Strategic Global Intelligence Brief for September 18, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Another Rate Cut in the Offing

Today, the Fed will lower the Fed Funds rate by another quarter point as they have been expected to do for the last few weeks. There has been nothing to suggest inflation is becoming an issue and even more ammunition for those who see some additional problems ahead. All eyes will be on the remarks that come along with that decision. If Fed Chief Jerome Powell asserts this is the end and makes a point of it, the markets will likely be disappointed as they have been hoping the Fed will think about more cuts this year—perhaps as many as two more. Thus far, the Fed has made a point of asserting it will act according to the data. If that means it will lower rates in the event of higher unemployment or slower growth, then so be it.

Will Lower Rates Help at All?

This is the bigger question—if rates are dropped will there be a dramatic response. The answer is likely a definitive "No." There are very few companies having issues getting money for expansion, and at a reasonable rate. The real motivation for the slowdown is that business has become cautious and uneasy about the future. This nervousness is a direct result of the trade war and the incessant changing of the tariff policies. The fact is trade matters to the U.S. economy and to many other nations. It has been next to impossible to plan. That makes companies very reluctant to expand or even to conduct business as usual. If the economy of the U.S. slows to the 1.6% to 2% levels that many have been predicting, the blame will rest squarely on the trade and tariff war.

Big Jump in Housing Starts

The data on housing starts is improving fast. The data this month has been up by over 12% from last month. The gains have been seen in every level of the market—from the high-end to the starter homes. The headwinds affecting the sector are still there—everything from labor shortage to more expensive inputs—but the mortgage rates have been falling. That has propelled people in the market. The one concern that looms over the market is mortgage rates could start to rise at some point in the near future and there is the fact that home prices have been rising pretty quickly in select markets. The really good news is the older Millennials are finally starting to get interested in buying a new home.

Short Items of Interest—Global Economy

Stalemate in Israel

The election in Israel has not produced a government as yet. The two main coalitions are in a dead heat. It is going to come down to the far-right party led by Avigdor Lieberman. One would have assumed he would back Likud and Prime Minister Netanyahu given the similarity in many policy positions, but there is real enmity between the two men and Lieberman had pulled his party out of the Likud group. He is now demanding that a grand coalition be formed between Likud and the center-left coalition led by a former Israeli general.

Evidence of Iranian Culpability?

At this stage, it is not clear that anybody knows who launched the drone attack on the Saudi oil facility, although the Houthis rebels have claimed responsibility. The U.S. has noted that installations were being set up in Iran, but the trajectory of the attack is unknown at this juncture. The fact is the U.S. has no responsibility to engage as there is no defense agreement with Saudi Arabia and Iran has threatened retaliation if attacked. It remains unclear whether the U.S. would risk American lives to defend the royal family in Saudi Arabia.

More Drama in Financial Markets

The repo (repurchase or buyback/sellback) crisis was unexpected, but now seems inevitable given the changes in bank rules. Last week, there was a huge demand for these overnight loans, but there was a crucial shortage of liquidity that caused central banks to desperately redirect money,

Chinese Concerns Mount but There Is Optimism in Some Circles

What are the prospects for a deal between the U.S. and China? As usual, it all depends on who one asks. There are the eternal optimists who assert both nations will soon have to realize that all this enmity has been costing them some real money and it would be in their mutual best interests if some kind of agreement was in place. Then, there are the pessimists who assert this has never been about pragmatism, but is rather a clash of intransigent personalities. Both Presidents Trump and Xi benefit politically from extending this conflict. As both nations take stock of what this has cost them thus far, there is ample reason for some kind of interim deal to be extended. There are those who seem to think such a deal may be developed sooner than later. Part of the reason for this newfound optimism is the oil shock and what that means to both the U.S. and China.

Analysis: Those who have been following the twists and turns assert both sides are working their way to a partial deal that calms tensions and provides an opportunity to deal with the bigger issues later. It has been noted that both Trump and Xi are under similar pressures. Trump can't appear to have capitulated to China while he works at solidifying his base. His re-election depends entirely on maintaining those core supporters and ensuring they get out to vote. If they lose even a little faith in his core promises, they might decide to stay home. Xi is in the midst of observing the 70th anniversary of the Chinese Communist Party and must appear as strong as he can possibly be as he will be competing with the memories of past leaders such as Mao Zedong, Deng Xiaoping, Hu Jintao and others.

The foundation of a deal seems to revolve around an aggressive attempt by China to reduce the surplus it maintains in trade with the U.S. in return for the U.S. backing away from the bulk of the tariffs that have been threatened. This leaves many of the key issues unresolved and part of some future negotiations. The U.S. had been demanding greater protection of intellectual property, reduction of business and financial restrictions and an end to Chinese industrial espionage. These are still important issues, but may be shelved for the time being. The demand from the U.S. has narrowed to addressing the deficit. The Chinese have indicated they are willing to dramatically increase the amount of food they import from the U.S. That would be a major victory for Trump as he would be providing a boost to farmers just as the harvest season kicks into high gear. China has also made some vague noises about buying other things from the U.S., but this is complicated as China wants the high-tech stuff the U.S. makes. The U.S. has been reluctant to sell it without expanded protection for that intellectual property. The U.S. would then roll back some (and maybe all) of the tariffs imposed on China just in time for the holiday shopping season in the U.S.

As logical as this course of action would seem, the political issue remains paramount. Would a deal make either Trump or Xi look weak? Can they both get away with declaring victory? Will both men try to ratchet down the rhetoric so the other can save face? The recent patterns would suggest they will not be able to pull this off, but the Chinese are now facing an energy crisis due to the incident in Saudi Arabia. That worries them as their economic growth has been weaker than what was expected.

More Italian Drama

The unexpected coalition between the center-left Democratic Party (PD) and the populist Five Star Movement was fragile to begin with and is scarcely two weeks old. It was a marriage of convenience between political leaders that had very little in common other than their opposition to the right-wing League party. Now, the former prime minister, Matteo Renzi, and previous leader of the PD has split away from his old colleagues to form a new center party and has taken about 30 members of the PD with him. Renzi stated that he supports the coalition and will remain a member, but he now has the ability to collapse the government if there is something he doesn't approve of.

Analysis: When this new coalition of strange bedfellows formed, many were shocked as Five Star had long considered the PD as their arch enemy and were especially opposed to Renzi. During his tenure as PM, he tried to introduce several measures aimed at fiscal frugality. These were deeply opposed by Five Star populists as they involved everything from pension reform to government pay cuts, additional taxes and reduced government outlays. The new coalition was likely to veer back to providing benefits galore while Renzi was still concerned with what this would mean for the Italian budget. By setting himself up as the key to holding the coalition together, he confronts both the PD and Five Star with a choice. Either go along with Renzi's ideas or risk a collapse of the government that would likely bring the League and their far-right policies to power. The risk Renzi is taking is that he and his policies are still very unpopular in Italy and there may be little room for a centrist with frugality and pragmatism on his agenda.

Three Oil Scenarios

The accusations are flying, but at this point nobody knows a whole lot of detail. On Sunday, Houthi rebels attacked one of the largest Saudi oil installations and likely cut their oil production in half—for how long is anybody's guess. The Houthi have been at war with the Saudi-supported government of Yemen and currently hold some important cities and facilities. The Saudi government backs the Yemeni government and Iran backs the Houthi. This has been a war that has dragged on for years and rarely gets a mention in the Western media, but that has all changed now. The U.S. initially asserted the Iranians were responsible for the attack, but Iran has denied their involvement although it is clear the Houthi have been getting weapons, training and other supplies from Iran. It is suspected the attack was carried out by a drone, but it could also have been some sort of missile. Immediately upon the attack, the oil markets went nuts as oil prices jumped by more in one day than at any time in the last 30 years. In the two days that followed, the prices came down a little, but they remain far higher than they had been. Now that there has been a little time to digest what this all might mean, there seem to be three scenarios in play.

Analysis: The most benign is this is an attack that will be very hard to replicate and the Houthi are not even going to try to do so. It is not clear the Houthi (or Iran) has an abundance of these weapons, although their availability is far greater than it was. The Saudi military has gone on full alert and will be far more prepared for another attack like this. There will certainly be reprisal attacks on the Houthi by Saudi Arabia, and it will be disproportionate. It is likely to have been a one-time attack designed to bring attention to the conflict and to make Saudi Arabia pay for their support for the Yemeni government. Under this scenario, the Saudi oil facility is quickly repaired and will be under only minimal threat in the future. Oil prices would return to what has been considered normal prior to the attack.

The worst-case scenario is this is only the beginning and the Houthi proxy war becomes a full-fledged conflict between the Iranians and Saudi Arabians with engagement from the U.S. The potential for this expansion has been building for years. This could be the trigger that turns this into an exchange with attacks on Iran by Saudi Arabia and vice versa. This will utterly shatter the confidence in the oil market and prices will begin to skyrocket. Some of the more alarmist comments have oil prices hitting above $100 and staying there for an extended period of time. The impact on the global economy would be devastating with many analysts insisting this is the issue that really plunges the global slowdown into global recession. There is also the danger that the conflict spreads to include other oil states and even the larger players in the area such as Russia and the U.S. This is the kind of situation that calls for some very careful and considered diplomacy, and the majority of the actors involved are not notorious for that kind of cool-headed behavior.

The middle scenario is a one that sees some strong military response by both the U.S. and Saudi Arabia, but with the actions aimed at the Houthi and not directly at Iran. This would take the form of air strikes and missile attacks aimed at degrading whatever capabilities the Houthi have to repeat this attack. The U.S. would likely offer tactical support to Saudi Arabia and let them do the majority of the fighting, but it is possible the U.S. engages beyond this support so that Iran and the Houthi rebels know the U.S. is in the area. It would also escalate the risks as it would then be possible that an American plane would be attacked at some point. This would be an ugly and destabilizing situation, but would stop short of triggering a major confrontation. Right now, this seems the most likely scenario.

The U.S. and Europe have been very reluctant to state that Iran carried out the attack as this would seem to demand a response that could involve a direct hit on Iran. The evidence is strong as far as the weapon's origin and it does not appear to have been deployed from Houthi-held territory. President Trump has been reluctant to carry out attacks on Iran, or anybody else for that matter. It seems he still wants that face-to-face meeting with Iran's President Hassan Rouhani. Analysts have concluded that Iran is taking a page from North Korea as they act in a very hostile manner and almost dare anyone to stop them.

Impact on U.S. Economy Expected to be Minimal

This kind of geopolitical crisis used to send the U.S. economy into a tailspin, but the situation is far different now than in past years. The level of household consumption for gasoline is now just 2.5%. Just a couple of decades ago it was over 80%. It is highly likely that oil prices and gasoline prices will rise, but they have been at multi-year lows this summer. Even if they jump by as much as 10 to 15 dollars a barrel, they will still be below what they were a decade or less ago. Gas prices will rise at the pump by perhaps as much as 50 cents to 80 cents, but that would still leave the cost of a gallon of gas under $3.

Analysis: The countries that will be hit hardest by these price hikes will likely be Japan, China and Europe. The U.S. is now the world's largest oil producer and is quite capable of providing the domestic and international market with more oil to cover the loss from Saudi Arabia. There will be other suppliers that will try to fill the void as well—everybody from Canada to Mexico to Russia, Norway and the other oil states of the Middle East. If there is a silver lining to all of this, it may be that this episode reminds people of the volatility in the oil sector, which makes alternative technologies more popular again. The low cost of gasoline has slowed the enthusiasm for electric cars or cars powered by natural gas. As the price of that gasoline goes back up, there are those who will look at the other options more carefully.

Simple Needs

When one travels a lot, it is amazing what starts to matter. The vacation traveler has much to look forward to and puts issues of the flight and the hotel room in somewhat lower-priority ranking than the business road warrior. I don't have the time to wander and explore, so the attractions of a given city do not matter all that much. As I was talking with another speaker on the circuit, we compared notes on what made a given trip good or bad.

The flight itself is a pretty simple proposition. I basically want three things. Take off on time, arrive on time and let me take a nap with my headphones firmly clamped on. The hotels are a bit more complicated. I really don't care about the lobby bar or the lobby itself. I will be in the room—working. Therefore, the first priority is a desk and a decent chair. It is amazing how rare those are. The second requirement is a decent bed. Most of the time that seems to be on offer. The third requirement is some semblance of peace and quiet. That means an A/C unit that doesn't sound like a 737 preparing for take-off and it means trying to get a room that is not on the same floor as the visiting cheerleader squad. Running water is a plus and lamps are always nice.

Beyond that, the trip will be judged a success if the Uber driver is friendly, the presentation A/V system works and my internet hot spot remains functional. There are those high maintenance speakers that want their brown M&Ms sorted and demand bottled water from Nepal, but I am happy being rather low maintenance.

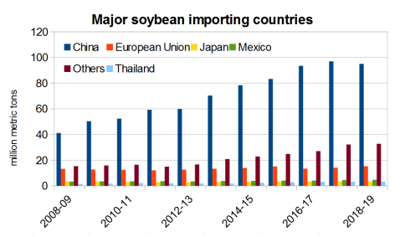

Major Soybean Importing Countries

The Chinese eat a lot of soybeans—or at least their livestock does. As China has developed, so has its taste for meat. They are now the world's largest consumers of pork and chicken and have been catching up as far as beef is concerned. To fuel that demand, the Chinese need feed for their livestock and soybeans are the preferred option. The U.S. farmer has been selling into that market for years with China being the dominant one. The tariffs hurt the U.S. farmer in a variety of ways. There is always the fear that China will find replacement markets. The burning of the Amazon forests can be traced directly to soybean demand in China. If the Chinese can't buy U.S. soybeans, they will buy Brazilian soybeans. It is the soybean operations that are burning off the forest to make way for more farms.