Strategic Global Intelligence Brief for October 25, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Chances for Major Deal with China Remain Remote—

There has been some excitement in the global markets over the possibility of a "phase one" deal between the U.S. and China, but that optimism has been tempered by the fact that few think the next phases will be developed anytime soon. The current deal is essentially an uneasy truce—an agreement to not make the current situation any worse. The threats to impose higher tariffs on more goods has been temporarily shelved, but there has been no discussion as regards the bigger issues—protection of intellectual property, Chinese support for exporters, the overall deficit in trade and so on.

One Solution to Housing Crisis

Almost every community in the U.S. struggles with the need to provide affordable housing. This need is often linked to employment. If people can't find a place to live near where the jobs are, they will be unable to take them. Housing and transportation are two of the most important issues as far as addressing joblessness in the poorer populations. Some cities are starting to experiment with different zoning laws—allowing multi-family units to be built in the middle of single-family unit neighborhoods. This can be very controversial as it mixes a rental population with homeowners and can result in lower property values for the existing homes.

Is the Future of Retail in Entertainment?

After many years and over $3 billion, there is a new mall/theme park emerging in New Jersey. It is a somewhat bizarre combination of a massive shopping mall and an amusement park plus a water park and more. The idea seems to be that people will not shop at a traditional brick-and-mortar store unless there is something else to draw them there. In less grandiose versions, there are stores offering music performance and shows to entertain the kids, sporting events and contests. The success of this approach has yet to be proved, but retailers are hoping this starts to reverse the trend towards the online option.

Short Items of Interest—Global Economy

'Wexit' in Canada?

There is unlikely to be a real attempt to secede from Canada, but the western provinces are not happy at all with the electoral outcome. The divisions in Canada are as stark as they have ever been. The Quebecois remain as adamant in their demands for autonomy as ever, but now they have competition from the provinces of Alberta, Manitoba and Saskatchewan. These western provinces did not vote for Trudeau and the Liberals, but these are more lightly populated regions and they were not able to overcome the votes in Ontario and Quebec. Now they are mumbling about pulling away from the nation altogether unless they get some of what they want.

Central Bank in Russia Cuts Rates

The Russian economy has been teetering on the brink for years, but the central bank was not in a position to do much in the way of stimulus as there was also a persistent problem of inflation. Now that the inflation threat has eased a little, the bank has acted quickly with a rate cut and an assertion that more will be coming so long as the inflation threat remains subdued. Russia lives and dies by the demand for its commodities. Lately, that demand has been fading—pushing the country to get more aggressive as far as boosting growth is concerned.

Hong Kong Protests and Economic Growth

Two of the more unusual aspects of the protests in Hong Kong are the fact they have lasted this long and have continued to grow, and the fact that these demonstrations have been having an impact on economic growth in the city and even in China itself. It is hard to overstate the importance of Hong Kong as a business and financial center; it has been a lifeline for China over the years. This activity has stalled as the global community tries to puzzle out what the next phase looks like.

What Does Slow Global Growth Really Mean?

The reports are coming in daily and they get progressively more depressing and dire. The latest fuel for the fire comes from the weak durable goods numbers in the U.S. Granted, the data slumped in part due to the ongoing issues at Boeing and the strike at GM that halted production, but even without these issues, there has been a decline in manufacturing activity in the U.S. That has accelerated the overall decline in global activity. Growth estimates are now less than 3%. This is as slow as it was at the time of the 2008 recession. How serious is this and will it drag the U.S. down significantly?

Analysis: To a degree, the U.S. is insulated from the global economy but only partially. The export sector is important to the U.S. economy as it accounts for 15% of total GDP. That is a $3 trillion dollar impact. The U.S. is not as vulnerable to trade variability as is Germany with its 55% dependence, but $3 trillion is nothing to sneeze at. The U.S. economy remains dependent on the consumer. As long as the consumer is in a good mood, the economy as a whole will respond favorably. There are only a few factors that really have an influence on consumer attitude and only one of them is that closely tied to the global economy. The most important factor is the job market. As long as consumers feel good about their employment status, they will be willing to spend. At the moment, the jobless rate is as low as it has been in 50 years. The second factor that has had an impact on the consumer is inflation. If they sense they are paying far more for the same things they bought last week, last month or last year, they become concerned. Generally speaking, the prices that have the biggest influence are food and fuel as these are the purchases made most often.

There has been no deterioration in the labor situation although there has not been the expected level of wage inflation either. The inflation threat has been subdued as well—fuel has actually fallen in many markets and food hikes have been relatively minor. In order for the global growth issues to affect the consumer, there will have to be layoffs connected to that slow growth as well as price hikes sufficient to concern the consumer.

Brexit–Saga Continues

The issue of Britain's withdrawal from the European Union has transcended whatever logic was ever involved. It is almost impossible to remember what prompted the desire to pull out in the first place. If one harkens back to the referendum, the issues were essentially immigration and regulation. The bulk of the population that voted to leave were motivated by the fear that migrants from Europe were swamping the U.K. They were ostensibly taking jobs and changing the culture of the country although there was never any data to support that assumption. A more salient issue was brought forward by the business community as they had been chafing at European regulations for years. To be honest, the majority of the polls suggested the vote would be to stay in the EU, but those who opposed Brexit assumed it would lose and didn't bother to vote. Then and now, the opinion polls showed that over 65% of Britons want to stay in the EU.

Analysis: Brexit has become a war of personalities and ideology. Neither side seems to want to find a solution as they are getting all the mileage they need from extending the conflict. The latest twists and turns have Prime Minister Boris Johnson losing key votes and the support of many in his own party. The vow to avoid another extension has been rendered null and the EU is now mulling over what its response will be. Johnson is calling for new elections by the end of the year and daring his rival—Jeremy Corbyn—to take the leap as the decision requires two-thirds support in Parliament. Thus far, Corbyn is not taking the bait, but his position is no stronger than Johnson's. They are both very unpopular with the voters and even within their own party.

Meanwhile, the British economy is adrift. Every day brings a new and more depressing analysis. The expectation is there will be a recession. The only question is how bad it will be. The worst-case scenario has growth numbers falling by as much as 3% to 4%, which translates into full depression. If there is a decline of this magnitude, the unemployment rate will likely soar to as high as 20% and the country will be slammed into a financial crisis that will take years to dig out of. Today, the British economy is the fifth-largest in the world; roughly the size of California's. In another year, it will not be in the top 10 and could be smaller than that of Mexico.

The domestic issues that concern the U.K. have been mostly ignored while this battle rages. The population has grown very weary of the incessant debate. At one time, the issue of Brexit was not in the top five as far as concerns. Now it is at the top of the list, but issues such as the National Health Service, crime, terrorism, economic growth and immigration still rank very high. The perception is that nothing is being done to address any of these. There is also deep division within regions of the U.K. The support for Brexit was always very weak in Scotland and Northern Ireland and only tepid in Wales. The majority of the Brexit supporters have been in the industrial areas of the U.K. where people were most concerned about immigration.

Decline Predicted in Remodeling Sector

While much of the attention is focused on the housing sector, there is a companion sector that drives a great deal of economic activity. The remodeling industry has been surging along for the last 10 years as it has been motivated by people selling their existing homes and renovating their new purchases. Also, many have had to adapt to taking care of senior relatives and stay-at-home children. That growth period may be coming to an end—according to the data collected by the Leading Indicator of Remodeling Activity.

Analysis: The study comes from Harvard's Center for Housing Studies. It predicts there will be an actual decline in activity next year, and that has widespread implications. Not only does this affect those that do these projects, but it will have an immediate impact on the retailers that sell to the remodeling industry as well as the legions of do-it-yourself homeowners. The reason for the expected decline is no great mystery. There has been a slump in the sale of existing homes as the prices have been rising and mortgage rates have started to escalate a little. There is also the fact that some of the big-ticket items sold by the home improvement stores have been getting more costly with the tariffs. The small-scale projects are expected to continue, but the bigger renovations will slow and could reverse in the coming year. An additional problem has been the lack of workers as this delays the start and completion of projects which often results in the consumer losing interest in the project altogether.

What Is the Boeing Timetable?

The 737 Max issue has become a major concern for the entire manufacturing community over the course of the last several months. It started out as a design flaw in the software that appeared to be easily fixed, but the issue ballooned from there as the FAA was harshly criticized for its failed oversight. It subsequently went into high gear to find anything else that might pose a problem. Boeing encountered more issues than expected and the plane's return was delayed over and over again.

Analysis: The word is that Boeing will have the plane ready to return to service by the end of the year, but nobody is counting on a specific date. The airlines have canceled flights into January and February and could cancel more. The purchases of planes from Boeing have all but ceased. This has cost the company 20% of its stock value and over $7 billion in pre-tax write-off. There are dozens of lawsuits that will be hitting the company in the months ahead. The airlines that fly the plane have been slammed as well as they have canceled hundreds of flights a day. Airlines around the world have been canceling orders and delaying delivery.

Even assuming the planes are judged fit for service, there will be ongoing issues with some 20% of passengers declaring they will not fly on a 737 Max. Judging by past behavior, this is likely an idle threat as people will continue to choose flights that are convenient and priced appropriately. The biggest economic impact has been felt by the thousands of suppliers to Boeing as they have not been able to sell to the company while production has been stalled. The most optimistic assessment is that inspections will be complete by the end of the fourth quarter and airlines will be back to regular schedules by the middle of the first quarter of next year. The financial impact on Boeing and the airline industry will last through most of 2020.

Can Wind Power Solve the Energy Crisis?

There are few issues that ignite the emotions like that of energy. This is not hard to understand as energy access is perhaps the most critical element in most people's lives (just ask the people who keep losing that access in California). The issue is made more intense by the costs of that energy—both in terms of actual monetary outlay and the costs to the environment from burning fossil fuels such as coal, oil and gas. The whole issue of climate change rests on the issue of providing energy. The International Energy Agency has just issued a report that asserts offshore wind power will be able to provide all the power needed in the world by as soon as 2040.

Analysis: There will be nothing automatic about this transition as the expectation is that such a development would require over $840 billion in investment. The assertion is offshore development is considerably more stable than onshore wind and solar and would involve less environmental risk. The assumption is that traditional fuels will get more and more expensive and complex to use. The concerns over climate change will only escalate and use of coal and oil will become ever more unpopular. This drives interest in alternatives such as wind. One of the key developments is efficient transportation of energy generated by the offshore developments. There have been great strides here as well.

The commitment in development funds will be significant, but not out of the reach of utilities, governments and business given the costs of developing traditional sources of energy. The era of truly cheap oil ended years ago. The other power alternatives have also become more expensive so offshore wind becomes price competitive by as soon as 2030.

Hate Grows Faster than Love

I am reading In the Garden of the Beasts by Erik Larson. It is the account of the first U.S. ambassador to Germany under Hitler and has proven to be both fascinating and terrifying. The part that is most disturbing is the account of how quickly the German people accepted hate and anger and how willing they were to express that hate. I am very sorry to say that I see far too many parallels between Germany in the 1930s and the U.S. today. There is a willingness to utterly vilify those with whom one differs. Too many are not content with disagreeing with someone—they must take it several steps further and condemn that person completely. They decide to hate those that disagree with them. Maybe these expressions of hate are just posturing and people are not really willing to go that far, but there have been too many times in history where actions have indeed followed these expressions of hatred and animosity.

I am not naïve and I understand it is hard to accept those whose positions are diametrically opposed to one's own. We are not talking about favorite sports teams here. I have a very, very hard time tolerating those who abuse animals or those who are bigots. I am frustrated by those who can't seem to deal with facts. I get it. I understand how easy it is to dislike and hate, but I also know that this attitude gains nothing. I will strive to change people's minds and accept the fact that I will rarely be successful. I will also strive to remember these are still people of value in their own right and do not deserve being hated. I am not planning to make them boon companions, but neither do I want them hurt or eliminated. I can only hope they feel the same way about me and the ones I love.

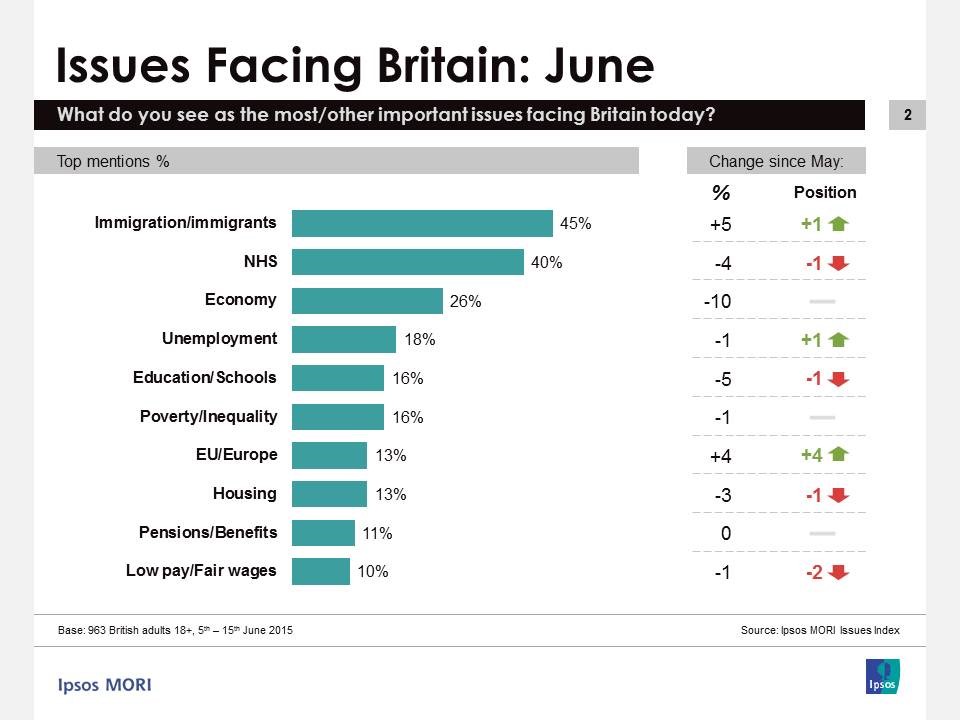

Issues Facing Britain

As the Brexit debate wears on and on, the British public continues to focus on the issue of immigration. The emotional side of the Brexit issue has been the fuel for this ongoing crisis. That immigration should be a focus of such anger is no shock—the British are among most other global populations that have come to resent the arrival of newcomers. In the U.K., the opposition is directed primarily at the Eastern Europeans who began to arrive in large numbers as these nations became members of the EU.