By Chris Kuehl, Ph.D., NACM Economist

Short Items of Interest—U.S. Economy

Mester Reminds People of the Danger of Low Rates

Next year, the head of the Cleveland Fed, Loretta Mester, will be on the Open Market Committee and voting on what to do with interest rates. She has been a hawk on rates for a very long time as she was a disciple of the Philadelphia Fed President—Charles Plosser. She will be picking up where Esther George from the Kansas City Fed left off. She is not only concerned about inflation, but cautions that low rates create a high risk of financial imbalance. The low rates contribute to asset bubbles, heavy and inappropriate reliance on debt and highly risky behavior fueled by that cheap debt. As much as people worry about the excessive debt by the government, it is important to note that corporate debt has never been higher than it is right now.

Is There Another Shoe to Drop?

The World Trade Organization (WTO) is ruling on the EU's subsidy of Airbus and the authorization for the U.S. to impose tariffs. This is just round one as the WTO is now taking up the issue of U.S. subsidy for Boeing. If they find that this is also against the rules, the EU will be allowed to retaliate against the U.S. This is one reason the U.S. has been treading lightly. The sense is that the WTO will oppose the U.S. system as well and there is a desire to keep this particular trade battle from becoming an all-out war.

Labor Expectations

The latest data on employment had not been released at the time of this writing, so all we have to work with is speculation, but it is anticipated the news will be mediocre at best. The total could be as low as 125,000. That would signal a drastic slowdown in job creation. If it is closer to 165,000, there will be a sigh of relief. The good news is there have been very few signs of major layoffs, but part of the reason for this reluctance has been the challenge of finding the needed skills in workers these days. Nobody has confidence they will be able to find the workers they need in the future if they lose the skilled people they have now.

Short Items of Interest—Global Economy

Ripple Impact of Thomas Cook Collapse

There is a very hard lesson to be learned from the collapse of the Thomas Cook travel company. It will be one that will be important to remember going into a slowdown. The sudden failure of the company left thousands of people stranded and hundreds of hotels and travel-related companies in danger of bankruptcy as they will not be paid. The reality is this was not a sudden collapse—the company had been struggling for months and perhaps years. It was just that nobody could quite believe that an old and venerable player like this would be in such trouble. The moral of the story is to look hard at those companies with which one does business and never ignore signs of trouble—where there is smoke there will be fire.

Africa Rising?

This is not the first time Africa has been hailed as the "next big thing." Every time this occurred, the continent has fallen short with too many wars and too many corrupt politicians. What might make this time different? Two factors have changed Africa in fundamental ways—many of the African nations are now healthier than they have ever been and they are more educated than they have ever been. The population under 30 now looks at a lifespan that rivals that of Asia and emerging markets in Latin America and the education levels are nearly at a par as well.

Ruination of Mexican Economy

In just six months, the economy of Mexico has utterly reversed course—going from solid growth over 2% to recession. Not all of this can be attributed to the policies of President Andres Manuel Lopez Obrador, but they have contributed. The country has stalled and is plunging back into crisis. That has major implications for the U.S. and the whole region.

Global Manufacturing Slump

One of the more useful aspects of the Purchasing Managers' Index (PMI) is that it is conducted all over the world in the same way—same diffusion index, same questions and even by the same company—IHS-Markit. The result of all this commonality is the results can be compared (apples to apples). The results of the latest set of PMI numbers is a concern. Since 2018, there has been a consistent decline in the PMI data for nations around the world—all of them. For the fifth time in as many months, the global manufacturing PMI has been in contraction territory; some of the largest economies have been deep in the 40s. Any reading under 50 indicates contraction. Last month, 13 of the 15-largest trading partners for the U.S. were under 50.

Analysis: There are many reasons for the decline and various nations have their own issues. The most important has been the disruption caused by the trade war between the U.S. and China. Both of these nations have been impacted, but it can be argued that the majority of the impact has been felt by other nations. Global manufacturing is just that—a global system. Commodities move all over the world and are converted into intermediate products that get converted into something else. The global supply chain is vast and complex. The U.S. imports a lot from China, but China does not import much from the U.S. It would seem that reducing imports from China would do wonders for the U.S. and have little impact on the U.S. given how little we sell them. The problem is that other nations sell to China and then buy from the U.S. If they can't sell to China because the Chinese can't sell to the U.S., then U.S. companies can't sell to these nations. This is a system in which pulling one string threatens to unravel the whole of the sweater.

The U.S. has thus far avoided a recession or even a serious slowdown. Most suggest the U.S. will sport growth around 2% in 2020. That is not bad growth, but it is considerably slower than the 3% that was common last year. Germany is already in recession and much of Europe is very close. This is not all due to the dispute between the U.S. and China—Brexit has done its share of damage as well. The point is that a disruption anywhere in the global manufacturing system or supply chain quickly manifests all over the world.

More Tariff Battles

The EU just lost an important case the U.S. brought before the World Trade Organization (WTO) and that authorizes the U.S. to impose 25% tariffs on a wide variety of European goods. If the U.S. follows through on these tariffs, the U.S. consumer will have to prepare to pay more for items such as French wine, Spanish olives and olive oil, Italian cheese and so on. The WTO ruling allows the U.S. to impose 100% tariffs on about $7.5 billion worth of goods, but thus far, the U.S. is holding some of its fire and is planning to impose a 10% tariff on new airplanes and 25% on a range of agricultural goods.

Analysis: The WTO ruled that Europe has been in violation of WTO rules on state subsidies for their aircraft maker—Airbus. This ruling was fought hard by the EU, but the U.S. was fighting even harder as Boeing had stepped up its attacks in the wake of its issues over the 737 Max. The controversy has been digging into Boeing sales. They have long resented the extensive support Airbus receives from the EU. If the tariffs are to be reduced or eliminated, the EU will have to back away from these subsidies. The Europeans seem unwilling to take that step.

The U.S. tariff policy towards the EU has been quite confusing. There have been many threats from the White House, but the majority of them have been empty. The promised tariffs on European cars never materialized and neither did the sanctions that were supposed to have been levied over European interaction with Iran. The U.S. is very close to the European states despite the animosity expressed between President Trump and some of the European leaders. There is no love lost between Trump and Germany's Chancellor Angela Merkel, but on occasion, Trump seems to have gotten along with President Emmanuel Macron of France as well as the leaders in Italy. It is very hard to punish one nation in the EU and not all the others. So, the U.S. has been tempered more often than not. The WTO ruling justifies a U.S. reaction and it is hard for the Europeans to challenge the assessment as they have been ardent supporters of the WTO and of following their guidelines. It would appear Europe will be stung by these tariffs but not badly. The U.S. consumer has alternatives, but there will be those who balk at more costly wine, cheese and olive oil.

More Worrisome Data Spooks Markets

The data coming out this week has convinced some in the market that there will be further interest rate cuts from the Fed despite the statements coming from most on the Board of Governors and among the regional bank heads. It is still quite unclear what anybody would expect in terms of economic growth from dropping rates from a very low point of 2% to a really low point of 1.75%. There is no evidence that companies are hesitating to execute their growth plans because they are having trouble gaining access to loans. Or, that they lack consumers or lack confidence regarding growth potential for the coming year.

Analysis: The data that has served to make the investors (and others) nervous includes the latest edition of the Purchasing Managers' Index for services. This month's reading was 52.6, the lowest it has been in over three years. This is much lower than anybody had predicted as it had seemed the service side of the economy was doing relatively well. The other factors that seemed to worry included the dip in factory orders by 0.1%. The expectation was that a rise might have been in order. Later today, the employment numbers will be released. There is some concern the numbers will be down as the ADP payroll report was disappointing. The optimists are suggesting another 165,00 added, but the pessimists are saying it will be closer to 125,000.

Before becoming too upset, it is worth noting that some of the distress in the manufacturing sector is due to some factors that may get resolved at some point. The Boeing 737 Max mess has seriously affected the aerospace supply chain and the GM strike has done the same kind of damage to the automotive supply chain. Once these are resolved, there may be a recovery in these sectors.

Retail Expectations Are High

There may be worry within the ranks of the investor and worry within the manufacturers and those that are closely tied to the global trading system, but the consumer either knows something that others do not or they are living in a state of ignorant bliss. The latest assessment from the National Retail Federation is that sales this holiday season could be up as much as 4.3%, although they have introduced some caveats that might change that sunny prognosis. The two most important factors are trending in a positive direction—unemployment remains low and the rate of inflation has also remained low. The worry is that either one of these factors could change by the end of the year. The expected employment data out today is not expected to be all that robust, but a big fall is not expected either. If that changes, the consumer will worry. Inflation has been expected for several years now, but it has not manifested. The Philips Curve predicts that wage inflation will follow low levels of joblessness, but thus far that has not been the case. The expected inflation from higher tariffs on goods from China has not manifested as the big retail players such as Wal-Mart, Target and others have pushed back on suppliers so they will not need to hike prices.

Analysis: The consumer is thus far in a pretty good mood. They have jobs, they have money to spend, they are no longer afraid of using their credit. The retailers are still focused on getting traffic with sales and discounts. Most of the surveys suggest that people are not overly worried about the future. There are some suggestions that these attitudes are changing a little as people start to worry about the trade wars and tariff fights, the upcoming election nastiness and the performance of the markets. The jump in oil prices reminded people just how vulnerable they remain when it comes to commodity pricing.

Who Says We Don't Pay Attention to What Readers Seem to Want?

At least on occasion anyway. In the course of the day and week and month, we get quite a lot of mail with suggestions as to how we might improve this newsletter and we really do consider all these ideas. There are some things we are just not equipped to do. For instance, there has been interest in more focused discussions about the local economy, but we are distributed in cities all over the U.S. and in other nations. It is impossible to do much local focus and still hold the interest of the broader audience. We have been asked to be more critical of certain leaders and politicians, but we are also asked to go easier on these same people. I am certainly not without my bias and preferences, but I try to stay focused on what matters most to business and the performance of the economy.

One suggestion that has been consistent is to write for the way that many people consume information these days. There has been considerable support for the short pieces on the first page and requests for more of these shorter treatments. At the same time, there are many that ask for more in-depth treatment. Our solution to this dilemma is to provide three pieces on the second page rather than two as we have been running a long article and usually a shorter one. We will now have three pieces so that we can cover more items of interest.

Sharing Road Warrior Frustrations

I often wonder about my pet peeves. Am I just getting entirely too cranky in my dotage? Have I become that gnarled figure on the park bench lamenting the ruination of society as we know it? Perhaps—but I know that I am not alone. Today, I had occasion to swap pet peeves with some other well-traveled folk and we discovered a lot of common ground. It would seem those in the hotel, airline and travel community in general should take note.

I have lamented the lack of a workspace in too many hotels these days—especially in resort settings. No desk, no chair (or at least not a chair designed for work). As I was commenting, my female colleague noted that she checked into a hotel across from a convention center and there was no table or desk of any kind. She demanded one be sent up and got a round table that would seat 10 people. Your hotel is ACROSS THE STREET from a convention center and you offer guests no place to work? My male colleague reported on a peeve that matched mine—a room service order of fast food wrapped in plastic with plastic utensils. This would be the meal one expected from a McDonalds drive-up window, but in this hotel that was a $45 meal. The list goes on. The beverage break service that was removed before the break occurred as the session went 30 minutes longer than planned. The food was removed and thrown away as the allocated break time had expired. Who knew my job as a speaker was to accommodate the busy schedule of the hotel staff? (Sigh.)

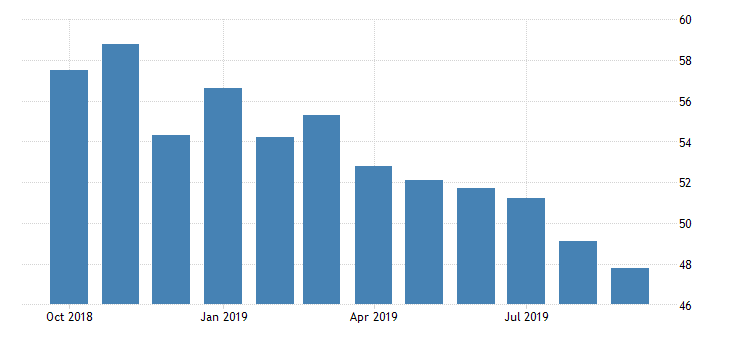

Manufacturing PMI Numbers for the U.S.

Just to put things in some perspective, the PMI for manufacturing in the U.S. was very near 60 less than a year ago and has now dipped into contraction territory for two months in a row. This is not a comfortable place to be, but there is a little sign of encouragement as the new orders index improved slightly this month. That tends to be the more predictive of the PMI indices. It is still under 50, but not as low as it was.