Strategic Global Intelligence Brief for October 16, 2019

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Is It Still the Economy?—

If the answer to this question is "yes," the polls suggest that Trump will win the 2020 election with a wider margin of victory than in 2016. The current position of the voting public is as polarized as it has been in decades with nearly equal numbers of voters thoroughly committed to Trump and thoroughly against him—roughly 30% on each side. That leaves roughly 40% of the voters waiting to decide and, if past is any prelude, they will vote according to the state of the economy. If the job market is solid, the stock market is healthy and recession seems to be a distant possibility, the majority of voters will vote for the status quo.

Negative Interest Rates—Timing Is Everything

There has been experimentation with negative interest rate policy among some of the world's central banks and the jury remains out as far as its effectiveness. The U.S. Fed has not tried the tactic, but a paper from the San Francisco branch has outlined the circumstances under which it might. The idea is that when an economy has completely stalled, there is a need to stimulate and it may require more than just low rates. The negative interest rate is essentially asking the Fed to pay borrowers to take out loans with banks—a means by which to get idle money off the sidelines and into circulation. The paper asserts that conditions might have been favorable for this policy at the start of the recession in 2008, but not at the present time.

Housing Contributes to Wealth Gap

There are more and more people with decent incomes that are renting as opposed to buying. That is starting to affect the wealth gap. Traditionally, home ownership is the key to savings for middle income people as their home value increases over time. The problem now is too many people are saddled with debt and are not in a position to leave renting behind, or they live in a region where housing costs are prohibitively high. The key factor has been student debt, but the fact is many of those carrying student debt also have debt from credit cards, auto loans and other obligations.

Short Items of Interest—Global Economy

Russian Troops Fill Void

As the U.S. abandoned positions in Syria to avoid contact with Turkish troops, the Kurds in the area were suddenly vulnerable and were taking heavy casualties. The civilian population was displaced as 70,000 people started to flee the onslaught. Turkey has ignored all requests to call off the assault so the Kurds in the region have turned to a new ally. Russian troops have been moving in where the U.S. troops were. This has presented the Turkish forces with a dilemma. If they continue to advance, they will encounter these Russian soldiers. Russia has warned that if any of their troops are fired upon there will be instant retaliation from the substantial Russian garrison that is currently active in Syria. The U.S. has utterly lost any influence in this region to Russia.

Does Anybody Have a Clue?

In the course of just three hours, there were statements from British and European negotiators that utterly contradicted one another as far as Brexit is concerned. One comment suggested the talks were at an impasse and in the next 20 minutes a statement was issued that indicated an agreement was imminent. The British pound has been gyrating up and down on every new utterance and nobody has a clue what to expect.

China Threatens Retaliation over Hong Kong

As if the trade impasse was not enough, the U.S. and China are at odds over what is happening in Hong Kong. The Congressional condemnation of China's actions has provoked a strong response from China with vague threats of retaliation for meddling in China's domestic affairs. It seems China has already started to waffle on its decision to buy more farm output from the U.S. That is seen as a reaction to the Hong Kong criticism.

Slow Global Growth—What Does It Mean?

The pace of global growth has not been this slow since the recession of 2008. Estimates from the International Monetary Fund (IMF) have growth slowing to less than 3%, down from the previous estimates this year. The most worrisome part of this decline is there has not been some major economic event driving the decline. There has been no global recession, no financial crisis, no major war or catastrophe and no surge in commodity pricing precipitating some kind of reaction. This downturn has been attributed to politics. It is a result of a trade war between the U.S. and China, but it is not just this conflict that has been weighing on the global economy. There is the Brexit chaos that has hamstrung both the U.K. and the EU; the dispute between Japan and South Korea that has all but ended trade between these once-close partners. Brazil is in conflict with its neighbors, India and Pakistan are at odds again, Turkey is cutting ties with the U.S. and Europe, and the list goes on and on. The result has been a halt to active global trade.

Analysis: There are essentially three scenarios developing in response to all this. The first is the optimistic version that holds out for cooler heads to prevail. It assumes that at some point the nations involved in these trade wars realize they are being harmed by the policies and therefore should start finding ways to settle at least some of the issues. Most assume this scenario will depend on the emergence of new leadership in several key nations—no more President Donald Trump in the U.S., no more Prime Minister Boris Johnson in the U.K., no more President Jair Bolsonaro in Brazil or President Andrés Manuel López Obrador in Mexico or Prime Minister Narendra Modi in India. Some of this change is more likely than others.

The pessimistic scenario is one that accelerates the shift towards isolation and nationalism. In this version of events, there will be nations that will sink into deep recession as their economies are highly dependent on exports (and imports for that matter). This would include Germany and Japan, but China, India, Brazil, Canada, the U.S. and others will be affected as well. The nations that have a large and active consumer base of its own will fare better, but will not be immune to the slowdown—especially if that home-grown consumer becomes concerned about their own job stability and financial health.

The third (and most likely scenario) is a version of muddling through. Nations will threaten tariffs and restrictions, but will back off at the last minute as has been the pattern with the U.S. in most cases. This scenario holds the U.S. and China will arrange a truce or two or three, but will not resolve any of the key issues. Brexit will be delayed, but with no hint of a breakthrough. The disputes between other nations will ebb and surge, and no real resolution will be developed.

What About the USMCA?

The revamp of NAFTA was supposed to be a seminal moment for the Trump administration. It turns out that getting out of something is a lot harder than entering into something new. The key issues at the start of negotiations were trade deficits, access to each other's economy and the issues of migrating business. The U.S. felt that NAFTA favored Mexico and Canada at the expense of the U.S. despite the evidence that suggested the U.S. gained as much or more from the deal in terms of markets and the ability to exploit Mexico as a manufacturing platform and Canada as a source of raw materials.

Analysis: Mexico rapidly approved the new pact as the legislature feared incoming President Andrés Manuel López Obrador. It assumed correctly that he would oppose many aspects of the new deal, but he has not been able to reverse the decision. The Canadian parliament has not ratified it either as there has been too much political turmoil over the fate of Prime Minister Justin Trudeau. The opposition in the U.S. has come from both Democrats and Republicans, and they want modifications. The Democrats want more safeguards for the Mexican workers and tighter environmental regulations. Republicans object to the trade deficit with Mexico as well as to working with the left-wing leader of Mexico. They demand more engagement on issues of immigration and the drug wars. At this point, passage of the USMCA as it stands seems highly unlikely and modifications will not be looked at seriously in an election year.

Global Migration Crisis

There has never been a larger number of crisis migrations. This is saying quite a lot given the past experiences from World War II and the decades of African unrest. It is estimated that one person is displaced every two seconds for a total of 26 million refugees globally. The factors that drive refugee movement include war, environmental disaster, climate change and poverty. Usually, these factors occur in combination and that complicates reactions. At the moment, the migration issue is red hot in dozens of nations—the U.S. argues over building a wall, Germany watches the AfD party gain supporters by the day, the U.K. elected to bolt from the EU, whole populations are expelled from nations as diverse as Thailand, India, China, Brazil, Venezuela and others. The issue of migration and immigration has radically changed over the last few years.

Analysis: The immigrants of 15 to 20 years ago were overwhelmingly motivated by economic issues. They were mostly male and between the ages of 15 and 35. The majority had some kind of basic skill and many were relatively highly skilled. They were leaving to find work and opportunity and fell into three broad categories. There were the ones who planned to start a new life and intended to assimilate as quickly as possible. They learn the language and the culture and adapt. The second category is the person who fully intends to return home as quickly as they can—after they have earned the money they need. These are the repeat migrants—coming in and out of a country to work. The third category was better described as a refugee—fleeing an untenable situation to find a new life elsewhere. This group has been growing at a very rapid rate and is now the dominant category.

Nations have long adapted to the first two categories. In fact, these migrants have been welcomed. These are the people who end up filling the employment needs of the country where they are migrating. The problem today is most nations are set up to deal with the first two kinds of migrant and have been unable to deal with the new kind of migrant. The refugee migrant is being chased from their home by force and comes with families. They have no desire to move and therefore learn new languages and cultures—they want to return home even though that option is no longer realistic. They are unable to work and soon become dependent on assistance from the government. That dependency lasts for a generation at least.

The solutions have been inadequate. The two dominant approaches have been to try stopping the migration in the first place. This has been both controversial and ineffective. Determined and desperate migrants will find a way in, but many will be hurt and exploited in the process. The second approach has been to cope with the influx, but that is expensive and offers little in the way of long-term solutions. Ultimately, the goal would be to reduce the motivation for the refugee in the first place, but ending wars, disasters, poverty, etc. is not by any stretch an easy task.

'Stop Doing Stupid Stuff'

The phrase was credited to Barack Obama at one point. The challenges that have been dragging the global economy down have all been some version of a self-inflicted wound. In some sense all of these downturns are products of bad decision-making, but this time around, the fault seems to lie with the policy makers. The top three mistakes according to most analysts include the U.S.-China trade war, Brexit and the confrontation between Japan and South Korea.

Analysis: The U.S. has a very legitimate reason to control bad Chinese behavior—everything from stealing intellectual property to boosting exports through government action. Dealing with these issues with a blunt weapon has been counterproductive and has damaged the U.S. as well as the global economy. The Brexit vote shocked the British, but the issues were and are real. There was fear of immigration and resentment when it came to European rules. Japan and South Korea have been at odds for years and intransigent governments have allowed these conflicts to fester. The plea is for leaders to avoid simplistic solutions and ideas as they grapple with the legitimate trade policy concerns.

The tendency has long been to address problems in isolation. Acknowledging the complexity makes it very hard for political leaders to make choices and decisions, but failure to tackle the core issues often creates bigger problems later. The U.S. has an issue with China, but the tariff/trade war has not proven to be an effective approach. It is not clear these big issues can be addressed without confrontation, but the current tactic has yielded nothing as far as Chinese reaction.

Women in the Work Force

The arrival of the woman in the workforce started in earnest in the 1970s and has accelerated through the last several decades. Today, the female share of the workforce is over 55%. The challenge is women are still consigned to sectors that have traditionally been occupied by female employees. This has been referred to as the "glass ceiling" and other terms, but the point is talent that should be broadly distributed is often narrowly scoped.

Analysis: The sectors still dominated by women include health care, education, social service, administrative activity and personal care. The sectors that remain heavily male include management, construction, engineering, production, entertainment, architecture and many others. The sectors that are mixed include law, accounting, finance, media and sales. The choices women make vary from the very high-level jobs as well as the lower-level jobs. The sectors that are not populated by women are often in the middle-level jobs. That can compromise the growth of many companies. The women in the higher and lower-level jobs are generally paid similarly to men, but the ones in the middle are often at a disadvantage. They are usually the only woman in that sector and fight old perceptions among those who hold that job.

Techno Fear

By this time. alert readers know that I have what can be described as an "awkward" relationship with technology. I am not exactly a Luddite as I do try to employ these miracles of modern science. It is just that they all seem to get the better of me more often than not. I am left adrift and unable to rescue myself. Even though I know this is my fault, I get frustrated and downright angry. I know that I should devote more time and energy to the understanding of tech, but I have other things I want to obsess over. I am intimidated enough by the normal workings of the tech world. Then I hear a session on cybercrime and security and I am ready to go live in a yurt.

By the time I am warned to never trust email, texting, web browsing, shopping, skyping, tweeting or ever being in the same room with a device (can't trust modern toasters or electric toothbrushes these days), I am prepared to start using whale oil lamps and communicating via homing pigeon. I learn that a pacemaker can be hacked and so can my coffee pot. What will my coffee aficionado friends think of me when they learn I like Pumpkin Spice flavored Keurig pods? Will my toaster reveal my fondness for muffins? Sobering thought. It is too late to run and hide. I am at their mercy and all I can hope is that Isaac Asimov was wrong.

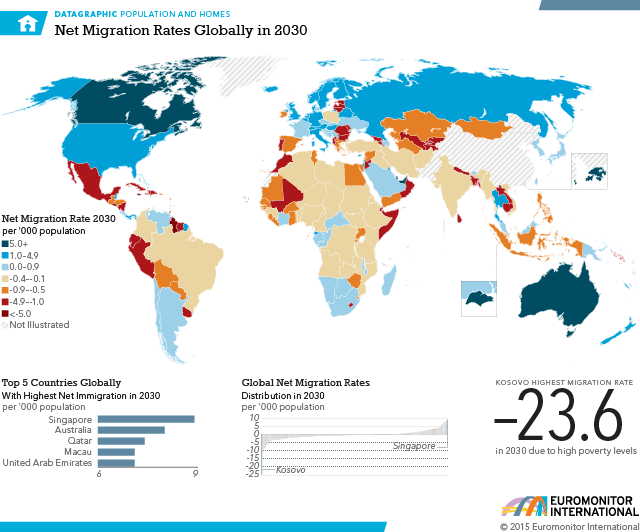

Net Migration Rates Globally in 2030

This map is kind of an eye chart and I apologize for the strain. The important thing to note is that those nations in blue are where the migrants will be heading and those in browns and tan are where they will be coming from. The U.S. and Europe will be seeing additional pressure, but so will various parts of Asia.