recession because the U.S. and China are at odds?

Analysis: There are basically three reasons the trade war between the U.S. and China has had such an impact on the rest of the world. The most important and obvious is that the tariffs have served to slow the Chinese economy by quite a lot. There has been an impact on the U.S. as well. This slower growth in the first- and second-largest economies can't help but have ripple effects. The Chinese are not importing as much as they once did since they are exporting less to the U.S. and some other nations. Countries like Germany rely on exports for over 55% of its GDP. This makes them vulnerable to slowdowns in the nations that make up their markets. Most nations that trade with China are sending them raw materials, commodities and intermediate parts that China will use to fuel their own exports. There has been an increase in demand from the growing middle-class population in China, but it is not large enough to entirely replace the money China has lost from reduced export opportunities.

The second problem stems from the reaction to the tariff policies. There has been very little consistency in this tariff/trade war. Restrictions are in place one day and removed the next. This has led to behaviors in the business community that have not been conducive to growth. When the tariffs were being threatened, the natural reaction was to load up on inventory now in anticipation of higher prices later. Then, the tariff would be delayed or dropped altogether, leaving business with excess inventory that stayed on their books as a liability. Other companies elected not to acquire that inventory and later got stuck with shortages and higher prices. The sheer unpredictability of the system has been a drain. The tariffs have been a political football and have had very little to do with economics or protection of U.S. business or jobs. The tariff that works is the one that seems permanent and can be counted upon by the affected businesses and consumers. A long-term system gives all parties time to adjust.

The third rationale is that countries and companies are now engaged in developing new supply chains. With these new options come new drawbacks and challenges as well as new costs. Shifting back to supplier nations such as India, Sri Lanka, Vietnam and Brazil has been expensive and time consuming. Vietnam has been getting a great deal of attention as it has provided a great platform to replace China. The problem is that it is now facing an energy shortage as it doesn't have the capacity needed to support all this growth. The infrastructure China built in the 1990s and 2000s gave them the edge needed to take global market share. The rest of the world has not had an opportunity to catch up. The total landed cost involved with any other nation other than China is expensive, so that has also served to slow trade.

More Brexit Drama

It seems almost impossible, but the drama of Brexit had been chased from the global headlines for a week or two. The attack on the Saudi oil facilities coupled with the ongoing trade and tariff war between the U.S. and China had been enough to take a little bit of the spotlight off the U.K. struggles. The issue is now back front and center as Prime Minister Boris Johnson has watched his entire plan blow up in his face. The British Parliament had already rebuked his attempts to dissolve the assembly and force a hard exit on October 31, but the final blow came from the Supreme Court as it ruled definitively that his maneuvers were patently illegal. He has also evoked the wrath of the Queen as it was revealed that he lied to her about the reasons he wanted Parliament suspended. He is now facing an utter collapse of the effort and is faced with options he declared he would never agree to. Thus far, he has asserted he will not resign. Given the near certainty that he will be required to break these promises, however, he may decide his reputation as a Brexiter is at risk and would rather resign and let somebody else execute the plan.

Analysis: Now that all of Johnson's maneuvers have failed and he has been rebuked, the options remaining for the U.K. are very limited. If there is to be an agreement with the European Union (EU), it will have to happen in the next two weeks, and there is no sign of EU compromise. It appears the U.K. would have to agree to the plan that was set out under former Prime Minister Theresa May and rejected by the Parliament. At the time, the assumption was Europe would offer a better arrangement, but that has not been the intent as far as the EU is concerned. The U.K. could ask for a further extension of the deadline, but the Europeans will demand some evidence this extra time would be put to good use and a different offer would be forthcoming.

The EU will not allow Northern Ireland to function as some kind of backdoor to the EU. Cutting off the Irish from the Northern Irish would very likely trigger a resumption of the hostilities that marked this region for decades. The business implications are disastrous for the majority of British companies and there will be plenty of pain in Europe as well. Germany has already seen severe damage from reduced trade. That situation would only be amplified in the event of a full break. The Johnson assertion is there are other nations where the U.K. can trade. This would replace what is lost from Europe, but thus far there have been only vague promises from President Trump about a trade deal with the U.S. There have been no details at all. Engaging with the various Commonwealth states such as India or Canada has been mentioned, but these countries have not expressed much interest in doing more than is currently being done.

Indian Tax Cut Welcomed by Some and Castigated by Others

The slumping Indian economy has been of deep concern for Prime Minister Narendra Modi as it was the economy that formed the basis of his electoral success. In the first year or so of his regime, the economy seemed to respond and many thought the reforms would continue and expand. The problem has been global, but it has caught India as well. The attempts to stimulate with lower interest rates proved to be inadequate and other tactics have been emerging. The decision to cut corporate taxes dramatically has been welcomed by the business community as one would expect, but it is not yet clear business will engage in the kind of behavior needed to spark the economy. Just as with the big tax cut in the U.S., the bulk of the savings have been internalized with stock buybacks and payments to investors. There is little sign of raises, additional hiring or even capital investment.

Analysis: The critics assert these cuts will be narrowly targeted and will only have a tangential impact on the overall economy. It will not put more money in the hands of the consumer since business has not passed the tax savings on. It will add to an already very substantial deficit and debt as it will deny the government a substantial chunk of revenue. The primary flaw with the plan is the reason for the Indian slowdown. It is not due to bad decisions by Indian companies or a problem in the financial sector or even an issue with consumer confidence. India has been caught in the trade war between the U.S. and China along with dozens of other nations. China's slow growth has meant less imports from India as much of what is sold to China is commodities of varying kinds. The near recession in Europe has robbed India of another major market for its manufacturing output. The U.K. is still one of India's most important trade partners and the Brexit mess has stifled a good bit of that trade.

This leaves Modi with very few options. The corporate tax cut will have a limited impact until there is a resumption of the Indian export business. That seems a fairly distant proposition at the moment. Theoretically, the Indians will see more activity as global business shifts away from China to an extent, but this will be a slow process and India's infrastructure may not be up to it.

Who Changes Jobs and Why?

There has been considerable change in the job market over the last few decades. Those at the higher end of the pay scale have more job security than ever. They have these jobs because they have the education, training and experience. These are all hard to gain without some time and hard work. Meanwhile, those with less of these advantages are stuck in low-paid jobs that offer little in the way of advancement. It was common for people to start at the bottom and work their way up, but today, if one starts at the bottom they stay on the bottom. The educated and trained jump into the middle. This makes job hopping a way of life for the lower paid as they have little opportunity to advance unless they do.

Analysis: This creates a dilemma for employer and employee alike. The employee has little incentive to be loyal to the employer as they know they will likely leave. The employer is similarly reticent to offer loyalty to people likely to leave. The plans to train people are constrained by the fear that all this training will be for nothing. The workers do not gain experience and the employer doesn't feel inclined to train beyond the minimum or offer additional opportunities. The same pattern gets repeated at every new job. The low-paid worker has few options in terms of getting pay hikes or promotions. The gig economy was supposed to offer highly skilled people an opportunity to sell their talents to the highest bidder, but in reality, it has been a very insecure means by which to make a living. That makes it hard to plan for the kinds of major purchases that drive an economy—homes, education, retirement. It also means that people are made highly sensitive to shifts in the economy as they can lose their jobs very quickly.

Ever Wonder About This?

I often wonder if the person who designed a product or service ever actually used that product or service. I have had devices that are impossible to use without having a third arm to assist the other two. This was the pressure washer which had instructions to pull the starter cord while holding the throttle forward at the same time that the pressure pedal was engaged. Three uses of my hands-on controls that were all quite removed from one another. I had not intended to buy a steam pressure washer. I have had contraptions that are so convoluted and badly designed there is no way they can carry out the intended function. And then there are the schedulers at airlines.

I was to fly from Fargo to Minneapolis to catch a connecting flight to St. Louis. My flight from Fargo was to land exactly two minutes before my connecting flight was to start boarding. This was the scheduled flight—not due to a delay. I landed at Terminal C and needed to be at Terminal G—a long walk for anyone familiar with Minneapolis. I just want to watch the scheduler make this sprint. As fate would have it, the flight had to change gates and I had a bit more time to make the connection but by the skin of my teeth. Has the scheduler never been in an airport or on a plane? I seriously doubt it—any more than the people who designed airplane seats have ever actually sat in one. It appears plane designers assume that all the passengers will be under 4-foot-tall and weigh less than 70 pounds. I want to see that designer in a middle seat between two guys who could play middle linebacker!

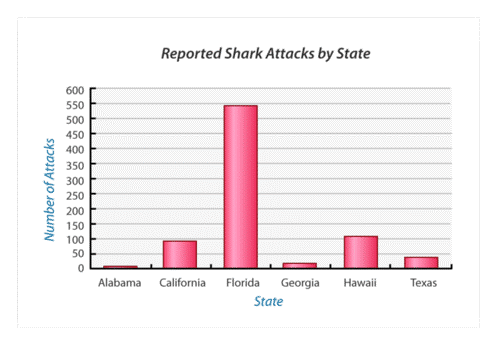

Reported Shark Attacks by State

Lies, damned lies and statistics! A reader made an important observation the other day and I owe a thank you to him. He pointed out that one of the oldest tricks in the book is to create graphs that portray data in an inaccurate and biased way so that people draw the conclusions desired. I once taught from a book called How to Lie with Statistics. It was eye-opening. It showed the reader all the ways that seemingly factual material can be presented to prove a given point. We tend to trust these graphs and charts, but we need to examine them closely to determine what the real story is. The one here would suggest Florida is the shark attack capital of the U.S., but fails to account for important variables such as length of coastline, proximity to areas where sharks live and the like. It also leaves out other states that have had shark attacks. My plea is for all readers to remain skeptical and vigilant and to point out when we end up promoting something that needs a more jaundiced eye.