Strategic Global Intelligence Brief for September 16, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

So Much for That Cheap Oil

At one point, the price per barrel of crude jumped by almost 20% before settling down a little, but the increase was still the largest seen in one day in the last 30 years. The attack on the Saudi oil fields has been expected for years, but it was thought the Saudi government had the means by which to prevent something of this magnitude. The damage done by the drone strike is significant, but only temporarily crippling. The real fear is that the oil fields have now proven to be vulnerable and to a group that is not very sophisticated. The Houthi rebels that have been fighting the Saudi-backed government in Yemen have not shown this kind of capability prior to this. It is asserted the Iranians provided the drone and certainly can supply more.

What Impact on Global Economy?

The initial shock of the attack on the Saudi oil fields has driven oil prices up and created intense volatility in the markets, but unless there are follow-up assaults, the impact on the global economy is likely to be somewhat short lived. Even with this shock, the price jump in the per barrel cost of oil is around $65 for Brent crude and $60 for WTI. These are still far lower than has been the case in the recent past. The oil producers in other parts of the world will be able to easily replace the oil that has come off the market. It can be expected that the Saudi output will regain traction sooner than later. The most critical issue is whether this is a one-off attack or just the start of a series of assaults on the oil infrastructure in the region.

What Happens to Iran Now?

Initially, the U.S. blamed Iran for the attack as they have been active supporters of the Houthi rebels. There was an assertion the U.S. would respond militarily once it was determined who was behind the attacks. At this point, there has been no formal claim that Iran carried out the attack and Iran has vehemently denied it. In truth, the connection is likely to stay murky as the Houthi could have procured the drone from a number of actors. It is unlikely they checked in with anyone prior to using it. If the U.S. does decide to attack Iran or if the Saudi military does, the situation in the region will become very tense very quickly.

Short Items of Interest—Global Economy

Canadian Election Set to Be Close

The Canadians go to the polls in about a month. Right now, Justin Trudeau has a very narrow lead. His campaign four years ago was full of grand gestures and promises of a new way of governing, but his track record has been mixed at best as scandal has surrounded many in his inner circle and the sluggish economy has been a drag on those plans. The Conservative candidate—Andrew Scheer—has the support of the right, while Trudeau is looking at challengers from both the Green Party and the New Democrats which represent the left. His Liberal Party is not capturing the enthusiasm it did the last time around.

Return of Traditional Parties in Italy?

The coalition formed by the Five Star Movement and the Democratic Party (DP) is a shaky one and many are still amazed these two enemies were able to cobble something together. The return of Matteo Renzi can be attributed to the fact that nobody seems to want to see Matteo Salvini and the League gain power. The DP is clearly getting the key posts with finance, economics and the interior and several others. The problem is that Italians are still impatient and could easily turn to radicals again.

ISIS Unites with Taliban

The talks between the Taliban and the U.S. were always going to be tense. Many within the ranks of the Taliban rejected the whole idea and these hardliners are now working with ISIS. The Afghan government was always suspicious as well. Now there is the abrupt about face by Trump which has reinforced that hard-line approach. If anything, the situation has now significantly worsened.

Time for the Index of Indices

Each month, we collect data from a variety of sources for a couple of organizations that represent the manufacturing sector—the Chemical Coaters Association International (CCAI) and the Industrial Heating Equipment Association (IHEA). These are made up of companies that either coat or treat metal or heat treat metal and are thus very engaged in sectors such as automotive, farm equipment, energy, aerospace and construction. There are very few parts of the economy these companies do not touch. The indices we look at are those that matter to them. What follows is the executive summary as well as some selected sections from the breakdown we prepare for each of them. To see the entire report, complete with the exciting graphs and charts, which provide a one-year assessment for that sector, send a note to This email address is being protected from spambots. You need JavaScript enabled to view it..

Analysis: It is a venerable Scottish saying that an ill wind blows nobody good. There always seem to be losers and winners no matter what the overall story in the economy might be. There are signs of a real decline that could lead to a recession and there are signs signaling that this will not be a recession but merely a slowdown, and perhaps a fairly short one. The outcome seems not to be in the hands of the U.S. or really any nation at this point; it is a matter of the slowing global economy. The big issues are still in play—the trade war that flickers on and off, the looming Brexit day and the impact that has had on Europe and the U.K., the frailty of overall consumer demand and so on.

At this point, there is data to support whatever mood you choose. Of the 12 indicators, six are trending positive and six are trending negative. Unlike last month, the swings are definite. The six that seem to be painting an encouraging picture include new automobile and light truck sales. The movement was not dramatic and could be best described as steady, but that is better than it sounds. The expectation had been that sales would be in steep decline by this time, but that has not been the case. The consumer is still interested in buying these new vehicles. There was also an unexpected increase in steel consumption. That may be related to the vehicle manufacturers, although there has also been demand from commercial construction and the energy sector. The rise in metal prices may reflect some of this activity as well. It seems the bigger motivator has been a recognition on the part of the metal producers that demand is not likely to surge back to life anytime soon, so the producers are cutting back on output. That has driven prices up from their rock-bottom low.

There has also been some moderate improvement in the appliance category as the gap between unfilled orders and inventory has closed a bit. The bigger news was in factory orders and the data from the Credit Managers' Index. Most of the industrial data has been trending in a generally negative direction, but factory orders have been improving. That may be due to some of the supply chain shifts taking place due to the tariffs. It may also just reflect the fact that consumers are still in a generally good mood. The data from the Credit Managers' Index is also interesting as it bucks the trend and somewhat contradicts the data from the Purchasing Managers' Index (PMI). The good news is that some of the more important favorable readings such as dollar collections and sales are back into very solid territory.

Now for the not so great news. It doesn't come as much of a shock when one looks at the bulk of the manufacturing data released in the last several months. The slowing global economy has taken its toll on global manufacturers. There has been a substantial dip in the levels of capacity utilization, a trend that is most unwelcome as it signals reduced hiring and reduced capital spending. Then, reduction in capital expenditure (capex) is now taking place despite a nice improvement in the previous month. The big crash and thud were in the latest PMI data as the new orders index fell to a low not seen in many years and the overall index was also in contraction territory. That the new orders numbers were actually worse than the overall index is not a good sign for the future. To round off all this bad manufacturing data, we have durable goods which did not have the advantage of the aerospace sector this month. The levels were down in several of the durable categories as business has been emphasizing caution above all else.

There was no joy in the housing sector either as there has been a semi-predictable slump in demand. The big homebuyers are reacting to the vagaries of the market and don't seem as eager to splash out on those mega-homes as before. The new homebuyer of more modest means has been put off to some degree by high prices even as mortgage rates lower. The transportation sector is also sending out signs of distress. These have been showing up in a variety of modes—trucking at the top of the list, but right behind them are air cargo and ocean cargo.

New Automobile/Light Truck Sales

The bad news is that the data for the vehicle sector is flat, but the good news is that the data for the vehicle sector is still flat. By this point, most of the analysts were expecting the sector to be in a pretty steep decline. It has been more than a little encouraging to see the sector hold its own despite the various inhibitions that were supposed to have affected the consumer by this point. The fact is that more positive factors have managed to hold steady. The four key elements as far as vehicle sales are concerned are: (1) the unemployment rate as people without jobs do not buy cars; (2) interest rates as people are not willing to go into debt to buy a car when the rates are too high; (3) vehicle pricing as there is a point at which a new car or truck gets too expensive; and (4) some exterior motivator such as gas pricing. There has been no major change in the pump price that would motivate people to start swapping their gas sippers for gas guzzlers as yet. Thus, the market has been steady enough. That is relatively good news for those supplying the auto makers.

New Home Starts

The housing sector has been everything but predictable over the last year. For the last few months, the data has suffered and there has been a steady decline. The number of new homes remains a fairly small segment of the total market, but there has been a sagging situation for the existing home. New home sales respond to differing motivators as far as the overall housing sector is concerned. It is not that mortgage rates don't matter, but the upper-end demand for new homes seems to depend on the performance of the stock market as much or more than the mortgage rates. This year has been pretty good for the market, but there has been lots of volatility, which has been taking something of a toll on upper-end housing demand. The low mortgage rates should be encouraging new home buyers, but these Millennial buyers are also facing higher prices. Also, many are simply not that interested in buying a home right at the moment. On top of all that, this is the time of year that housing often hits a slump.

Steel Consumption

The level of steel consumption has been holding steadier than many had expected and now shows some signs of improving a little. Outside of a big dip at the start of the year, the consumption numbers have not been at all bad. The three big markets for steel in the U.S. have been in some flux, but they have not collapsed. The manufacture of vehicles has been solid enough as a whole, although sectors such as farm machinery have been down. The trucking industry has been adding capacity and so has rail. The construction sector using steel is either public sector or commercial. The latter is doing pretty well—especially in the health care sector. Warehousing has also been expanding and that involves considerable steel use. The oil and gas business drive a lot of the pipe and tube market. There has been growth here as well. Only public sector construction seems to be in a near permanent state of the doldrums.

PMI New Orders

The Purchasing Managers' Index has crossed a threshold that nobody wanted to see and very few expected to see at this juncture. It was only a few months ago that the overall index was in the 60s. Now the overall index is below 50. The new orders index has fallen to 47.2—further down than the total PMI. This marks the first time that new orders numbers have been in the contraction zone (a reading below 50) since the recession. The fact is that manufacturers are seeing reduced demand now and fully expect this situation to worsen in the months and years to come. The factors making manufacturers uneasy are very familiar by this point—everything from the burgeoning trade war between the U.S. and everybody else, the slowdown in the global economy, outright recession in the EU and fears that all of this stuff will catch up with the American consumer sooner or later. The unfortunate assertion is that these numbers are going to get worse in the months to come.

Durable Goods Orders

As was noted for capex, there was an unexpected bounce up in the durable goods data last month. These numbers could have deteriorated given the issues as far as capacity utilization and the PMI were concerned. They rose briefly, but have now resumed their downward path. Unfortunately, that is consistent with the kind of data coming out of manufacturing these days. Part of what affected the data last month was a surge in aerospace activity, but these bursts are few and far between. There was no corresponding activity this month. The industrial sector is in a cautious mood right now—not exactly anticipating a recession quite yet, but worrying about the global slowdown enough to temper their expectations.

Transportation Activity Index

The transportation sector is often the harbinger of things to come in the economy as a whole. It makes sense that when there is less economic activity, there is reduced need for shipping things in and out of the manufacturing sector. The data this month tracks well with the other industrial data—it is showing a reduced level of activity, which is taking place across all the modes. Trucking may be getting hit the hardest, but air cargo has been down for the last few years and ocean cargo has been getting hit by all those trade spats and tariffs. The levels of both inbound and outbound freight have been affected by the many rounds of tariff imposition as well as the uncertainty over what the next move might be. The good news is that the index has not slumped into contraction territory, but the bad news is that it is certainly flirting with that level given that it is now at 51.2—the lowest level seen in nearly five years.

A Feline Crisis—All's Well That Ends Well

Last week was traumatic in the extreme. I very nearly lost my cat daddy status and I can't think of a time when I was more upset. For those who do not take pet ownership quite as seriously as my wife and I do this may seem a little over the top. However, my feline five are my responsibility and they mean a great deal to me. This saga all started as I was on the road making presentations in Wisconsin. When I checked in with my wife on Tuesday night, she was very upset as she could not locate the new kitten. She had searched every corner of the house, but we could not figure out how he might have gotten outside. It then dawned on me that I had gone into the garage and left that door open for a minute. He apparently seized the moment. Then, when my wife went into the garden and left another door open; he again seized the opportunity. He did not return that night, Wednesday night or during the day on Thursday.

I was nearly paralyzed with worry and have never felt so helpless. My wife was alerting neighbors, posting on the local blog, searching at all hours as I sat in hotel rooms trying not to think the worst. We have predators in the area—everything from coyotes to bobcats to feral dogs and cats. It was a nightmare. On Thursday night as I was getting ready to check into another hotel she called and told me he had just wandered back into the garage—clean, dry and only a little concerned. He was very thirsty and made a beeline to his cat buddies and has since stuck very close to us. My sense of relief was profound. All is now well with the clan and my status as cat daddy remains intact, but I can guarantee I will watch those doors from now on.

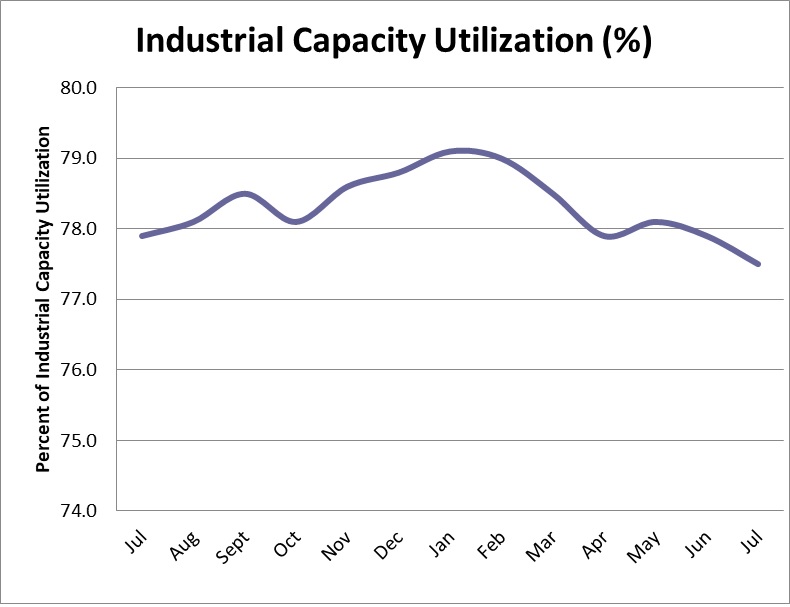

Industrial Capacity Utilization

The trend line for capacity utilization is not in a crisis situation as yet but this is definitely not the direction anyone wants or had expected to see. It is now at the lowest point seen in well over a year. Granted, the reading is not that far from what is considered normal but it is sinking, and that is the worry. When there is this much idle capacity, there are ramifications. The manufacturing community is less likely to hire, less likely to buy new machinery and needs less in the way of parts and other inputs. Ideally an 80% level of capacity usage is considered the lowest comfortable level. That goal is getting more distant every day.