By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Manufacturing in Recession?—

According to two-thirds of the economists polled by the Wall Street Journal, the overall manufacturing sector in the U.S. is now officially in recession as there have been two consecutive quarters of contraction. The decline has yet to plunge growth under zero, but the estimate is that the overall economy will grow at a 1.77% pace in the fourth quarter—as slow as it has been in several years. The reason for the recessionary trend is a combination of factors with the trade war at the top of the list. There has also been an accompanying concern over the rate of global growth in general. The assertion has been made that this is not as critical as it would appear as manufacturing is "only" about 11% of the total GDP, but that is about $2.7 trillion—a figure that is larger than the entire GDP of India.

Inflation Cools

The latest assessment of consumer inflation was flat with a tiny change of 0.1% over what it was last month when it jumped 0.3% from the prior reading. The two factors that combined to reduce that inflationary pressure included energy prices and the costs of some replacement parts. It is more than interesting to see this decline. Energy prices fell despite the attack on the Saudi oil infrastructure and the price of parts fell despite the tariffs that have affected many of these items. The U.S. now dominates the oil world and shrugged off the issues in the Middle East and it seems that parts makers in China are doing their best to eat the tariff costs so they do not lose market share.

New Fed Rules Provoke Dissent

New rules on large banks will be coming soon and Lael Brainard is not happy about it. The rules will reduce the regulatory pressure on larger banks by reducing the existing requirements on capital and liquidity These requirements were developed in the aftermath of the financial sector meltdown that preceded the recession in 2008. It has been asserted that they hamstring the banks and keep them from engaging in more activity. Brainard disagrees and sees the reduction of regulation as an invitation to another round of high-risk activity that invites another meltdown as banks engage in ever-riskier activity.

Short Items of Interest—Global Economy

Turkish Invasion of Syria

The Turkish military has opened up a broad front in Syria as they attack Kurdish positions. It is estimated that 70,000 Syrians are fleeing from the region. Already there have been thousands of casualties. The Syrian government has now vowed to defend itself against the invasion and that brings yet another player into the conflict. The Kurds have been utterly abandoned by the U.S. as a result of Trump's decision to pull U.S. troops. Reports indicate the big winner thus far has been a regrouping ISIS as they are gaining recruits from within the hardest-hit populations under threat from Turkey.

Brexit Deal Possible?

The latest word from Europe is that there may be hope for a Brexit deal after all. A statement was issued after Prime Minister Boris Johnson and Irish Minister of Defense Leo Varadkar met and, although it was vague, it opened up the possibility of a deal that would avoid the worst of the Brexit mess. Investors have been sufficiently impressed to allow the pound to gain more than it has in months. Nobody has any idea what this "new" wrinkle consists of and there is still plenty of time for an agreement to fall apart.

Law and Justice Party Set for Victory in Poland

The parliamentary elections in Poland are expected to bring the Law and Justice Party another victory and ensure that Jaroslaw Kaczynski continues to govern through his populist/nationalist government. He has been a thorn in the side of the EU for the last four years, which seems to a popular place for him in Poland. The support for Law and Justice is high in the rural areas and among the working class in Poland who blame the elites and Europe for most or all of their ills. The opposition remains highly fragmented and has never mounted a real effort against them.

Report from the Index of Indices

Regular readers know the drill by now. Each month, we pull together a series of economic indicators for a couple of manufacturing organizations. These data points are followed by the industry. Combined, they tell a pretty accurate story. What follows is the executive summary and some selections from the total report. This index is prepared for the Chemical Coaters Association International and the Industrial Heating Equipment Association.

The short version of this month's interpretation of the data would be "steady as she goes." The majority of the data was very similar to the data collected the month prior. That is basically a good thing given all the uncertainty that has marked the economy of late. It is even better news that most of the data trended up slightly. The expectation has been that trade wars, oil shocks and cautious business attitudes would have combined to slow the economy by this point. In fact, there has been a slowdown from where the economy stood at the start of the year, but it has not been dramatic—going from around 3% growth to something closer to 2%. The readings this month show some of that caution, but many had expected a drastic reduction in activity by this point and that has not emerged.

Of the 12 readings, there were 10 trending in a positive direction as opposed to only two sagging into negative territory., This ratio has not been seen in years, but there is a caveat (as usual). The majority of these improved categories were only showing very slight changes from the readings the month prior. Even the two negative readings showed little drama.

Among the minor shifts noted, there was the data from sales of new automobiles and light trucks. This has been consistent for many months now with a high point of 1,749 million in December of last year to a low of 1,642 million in April. The reading now is at 1,718 million. The metal price data showed little change from last month, but over the last several months, there has been a distinct improvement. The PMI New Orders have been on a steep decline over the last few months, but that has leveled off a bit and this month's readings were very similar to those of the month before. The fear is these numbers are predictive and remain mired in contraction territory. The level of durable goods orders has been stable enough despite the wrangles over when the 737 Max will be flying again. The factory order numbers are also stable. That is a little unusual given the advance of the holiday spending season. There has been that same level of stability in the appliance category as well. Rounding out the collection of minor shifts is the data on transportation. There has been a long-term decline as the economy has slowed a little, but this last month was similar to month prior.

There were also several readings with more dramatic movement from both a positive and negative perspective. The biggest jump was in new home starts; it was likely the most unexpected. The multi-family and high-end sectors are driving that market. There was also a nice boost in the steel consumption numbers as the vehicle manufacturers have continued to demand and there has been a boost in commercial building activity as well. The increase in capacity utilization was not particularly dramatic, but it was a welcome trend in the right direction and suggests there is a little less slack in the system.

The two readings that trended in a negative direction included the data from the Credit Managers' Index (CMI) and the data from capital expenditure (capex) numbers. Capex remained fairly stable as there has been some expression of caution, but thus far the business community has not abandoned plans for expansion altogether. Nevertheless, it trended down a little, which seems consistent with the data from capacity utilization. The biggest drop was with the CMI. Even here, the difference between last month and this was somewhat less dramatic than might have been expected. The positive readings in the CMI remained strong, but the nonfavorable categories looked weaker than they have been.

If there is an overall conclusion to be reached, it is that most of the more dire predictions regarding the economy have not come to pass, but there remains considerable unease. The variables have been hard to determine—much less predict. Is the trade war impact overblown or is it about to kick in? Will interest rate policy change and will it make a difference even if it does? How will the elections impact all of this given the possibility of a stark contrast between left and right thinking on the economy?

New Automobile/Light Truck Sales

It would appear the automotive sector has stabilized, and at a reasonably high level. This is not what had been expected even a few months ago, but the consumer has continued to be interested in acquiring a new vehicle. The assertion had been that market saturation combined with some concern regarding the future of the economy would have dimmed forecasts by this time. There have been some significant changes in the market even as sales have remained strong. The demand for sedans has collapsed by as much as 20% for some makes and models, while the demand for SUVs, CUVs and trucks has risen by an average of 16%. The low price of gasoline has encouraged interest in the larger vehicle and diminished interest in the fuel sippers as well as electric cars and other alternatives. The expectation now is that demand will continue to hold and extend into next year—unless there is bad news on the employment front.

Industrial Capacity Utilization

The capacity numbers have been a little worrisome, but they do not yet constitute a crisis. As has been referenced many times, the ideal position for these numbers would be between 80% and 85%. This is not an exact science however—the inference is that numbers below 80% signal too much slack capacity. That would mean greater reluctance to acquire more machinery or to hire more people. When the capacity numbers hit 85% and above, there will be shortages and bottlenecks. That would suggest more machinery acquisition would take place and more people would be hired. To see the data hovering at the high end of the 70s suggests there is some slack, but not a great deal. On the other hand, it is a long way from seeing a surge in expansion on the part of the manufacturing community.

New Home Starts

The housing market has suddenly sprung back to life and it has given the overall economy a nice little shot in the arm. The data has been volatile over the last several months however. It started a little trend back up last month, but these gains accelerated and the numbers are as good as they have been in the last couple of years. Granted, the new home market is very small compared to the existing home sector, but it is also the most sensitive to overall economic trends. Its growth is tied to factors such as mortgage rates and overall rates of employment, but the construction of higher-end homes depends on the performance of the stock market as much as any other factor. The major impetus for the additional growth has been multi-family housing as there are still many communities that lack the needed number of apartment units. As with anything in real estate, there are wide differences between cities with some very hot markets and those that have grown cold. The price of homes has fallen according to the latest Case Shiller data, but there are still cities where prices have stubbornly remained high.

Steel Consumption

The steel consumption numbers have been more stable than anyone would have predicted just a few months ago given all the angst surrounding the tariff policies. Many of the expected reactions failed to develop. Part of the reason for this was the on-again, off-again nature of the tariffs and the subsequent cascade of exemptions. Beyond that, there was an adjustment on the part of both steel users and producers. In the beginning, there was a good deal of stockpiling and then there was a lot of "origin shifting" to get around the restrictions. Prices did not rise as much as feared and there was not the decline in consumption expected—especially in construction. The slump in public sector building continued, but commercial development has been expanding as there has been more development in warehousing, health care facilities and in the energy sector with more pipelines. There has not been a major boost in the last few months, but neither has there been a reduction in activity. That appears to be a trend that will continue for the next few months.

PMI New Orders

There has been a significant increase in concern regarding the potential for a recession in the next year or so. At the moment, one can find as many people predicting its imminent arrival as there are those who urge people to relax. One of the factors that has fed concern over such a downturn is the data from the Purchasing Managers' Index (PMI). The overall index has been below the 50 line that separates expansion from contraction for the last two months. That marks the first time the index has dipped that low in several years. The decline of the New Orders Index has been even more dramatic. It was just a few months ago that readings were in the 60s. Now, they have dipped into contraction for the last two months in a row. The numbers are not at crisis level and there was even a very small improvement in the last month, but concerns remain. The new orders are somewhat more predictive than the overall CMI, so this decline is a bit of a concern.

Capital Expenditure

The rate of capital expenditures has diminished a little this month, but has been relatively stable over the course of the last several months. The fact is that many companies are starting to adopt a very cautious strategy and this has slowed investment. One survey that has demonstrated this caution is from the Fabricators and Manufacturers Association—the Forming and Fabricating Job Shop Consumption Report. One of the questions concerns plans to expand—either through hiring or adding equipment. The last quarter showed that investment has been slowing, but the good news is that companies are not abandoning their expansion plans. They are planning to delay these purchases and still intend to expand if and when conditions improve. There has long been a connection between capacity utilization and the level of capital expenditures.

Factory Orders

The level of factory orders has been steady enough and up from where it was a month or so ago. This is the time of year that factory activity improves a bit as the holiday season approaches. Most retailers did their planning months ago and started to accumulate the needed inventory in the summer. The uncertainty that has surrounded global trade has forced some big changes in terms of strategy though. Many companies bought more inventory than usual as they anticipated the higher tariffs and they are now working off that inventory. There has also been some uneasiness about the confidence level of consumers going into the holiday season. That has limited the expansion of factory activity as retailers have elected to engage in a "lean inventory" strategy.

Birthdays!

I have to confess I have long had Eeyore's attitude towards birthdays. You know: "Birthdays … what are birthdays? Here today and gone tomorrow." As I have aged, I am less enthusiastic about the passage of time, but also more grateful that I am still enjoying the opportunity to have birthdays to celebrate. The best part of the occasion is hearing from people—friends and acquaintances who take the time to wish me well. It reminds me that I would like to reach out and spend more time with those that I have been fortunate to have in my life over the years.

My wife and I generally enjoy a low-key observance—nice dinner out and she always makes me a dessert of choice. This year, the timing is right and we will take in a performance at the local community theater. Tonight, I celebrate in my usual fashion by giving a talk, but at least I am home and not on the road. The gift of note this year is a new Fitbit so I can determine just how much of a sloth I am from one day to the next, but there were also some nice flannel shirts for when I want to utterly ignore that pesky little nag on my wrist. The cats were very enthusiastic as there was wrapping paper to shred and those shirts proved irresistible. All in all—a very good day and an opportunity to ignore aging altogether.

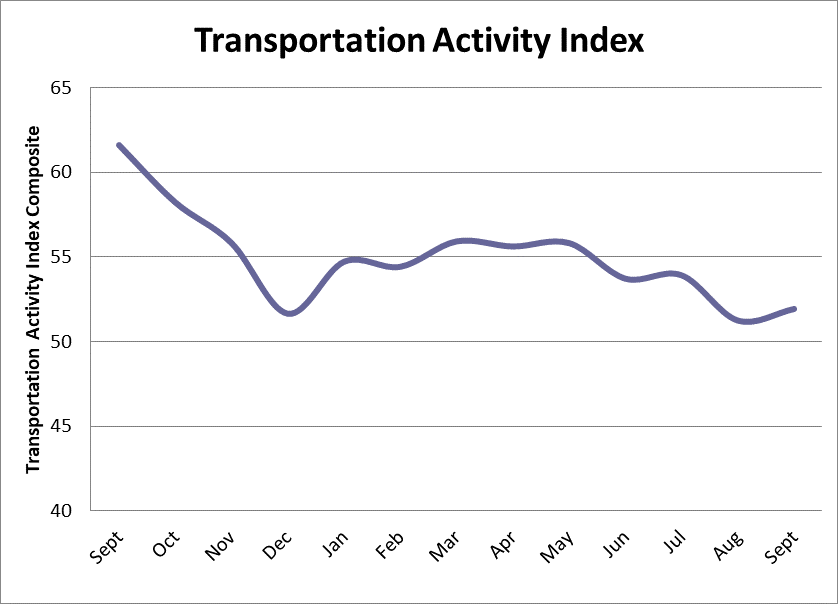

Transportation Activity Index

The Transportation Activity Index looks at all the major modes—from trucking to rail to air and ocean as well as the key inputs like fuel costs. The transportation sector is a harbinger as far as the rest of the economy is concerned. The transportation of freight depends on whether there is any demand for inputs or for the product being produced. The data from the last few months has been weaker than it was at this time last year. That has been especially obvious in the trucking category. The rail carriers have been hit by reduced agricultural activity and there was less shipping of coal this year. The air cargo sector has been down a long time as there has been limited demand for expedited shipping activity. The last month saw a slight uptick related to the arrival of the holiday retail season and the busy package delivery companies.