Short Items of Interest—U.S. Economy

NAFTA Is Dead—Long Live NAFTA

The U.S.-Mexico-Canada Trade Agreement has been signed by the respective leaders of the three nations, but that may be the easier of the battles to wage. Now the agreement has to be approved by the legislatures of the three signatory nations. That is expected to be an uphill battle. There is substantial opposition from both Democrats and Republicans in Congress. The agreement was made under the old Mexican leadership and it is not certain the new President (Andrés Manuel López Obrador) will back it with the same enthusiasm. There is even opposition within the Canadian parliament. It is not a done deal and will doubtless require some modification if it is to survive this legislative scrutiny.

Fed Plans to Stay on Course

Despite the fulminations of President Trump and his objection to the Fed plan to keep raising rates—they are going to keep raising rates—at least in December. There is less certainty regarding the plans for 2019 although most observers assert the Fed will hike at least two more times. At this stage, it will all come down to inflationary pressure. The rise in commodity prices has been somewhat uneven with oil headed down at the same time that metals are headed up. The major shift is in wages as they are starting to gain. If that trend continues, the likelihood is Fed rate hikes will continue.

Fed's Financial Stability Report

This is the first issuance of this kind of report—one of the new systems mandated by the Bank Reform Act and other legislative responses to the recession in 2008-2009. The Fed has highlighted three areas of considerable concern as far as the economy is concerned. The Fed is not alone in noting these areas, which include: artificially high asset prices, a very high level of debt owed by businesses and the issuance of risky debt. If anybody has been wondering why the Fed has been so eager to hike rates even as inflation has continued to stay fairly low—this report will provide the answer. All three of these vulnerabilities stem from the loose monetary policy that had been pursued for over a decade. Now that activity is posing a real danger.

Short Items of Interest—Global Economy

Yemen as Breeding Ground for Terror

The global intelligence community has asserted the biggest risks will stem from Yemen in the years ahead. This brutal war between factions sponsored by Saudi Arabia and Iran has crushed this nation and created a humanitarian crisis of epic scale. This is the environment that breeds fanatical anger. It is assumed Yemen will soon overtake Syria as the center of terror recruitment. The initial targets will likely be the two proxy protagonists (Iran and Saudi Arabia), but will soon include the U.S. and Europe.

Does the U.S. Want Brexit to Fail?

It has been asserted that the U.S. wants to see the Brexit plan put forward by Theresa May fail. It is no secret that President Trump supports the most dedicated of Brexit advocates such as Boris Johnson, but there are also some economic reasons for the U.S. position. A U.K. without access to Europe will need trade partners and the U.S. will be close to the only real option. This would permit the establishment of trade deals that would be very favorable to the U.S. and likely not so very good for the U.K.

New Mexican President Subverts Institutions Already

Andrés Manuel López Obrador (AMLO) has not even taken official power and he is already attacking some of the country's institutions. Referendum votes are not supposed to affect the basic rights of Mexicans or fiscal policy. He has already used the polls to impact both of these areas. The new airport in Mexico City has been scrapped even though it is 30% complete. The second item is to create support for his social welfare plan—even before most people know what is in it. In simplest terms, it is a massive effort to redistribute wealth.

Any Realistic Chance of a Trade Deal Between U.S. and China?

It remains something of a long shot, but there are reasons both nations would want to reach some kind of resolution to their differences. There have been talks underway for the last several weeks with an eye toward the G-20 meeting. The thinking is that Trump and Xi would have the perfect opportunity to meet and officially bless some kind of deal—even if it might be a temporary one. On the other hand, there are lots of barriers that will have to be overcome—not the least of which is the basic hostility expressed by Trump toward China. It is not clear this enmity is his or if it is a reaction to the attitude of his "base." It is common for China to be held out as a mortal enemy by politicians from both the right and left, but it has often been the case that this anger never gets past the hyperbole stage. There's lots of drama followed by doing practical deals. Thus far, the anger has dominated and the deals have been few and far between.

Analysis: The primary issue is whether these trade disputes hurt the U.S. or China more. In other words, which leader is likely to blink first? There is not a lot of consensus on this topic, but many assert the initial pain will be felt by the U.S. and later China will feel the brunt of the impact. The U.S. imports a great deal of consumer goods from China, so the trade restrictions and tariffs will make these goods more expensive. That is going to accelerate the pace of inflation in the U.S. and could trigger several responses that will weigh on the economy. More inflationary pressure will mean higher interest rates as the Fed works to keep that rate down. The fear is that hiking rates too far will result in a slowdown, but failure to hike them invites a major surge in inflation.

Within a year or so, the situation will likely improve for the U.S. and worsen for China. The U.S. has already started the process of seeking alternatives to Chinese goods. Nations like India, Vietnam, Brazil and many others will cheerfully grab the market share that once belonged to China, but it will take time for these suppliers to ramp up enough to replace the output from China. The harder task lies in finding a consumer base that rivals the U.S. and China will struggle to find alternate markets. The U.S. needs new sources. Those can be developed eventually.

The supposed deal on the table would involve the U.S. agreeing to hold off on imposing the next round of tariffs until sometime next spring or perhaps agreeing to halt them altogether. In return, the U.S. wants to see a wholesale revamping of the Chinese economy. At first blush, this seems next to impossible as no nation is going to want to engage in something that radical under pressure. What makes this a possibility is that some of these changes and reforms are in line with what Xi Jinping has been calling for.

The four areas that seem to be at the center of the conversation include protection of intellectual property. This has been very high on the list of issues for the U.S. as well as Europe and Japan. The Chinese have been very poor at enforcing these rules. Many companies are reluctant to do business in China for fear of having their technological secrets stolen. This has been an issue Chinese leaders have expressed interest in over the years as this theft takes place within the nation's business community as well. A second and related issue is technology transfer. Many companies doing business in China are pressured to share technology and trade secrets with the Chinese whether they want to or not.

The third area of concern is a familiar one. The majority of the business community in China remains in state hands and there is an enormous web of subsidy and support for these industries. Steel making is a classic example. China heavily supports the production of steel—even as demand has collapsed. It is asserted that over a third of the steel produced is of poor quality and has no market, but the production is supported regardless because China doesn't want to see loss of jobs. These subsidies allow China to compete unfairly. This is another area where some cooperation might occur as Xi and the majority of the leaders want to reduce the size of that subsidy budget. It is, however, a highly politicized issue that pits the regional leaders in China against those in Beijing. The fourth area of discussion is cyber espionage. This is not trade related directly, but there has been deep concern over the range of cyber attacks that have been launched by China at the U.S.—some of it aimed at the U.S. business community.

Even though there is some common ground to work with, the estimate is that no real deal will emerge at this meeting. President Trump has not shown much desire to halt his China bashing and Xi Jinping has his own nationalists to contend with. They do not wish to capitulate to the U.S. in any way. The chances of a deal are 10% at best.

Great Latin American Experiment

The two largest economies in Latin America account for just over $3 trillion in annual output. Brazil and Mexico dominate the economies of their neighboring states and have an outsize political and cultural influence as well. Both nations have been accused of getting in their own way and failing to deliver on the promises that have been made to their populations over the years. Mexico has been unable to shake off the impact of the U.S. and successive governments have failed to get a grip on the horrific drug violence that claims thousands of lives every month. Brazil has been called "the country of the future and always will be" as it can't seem to escape the ravages of corruption and government ineptitude. Crime is also a major issue in Brazil. In past years, the Mexican leaders have been technocrats who promised efficiency and economic growth. Neither mission has been accomplished. Brazil's left-leaning government promised relief, but was quickly swallowed up by corrupt practices at the highest level. Now both nations have reacted with the selection of radical outsiders who promise rapid and significant change. Most analysts do not hold out much hope for success as neither leader has anything approaching a legislative power base. The U.S. will play a huge role as is always the case, but the leadership is contradictory and confrontational. Trump is likely to be deeply opposed to the leftist President of Mexico (there have already been disputes) but may be very supportive of Brazil's new leader as Jair Bolsonaro asserts he is a great admirer of President Trump.

Analysis: Both men are populists and outsiders and have come to power due to voter frustration. Mexico and Brazil were both growing fast only a decade or so ago. The Brazilians were the lead nation as far as the BRICs were concerned and the population expected good things to keep happening under the leadership of Inazio "Lula" da Silva. Mexico was surging as well under the leadership of the PAN party and their technocrats. Strides were made under Vicente Fox as well as Felipe Calderón, but slowed when the PRI took control under Enrique Peña Nieto. Brazil faltered as corruption undermined the Worker's Party and left Lula's successor highly vulnerable. The real issue was global recession and the collapse of the U.S. economy in 2009. The dependence on the U.S. has long been a weakness and it came back to haunt this time. The voters rebelled against the people in power and have now decided to roll the dice with these untried leaders.

Both men made many promises they will be very hard pressed to keep. AMLO has offered a fairly standard leftist policy with vague promises of more jobs and greater wealth distribution. At the same time, he will confront the drug gangs, force the U.S. to back off on its immigration threats and develop better relations with the rest of the world. He has not yet indicated how he plans to do any of this. Bolsonaro is likewise facing the challenge of meeting his own demands. He wants an end to corruption and crime. He has hinted that he is open to the tactics that have been tried in the Philippines by Rodrigo Duterte (over 60,000 suspected criminals executed by vigilante groups and the police). He misses the good old days when the military ran Brazil and wants much of that back.

The U.S. will be pivotal to the success of either man. This is a problem as the U.S. is usually not much engaged beyond some grandstanding and vague promises. The likelihood is that U.S.-Mexican relations will worsen as there will be little comity between AMLO and Trump. Brazil may be a different story given the fact that Bolsonaro is already playing heavily to Trump's ego. The first real test for Mexico will be the ratification of the U.S.-Mexico-Canada Agreement. It is not assured that it will make it through the U.S. Congress or the Mexican legislature.

Growth in Brazil

The latest quarterly data shows that Brazil is seeing some economic recovery. The growth in the third quarter was at 0.8%, a 1.3% expansion over what third quarter numbers indicated last month. This is still a little short of the 1.6% annual growth that had been predicted, but it was trending in the right direction. The most important factor in this growth spurt was the end of the trucker's strike that had all but stopped commerce in the country. The threats are still in place for more strikes, but there also seems to be some willingness to see what the new president will be able to do.

Analysis: Most analysts assert that the honeymoon for Bolsonaro will be short-lived. His approach will not please the major unions and they may elect to resume their pressure on his government. The real key to expanding growth will be exports. There are, however, no signs suggesting these will bounce back anytime soon.

Fed Bashing

The Federal Reserve has been the latest target of President Trump's scorn as he has reacted the way that most politicians do when there is a threat to put the lid back on the cookie jar. After a decade of record low rates, the Federal Reserve now has ample reason to worry about the threat of inflation and is reacting accordingly. Rate hikes have been modest and still leave the Fed Funds rate at near record lows, but Trump seems to be trying to set the Fed up as the fall guy when the U.S. economy starts to cool off in the coming year. Jerome Powell was selected by Trump to be the Fed chair and has been unwavering in his support for the current policy of gradual rate hikes into 2019.

Analysis: The irony is that President Trump has picked all but one of the Fed governors. They are all standing behind the policy set by Powell. If there was a genuine interest in maintaining a super loose monetary policy, the selection of very dovish members of the Board would have been in order. President Trump selected none of these. In truth, these have been the selections of Steve Mnuchin, but Trump could have intervened. This seems more an attempt to find someone to blame when the economy dips in the coming year.

Collections

Many of us collect things—all sorts of things. I am certainly one of them and have accumulated various items as a result. I love wrist watches and probably have 50 of them. I have in the past been enamored of such things as dragons, lighthouses, wolves, Dr. Who stuff and so on. My most consistent obsession has long been books. I have some 5,000 volumes in bookcases all over the house. Why do we do this? I suppose some see this as a kind of investment or legacy, but that is not my motivation. I just like looking at these objects and thinking about the meaning behind them.

The watches have nearly always been gifts from my wife. I remember every occasion prompting that gift. Most of the things acquired were on some trip or in some unique place. Looking at the things will trigger memories of that trip or some little shop. There are items that remind me of my father. I lost him when I was just 31 and I let his gifts to me keep his memory alive. I look at the books and bask in the ability to get lost in them when I get the chance.

I think about this when I see people who have lost everything to fire, flood or other disaster. I agree fully that the important thing is having family who survived, but I also know how heartbreaking it would be to lose these things. I can never replace the things my dad gave me and can likewise never replace the other items that have triggered so many memories. It is just another reminder to treasure what one has.

Consumer Spending

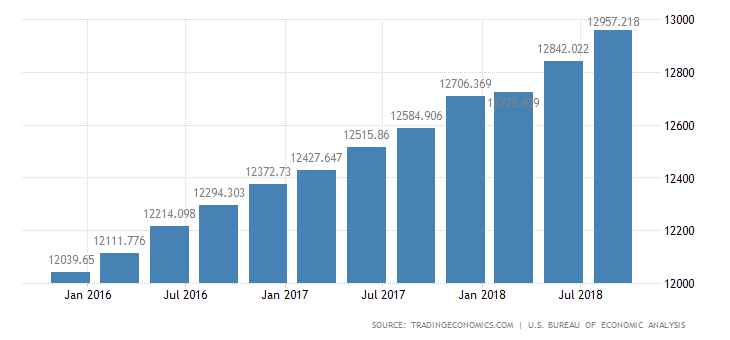

The latest word from the world of retail is that consumer spending has been rising as the holiday season has gotten underway. This had been expected given the improvement in consumer confidence and the fact that most of the motivators for spending have been in place. The jobless rate is still extremely low and there has been evidence that family incomes have been up. The trend has been manifesting for some time as the graph below shows. This is perhaps the most important factor as far as the growth of the overall economy—we are a consumer-oriented society. This connection will be important next year as prices for many consumer goods start to rise. Will the consumer's good mood survive these price hikes?

CONSUMER SPENDING