Strategic Global Intelligence Brief for October 23, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Fed Injects More Liquidity—

As promised, the Federal Reserve injected more long-term and short-term liquidity into the markets in an effort to reduce the volatility manifesting of late. The overnight lending markets have been nervous and somewhat unpredictable so the Fed has been making a series of emergency moves. The New York Fed has injected $99.9 billion in temporary liquidity and $7.5 billion in permanent reserves. The short-term action was accomplished with $64.9 billion in overnight repurchase agreements and $35 billion in a repo operation. It is hoped this intervention calms the overnight market to the point that banks can operate with more confidence, which would help stabilize the economy. The sense that a recession is at least a possibility has been affecting the financial and business community—making companies more cautious than they would ordinarily be.

Auto Sector and the Triple Whammy

There are few sectors that have the influence the automotive sector has—in the U.S. and in the rest of the world. It is one of the largest employers in every one of the developed nations—for every person working on the line, there are 23 people whose jobs depend on this work. The sector has been struggling of late. There are three factors at work. The first is that most markets are saturated—there are 10 cars for every 10 people in the U.S. The numbers are similar in Europe and even in developed Asia. The costs of manufacturing are going up due to factors such as tariffs, emission controls and safety demands. Then, there is the ongoing issue of protectionism as every nation wants to preserve their jobs. Add in the emergence of new technology and the reluctance on the part of Millennials to buy cars and you have a recipe for declining sales for years to come.

Why No Deal with China?

Pragmatists have been trying to puzzle out the strategy behind the Trump tariffs on China. It is now starting to dawn on them that there is nothing pragmatic about this dispute. Trump dislikes China and President Xi dislikes the U.S. It has become intensely personal for both and likely always has been. There was an assumption that Trump would make a deal at the last minute to boost the economy prior to the election, but time is running out; a settlement is made more difficult every day. Trump's demands have become overtly political and impossible for Xi to agree to. Even if Trump makes an offer at this point, the Chinese are not likely to agree to one.

Short Items of Interest—Global Economy

More Brexit Drama

There seems no way to escape the situation that Prime Minister Boris Johnson finds himself in. The British parliament is not going to do a deal prior to the October 31 deadline. That means Johnson is going to have to ask for an extension from the EU—a step he vowed he would never take. It is very likely the whole thing gets kicked down the road by at least three months. It is also likely new elections will be called in the U.K.

Vietnam Outstrips Capacity

The nation that has been the biggest beneficiary of the U.S.-China trade war has been Vietnam. It has seen a 65% increase in business with the U.S. The problem now is Vietnam lacks the capacity to take on this much work. The power grids are overwhelmed, there is not enough labor and the transportation infrastructure is creaking and failing. Billions in investment is needed just to handle current demand.

Latin American Ferment

There has been considerable chaos in Latin America in the past year—populists coming to power in Brazil and threatening in Argentina. Riots in Chile and Peru alongside near revolt in Venezuela. The root of almost all of this unrest has been economic stagnation. Populations had been led to believe that things would be much better by this point. That promise has not been kept—by either the right or the left and frustrations are overflowing.

Trudeau Wins—Sort Of

The Liberal Party in Canada won, but it didn't. The story in the Canadian press was essentially that both parties lost, but that one lost more than the other. Prime Minister Justin Trudeau will now have to form a minority government by cobbling together a coalition with smaller parties whose positions have differed from his throughout his first term. These parties gained support and votes in this election. Unlike his first election, there is no groundswell of support and enthusiasm. Even his most ardent supporters from that election have cooled.

Analysis: This election was called the "No-Issue" race as the focus of both campaigns were somewhat uncharacteristic of those in Canadian. Trudeau was attacked on personal issues and was also dogged by accusations of cronyism for trying to direct parts of some investigations. His opponent—Andrew Scheer—was attacked for being a dual citizen of Canada and the U.S., and essentially for being dull. There was very little conversation about the bigger concerns of the average Canadian—taxes, regulations, climate change, relations with the U.S., trade and so on. Even the big social issues that Trudeau ran his first race on were missing from the debates.

The likely outcome is a coalition between the Liberals and either the New Democrats (NDP) or the Party Quebecois. The NDP lost votes as their left-leaning message seemed to spook voters more than expected. Trudeau kept pointing out that a vote for the NDP would really be a vote for the Conservative Party as it would take support away from the Liberals. The Party Quebecois picked up three times the seats they had previously and are back in the role of kingmaker. They have a very focused agenda, however, and throw their support behind the party that grants Quebec the most in terms of autonomy coupled with massive amounts of aid and assistance. Regardless of the coalition that forms, the Canadian government will be weak for the next few years. Many pundits are already asserting that a new election may be called sooner than later.

Trade War with Europe Postponed Again?

For the last several months, there has been a threat hanging over the European auto industry (and the U.S. counterpart for that matter). The Trump administration has been promising to impose tariffs and other restrictions on the industry in Europe despite the fact the European and American sectors are very closely aligned. The U.S. auto industry has had its issues with foreign imports over the years, but the majority of that concern has been directed at the imports from Asia rather than the vehicles that come from Europe. Furthermore, there has been considerable investment in the U.S. from Europe—establishing manufacturing operations for Volkswagen, BMW, Mercedes and the merger between Chrysler and Fiat. The fact is tariff threats have had little to do with the auto sector itself, they have been threatened because President Trump has been unhappy with a variety of EU positions on subjects such as Iran's nuclear deal, the stance on Brexit, opposition to Russia and the like. These are politically motivated tariffs masquerading as economically driven tactics.

Analysis: The deadline has been approaching and the question was whether the Trump threat would be carried out this time. The latest word on the issue comes from Commerce Secretary Ross who is now suggesting that the next step will be further negotiations rather than the imposition of these restrictions. There is more positive news here than meets the eye. It is very unlikely the Europeans will alter their political positions to thwart the tariff plan. There will be no change in Brexit strategy because of the U.S. and no shift in position on Russia, Iran or any other geopolitical concern. That means talks will be over the actual industry itself. There are areas where the two sides could agree—more purchases from the U.S., fewer imported parts from Europe, more investment in the U.S. and so on. These would be concessions the Europeans and Americans could agree on.

To note that relations between the U.S. and Europe are strained would be an understatement and that has been costly to both. Germany is in recession and France teeters on the edge. The struggling southern tier states such as Spain, Italy, Greece, etc., are still in distress and starting to backslide again. The U.S. is hurting as its export sector takes a hit from the tariff and trade war. The two sides really need to bury the hatchet and resume normal relations.

Will China Mollify the Protestors?

The protests in Hong Kong are now in their fifth month. That presents China with a major problem. It was assumed these demonstrations would end rather quickly. The Chinese would show force and that would be enough to get the protests to end. That has not been the case. Now China is faced with making a choice. There has already been one round of concessions as the government agreed to scrap the law that would have allowed the Beijing authorities to extradite people from Hong Kong for trial in China. That was not enough as the protestors had moved past that demand to one that involved removing Chief Executive Carrie Lam as the head of the Hong Kong government. That is now the offer China is making—provided that President Xi Jinping approves. She would be removed by March of next year.

Analysis: It is not at all clear this will be enough to halt the protests. The demands have now expanded far beyond the original goals. Many are holding out for real and complete democratic control of the city. That will never be granted by China, thereby creating a very dangerous impasse. The question now is whether the protest groups fragment. It is very hard to determine just what the average resident of Hong Kong is feeling—polls are illegal and reporting is next to impossible. There are not even official spokespeople for the protest groups, or rather there are many and nobody really knows who represents what.

As near as can be determined, the population falls into four groups. There are those who are against the protests altogether and support the mainland position. They may be as many as half the population or as few as a quarter. The next group is made up of people who don't have a position one way or the other and just want things to calm down—maybe 20% of the population, but made up of the business community. The third group wants change but will settle for incremental progress such as getting a new leader and rescinding the worst of the mainland rules. This may be 20% or so of the population. That leaves the most hardline of the demonstrators who want nothing less than autonomy or independence for Hong Kong. They are in the distinct minority—perhaps no more than 5%, but they have been leading the protests and will not be controlled without the use of force. If the police and military force a crackdown on this group too aggressively, there is the risk that people who have not been as radical will become more aggressive in response and China will face the need for a major and likely bloody confrontation.

Trouble in the Housing Market

The expectation had been upbeat when it came to the housing market. The data suggested that a rebound was in store for the second half of the year, generally very good news for an economy that depends on the continued good mood of the consumer. There is no greater store of wealth for the average American than their home. Its value has a lot to do with their confidence levels. Furthermore, the industry around home sales is massive—encompassing banks, real estate operations, remodelers, insurance providers and so on. The new homes data was pretty decent, but the real focus is on the existing market. The data this month was disappointing.

Analysis: There was a decline of 2.2% from August to September; the expectation had been there would be a gain. The two key factors seem to have been a shortage of available homes to buy and the fact that prices have risen in part due to that shortage. There have also been some trends of late that are causing adjustments in the housing sector. It was once assumed that older homeowners would be selling their larger homes to move to smaller ones or into some kind of retirement community. There is now a great deal more support for "aging in place" so there are fewer of these houses on the market. The remodeling industry now ranks retrofitting homes for elderly residents as one of their fastest-growing sectors. The second issue is that Millennial buyers are still showing some reluctance to buy homes. When they do decide, they have less money to work with. This kind of slump has a greater impact on the economy than slumps in the new home sector.

Boeing and the Greater Economy

As expected, heads are starting to roll at Boeing. The only mystery is that it has taken this long for many of the top officials in the company to be shown the door. The 737 Max debacle has been crushing for the company, but it has also had a major impact on the U.S. economy as a whole and may ultimately contribute to a decline in growth. The sectors affected grow with every passing week. The airlines that fly the 737 Max have been forced to cancel thousands of flights and have no idea when they will get them back. There are even rumors that Southwest is looking at a merger with either JetBlue or Alaska Air in order to get access to aircraft other than the 737. Thousands of companies that have been part of the Boeing supply chain are in real trouble. Many will not survive many more months of this idleness.

Analysis: There has been plenty of criticism to go around. The data suggests that Boeing knew there were issues with the systems and chose to ignore them. It is also true the FAA failed to do the job it is required to do. Now it seems to be overcompensating for these previous breakdowns. The alternatives to Boeing are very limited as only Airbus has the capability to provide that kind of aircraft. It is having issues of its own in Europe and is now being hit by a World Trade Organization ruling that accuses them of getting illegal subsidies from throughout the EU. The impact of all this is being felt by the airline industry and ultimately by passengers who will see higher fares and fewer options.

Have I Seen Everything Now?

After years of being a road warrior, I assumed that I had seen just about everything one can see during these travels. I have seen more than my share of nitwits on planes as they stagger down aisles dumping coffee on one another, slamming people in the head with their bags and generally behaving with maximum rudeness. I have seen lots of drunks and screaming kids and fits of air rage. I see just as much anti-social activity in airports, hotels and conference centers. But every now and then, there is a new experience to add to the collection.

I was staying at a nice chain hotel offering a free breakfast. As I felt a little puckish, I decided to avail myself of the offering. I dutifully cleaned up, took my shower, shaved and dressed for the day. I thought it would be crude of me to stagger down and act like the bistro was my own kitchen. As I arrived, I noted that not everybody shared my attitude as there was a rather ample gentleman dressed in his "tighty whiteys" and a T-shirt that really didn't do a good job of concealing his rather hirsute appearance. The hotel staff was taken aback and seemed as stunned as the rest of us. Before he could be instructed to come back with more modesty, he had snagged his coffee and handful of Danish pastries and padded back to his room. My appetite waned at that point and I decided that I would be willing to wait until lunch.

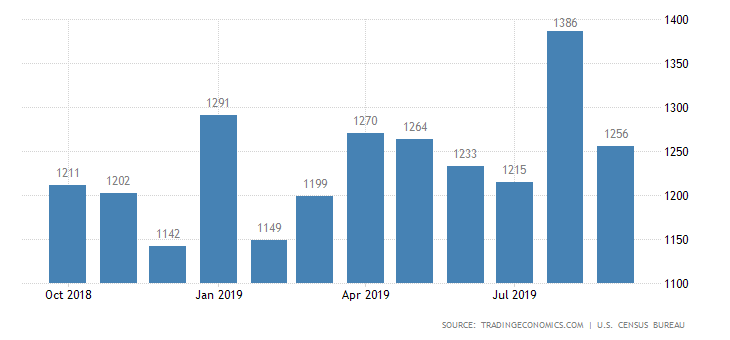

Housing Starts

There has been a good deal of volatility as far as housing starts are concerned, but in general, the news has been fairly good over the last several months with a big surge at the end of the summer. The factors driving new home activity are the stock market as that has encouraged the construction of higher-end homes and the low mortgage rates which have driven the starter homes. The struggles in the existing home market do not seem to have affected the new home market as yet.