By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Interest Rate Cuts—

The Fed is starting to consider what it does next. The consensus view is that another quarter point reduction is likely. The two reductions that have taken place in recent months have been described by the Fed as "insurance" as there was no real pressing reason to cut rates. The impact has been positive in the sense that interest-rate sensitive areas have responded (housing, auto loans and purchases for more long-lasting goods). The question now is whether another cut will have the same impact. There has been no threat from inflation to worry about, but there are still concerns over what lower rates mean for small banks and savers as well as the threat from lending to those that are too high risk.

Manufacturing Losing Influence?

For a variety of reasons, the manufacturing sector has been seen as an indicator for the economy as a whole. The connection is based on everything from jobs to the materials that figure into manufacturing. The sector has been struggling this year, but the overall economy has continued to thrive. This has been attributed to the consumer and their continued level of confidence. Will that confidence continue even as there are more issues of inflation and possibly job losses? The sense is that some of the bigger economic worries will start to affect consumer mood, but not for a while yet.

China on Charm Offensive

China started out asserting the trade war would be short and wouldn't make all that much difference to their economy. That tune has changed as the dispute has dragged on and become obviously personal. The economy in China has stumbled to levels not seen in 30 years. The impact on the country has been hard to avoid. The response has been to launch a series of efforts to win support from U.S. business as well as from communities that need investment. The economic development organizations have been seeing a great deal of Chinese interest of late.

Short Items of Interest—Global Economy

Brexit Extension

To the shock of absolutely nobody, the EU has agreed to postpone the decision on the U.K.'s departure from the EU. The new deadline (at least from the EU point of view) is January of next year. The central question is what is expected to change between now and then. Will the British change their positions? Will the EU? At the moment, the answer to these questions would be no. It is possible the British will have another election by then. That could change everything, but then again, there is the distinct possibility that nothing will change at all.

Is Central European Boom Over?

For the last several years, the Central European states (Poland, Czech Republic, Hungary, Slovakia) have surged as they have been able to take advantage of low interest rates, active consumers and loads of investment from Western Europe. The bulk of that investment has been coming from Germany. As the Germans experience recession, they are slowing their rate of investment into the region. That has taken the wind out of the sails of these economies. Given that Russia is not in great shape either, there are no good options. The expectation is for these economies to start sliding into recessions of their own.

Pakistan Faces Surging Islamists

Prime Minister Imre Khan swept to power with promises of reform and was seen to have the notoriety of his cricket career to protect him from criticism. The economic struggles of the country coupled with the nationalism that has been triggered by the attacks from India's Narendra Modi have eroded his support. He is now dealing with a national protest movement led by Maulana Fazl-ur Rehman—leader of Jamiat Ulema-e-Islam. This is a party connected to Pakistan's Taliban and other Islamic radicals. It is getting support from the rural areas.

Does al-Baghdadi's Death Change Much?

The death of ISIS leader Abu Bakr al-Baghdadi has been trumpeted as a great blow to the terror organization he founded and led, but most analysts are hastening to put his death in context. The bottom line is this doesn't end ISIS and, in some respects, it may even make the region less stable (if that is even possible). The comparison has been made to what transpired after the death of Osama bin-Laden. It was initially assumed his demise would mean the end of al-Qaeda and the terror networks that had been spawned, but in a very real sense, the death of Osama bin-Laden paved the way for Baghdadi. As the leader is killed, there is a scramble for the position among those that remain. It has been compared to what happens with drug gangs—killing the head only creates a power struggle among the lieutenants. They try to outdo one another with their ruthlessness. It is likely to be so in the areas where ISIS remains active.

Analysis: The analysts point out that Baghdadi was vulnerable to this attack because his power and organization was already waning. The dreams of an ISIS caliphate had long ago been shattered by the joint efforts of the U.S., NATO, Iraq, the Kurds, Russia and Syria. ISIS had lots of enemies. At one point or another, they all attacked the common threat and ISIS lost all the territory it once controlled. Baghdadi had run out of places to hide and many of his supporters had split to join other groups. He was finally trapped and had no choices left other than using a suicide vest.

The question now is what replaces him and perhaps ISIS itself. The intelligence community has identified at least 50 other groups that claim to be insurgents or rebels of some kind. Some are Islamic radicals, some are ultra-nationalists, some are tribal fighters and some are not much more than criminal gangs. With the collapse of the ISIS dream, they have all reverted to the traditional tactics of the terrorist and insurgent—bombings, random attacks, focus on civilian casualties. There is no front, no battleground. Baghdadi believed he could fight armies with one of his own. That proved fatal for ISIS. Now the old tactical plan is back. The terror groups are still getting support from the same allies—Iran, Russia, Taliban, Pakistan and fellow terror groups around the world.

The best-case scenario is that ISIS and its allies will quiet for a while as they develop a new leadership structure, but the more likely result of al-Baghdadi's death will be a series of terror attacks designed to announce to the world that ISIS remains and some new leader is emerging to carry on the fight.

Peronists Return to Power in Argentina

The populists have scored another victory in Latin America as the Peronists have reclaimed power in Argentina with roughly 48% of the vote to the incumbent's 40%. President Mauricio Macri had been trying to reform the nation's economy and dig it out from under the disaster that had been created by the previous Peronist government, but the damage was too extensive and global economic trends did him no favors. The country now has the old regime back in place. It is promising a return to the old strategies. The new regime will be far more interventionist as far as the business community is concerned and it will be far more oriented to free spending policies despite having little money left to spend.

Analysis: These are just a few of the problems that Argentina faces now. The GDP of the country is shrinking and is in formal recession while inflation is running at 50%. The unemployment rate is well over 10% (the official number). Outside analysts have it closer to 20%. The estimate is that a third of the country lives in poverty and the country is set to default for the ninth time on debt of over $100 billion. The International Monetary Fund (IMF) provided a massive loan to Macri's government ($57 billion), but the regime has been unable to keep current on its obligations. The Macri regime inherited a shattered economy deeply in debt to every agency one could think of. The previous regimes elected to solve that debt issue by stiffing those that had bought Argentine bonds or who had loaned the government money. Not surprisingly, these lenders no longer wanted to do business with Argentina. Now, the new leaders (who are the old leaders) are asking those same investors and lenders to cooperate or face another default. In a matter of hours, the country has regained its old pariah status.

The former President—Christina Fernandez—ran as the running mate to Alberto Fernandez (no relation). She still faces eleven counts of corruption, but now that she is back in power, these charges will be suspended. Her track record was utterly miserable and she had been credited with the destruction of the national economy. Her return is not good news for the country's reputation.

'Phase One' Deal?

The U.S. and China appear to be heading towards a deal, but by most accounts, it will not amount to much and will not address the big issues that have kept the two sides apart. The "phase one" deal will likely involve China purchasing more agricultural output from the U.S. as well as some further promises to protect intellectual property and to adjust some of its currency policies. The big concerns regarding China's subsidies and overall trade surplus with the U.S. will not be dealt with—at least not yet.

Analysis: The Chinese had reduced its soybean purchases from the U.S. in retaliation for the tariffs imposed by the U.S., but a bigger factor in the reduction has been the swine flu epidemic. It has been estimated that China has destroyed over 20% of its hog population in order to stop the spread of the outbreak, but now the country is focusing on raising a new generation of piglets and it needs the soybeans from the U.S. The actions on intellectual property have been promised many times in the past and there is reason to be skeptical this time. Meanwhile, it is not clear the U.S. will reduce any of the existing tariffs although part of the agreement is to halt the further increase that had been scheduled. It is assumed this deal will be hailed by both Presidents Trump and Xi as a great progress, but most analysts see it as not much more than a truce given the number of outstanding issues that remain. Neither government really wants this issue sitting front and center in the next few months.

Lots of Big Economic Reports This Week

It is the end of the month. That brings a load of data that should provide some solid indicators on the state of the U.S. economy at the end of what has been a pretty tumultuous year. By and large, the expectation is this week's data will be worrisome, but not quite bad enough to provoke real panic.

Analysis: First up is the initial assessment of Q3 growth. It is expected to be considerably slower than it has been for the last few quarters. Many estimates have this growth number at 1.6%, or perhaps even lower. This is much slower than the 3% that was notched less than a year ago and down from the 2% rate noted earlier in the year. This announcement will come just as the Fed starts to discuss what it plans to do with rates. Most expect the Federal Open Market Committee (FOMC) to lower the Fed Funds rate to 1.75% as it becomes ever more concerned about what a slowdown means to the overall economy. It is worth noting that even a slowdown to this level is still pretty distant from recession, but it is just as distant from robust growth.

This will also be a week for the latest job numbers. The data that has been coming over the last several months has been sustaining much of the economy's momentum. The consumer pays more attention to the jobs data than anything else. As long as the unemployment rate has been low, they have retained their confidence. The expectation is there will be some job gains—between 85,000 and perhaps 100,000. This is not the rapid pace that has been sported earlier, but it isn't a decline either. This will be a month that is thrown off a little by the General Motors strike. Those people will appear on the unemployment rolls and will slip off them once they return to work.

The third set of data of special interest will come from the Institute for Supply Management. The Purchasing Managers' Index (PMI) is expected to improve a little from what it registered last month, but it is also expected to remain under the 50-line that separates expansion from contraction. The U.S. index will be among a whole series of PMI releases. Other nations are expected to see some steeper declines—especially the one for China. The sense is that overall global manufacturing is slumping although not yet to the point of a global recession.

Deficit Swells to New Record Levels

No matter how one looks at these numbers, it is very bad news. The federal deficit is getting worse year-after-year. In 2019, the U.S. government spent a trillion dollars more than it took in. The budget gap is now at $984 billion and the deficit has been worsening during each of the last four years. There was a period in the 1980s when the deficit situation was even worse, but that was a period marked by two recessions and an unemployment rate of 11%. The deficits the government has been running of late have taken place during a period when it would have been expected to have improved.

Analysis: The reason for this major budget imbalance is not hard to determine, but that doesn't make finding solutions any simpler. The big tax cut reduced revenue sharply and there as there was no countervailing tax income from growth. The major spending categories for the government have continued to grow as the population ages. The biggest and fastest-growing segments of the budget have been Medicare and Social Security. Both of these are slated to keep expanding for several more years. Medicaid has also expanded, but not as fast. The military has seen a major increase in its budget. Then there is the annual outlay for debt service, which is creeping up on $400 billion a year. There has been very slow growth in the rest of the federal budget, but that only accounts for about 30% of the total. In the event of another recession, the outlay on spending for unemployment and various welfare assistance programs will surge and the budget will be even more strained than it is now.

We Cat and Dog People Already Knew This

There is always some debate over whether the animals in our care really have any feelings for us. At least there is a debate among those who don't have an animal to care for. The cynics assert they just notice us in order to be assured regular feedings. There are always those who think it clever to assert that cats are really plotting the demise of the human. We all know better and have seen ample evidence of how much our cats and dogs value and love us. Now we have some more scientific proof. It has been shown that dogs and cats activate the same areas of their brains as humans do when they are feeling love. It is the reward center of the brain.

I am no expert on the brain—human, dog or cat. I don't know that I fully understand what these brain scans have revealed about what dogs and cats think of their humans. I tend to pay attention to what my feline five do. It seems pretty obvious that we matter as more than food provider and something warm to lie next to. Scoot has always been the most demonstrative of the bunch and her behavior towards me is clearly based on affection. I am not the feeder in the family due to my travel schedule, that task falls to my wife. Scoot likes her well enough, but she seeks me out and sticks to me like glue when all she gets from me is lots of attention. Those dreamy looks I get when I have been gone a while seem pretty authentic to me.

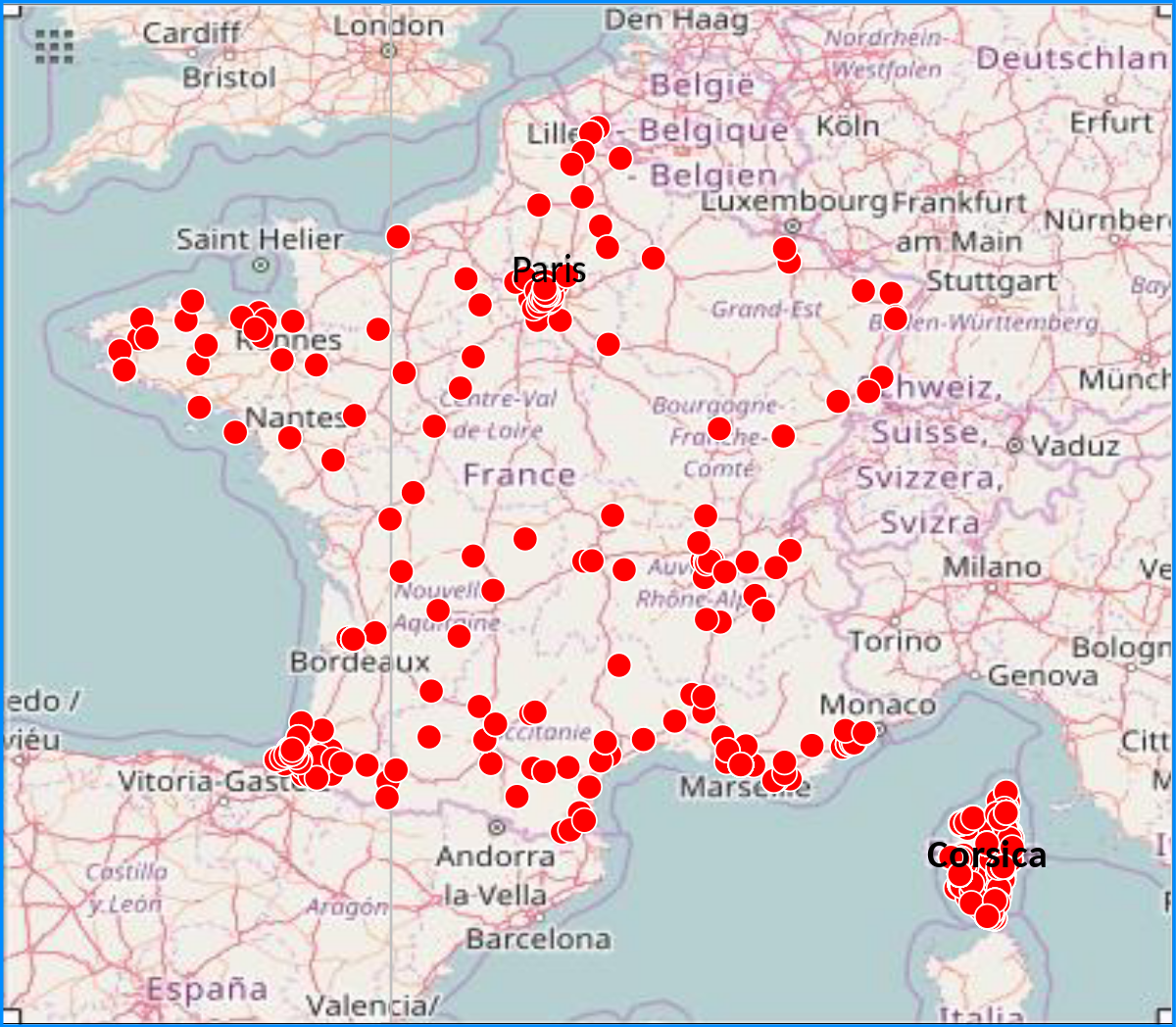

Terrorist Incidents in France 1970 to 2019

The map shows the terrorist incidents that have taken place in France from 1970 to 2019. These are groups that are motivated by nationalism, Islamic radicalism, left-wing politics, right-wing politics and others. The point is terror is ubiquitous and nearly constant. Wiping it out is next to impossible without creating a police state. Even that has not been a deterrent as many police states will attest. It is a threat and a danger that requires vigilance, but also requires sacrifice if the core values of a modern democracy are to be preserved.