By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Tariff Threat Remains—

Nobody seems to be getting too excited over the latest "deal" between the U.S. and China although there is some sense both countries are walking away from the edge of the cliff. The White House has reminded China that these more punitive tariffs will return to the table in December if a real agreement is not struck, while China has made it clear it wants everything in writing before it goes another step. It seems that both nations have been damaged by the conflict, but neither is really ready to capitulate in any meaningful way.

Markets Mixed as Trade Talks Percolate

It has been an up-and-down period for the markets as there have been some glimmers of hope on the one hand and disappointment on the other. The partial truce between the U.S. and China gave the markets some confidence (limited but there). In the same period, there was a setback as far as Brexit is concerned. It appeared there might be a breakthrough, but that evaporated as neither the U.K. nor EU were prepared to concede much to the other. The sense is Brexit is back to being an unmitigated crisis and nothing much will really change as far as the trade war.

Retailers Fight Back

By all accounts, this has been a tough season for the U.S. retailer and there is not much suggesting it will get a lot better. The consumer is in a good mood, which is positive, but there has also been more of an effort to save. That has limited the progress of the retailer. Then, there are the tariffs and higher prices, and the impact of e-commerce. One of the age-old tricks is showing up. Prices are being hiked, but at the same time big sales and discounts are advertised with the hope that consumers do not notice the original price went up quite a bit. This psychology usually works pretty well for products people do not buy often.

Short Items of Interest—Global Economy

Kurds Change Sides

As the U.S. decided to abandon the Kurds to their fate, the leaders of the Kurdish militia have swiftly reacted to establish new relationships. They have decided to ally with the Russians and the Syrian military. Under Bashar al-Assad the Kurds were sometimes attacked, but in recent years they have been allied to some degree against the ISIS forces. There has been evidence of Syrian action against the Turks already. It is not clear what help Russia will be providing at this point, but there has been talk of weapons and other aid but not of any personnel. The shift to Russia and Syria will effectively end any further cooperation with the U.S. on any front in the region. That throws the whole situation in Iraq into disarray as well.

Nobel Economics Prize

The Nobel Prize in economics has generally gone to those who work in more theoretical areas of economic research, but there have been many laureates who have worked in more policy-related areas. The trio that was selected this year falls in that latter category as they have been conducting field studies to determine whether policies designed to alleviate global poverty really work. Not surprisingly, they generally conclude the policies have not been all that effective. The implication is most programs are inadequate and ill-suited to the goal. These tests have become standard for much of development economics.

The Cost of Graft and Corruption

That the former South African leader Jacob Zuma was among the most corrupt leaders on the content was no secret. Current prime minister Cyril Ramaphosa has been trying to put a dollar amount on that graft and has concluded this activity cost the country some $34 billion. The reason he has been making this point is that his government has been cash strapped and unable to carry out the reforms promised. His assertion is that his predecessor is to blame for the stalled process. For the most part he is correct in that assertion.

Meaningless Gesture or a Start?

The "deal" between the U.S. and China last week has been described as just a delay tactic before the next scheduled round of tariffs—the ones that would have pushed the tariff from 25% to 30%. This is not an altogether insignificant move, however, as many U.S. companies would have been crushed by that 30% tax; they are barely hanging on with the 25%. The fact remains that none of the major issues have been addressed and there is no sign these will be dealt with anytime soon. The Chinese have simply agreed to do what they had already been doing—buying more farm output from the U.S.

Analysis: The dispute between the U.S. and China has long since ceased to be about trade. It is a personal war of wills for Presidents Trump and Xi as both men stand to gain personally from the confrontation even as the battle damages their nation's economy. This does not mean there are no real issues. The U.S. and China have been battling each other for many years over trade as they are clearly both partners and rivals. That mutual need and animosity drives one of the most complex relationships in the world. The U.S. wants China to do a far better job of protecting U.S. intellectual property and to reduce the industrial espionage that puts U.S. technology at risk. The U.S. wants the Chinese to buy far more from the U.S. so the trade deficit between the U.S. and China diminishes. The Chinese want continued and expanded access to the U.S. market. As if the trade issues were not enough, the U.S. wants China to halt its attacks on populations inside China—Uighurs, Tibetans and the protestors in Hong Kong. China wants the U.S. to cease backing the Republic of China (Taiwan) and wants the U.S. to leave Chinese allies alone throughout the world.

This latest truce agreement accomplishes very little, but at least there is the sense that both sides remain engaged. The business community as a whole has grown very frustrated with the two steps back and one step forward pace of the negotiations and maintain this approach has been creating long-term issues that may now be irrevocable.

Kurdish Crisis Deepens

As the Turks prepared to attack Kurdish positions in Syria there were several scenarios in play. The most optimistic was one that asserted the whole attack would be more symbolic than anything else—a short and shallow invasion just designed to push Kurdish positions away from the border. The worst case was for a nasty and lengthy confrontation; that seems to be what is developing. There have been cases of Turkish troops and their Arab allies killing prisoners, mass killings of civilians and deliberate targeting of schools and medical facilities. Now there are reports Turkish troops have fired on positions where they were explicitly told there were American personnel.

Analysis: The U.S. position with the Kurdish fighters that backed the U.S. in Iraq and against ISIS has been utterly destroyed. There has been outrage within the U.S. military as this act makes it all but certain the U.S. will never be able to develop allies again. The situation has been developing for years; the majority of analysts opposed the U.S. intervention in Iraq in the first place. The country was always deeply divided between Sunni, Shiite, Kurd and Turkoman. The British cobbled together a nation that made no sense. The regime of Saddam Hussain held the nation together through force, but in his absence the divisions exploded. The U.S. soon sank into that mire. The Kurds allied with the U.S. because they hated the others in Iraq and hoped the U.S. would help them achieve their ambition of having their own country. The Kurds have an autonomous region in Iraq, but there are more Kurds in Syria and Turkey than in Iraq. They want their territory added to that in Iraq to form an independent Kurdistan.

The U.S. made common cause with the Kurds, but interests have never been identical. It was an alliance of mutual convenience until it wasn't. The critique leveled at the Trump decision is not that the U.S. should sacrifice its interests to that of the Kurds, it is that the U.S. owed these allies an orderly drawdown and an effort to ensure their protection. In Cold War days, the U.S. thwarted the ambitions of the USSR and its allies by placing U.S. troops in harm's way. They became the trip wire—an attack on a U.S. ally risked killing U.S. soldiers. That served as a deterrent as it would invite a U.S. counter response. Would Turkish troops have avoided an attack on the Kurds if U.S. soldiers were in the way? Given the recent attack on a position where the Turks were told U.S. troops were stationed, it seems they are not so deterred. That means the U.S. has to be prepared to retaliate against the Turkish forces. It is more than a little awkward for one NATO ally to attack another. This crisis has been over a decade in the making and it is not at all clear what course the U.S. has before it.

Banditry in Northern Nigeria

The prime issue for the Nigerian government has been the fight with the Boko Haram terror group, but an even larger issue has been the gangs of heavily armed bandits that roam the communities of northern Nigeria. The death toll thus far has been in the thousands and some 40,000 have been forced to flee. The region is home to some 30 million people and has become desperately insecure. The latest tactic has been to offer amnesty to those bandits in hopes they halt their activity, but the fear is they will simply take the deal and resume their activity.

Analysis: Nigeria has been the host to a whole series of attacks over the last decade or so. The bulk of the problem was once concentrated in the Delta region where the oil operations are concentrated. The attacks were designed to force oil companies to pay local gangs—there has been concentrated theft and sabotage. This activity has now spread to other parts of the country as desperation grows. The bandits have learned this is a way to make money as the nation has offered very little to its vast population. The oil money is not what it used to be and there is little else for the population to do. The whole country is beset with roving gangs of unemployed men looking for any way to make money. Most turn to crime of one kind or another.

The Nigerian government was once hailed as an example for the rest of Africa, but years of corruption, a financial crisis and issues along its borders have combined with ever-present ethnic tensions to convert the country into one of the most chaotic and dangerous on the continent. The enmity between Igbo-Yoruba and Hausa-Fulani ethnicities has become ever more serious and could conceivably lead to another war as took place years ago—the Biafran War cost millions of lives directly and indirectly. The current leadership in Nigeria is overwhelmed and the president is not in good health.

Dramatic Move by Federal Reserve

The overnight loan market has been in turmoil for the last several weeks and the Fed has been intervening to ensure there is enough liquidity in the system. The decision the Fed has made was not unexpected, but the scale of the action has taken the markets by surprise. The Fed will be buying some $60 billion worth of Treasury bonds a month for the next six months and perhaps for longer. The goal is to get reserves back up to their traditional levels. The Fed buys these bonds through the banks and credits their reserve accounts.

Analysis: The liquidity crisis drove those overnight loan rates sky high and that had been limiting the normal flow of activity. This nervousness has been attributed to everything from the trade war to the sense that manufacturers are starting to get in real trouble. The Fed had been dealing with this issue over the past few weeks, but this is interpreted as the Fed going all in to guarantee the system continues to function more or less smoothly. The purchase will be on short-term bonds rather than the long-term bonds that were part of the quantitative easing plan a few years ago. The Fed is referring to this as "organic." These purchases will be in line with the bank's liabilities. The Fed has been trying to reduce its balance sheet over the last few years as it had ballooned from around $800 billion at the start of the recession to over $6 trillion as the three rounds of quantitative easing were implemented. This process of reducing that balance sheet has involved selling some of those long-term bonds, but the Fed has wanted to remain a little cautious about that game plan as it tends to crowd out other bonds offered by corporations and municipal governments. It is assumed this latest buying plan will have only a minimal impact on that longer-term issue.

Retail Numbers Expected to Stay Strong

The latest retail data will be released this Wednesday. The expectation is consumers will still be in a good mood and willing to keep the overall economy afloat. The data from August showed a gain of 0.4% and this month's reading is expected to be in the same range—around 0.3%. Thus far, the economic news has been ranging from mediocre to bad with the exception of the retail sector. Manufacturing has slumped to recession levels and there has been all manner of trade misery, but the consumer remains optimistic and continues to spend—even on imports that have started to rise in price. The most important factor for the consumer remains the employment situation. There has been little to worry about with rates falling to a 50-year low.

Analysis: Later in the week, there will be a report from the Federal Reserve regarding industrial production. There is some slim hope that manufacturing data will have improved a little. Factory activity has risen by 0.5%. That might be enough to pull the entire sector out of recession territory, but there continue to be signs of distress as well. The Purchasing Managers' Index has been in contraction territory for two straight months now and there has been decline in the rate of capacity utilization. Durable goods orders have been down as well. The overall sense is manufacturers have been hit hard by the tariff wars and the slowdown in global growth as many of them are dependent on their export markets.

How Bad Is It?

The local news can be awfully depressing on any given day. My city seems to have become the new murder capital of the world—or at least it seems that way. It is a rare day that an incident doesn't dominate the news cycle. It is sobering and makes one think one is living in a war zone. The challenge is separating genuine concern for those who have been affected by these tragedies from the wider context. Are we really living in a more violent and dangerous time? The statistics would suggest that we are not. The rate of violent crime has been far higher in past years and there is the simple fact that cities have ever-larger populations. More people mean more opportunity for criminal behavior. We also know a lot more about what goes on in our community than before.

As with many neighborhoods, ours now has an internet identity where neighbors can share things. We learn of lost pets, garage sales, local events. We also learn that somebody's car was broken into and suspicious people have been spotted. In past years, I would know nothing of these incidents and ignorance really can be bliss. Now, I am wary and make a point of closing and locking doors. I have security cameras and alarms and I am in a very nice neighborhood. Has anything happened at my home or even on my street? No—but there has been an issue or two in neighborhoods not far away. I suppose I am grateful to be forewarned, but there is also a lot to be said for being blissfully unaware.

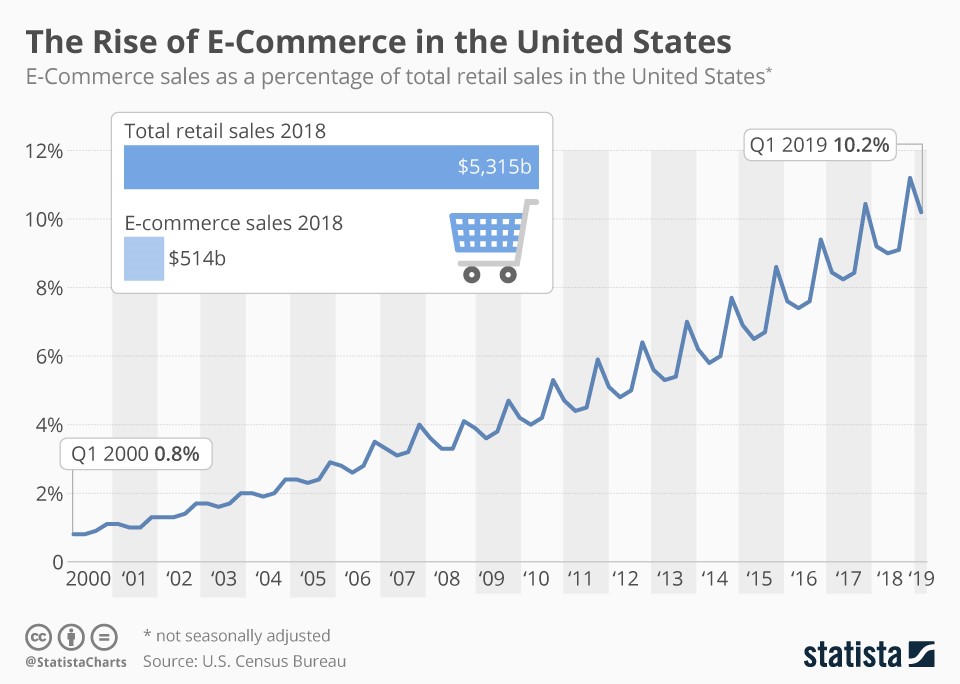

The Rise of E-Commerce in the U.S.

As the retail data comes in, there are all manner of questions. One of them is the role of e-commerce. It is quite obvious that more and more shopping is being done online, but there is more to it than just the willingness of people to do their buying this way. The pattern is dramatic with peaks around the holiday season every year. It is also important to note that e-commerce is still a very small percentage of total retail activity.