By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

More Manufacturing Data on Tap This Week—

The last few weeks have repeatedly shown weakness in the global manufacturing sector. That has been weighing on the U.S. economy as well. The latest set of Purchasing Managers' Index (PMI) numbers have been weaker than they were last month. Today, there will be more data released pertaining to the durable goods sector. The expectation is that durable goods orders will be down. That reinforces the sense that manufacturing is in a slump; one that is both likely to accelerate and to last a while longer.

Trade Data to Indicate Trends

The Commerce Department will release the latest trade data on Nov. 5 and all eyes will be on the report. The seminal plank of the Trump economic plan has been rooted in trade and the effort to reduce the deficit the U.S. runs with the rest of the world. The special target has been China, but many other nations have been affected by the threat to impose tariffs and other restrictions. The question is whether any of this is achieving the desired results. Is the deficit getting smaller and what has changed? Is the U.S. consumer buying less from around the world or is the U.S. finding ways to export more? In the great scheme of things, it would be much preferred to see the deficit shrink because the U.S. was exporting at a greater rate. That may not be the outcome, however, as the U.S. has been inhibited by a strong dollar and the fact the global economy has slowed and other nations are not buying as much.

Jobs Report Reinforces Fed Position

At the last meeting of the Fed's Open Market Committee, it was pretty clear the members wanted to leave the interest rates alone from this point. There was quite a bit of dissent as the rates were dropped to 1.75% and there seems little desire to go any further. Now that the latest jobless numbers have come in, there is even less pressure to drop them. It would appear the U.S. economy is humming along at a decent pace—at least through the remainder of 2019. The hiring spurt is likely connected to the temporary addition of holiday jobs, but that is still a boost to the economy.

Short Items of Interest—Global Economy

Trade Deal with Japan Enters Phase Two

The trade deal with Japan has been a little hard to sell in Japan as the provisions gave more to the U.S. than to Japan. The deal calls for the Japanese to reduce tariffs on beef from the U.S. as well as other farm exports, but the Japanese still face tariffs on imported cars and car parts. That is supposed to be part of the second round, but that has to follow a ratification of the current arrangement by the Japanese Diet. This is likely, but the fight will be intense. The pressure will then be on Japan's leaders to get something substantial from the U.S.

Neither Side in Spain has the Money to Fulfill Promises

It is all too common for political parties to promise far more than they can deliver—that always seems to be part of the game. In Spain, the promises made by both of the two main parties verge on the absurd. The Socialists are promising a host of new government programs and higher wages all around, but there is no way to accomplish this without massive tax hikes. The center right is promising deep tax cuts, but without losing any current services. That means taking out debt Spain is prohibited from doing by the EU.

New Chinese Trade Pact Is Very Weak

The Regional Comprehensive Economic Partnership is about as convoluted as it sounds. The Chinese have tried to tout this as a major breakthrough in regional economic trade and have noted that even India is considering membership. Given that India has usually been the one to limit trade pacts that involve China, that might be an accomplishment. What it really means is the pact is very weak and requires next to nothing from any of the members—no reduction in trade barriers, no change in trade patterns. It looks good on paper, but seems to change nothing at all regarding the interaction of the member states.

Settling Trade Dispute with China

The trade war between the U.S. and China has been developing for years—perhaps decades. There are a multitude of dimensions involved—the whole concept of "settling" the dispute is fantasy. At best, the U.S. and China are rivals competing for global preeminence economically. At worst, these are two enemy states that only succeed at the expense of the other. The focus right now is on what has been termed "Phase One" by the Trump White House. The Chinese do not have a name for this stage and just refer to the need to "make progress." The goals of the U.S. remain murky as there have been many statements over the last couple of years. The demands from China have been clearer as they want access to the U.S. market and minimal interference with how they choose to organize their economy and do business.

Analysis: The core of Phase One for the U.S. is more exports to China and fewer imports from China. The original motivation for the current trade war was reduction of the trade deficit the U.S. has long sported with China. Over the months of the dispute, the goals and aims of the U.S. shifted and involved everything from China's currency policies to the ways that Huawei does business to the very foundations of the Chinese economic system. There have been long-standing disputes over the ways that China pressures foreign firms to share technology and the widespread use of industrial espionage. The list is a long and complicated one. It now seems the U.S. is returning to the original goal of deficit reduction as they are asking China to dramatically increase their imports from the U.S. China has agreed to do just that, but in limited areas. There is not much interest in acquiring more of the U.S. industrial output, but there is interest in importing more farm output. That interests the Trump team given the situation U.S. farmers are facing. Bankruptcies are up by 27% in the U.S. farm sector. A good bit of that pressure stems from the trade disputes.

Both nations have been hit by the trade disputes. China has seen growth shrink to a 30-year low as they have lost a good deal of the U.S. consumer market they depend on. The U.S. farmer has been damaged by the export restrictions and there has been some reaction from the manufacturers as well. The bigger impact on U.S. manufacturing stems from the general global economic slowdown which has been accelerated by the U.S.-China dispute. The countries that sell to China are hit by the Chinese slowdown and they end up buying less from the U.S. as a result.

Power Struggle in Germany

There are still two more years of the Merkel Chancellorship, but she has stepped down as the head of the ruling Christian Democratic Union (CDU). That set off a contest over who will lead the CDU when that next election comes. The initial victory was won by those who support Merkel as her hand-picked candidate overcame the challenge from the more conservative elements of the center-right coalition. Annegret Kramp-Karrenbauer has been referred to as "mini-Merkel," but that is not altogether accurate as she lacks the background to simply slide into that role. Her tenure has already been marred by some unexpected electoral losses in regions where the party was supposed to be strong. This has given her critics a lot of ammunition, but it doesn't appear that an outright attack on her leadership is underway as yet.

Analysis: The challenges facing the CDU have been mounting. The "grand coalition" between the center-left Social Democrats (SDU) and the center-right CDU is in tatters as the SDU has tired of being the little brother. It seems prepared to make an outright move to regain power lost decades ago. A bigger threat to the CDU has come from the far right—Alternative for Germany (AfD). The AfD has been peeling away the more conservative elements of the CDU and has been gaining support from the disaffected voters who have not been benefiting from Germany's growth. Now that the German economy is in recession, there are far more angry people than before. Merkel has been unable to rally them. Her position on immigration alienates these voters. That will be a huge factor going forward, however. The SDU has much the same position as does the CDU, but the far right has been making great political strides on this issue.

The current health minister is Jens Spahn. He has been an ardent critic of Merkel in the past and has been calling for the CDU to stop focusing on who runs what and to start dealing with real problems. His tenure as health minister has been busy and he has been credited with making significant reforms. He has been positioning himself as a candidate for CDU leadership and as chancellor on the basis of being able to get things done.

Chances for a Recession in the Next Twelve Months

It is an old joke but bears repeating at times like this—economists have predicted 17 of the last three recessions. Contained in this little dig is an element of truth as economists are always likely to predict the worst as opposed to trying to sugarcoat something. After all, there will be few that express disappointment if an economist is mistaken about the arrival of a recession, but many will be upset if the forecast is for growth and the economy tanks instead. That said, the aim is still to be accurate. There are a multitude of tools and indicators that can be used to ferret out the most likely future scenarios.

Analysis: One such tool is the model that Bloomberg Economics created. The latest iteration of the report suggests there is a 27% chance for a recession in the next 12 months. That is higher than it was a year ago. The rating is not as high as it has been prior to previous recessions and doesn't warrant a panic response. It would be best described as a yellow warning light as opposed to a red light of impending danger.

There are perhaps four factors that are driving the model at this point. At the top of the list (as usual these days) is the trade and tariff war. This has taken a major bite out of the U.S. manufacturing sector as well as agriculture since these are the areas where the U.S. has the most exposure to the global economy. The decline in manufacturing over the last several months has not been entirely due to the disruption in global trade, but it has been by far the most important factor. The other factors affecting manufacturing have been the ongoing mess at Boeing, labor actions in the auto sector and some slowdown in the energy arena. A third recession marker is the activity in the markets, which comes down to the inverted yield curve. This has not always been the most timely of indicators as there have often been many months and even years between the inversion and a recession, but it is something worth watching. The fourth area that has amplified the recession risk has been the less than stellar performance in the corporate world. There have been a lot of disappointing reports for earnings with more companies missing their projections. This generally means companies will start to focus more on cost cutting. That means less hiring and even some increased layoffs. It certainly means less investment in new equipment or facilities. This has been demonstrated by reduced capacity utilization numbers as well as reductions in capital investment.

Can a Recession Be Predicted?

Another of those lame jokes with an element of truth is that economists are 90% accurate when predicting the past. The challenge for the economic analyst is that assessment is based on data. It will always take a while to get the data necessary to make those predictions. When a recession is actually declared, it has been in place for months. Is there a way to predict the onset of a recession early enough to execute plans to blunt its development? The assertion is that such a system has been developed—the Sahm Rule. This has been attributed to Fed Economist Claudia Sahm.

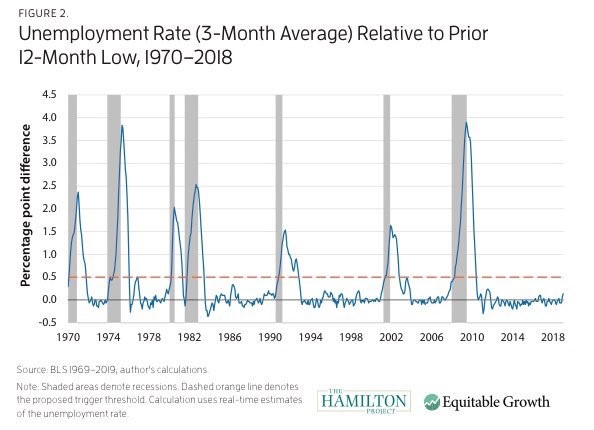

Analysis: She has been studying the relationship between employment and recession. There has always been an obvious connection as business will shed workers very quickly when economic slowdowns manifest. This is the quickest way to reduce costs; reduced demand means fewer workers are needed in any case. This is the formula she developed. It would have predicted any of the recessions over the last several decades. "If the average of the unemployment rate over three months rises a half-percentage point or more above its low over the previous year, the economy is in a recession." The good news for now is that the Sahm Rule has not indicated a recession in underway.

The second part of her analysis involves what should be done about the recession when it does arrive. The standard response is to adjust interest rates, but the impact from that move will be months in arriving. The fiscal response has been to lower taxes, but given that only 50% of the population pays those income taxes, the impact is blunted. Sahm's recommendation is to swiftly implement the policy that was employed in 2001 and 2008 when the economy was clearly in the middle of a recession—sending lump sum payments to individuals. Her plan would be to clearly indicate when this policy would kick in; it would be deployed before the recession deepened. This is always a controversial move. Designating when it would deploy ahead of time would take considerable pressure off the politicians in power at the time.

Speaking of Employment

The job numbers released last week were much better than had been expected—there was not even much reaction to the GM strike. The motivation for the gains was traditional, but the performance of the job market was better than expected. This is the time of year for holiday hiring. It appears that both the retail and transportation communities stepped up. These are temporary jobs for the most part, but that is still positive.

Analysis: Given the low rate of joblessness, many of those seeking jobs are only interested in those part-time positions. Those who take these seasonal jobs generally spend all that they make, which stimulates the economy as a whole.

What Does It Mean to Be Happy?

This is an unanswerable question if ever there was one. Quite obviously, the response would depend on who was being asked as we all derive happiness from different things. I was talking with a guy at a conference who was relating a story about his father and being happy. It was his dad's opinion that work defined a person and happiness would be found in this connection. He was a farmer and made it clear that much of what he did was simply hard work and not designed to bring happiness. It was what was necessary to make a living. The work of a farmer can be utterly undone by the vagaries of weather, insects, global prices and a host of other factors. His happiness came in appreciating the little things and the not so little things—a beautiful sunset or sunrise, the wild enthusiasm of his dog when he came back from the fields, the wonderful meals his wife made every night, the peaceful times on the porch swing with the woman he loved as much now as he did in high school. Happiness was not a constant—it was special.

It seems that too many expect to be "happy" all the time and we further expect it to be provided for us. It strikes me that happy means being content and being open to those special moments knowing that they are rare. There is much to frustrate us and much to be angry and disappointed about, but often this blinds us to the opportunity to enjoy. I get too focused on the former and too often forget the happy moments that are all around me. I need to emulate that farmer more often!

Unemployment Rate Average

Earlier in this issue, there was reference to the Sahm Rule. This chart illustrates what is involved in that analysis. It shows the connection between rates of unemployment and the advance of a recession. The power of an analysis like this is that one can anticipate the impact of a downturn with enough time to take steps to blunt the impact.