Strategic Global Intelligence Brief for November 9, 2018

Short Items of Interest—U.S. Economy

Why Midterms Likely Mean a Booming Retail Season

There are multiple reasons why this holiday retail season is likely to be great, but there is one key reason why it could blow the door off of records.

First, let's state the obvious reasons why this year's retail season could be a record-breaker:

- GDP trending near 3% for the first time since 2005.

- On top of a $19 trillion economy, this creates significant consumption.

- Unemployment rate of 3.7%, the lowest since December of 1969.

- U6 unemployment rate at levels not seen since April of 2001.

- Seven million open jobs; August and September were the highest ever.

- Even wages were starting to increase at an annualized rate of 3% in October.

Second, the end of the midterm elections allows both the right and left to relax. There was more anxiety building about the midterm elections than most understand. Our personal lives were being impacted by local TV ads, election signs, some overzealous friends and neighbors who went off on social media, etc.

Third, the Democrats can celebrate a small victory in taking over the House; Republicans will celebrate a strong win in the Senate. To the average voter, everybody got something. So, as retail shoppers, the political environment will be calming down and economic activity is strong enough to give them optimism about consuming. The ugliness can subside a bit. That will probably open up and increase consumption in the near term.

Short Items of Interest—Global Economy

German Construction Slows but Industrial Production Inches Up

Germany offered up a mixed dose of economic news over the past two days—making it difficult to assess any recent changes in one of the most important economies in the region.

There is a German construction Purchasing Managers' Index (PMI) that showed the construction sector in Germany slipped into contraction in October. The PMI for construction dipped to 49.8 from 50.2 in the prior month and hit lows not seen in more than seven months. IHS Markit economists noted this was the first dip in the PMI below 50 without a weather-related impact in more than four years.

According to the report, housing was the worst-performing sector in the German construction sector. Unlike the U.S., hiring in the sector hit a 29-month low. Sentiment was also falling as other German economic metrics started to weigh on construction owner sentiment.

Lastly on the construction report, prices for raw construction materials and higher oil prices were starting to eat into company profits. That was affecting employment, which also fell to a 29-month low.

On a positive note, industrial production improved in September. Production grew by .2% month-over-month, exceeding analyst expectations for a .1% decline. Interestingly, it was the German domestic market that was fueling gains in industrial production. All-in-all, economists in the country believe the German economy "came to a standstill" in the third quarter—spilling over into Q4.

Trump and Foreign Policy

The world as a whole watches the U.S. elections with as much interest as they watch their own. This is especially the case when that nation has a deep and complicated relationship with the U.S. They are quite attuned to the patterns of the U.S. political system and are now trying to work out what this will mean for them as far as President Trump's doctrine is concerned. The major issue for most of these nations is there really isn't a Trump doctrine that can be identified or reacted to. This presidency has been described as transactional as opposed to strategic. The majority of the past presidencies have had some sort of overarching mission or goal that informed all the other decisions. During the years of the Cold War that was easy to identify as everything the U.S. did as far as foreign policy was concerned was shaped by the conflict with the USSR. Nations that joined our side got favors and those that didn't were shunned. In the post-Soviet years there have been other strategic goals such as those advocated by the "neo-cons" under Bush. This was to spread the American way worldwide—everything from our version of democracy to capitalism in the U.S. mold. Under Obama, it was a return to lofty goals of multi-lateralism and some sort of global cooperation akin to what Woodrow Wilson once advocated. Today, there is no unifying idea other than "America First." That has not been unifying as there is no consensus on what that means—which America is to be placed first?

Analysis: A good example of the confusing nature of this approach is the steel tariff debate. The rationale for imposing tariffs on imported steel is to protect national security by assuring the U.S. steel industry they will have sufficient market share. The problem is steel prices have risen by over 40%. That has put immense pressure on U.S. manufacturers that use steel. Which of these Americans are being placed first—steel makers or steel users? There are 10 times more people working for the steel users than work for the steel makers. Manufacturers are responsible for GDP numbers that are six times larger than steel. If national security is really the issue, one can understand limits placed on steel from hostile countries like China and Russia and even on nations that are unstable and unreliable such as Turkey. But why are there tariffs on steel from Canada? It is the No. 1 supplier of steel to the U.S. It would be tough to find a nation friendlier to the U.S. (at least until now and the conflict between Trump and Canadian Prime Minister Justin Trudeau).

What makes other nations nervous about the current situation in the U.S. is that President Trump now faces an overtly hostile House of Representatives led by a very angry set of Democrats who have been bullied, vilified and ignored for two years. They plan to make his next two years as miserable as they can and will soon be developing their run for the 2020 elections. In previous years when presidents face this kind of situation, they have become more active in foreign policy as this is an area where Congress has far less influence.

President Trump has shown a unique style of governing—one in which he ignores those he doesn't agree with or like and focuses all of his attention on those who support him. He has been pursuing that kind of approach in foreign policy as well. He has deep animosity towards leaders such as Chancellor Angela Merkel, Trudeau and EU leaders, while he has pursued very close relations with Benjamin Netanyahu and Vladimir Putin (although this one has faded). He now has some potential new allies in Jair Bolsonaro of Brazil and the new challengers to Merkel in Germany. He initially tried to make a splash with his overtures to North Korea, but that has stalled out. Might he try something dramatic with another arch enemy such as Cuba or even Iran? Will he continue to pressure China as hard as he has or will he pull some kind of deal? Is Europe still to be his target of ire and frustration or will he make common cause with the populist movements there.

U.S. Pressure on Iraq and Kurds

The U.S. has been worried about one aspect of the Iranian sanctions. If these take hold, the price of crude will shoot up in reaction to the loss of capacity. This is the main reason the U.S. delayed the sanctions for some 10 nations that buy from Iran. Among those that got an exemption was China as they are the biggest consumer of oil from Iran. If China has to look elsewhere for that oil, it will most certainly drive prices up. That is something the U.S. would like to avoid.

Analysis: This concern has led the U.S. to put pressure on the Iraqi government and the leaders of the Kurdish territory to allow oil exports from Kirkuk again. That would push about 400,000 barrels per day into the market and soften the blow from reduced Iranian output.

Fed Elects to Stay the Course

In the midst of all the election hoopla, it almost escaped the notice of the business world that the Federal Reserve had a meeting this week. To be sure, there was not a lot of tension regarding what the Fed's decision would be as they have been signaling their intent for the bulk of the year. Still, the assessment of where the U.S. economy is at this moment has been the subject of some debate. There has also been the steady criticism from the Trump White House. It had not seemed that anybody at the Fed was paying any attention to the Trump objections, which is what one would expect from a central bank. They are independent for this very reason. There are few politicians who welcome the end of the party and this crop in the U.S. is no exception. The rapid growth of the U.S. economy this year has not been entirely due to the existence of low rates, but they have certainly played a role. As they slowly increase, there will be a slowdown.

Analysis: The statements from the Fed reiterated the arguments that have been made for the last few years. There was nothing in the tone of the discussion that would suggest a change in plan. The No. 1 motivation for any central bank to hike rates is to protect the country from a threat of inflation. The Federal Reserve knows these actions have to be taken far in advance if they are going to have an impact. It is not that a quarter-point hike is going to immediately change the plans of any given business and the Fed doesn't want to see the inflation threat escalate to the point that drastic action has to be taken. This was the situation Paul Volcker faced in the early 1980s and rates came up very sharply. This precipitated a recession that lasted for a couple of years. That is not something Fed Chairman Jerome Powell wants to repeat. The plan is to apply the financial brakes slowly and methodically so no dramatic reaction is needed and the inflationary trends of the economy fade naturally. The pace set by the Fed thus far has rates between 2.8% and 3.1% by the middle of next year. This is hardly high, but it is certainly higher than it has been in the last decade or so.

There are two other motivations for a rate hike for the Fed. The first is there has been a significant amount of speculative loaning underway. This poses a risk the Fed is not that comfortable with. With rates this low and the stock market hitting new highs on an almost daily basis (at least for a while), it has been tempting to borrow a lot of cash for a short period, invest it in the market and then pay the loan off so that the whole process can be repeated. This is a major money maker as long as the cost of borrowing is low and the market keeps surging. What worries the Fed is that some investors will get caught in a downturn or mini-correction. They will have borrowed more than they can pay off if the market slumps. All of a sudden, that bank is sitting on a lot of nonperforming loans. The Fed is not interested in shutting this activity down completely, but they want to reduce the risk of too much exposure. A higher interest rate doesn't entirely stop this strategy, but it makes it a bit more demanding.

The third motivation is more about future threats. The Fed has two major duties as far as managing the monetary system. The control of inflation is seen as the primary task, but they also play a role in halting recession, although the primary respondent to recession pressure is Congress. When the economy slows down, the Fed will seek to boost growth by lowering interest rates. If they are already low, the impact of such a move would be minimal. The Fed would like to have some ammunition available for the next recession. Several analysts assert this next downturn could occur as soon as late 2019 or early 2020. The Fed would like to see rates closer to perhaps 4% or even 5% by that time, so cutting them again would have an impact.

Trump has been critical of the Fed's intent and has been urging it to keep rates low, but this advice has been ignored for the most part. The fact is the Fed is used to this kind of critique and is designed to withstand it as their terms in office are staggered and last seven years. If Trump had really wanted a radical departure from previous Fed policy, he could easily have packed the Fed with those who agreed with that position as there were six vacancies on a seven-person board. None of the Trump selections could be described as radicals or even critics. Jerome Powell as chair, Richard Clarida as vice chair, Randy Quarles as regulatory expert, Marvin Goodfriend, Michelle Bowman as small bank representative and Nellie Liang as the last selection (a former Fed economist and a registered Democrat). This is a Fed built by Treasury Secretary Steve Mnuchin.

Agenda Items

The race is on to set the new priorities for the new Congress. By all accounts, the issue will be highly contentious. The U.S. ostensibly has a two-party system with Democrats and Republicans, but the reality is that both parties are deeply divided. The GOP has its solidly Trump-supporting base, but also has a moderate middle group that doesn't always see things the president's way. The Democrats have a far-left progressive wing and moderates of their own. The internal clash will dominate for the next few months. This is especially true in the Democratic Party as there are those who want to focus on impeaching President Trump while others want to try bi-partisan solutions to health care, infrastructure development and overall economic growth.

Analysis: Voters are just as split with deeply held positions on a wide range of social and political issues. They will not want their representatives to deviate much from these positions. The wiggle room politicians once had has been eliminated by the fact that most voters are now driven by single issues and not by the performance of the economy. This was the election that was simply not about the economy. It was everything else. Almost all of those are core issues for one block of voters or another. Going against that group will cost politicians their support no matter what else they may agree on.

Technology Grows Apace

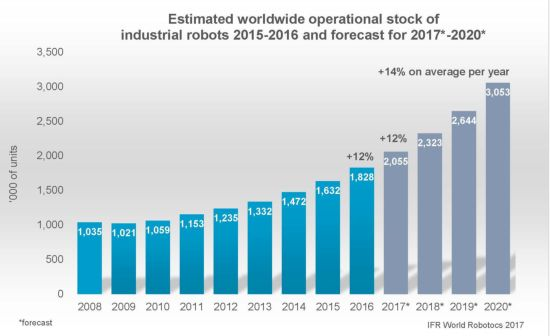

The most significant development over the last several years has been the astounding growth in the use of robotics and technology, which has been accelerating with the whole idea of the "internet of things." The usage has mushroomed but so has the capability and scope of the technology. We have been witness to several major changes in our basic routines already and the process had really just started. The emergence of Uber and Lyft destroyed the taxi industry, while the arrival of Netflix, Hulu, Amazon Prime and all the others shattered the old paradigm of TV. This is now altering the whole movie business. The online shopping option has all but killed traditional retail, and the list goes on. Robots are making dramatic entry into health care and AI (artificial intelligence) promises even more. Drone technology changes everything from freight delivery to inspection protocol. The implications are vast for everything from pricing to employment. For the most part we are not ready for it.

Some Political Observations

The hot topic all week has been the election and what it might mean to the groups where I have been speaking. The audiences have ranged from steel producers to steel consumers, small to large manufacturers, bankers, mid-market family owned business, women in traditionally male sectors and Americans deeply engaged with business in foreign countries as both supplier and consumer. With all this diversity, three things stand out.

The first is that frustration with Trump's style and behavior doesn't necessarily mean opposition to his policies. There is a good deal of anger and frustration over Chinese trade behavior. Many have been questioning why the U.S. cuts so many other nations a break at the expense of the U.S. There is not the tough attitude towards illegal immigration expressed by some, but there is real concern the U.S. could face the kind of crisis that has crippled Europe.

The second observation is that few like what they are hearing from Democrats so far. If all they want to do is attack Trump with impeachment threats and investigations, there will be little support. The overwhelming sentiment is that people want the politicians to do something about labor shortage, bad infrastructure, debts and deficits and health care.

The third observation is people are truly sick of the kind of campaigning that dominates. They know they are not the intended target and these ads are designed to motivate the base. Yet, the worry is that all of this alienates the public to the point that nobody has any trust at all in the government and the political leaders. It is not healthy that Congress is held in such low esteem.