By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Are Investors in Fantasy Land?—

Once again, the markets are setting records. This baffles those who still insist there is a connection between the status of the economy and the markets. There has been a steady drumbeat of down economic data—reduced industrial output, weaker Purchasing Managers' Index (PMI) data, reduced levels of consumer confidence and continued worry about the impact of a trade and tariff war. The global rates of growth have not been this low since the recession. The markets seem to think the trade war will end at any minute. They also believe the central banks will keep cutting rates. Will this happen? Perhaps, but it might not. That could cause this optimism to fade fast and be replaced by real pessimism.

Consumer Confidence Looks a Little Shaky

The expectation had been that levels of consumer confidence would track back up a little by this point. This is the holiday spending season after all. The retail sales numbers have been better than expected, but that has not resulted in a more confident consumer. For the fourth month in a row, the levels of confidence as measured by the Conference Board have declined. Granted these are still relatively high levels, but the consumer is getting more and more nervous about issues such as the trade war, slow global growth and the impending election. Polls are still showing that likely voters will be going to vote against someone rather than for anyone.

Home Prices Rising Again

For the last several months, the price of homes has been in decline, but that has now started to reverse. The last two months have sported a hike in prices—3.1% annual growth in October and now 3.2% annual growth. The majority of this gain has been in the existing home market and has been driven in large part by lower mortgage rates. There is still a fear too many homes will be hitting the market as Boomers try to sell their homes, but thus far this trend has not manifested in a national sense.

Short Items of Interest—Global Economy

Mexico Tries to Stave Off Recession

The announcement from Mexican President Andrés Manuel López Obrador (AMLO) has been greeted with both skepticism and hope. The country has tumbled into recession since AMLO took control due to both internal and external factors. The trade war with the U.S. has hurt, but so have budget decisions that favored expanded welfare at the expense of development. Now AMLO is calling for a $47 billion investment infrastructure as a means by which to engage the private sector, but nobody has a clue where that money is going to come from.

Is USMCA Close to Ratification?

There is intense pressure on the Democratic leadership to bring the USMCA to a vote and get it passed. Moderates in the Democratic party want it, Mexico and Canada are pushing for it and of course Trump and the Republicans favor it. The hang-up has been labor and environmental standards and how they would be enforced. The other issue is whether the Democrats want to hand Trump any kind of win given the emerging election. Most assume the deal will be struck by the end of the year. The fact that this pact differs very little from the NAFTA agreement it is supposed to replace has been ignored.

British Pharma Rules and Trade

The Tories are counting on a trade pact with the U.S. to ease the pain of Brexit. The U.S. is well aware of the need and has been using leverage at every opportunity. One involves the pharma rules in the U.K. that allow the National Health Service to use generics and bio-similar drugs as a means by which to save money. The U.S. is demanding extended patent protection for drugs and the reduced use of these substitutes as a part of the trade deal. This would cost the NHS billions and the issue has become a campaign point for the Labor Party. This is not the only provision that would favor the U.S. in a proposed trade deal. That has added to the whole Brexit conversation.

Should We Give Thanks for This Month's Credit Managers' Index?

Over the last several months, the Credit Managers' Index (CMI) has been volatile, and that is an understatement. There have been some consistent trends through the year, but the variability has reflected the changes and shifts that have been taking place in the economy as a whole. Each month, we interpret and review the data that has been collected by the National Association of Credit Management. The CMI has proven to be a very effective tool for assessing the state of the economy and it is predictive given the nature of the credit manager's world. They are far more interested in the state of their creditors in the future—when they are scheduled to pay. Thus, they tend to think ahead by 30, 60, 90, 120 days or longer. What follows is the executive summary of the CMI. To see the whole report with graphs and charts, visit the NACM website and search for the CMI.

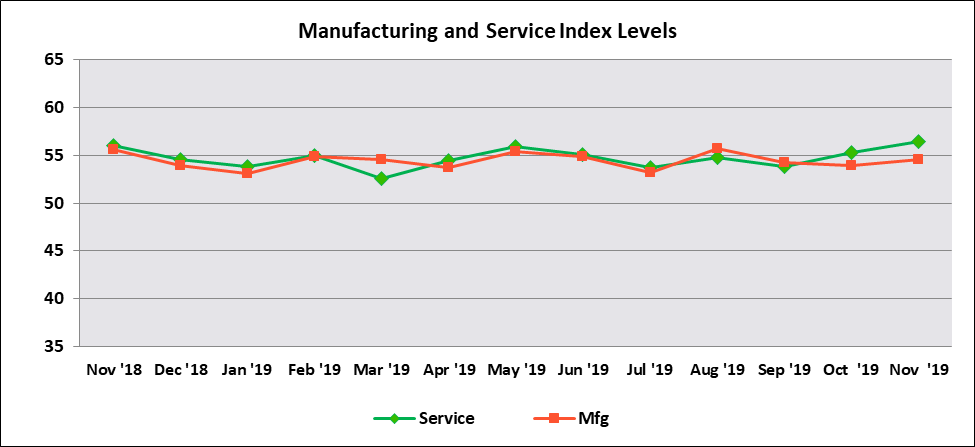

The data this month is more than a little interesting and encouraging. It is the second month in a row for a positive trend in the overall Credit Managers' Index; there have been gains in both manufacturing and service. This gain is more impressive given the fact that many of the other economic indicators have been trending in a negative direction. The Purchasing Managers' Index has been in contraction territory for the past three months, however, the latest new orders index started to come back towards expansion territory. Most of the recent indicators have shown increased caution among those in the business community. That seems to be the watchword of late. The Fed has seen a decline in business borrowing and capital expenditures have been trending down along with capacity utilization numbers. The CMI is the current ray of economic sunshine. This is important given the tendency for the CMI to predict the future a little more accurately than many other surveys.

The overall score improved from 54.6 to 55.5, marking the highest point reached since May of this year when it stood at 55.7. The index of favorable factors rose from 60.1 to 61.6, taking the numbers back to levels seen in August. The index of unfavorable factors improved as well (50.9 to 51.5). That is higher than it has been in well over two years—in February it hit 51. The breakdown of the categories suggests some interesting trends.

The sales score ramped up very nicely from 57.9 to 61.6. It was not quite as robust as the 64.4 notched in August, but headed in the right direction and back above 60. The new credit applications numbers also returned to the 60s with a score of 61.2 compared to 59 in October. The dollar collections numbers fell from 62.1 to 59.2—a little unexpected. There has been some evidence that companies are trying to work their credit numbers down a little in anticipation of a tougher year in 2020. Dollar collections would be expected to be up more than they are. The reading for amount of credit extended improved significantly from 61.6 to 64.3, the highest point reached since May of this year. There are obviously those still buying and still accessing credit in order to do so.

The rejections of credit applications showed some decline, but still managed to remain in the expansion zone (a scored above 50) with a reading of 51.3 compared to 52.1 in October. For the past year, this category has been strong with no time spent in the contraction zone. The accounts placed for collection remained in contraction territory but improved slightly from the month prior. It was sitting at 49.1 and is now at 49.8—an incremental move, but one that is in the right direction. The disputes category moved back into the expansion zone with a reading of 50.3 after an October number of 48.1. The dollar amount beyond terms reading was very nearly the same as it had been in October, but there was a slight improvement as it went from 52 to 52.6. This is another of the indicators that seems to show increased worry about the coming year. Companies seem to be trying to get current with their credit so they are not taking that burden with them into the new year. The reading for dollar amount of customer deductions also improved nicely with a reading of 51.4 compared to the 50.9 in October. The data on filings for bankruptcies trended in a positive direction as well with a reading of 53.5—nearly identical to October's 53.4.

This month marks the first time that five of the six unfavorable readings have been in expansion territory in nearly three years. The only category in contraction now is accounts placed for collection. It is unlikely this signals a new period of rapid growth for the economy, but it does reduce the potential for a serious recession.

Manufacturing Sector

As for manufacturing in the U.S., by most accounts the sector has been struggling, and for a variety of reasons. The most pressing of late has been the impact of the trade war with China. There has been a challenge getting the parts and materials needed from China. The slowdown in the Chinese economy has also affected those nations that traditionally sell to the Chinese—they now can't buy as much from the U.S. as they once did. The worker shortage has also played a major role and most of the manufacturing data has been troubled—everything from three months of the Purchasing Managers' Index in contraction territory to the reduction in industrial production numbers, durable goods orders, capacity utilization numbers and so on. The fact the CMI is trending in a positive direction is a welcome surprise.

The combined score for the manufacturing sector went from 53.9 to 54.5. That takes the numbers back to the levels seen in August. The readings have been at this level most of the year, but had slipped a bit in October. The index of favorable factors tracked up a bit from what they had been in October. The reading is now 59.7 and was at 59.1. Much of the year has been showing readings above 60, but they had started to fade a little at the end of summer. The index of unfavorable factors improved over the October readings with a 51.1 compared to 50.5 last month.

The sales numbers broke back into the 60s with a reading of 60.7 from 56.7 in October. The new credit applications reading stayed very close to the October reading with a 59.8 compared to the previous 59.2. There was a slight decline in dollar collections as the November reading was 56.8 compared to the 58.7 noted in October. These are still very solid and healthy levels and on par with the bulk of the last year. The amount of credit extended stayed in the same spot as last month—at 61.6.

The rejections of credit applications fell a little, but remained comfortably in the expansion zone with a reading of 51.6 compared to 52.1 notched in October. The accounts placed for collection stayed very close to last month's readings and just short of breaking back into expansion (49.3 to 49.4). The disputes reading also tracked in a more positive direction, but remains in contraction territory with a reading of 49.6 compared to the 46.7 in October. The dollar amount beyond terms data was also very close to the numbers from October. The reading last month was 52 and this month it is 52.1. There was a bit of a drop in the dollar amount of customer deductions from last month as it slid from 51.1 to 50.8. The reading for filings for bankruptcies trended back to healthier levels with a 53 compared to the 51.7 previously. The last time bankruptcy data was at 53 was in July.

The point is the CMI data is contradicting some of the gloom and doom story that has been building in the manufacturing sector. The inhibitions have been real enough, but there continues to be expansion tied to steady consumer demand.

Service Sector

The retail season is in full swing; the numbers have been better than expected. Retail sales have been up in general although there has been somewhat less interest in the high-dollar items that drove holiday sales in past years. The level of consumer confidence remains high as long as the jobless rate stays down and there have been few signs of impending layoffs. The CMI data on the service sector tends to be weighted towards the retail community as well as health care and construction. The data seems to be mirroring what the retailers are reporting.

The combined score for the service sector improved from 55.3 to 56.5, the highest reading in over two years. Last November (2018) the reading was at 56, but it has rarely been higher than 55 since. The index of favorable factors improved quite dramatically with a reading of 63.4 compared to October's 61.2. This reading is as high as it has been since May of this year. The index of unfavorable factors also noted an improvement with this month's reading of 51.8, but in this case the jump was small—moving from 51.4 in October.

The sales numbers are as good as would be expected this time of year. The reading in October was 59.1 and now it's back in the 60s with a reading of 62.5. That is comparable to the August number of 63.4. The new credit applications data also tracked back into the 60s with a reading of 62.5 from 58.7 last month. The dollar collections number also registered in the 60s, but the reading was down from the month before. It was sitting at 65.5 and is now 61.7. The amount of credit extended also jumped dramatically and stayed in the high 60s (from 61.6 to 66.9). This marks the first time since August that all the sub-categories have been in the 60s.

The rejections of credit applications slipped and now teeters precariously on the edge of contraction with a reading of 51 as opposed to the October reading of 52. The accounts placed for collection trended back into expansion territory with a reading of 50.1—not firmly in the category, but better than the 48.8 registered last month. The disputes numbers also trended back into expansion by the narrowest of margins as it has gone from 49.4 to 50.9. A narrow win but a win, nonetheless. The dollar amount beyond terms improved from 52.1 to 53.1. That puts the data in a healthy position. The dollar amount of customer deductions rose to a level of 52 compared to the 50.7 noted in October. The filings for bankruptcies numbers slipped a bit from 55.1 to 54, but this is still a solid reading in the mid-50s. The good news is that all of the readings are now in the 50s for the first time in three years, a development that promises decent numbers in the months to come. There will likely be some slowdown once the holiday season is over, but the decline may not create as much angst as last year.

November 2019 versus November 2018

This is only the second time this year with two consecutive readings trending towards the positive. It comes at a good time as far as creating some optimism for the coming year.

Things to Really Give Thanks For

There is a lot of mandated introspection this time of the year. During the holidays, we are required to give thanks, be cheerful, welcome family, be generous and so forth. It is not really appropriate to be a grump. Actually, I am a big fan of Thanksgiving for a variety of reasons. There is the food for one thing—my charming and lovely wife is not just another pretty face—she is a world-class cook. I enjoy time with family and I deeply appreciate the fact I don't travel this week. Another thing to be thankful for occurred to me in conversation with my business partner, Keith. I am very thankful for my father and the values he instilled in me.

Dad passed away far too soon—he has been gone for 35 years. I was only 31 when he died of a heart attack, but he had certainly made a lifelong impression on me. Dad was never a traditional disciplinarian. I never heard him raise his voice. If I transgressed in some way, he simply looked at me and expressed disappointment: "That wasn't very well thought out was it?" or "Was that really the best way to handle that?" or "Was that really your best?" The very last thing I wanted to do was disappoint my dad in any way. I wanted to live up to his standards, to be as smart as he was, to be the man he was. Some three decades after his death, he is still constantly on my mind as I attempt to do anything. Would he approve and be proud of what I am doing or would my actions disappoint him? I still hear those words: "Was that really your best?" It seems that Keith had a similar relationship with his Dad and my wife had a father like mine, as well. All three of us continue to be influenced by those quiet voices. I give real thanks for having that relationship to guide me.

November's Credit Managers' Index

The scores for the Credit Managers' Index have been volatile with a whole series of ups and downs, but the range of this variability has been relatively tight. There has not been the pronounced and steady decline that has been seen in the Purchasing Managers' Index, for example. The latest numbers are optimistic as there has been a trend up for two months in a row.