Strategic Global Intelligence Brief for September 23, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest— U.S. Economy—

Who Pays for Those Tariffs?

By now, we have become accustomed to Trump's habit of doubling down on a subject even when proven wrong. He still insists China will be paying the costs of the tariff and that is 100% untrue. This is not a tax on China—it is a tax on the imports coming from China. The tax will be paid by the entity buying that product. The fee will be assessed on the product and will be paid by one of three participants in this arrangement. It may be paid by the Chinese exporter so that they will not have to raise their prices and lose market share. It may be paid by the U.S. importer so that they will not have to risk losing consumers or it may be passed on to the consumer. Thus far, we are seeing examples of all three. At the moment, the first two options appear to be the most common.

USMCA Fate Depends on Labor Support

There are many in Congress and the Trump administration who want to see the U.S., Mexico, Canada Agreement passed by the end of this year. However, there are major roadblocks and its passage remains in serious doubt. The Democrats are not eager to hand Trump a big victory as the campaign season gets more serious, but neither do they want to be seen as obstructing the deal. The key will be whether the labor unions back it. The majority of the union leaders opposed NAFTA and demanded that something new take its place, but the new pact would need stricter labor standards in Mexico to gain their support. The Mexican government is supportive as far as these standards are concerned, but nobody knows how the rules will be enforced. That is the sticking point.

Household Net Worth Slows

The net worth of the U.S. household grew at a slower pace in the second quarter, but it still grew. The major problem has been the volatility of the market as there have been big losses and gains that have affected the value of the household. There has also been a slowing of home appreciation, which has also affected the value of the home—usually the largest share of household net worth.

Short Items of Interest—Global Economy

Thomas Cook Collapses

This is a 178-year-old company that annually handles hundreds of thousands of travelers all over the world. With very little warning, it collapsed over the weekend. It is estimated that 600,000 people are now stranded with no way to get home or to their destination. The travel sector is in chaos. The issues have been building for years—everything from competition to fuel costs and the way people travel these days. The package tour has been falling out of favor for some time, but obviously many people still used it.

India Facing Plastics Ban

The Modi government will shortly implement a ban on single-use plastic bottles. The business community is protesting that there has not been enough time to react. The country is buried under billions of plastic bottles and has very little recycling capacity. The global movement to ban plastic bottles has been heating up, but India has concluded it is in a crisis situation.

German Recession

The latest numbers from the Purchasing Managers' Index are telling a grim story in Germany. The nation is teetering on the edge of real recession, one that could be an extended one. The combination of trade wars has slammed a nation that relies on exports for 55% of GDP. The population is very worried and blames everything from the immigration wave to the reluctance on the part of the Merkel government to engage in stimulus efforts. Most of Germany's challenge is coming from outside, which limits what the government can do.

Replacing China Will Not Be Simple

The trade and tariff war with China has been vexing in the extreme as it seems both Presidents Trump and Xi have been motivated more by domestic political concerns than economic ones. The talks seem endless. Every time they seem to be on the verge of a breakthrough, the whole thing tumbles, but never quite dies either. In the great scheme of things, the U.S. seems to have less to lose in this battle than do the Chinese. The Chinese challenge is to find consumers like those in the U.S. and there aren't any. No nation has the appetite the U.S. has for the consumer goods produced by China. The U.S. has the supposedly simpler task of replacing China as a supplier. The expectation is the U.S. will simply arrange to import these goods from other nations that are eager to replace China as a supplier. These are the nations the U.S. bought from before China came into its own at the start of the century. There is a major problem with this strategy, however. These potential supplier nations are not ready to supplant China. It could be years before they are.

Analysis: Prior to the start of the 2000s, the U.S. and the other developed nations imported goods from dozens and dozens of nations. China was just one of many. This is what led the Chinese to invest in massive infrastructure development—roads, rail lines, seaports, airports, energy plants and so on. The juggernaut that was the Chinese export engine was not based on cheap labor, low production costs or even lax environmental and labor standards (although these played a part). The real key to China's success was that infrastructure and the decided advantage it gave China in terms of total landed cost.

In order for rival supplier nations to start to erode Chinese market share, they will have to develop that infrastructure themselves. This will be a very time consuming and expensive proposition. Vietnam has seen a dramatic increase in demand for its output from the U.S. and is more than eager to take that business away from China, but it is now worried that its energy system is not up to the task. India has antiquated roads and ports and skilled labor is in short supply. Even the financial systems are not up to the task. For most of the nations that seek to replace the Chinese, the path will be expensive and long. Frankly, they worry about making all this investment only to discover the U.S. and China have reached some kind of rapprochement.

There is also the possibility that more production of these goods will occur in the U.S. itself, but that is not a simple process either. The primary inhibition is the U.S. consumer as they are not prepared to pay the prices required if the product was made in the U.S. It would not be just a matter of not liking a given price, the more expensive goods will mean people will not be able to buy as many things as they did before. There has already been some return of industrial capacity to the U.S., but the shift in production of consumer items will be far slower.

Iran, Saudi Arabia, Yemen—What Now?

The latest word is that everybody in the region is remaining on alert and there are moves to try to calm things down. The Iranians made an unexpected gesture of releasing the British-flagged oil tankers that had been seized by the Iranian navy when they were supposed to have crossed into Iranian waters. The U.S. has sent additional troops to Saudi Arabia in support roles, but Trump has been toning down his rhetoric. Iran and the U.S. will not have formal meetings at the UN, but the Iranians have their visa permission to attend and some kind of "secret" meeting could take place.

Analysis: Iran continues to deny it deployed the drone attack and the Houthi continue to insist they did. The Saudi government is investigating, but has not indicated an attack on Iran is planned although they have been pounding Houthi-held territory again. The incident seems to be part of a bigger power struggle. Thus far, all parties seem to be trying to back away from escalation. The U.S. is not eager to be drawn into a conflict like this, but there is concern that more such attacks could seriously destabilize the oil region and the U.S. has engaged to defend oil before. Those past engagements took place when the U.S. was far more dependent on oil from the region, however. Today, the U.S. is the world's biggest oil producer and has the ability to make up for lost oil production from Saudi Arabia. The bigger concern is that further attacks or an escalation of tension would be reflected in the per barrel price of oil. That would create inflationary pressures in the U.S. as well as the world in general. The fact that this attack was not followed up immediately with another one has been taken to be a good sign and a signal that nobody really wants to see this engagement worsen.

Where Are We Now? Some Data to Look at This Week

Toward the end of the month, there is quite a bit of new data to look at. These are never enough pieces of information capable of telling a definitive story, but they certainly provide information on trends. Over time, they can add up to a pretty solid roadmap. There is a lot of transition talk right now as there has been a distinct slowdown from the start of the year. These heady days of over 3% growth are in the past, that much is certain. The real question is how slowly the economy is moving now and whether this will lead to an outright recession. The worst-case scenario seems unlikely, but there is clearly fragility in the economy that could send trends in the wrong direction. It is also important to take note of what is going on in the other parts of the world as this directly and indirectly affects the U.S.

Analysis: The expectation in Europe was that data from the latest Purchasing Managers' Index (PMI) would show a slow improvement over last month—at least in the manufacturing sector. The assumption was that the combined index would be at 52—slightly up from the 51.9 in August, but the numbers worsened. This has many expressing deep concern regarding the potential for a deep recession. The reading came in at 50.4, the lowest point seen in six years. Almost immediately, there was a negative reaction among investors with markets down by at least a percentage point or two, while the euro fell further against the dollar. The major issue has been the near collapse of the German manufacturing sector as it hit a reading of 41.4—the lowest point since the recession in 2008-2009. The sector has been slammed by the impact of the trade war between the U.S. and China, the worries over Brexit and the slump in the auto industry. The trade war has slowed the Chinese economy, which has meant fewer imports from Germany to China. Brexit means Germany loses one of its most important European trading partners and the auto sector has been hit by everything from shifting consumer mood to scandals over cheating on emissions standards.

Closer to home, the Commerce Department will release some additional housing numbers on Wednesday. These will be for new home sales. The expectation is there were more this month than last. The sales of existing homes also improved last month. That has been attributed to the lower mortgage rates that have appeared. The new home sector is also sensitive to the mortgage market, but other factors play a bigger role. The price of new homes remains high due to the lack of skilled labor available in many markets as well as the rising costs of materials. The new home sector continues to be weighted towards the higher-end homes. That tends to skew the numbers as well. The expectation is there will be a 3.8% increase over last month.

There will be a slug of new data emerging on Friday. The Commerce Department will release durable goods data. This will be eagerly awaited as there has been a real mixed bag of information pertaining to the manufacturing sector of late. The latest PMI has been down, but there was better news from industrial production numbers. The expectation is that durable goods orders will be down by 1.2%, which will contrast sharply with the July numbers as they were up by 2%. The U.S. manufacturing sector has been bucking the global trend for the last two years, but now that global slowdown seems to be catching up with the U.S.

The data expected as far as consumer spending will likely be better—a 3% increase is anticipated. That would go a long way towards offsetting the manufacturing slump. The consumer remains relatively buoyant as the things that matter most to them are still positive—employment and inflation. The worry is that both of these factors might start to shift, and fast. The employment situation will start to look worse with every month of struggle in the manufacturing community. The trade war and tariffs have not yet made much of an impact on inflation, but the latest round of tariffs has been aimed at consumer goods from China. The retailers such as Wal-Mart, Target, Home Depot and others will likely refuse to hike prices and will pressure their suppliers to eat the cost of the tariffs. That means producer price inflation may be the first place these hikes are manifesting.

Americans Saving? Who Would Have Believed It?

There are not many things one can count on as far the economy is concerned, data shifts and rules seem to be designed to be broken. One thing that seemed certain was there was no power on earth that could get the American consumer to save. The mantra was always "I can't be broke; I still have checks." For many, saving money is a virtue, but not necessarily among economists. Japan is a nation with aggressive savers. Their refusal to consume has mired the country in a 30-year period of deflation. There has been talk of the Japanification of the U.S. too. One way this may be manifesting is that savings rates are above what would be expected.

Analysis: The savings rate is now above 8%, higher than it was in 2012, when people were still digging out of the recession hole. The percentage of income that people saved last year was 17% as opposed to 5.2% in spending. Three factors seem to be playing the biggest role. There are those who were burned by the recession because they had no pad, so they are working to make sure they are not that vulnerable again. There are the Baby Boomers who are saving for what could be an extended period of retirement. Then, there are those who have enough wealth to save and still spend. The upshot is that savings have started to drag on the overall progress of the economy. It isn't a crisis by any stretch and in many ways a consumer who saves more is a secure consumer, but given the dependence on consumption, the U.S. economy can't handle too much frugality.

Fitting In

I ran across a letter from a reader asking an advice columnist what to do and was struck by the differences between now and my younger years. The issue was the bigotry of the writer's friends. She described this couple as long-time friends from grade school. They had helped her over the years in many ways—everything from loaning money to moving her out of her apartment in the middle of the night so she could escape an abusive boyfriend. She is upset that the two of them are also virulent racists with very negative attitudes towards Hispanic people (as well as other minorities). She asks if she should confront them, shun them or accept it.

When I was younger, I knew many people with whom I disagreed over some pretty fundamental issues. This was the Vietnam War era after all. But I also liked and respected the people I had issue with. My boss at the gas station was a true hater of "hippies and draft dodgers," but he was also one of the best bosses I ever had. We are none of us perfect and we have no right to expect it in others. Somewhere along the way. we lost the ability to see the whole person—flaws and all. We have to recover that ability. We have to see people for the complex individuals they are. We really must stop expecting people to be perfect (as we define it) and accept the fact that we will always see flaws even as people always see flaws in us.

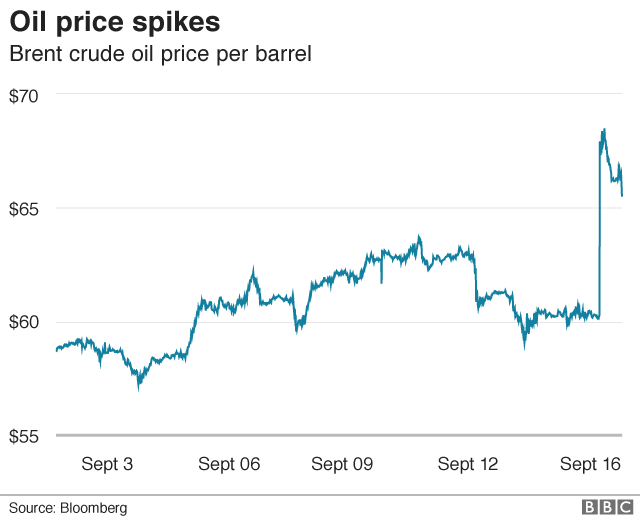

Oil Prices

The price per barrel of oil spiked with the attack on the Saudi oil fields. That was certainly expected, but what was not anticipated was the rapid retreat. Prices are still higher than they were prior to the attack, but even at the peak, the per barrel price had not hit $70. Now it is back in the 60s and falling. It seems that lack of demand is more important than a supply disruption—at least for now.