Short Items of Interest—U.S. Economy

Growth of 3% This Year? No Way

It is dangerous for political leaders to predict what is going to happen in the economy, but for a variety of reasons, they persist. It is expected of them to do so, but in the end, they are nearly always wrong. Trump has been asserting that his policies would bring growth of at least 3%, but that seems unlikely now. The consensus view is GDP growth will be near 2.2% and possibly lower by the time the year is over. The slowdown in global growth has had an impact on the U.S. and to some degree it has been due to some of Trump's policies. The fact is that pursuing growth often comes at the expense of other goals, and so it has been with Trump. The real priority has not been growth, but a more hardline relationship with China as well as with the majority of the traditional U.S. trading partners.

Slow Pace for Inflation

There was a very minor hike in consumer inflation registered this month. The expectation had been there would be more reaction to the price hikes that have been coming as a result of the tariffs on goods from China and elsewhere. However, many of these have yet to kick in and there has been offsetting pressure from the drop in the price of oil. The cost of gas at the pump has been falling through the summer—not usually the pattern. The average driver has been able to save around $1,000 in fuel costs over the past year. That is roughly what the tariffs on Chinese goods are expected to cost the consumer.

Zero Interest Rates?

Lately, the pressure on the Federal Reserve has been intense. There seems to be a belief that a global slowdown can be reversed by simply cutting interest rates to zero, or even going negative and paying companies to borrow. There is no evidence to support this notion especially when the economy is still growing at a semi-respectable pace. The Europeans toyed with the idea of negative rates when they were in the depths of a real recession, but it makes no sense now. Such a move would invite inflation, irresponsible borrowing, and most important, would damage small banks and anybody trying to save money.

Short Items of Interest—Global Economy

ECB Engages in New Stimulus Effort

To the shock of few, the European Central Bank (ECB) has elected to engage in another round of stimulus. At the same time, Mario Draghi has reiterated this is about as far as the ECB is capable of going and the rest will be up to the fiscal side. Rates are being cut again and the bond-buying effort has been relaunched. The eurozone economies are already in recession or very near and the ECB has been signaling this move was imminent. The reaction from Trump was hostile as he accused Draghi of trying to devalue the euro. Given that Trump has been calling for the Fed to lower rates to zero or below, his critique of the ECB seems more than a little disingenuous.

Spain Heads for New Election

The voters gave Prime Minister Pedro Sanchez and the Socialists the majority of their support in the last election, but it was not enough to allow a government to form. That meant a potential coalition with the other left-leaning party—Podemos. Those talks have broken down again and it now looks certain that another election will be in the offing. The polls state the balance would remain the same as it is now.

EU Will Not Budge on Irish Backstop

The EU Parliament has once more reiterated that it will not approve any Brexit deal that does not address the hard border issue in Ireland. It demands that the U.K. essentially leave Northern Ireland under EU rules. That basically means the U.K. is in a customs union with the EU whether it likes it or not. The EU will not tolerate a situation in which Ireland becomes a giant loophole for British business.

Global Slowdown Is Real

This much everybody seems to agree on. The data is hard to ignore and is coming from all directions. The International Monetary Fund, Organization for Economic Cooperation and Development (OECD), World Bank, the European Union and even the U.S. Treasury Department and the Congressional Budget Office all agree the pace of global growth has been fading and more quickly than had been expected. What there is not so much agreement on is why. The problem is there are many culprits to choose from and it is not as simple as blaming trade wars and tariff spats, although these have been playing a role as well. The latest set of assessments has global growth slowing to less than 3% this year and in the 2.5% range next year. There are already some major economies that have slid into recession territory, such as Germany and Japan. China has seen growth fall to less than half what it was just a few years ago. The U.S. is starting to see a decline despite the persistence of the consumer sector. These declines do not necessarily signal that a true global recession is imminent, but it is clear some countries are falling into that trap already.

Analysis: At this point, there are competing theories as to why this taking place now. In truth, these are all factors, but some are more culpable than others and some are more easily dealt with than others. At the top of the list of immediate motivations is the trade war between the U.S. and nearly everybody. The Trump plan remains murky, but it seems to be based on a desire to alienate and frustrate as many trading partners as possible. The logic behind attacking China with tariffs and other barriers is relatively sound given the way China has comported itself in terms of trade as well as the innate conflict that exists between the U.S. and China. The antagonism shown towards Europe, Canada, Mexico, Japan and dozens of others has been far harder to understand or justify. The U.S. is not as dependent on trade as many other nations, but exports account for about 15% of total GDP. In contrast, the German economy is 55% dependent on exports and the global slowdown has been devastating to that sector. In time, companies can adjust and develop new supply chains, but that is made far harder by policies that change on a whim.

A second motivation for the global slowdown, and one that is perhaps harder to deal with than trade wars, is debt. There has been a great deal of attention focused on the burgeoning debt levels that countries have accumulated, although nobody seems interested in actually doing anything about it. Less attention has been focused on the debt accumulated at the corporate and consumer levels. There has never been this much debt in the corporate community. It is due in part to a decade of low interest rates. In some respects, this has been an ideal time for governments and companies to go into debt as everything from bond yields to loans have been at record lows. The problem is that at some point the cost of the debt goes up and so does debt service. Then, there is the small matter of having gone into debt for projects and investments that do not pan out as planned. The consumer debt situation is even more threatening. The debt load is back to dangerous levels. Should there be a major slowdown or recession, the consumer will be in crisis almost immediately as will all the entities that provided that debt.

A third reason for the global slowdown is a changing consumer. The majority of the developed world population has been aging and is now quite clearly in the final quarter of their consuming lives. This means Boomers are not the drivers of the consumer economy they once were. This not just a U.S. issue, the aging demographic has been affecting the Japanese and Europeans for longer than in the U.S. The next generation after the Boomers is not able to replace them as consumers. The Gen-X cohort is the smallest of the generations and has not been the big spenders the Boomers were. Behind them are the penny-pinching Millennials. Not that they are really all that committed to frugality, they are basically saddled with debt already. Many entered the workforce in a recession and started out at a lower rate of pay. To top it off, they are "experience buyers" as opposed to "thing buyers." That has slowed everything from factory activity to transportation and distribution, and certainly retail.

Some Shifts in Employment Data—Good and Bad

The employment situation is not always the most important factor to examine when one is trying to puzzle out what is happening in the economy, but for the vast majority of the population, it is the only thing that matters. The analysts want to understand investment trends, productivity and capital flows, and the interaction of fiscal and monetary policy as well as the interconnections of global commerce and trade. The majority of the population just wants to know if they have a job and are going to be able to keep that job with a reasonable expectation of getting a raise from time to time. The jobs data is often the only thing people are interested in and the only criteria they have for judging the overall health of the economy. There has been a good bit of activity to assess as far as the job market is concerned. The data has been pointing in both positive and negative directions.

Analysis: We can start with the big data, as that has been interpreted as very positive. For the most part, the fact that the overall rate of joblessness has been well under 4% for the better part of the last year is a good thing. For decades, the "normal" rate of unemployment was considered to be 6%. There are some caveats to consider when looking at this data, however. The first and most important is to note what kind of jobs are being created. Many are not very well paid. The bulk of the new jobs have been in the service sector and the lower-skilled segment at that. This is not unexpected given the fact the U.S. economy is about 75% to 80% dependent on services, but in past years, there has been more growth in the higher-end services in the professions, health care, finance and high tech. Now, the growth has been in food service, services for the elderly and a range of personal services. This is one reason there has been little evidence of wage inflation as one would have expected with jobless rates this low. The old reliable Phillips Curve is not as prescient as it once was as it asserted that as unemployment rates went down there would be wage hikes, Fewer available workers means those getting hired will be paid more and companies will pay their existing employees more so they are not tempted to work for someone else. The wages have not moved much as the majority of the new jobs are not paid well to begin with. Also, the shortage of people with appropriate skills has forced many companies to hire essentially unqualified people with an intent to train them. While they are being trained, they are not commanding the wages they might see later.

The Job Openings and Labor Turnover Survey(JOLTS) report was released this week. There were at least two interesting observations to be made. The first is there were fewer job openings listed, although there are still far more jobs on offer than there are people available to take them. Usually, it would be assumed this meant employers were finding people they needed, but there is evidence of less helpful trends. Many employers have simply abandoned the search altogether. This may be due to frustration with the labor pool, but it may also signal a more general period of slowdown. Manufacturing has been showing signs of stagnation for some months now. That has been manifesting in the willingness to do additional hiring. Even the service sector has been slowing down of late. The second interesting piece of data from JOLTS was the quit rate. The number has not been this high in close to two decades. That is a very solid sign of confidence among the overall population. The quit rate measures the number of people who are willing to simply leave their jobs and trust in their ability to find a new one. These are not people who have been fired or laid off and these are not people who are leaving because they have already been offered a new job. They just quit and believe they can find a replacement job easily enough, and when they want to. This is certainly a confident attitude, but it is also one that can change very quickly. Should all this caution and slowdown in various sectors result in big layoffs, there will be far less faith that a new job is just waiting out there.

Beyond all this, there is the continued striation between job opportunities. The fact remains that unemployment rates are higher for those with less formal education and for those who lack experience. The rates are still markedly higher for minority groups and those from urban areas. The rates are higher for single parents and those who lack transportation. Rates are also far higher in rural areas where there are fewer options. At the other end of the scale, there are those leaving the workforce due to the need to care for elderly relatives.

Same Tune—Different Verse

Trump has once again delayed some of the tariffs that were to have been imposed on more Chinese goods at the start of October. This "gesture" is ostensibly to reduce tension with China as the next round of talks gets underway. The affected items are mostly industrial. The pressure to delay the tariffs has come as much from U.S. business as from the Chinese as these imports are used by U.S. companies to make other goods.

Analysis: Trump's wheeling and dealing approach to tariffs may work in some negotiating environments, but this is arguably not one of them. The U.S. business community (or any business community for that matter) craves some kind of stability when it comes to the environment where it operates. Businesses know full well there will be uncertainty due to competitor's moves and changing consumer tastes, but they do not expect or appreciate constant shifts by the government in terms of rules, regulations and taxes. If they are expected to reduce their exposure and engagement with China, then so be it. They will adjust and find other sources. The threats and the subsequent abandoning of that threat make it impossible to plan or even to accurately price. The end result has been that U.S. companies have been essentially paralyzed by these negotiating ploys. Given the reaction of the Chinese, it has been hard to determine what the U.S. has been able to gain from any of this.

Is There a National Security Policy Under Trump?

At this point, it is hard to determine what it might be. There has been yet another firing. With the departure of National Security Advisor John Bolton there is once again a void. Thus far, the position has been filled by a hawk (Michael Flynn) a moderate (H.R. McMaster) and an ultra-hawk (John Bolton). All have been dismissed when they disagreed with Trump.

Analysis: The strategy as near as anybody can determine is based on Trump's belief that he can work with world leaders one-on-one. These include such leaders as those from North Korea, the Taliban, Iran and others. Thus far, this approach has not yielded much.

On Being Out of Sync

We are surrounded by those who want us to do a particular thing or act in a particular way. This is the whole purpose of advertising after all. We are to react to the message and purchase or act accordingly. It is pretty easy to determine who an ad is aimed at and pretty easy to know that we either fit or don't. The ultra-glam purveyors would be horrified to see me in possession of their product—I am NOT the person they are aiming at. It is interesting when an entire venue is devoted to shaping my behavior. I notice this a lot with hotels.

Every now and then, I am at a meeting that takes place in a resort area of some kind. The vast majority of those staying at that hotel are there for the resort and the rooms reflect this. Last night, I was in a room at a hotel that is part of a big resort and water park in the Wisconsin Dells. The front desk presented me with a massive pile of brochures and maps to the 765 different ways to be in the water. My room overlooked a maze of water attractions. But here is the problem for the weary business traveler. There was no desk in the room—only a tiny table with no lamp. The chairs were rock hard wood and there was a real shortage of outlets. The message was clear—YOU ARE SUPPOSED TO BE ON VACATION HERE—GO GET IN THE POOL. I get the same feeling in most of the hotels in Vegas—GET OUT AND GAMBLE. In more than a few cases, I have eschewed the designated hotel at a conference in favor of a Holiday Inn Express or a mid-range Marriott—just to get a decent desk and office-style chair. Good free coffee is a plus as well, so I give extra points for a Keurig machine with a choice of pods along with actual half-and-half (my needs are simple).

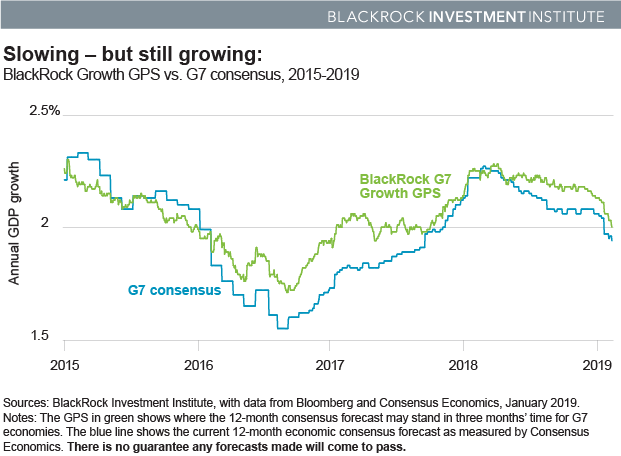

Global Growth Outlook

The global growth situation is certainly not where most would prefer it to be, but neither has it reached a crisis point. The situation looked worse in 2016 and improved quite a bit from that point. The trend now is starting to decline. There is not much reason to expect a reversal unless one of those key motivations change. The trade war could be ended pretty quickly in some sense, but the reality is there will always be some level of tension between the U.S. and China.