Short Items of Interest—U.S. Economy

Mixed Start to Retail Season

Black Friday has come and gone. Then there is Cyber Monday to consider. At one time, the only one of these that really mattered was that fabled Friday after Thanksgiving when the retailers pulled out all the stops to get that first consumer dollar. Now, we are dealing with what many are calling Blackvember as the sales and discounts are starting up much earlier. The lure of Cyber Monday has faded as online shopping has been taking over the retail world. It was once the case that people only had decent Internet access at work and they did their shopping from the office, but now, most people have better systems at home. The initial indication is consumers spent more this year. That has been particularly the case for lower-income shoppers. It has also been noted that "practical" gifts are not as dominant as they have been in recent years.

Meanwhile in Durable Goods Land

Not everything is coming up roses as far as the economy is concerned. The retailers are looking at a pretty decent year if trends continue, but the sellers of durable goods are not too happy as the orders slumped in October. The level of business investment has been declining for the last few months, which doesn't bode well for a strong fourth quarter. Much of this slowdown is predictable given the fact that the tax cut had many businesses more active in the first part of the year than would normally be the case. The front-loaded year provided some really nice numbers in Q2 and even Q3, but now, the buying has started to taper off suggesting 2019 will be significantly slower than 2018.

Revenues Up but Profits Lag

One aspect of the retail season has already become evident. The effort to draw in as much consumer activity as possible has come at a cost. The strategy is basic—offer deep discounts and sales in an effort to get people into the store. The assumption is once people are in the store they will be tempted to buy other things not carrying the deep discount. The problem is shoppers are now commandos—bent on accomplishing the mission and nothing more. They swoop in for the sale item and bolt. The retailers are making next to no money on these items so they are seeing nice revenue numbers and good traffic, but they are not making much of a profit. That will leave them weak and vulnerable next year.

Short Items of Interest—Global Economy

Mexico Denies Existence of Deal With Trump

White House officials have asserted a deal was struck with the new president of Mexico. It would have migrants seeking asylum in the U.S. waiting in Mexico for the decision. President Andrés Manuel López Obrador is under intense pressure from those in Mexico who do not want this immense economic burden. There appears to be no deal in place and it remains unlikely there will be.

Protests Erupt in France

The popularity of President Emanuel Macron hit new lows as protests have erupted all over the country in response to a plan to increase the tax on fuel in order to fund efforts to develop cleaner energy. Gas prices are already very high in France. The public thinks the money will all go to big companies to finance research and development that they should be paying for themselves.

Big Defeat for Taiwanese Leader

Tsai Ing-Wen and the Democratic Progressive party just suffered some major electoral defeats. She has been forced to resign as head of the party. It seems her confrontational approach to mainland China is not all that popular in Taiwan. The more conciliatory KMT group has been exploiting this attitude shift.

European Version of PMI Creates Concern

The Purchasing Managers' Index (PMI) has been a very useful tool for analysts for years as it has the virtue of being extremely current and fundamentally unbiased. The purchasing manager is simply stating what he or she did that month in the way of buying. One can assume that buying more steel signals expanded production and buying less signals a pullback. The index also has a simple diffusion index that states anything over 50 is expansion and anything under 50 equals contraction. The U.S. is currently enjoying a period of robust PMI activity with numbers consistently in the mid to high 50s. Not so with Europe.

Analysis: The numbers have not yet tumbled into the 40s, but they are as low as they have been in four years and have been dropping like a stone. As recently as October of last year, the Germans were in the 60s and France was in the high 50s. They have both been tumbling and now stand at around 51. The whole of the eurozone has likewise fallen. The sense is most of the engines that had been driving development have been fading as consumers and investors are both starting to fade. The other issue is that Europe has been experiencing the fallout from issues such as Brexit, aggressive U.S. trade policies and the slowdown in China. The impact on Europe is not good and will likely keep the European Central Bank (ECB) from hiking rates any time soon. That affects the U.S. and the Federal Reserve as it creates an even wider gap between the central banks and further bolsters the dollar at the expense of the euro. If it was the aim of the Trump White House to build a bigger export base for the U.S., the policies pursued have been an utter failure and have actually made the deficit far worse than it might have been.

The Oil Realities

The price per barrel of oil has been plunging fast. As last week ended, the price had sagged to levels not seen since 2015. Investors were falling all over each other in an attempt to get out of their positions. The reasons for the swift decline have not been all that mysterious. They have propelled the oil decline to nearly unprecedented levels in terms of speed of reversal. Conventional wisdom in October had the price getting as high as $100 a barrel by the end of the year. Now, there is genuine concern prices could collapse all the way to $50 if the current situation persists. The assertion by Trump that Saudi Arabia can be thanked for the reduction is nonsense as Saudi production has played almost no part in this surge. For that matter, the whole impact of OPEC has been minimal. If there is anyone to blame for the sudden glut, it would be the U.S. and Canada with an assist from some of the European producers. The fact is the higher prices that emerged in October prompted a major increase in output from the U.S., Canada and even Mexico as the per barrel price had reached the point where they could make some profits. Given the speed with which these operations can bring oil to market, they seized the opportunity even as they acknowledged the window would likely close pretty quickly.

Analysis: As important as supply is to the oil market, the more vital part of the equation is on the demand side. The investment community is not all that worried about production decisions as they know full well these are relatively easy to alter. The output from the U.S. and Canada can quickly be reduced and if necessary, brought back just as quickly. Demand is another story altogether. It is not looking good at this stage. Global growth has started to visibly stall in many of the key oil consuming states. Chinese growth has fallen to around 6%—nearly recession in the Chinese context. This is a nation that has to produce some 1.3 million jobs every month just to keep pace with population growth. That can't be done at 6% growth. Japan has fallen back into recession and Germany has lost 0.2% growth as well. Europe as a whole has been stalling. The U.S. has been growing on the strength of the U.S. consumer, but the threats of more trade wars and more tariffs have affected the export sector at a time when the dollar has been strong enough to deter exports and encourage imports. The sense is the U.S. can't continue to be the only nation on earth sporting a growing economy. Most expect 2019 to be a more challenging year for the consumer in the U.S. as inflation will become an issue; one that accelerates the pace of interest rate hikes.

The reaction from the OPEC states has been predictable. They could not possibly care less what Trump and the U.S. thinks of their oil policy. They are dependent on oil revenues and will not tolerate a situation that consistently results in cheaper oil. There are already talks under way within the organization regarding how much production to pull back. It is not a matter of if they elect to reduce production; it is only a matter of how much to reduce. There are some who assert Saudi Arabia will give the U.S. a break when it comes to these reductions as acknowledgement of Trump's defense of Crown Prince bin Salman, but this is a position that has never been taken by the kingdom. They do what is in the best interests of the royal family and the country—regardless. The U.S. had asked them to reduce hostilities in Yemen. Saudi Arabia reacted with an intensified campaign of bombings. The only factor that will keep them from reducing oil output in order to drive up prices is the fear that other oil states will simply move to fill the gap and cause the Saudi government to lose market share.

The U.S. is the unusual actor these days. It was not long ago that higher oil prices would have sent a chorus of outrage through the whole of the U.S. economy, but today the U.S. is a major oil producer. When prices are higher, there are many in the oil business welcoming those prices. It may well be the U.S. oil producers will cut back production so prices can drift back up. Simply stated, the U.S. doesn't have the ability to make money from oil until it is between $70 and $80 a barrel.

Infrastructure Development Faces Even More Challenges

There are few areas that get more lip service and less real attention than the national infrastructure. For over two decades, the nation's infrastructure has been ranked as D and below by the American Society of Civil Engineers. It has been ranked below that of Spain and Italy. Every politician has been mewling about how much needs to be done, but when it comes to allocating funds, there has been a singular lack of interest.

Analysis: Recent developments have made the situation even worse. The imposition of steel tariffs and a variety of other trade restrictions have been budget busting for a wide variety of projects—everything from roads and bridges to airports and seaports. Most of these projects are now faced with such huge cost overruns, they will either need to be scaled back or they may be abandoned altogether. The other factor starting to affect cost is the lack of skilled labor. The construction sector has been hit as hard as manufacturing and transportation. That has translated into much higher labor costs. In many cases, there are long delays waiting for work to be done as there are insufficient numbers of skilled workers available at any price. The estimate is that most of these public projects will be facing costs that will double or even triple in the next few years.

The deterioration of the national infrastructure has already compromised growth and has rendered many parts of the country uncompetitive. There is real danger of some places being virtually abandoned by business as it has become too difficult to service the area or keep it connected to the rest of the country. These are problems of an undeveloped nation—not a nation that once prided itself on its infrastructure advantage.

The Cost of Climate Change

The latest salvo in this debate has been fired by a massive government report that comes from 13 federal agencies that collectively produced a nearly 1700-page report. This was mandated by Congress a few years ago and focused almost exclusively on the potential economic impact of climate change. It makes grim reading as it concludes the U.S. economy is likely to shrink by as much as 10% between now and the end of the century. The report does not dwell on the causes of climate change and acknowledges there are likely many contributing factors that range from natural cycles to the increased production of greenhouse gas. The point of the report is that causation is a secondary issue to what can and should be done about the threat.

Analysis: The analysis of the impact looked at a wide variety of economic changes and elements ranging from crop failure to persistent wildfire threats that will soon include areas in the Southeast. The weather issues ranged from more frequent storms, flooding and drought that will rival the dust bowl days. The economic impact also includes damage to infrastructure, altered supply chains and shifts in human migration as people leave areas that are no longer economically viable.

The report has the feel of a challenge as opposed to an attempt to lay blame. The focus is on recognizing the threat and developing means by which to counter it. This will include everything from the development of technological fixes to restrictions on where people can live and what industry will be allowed as far as environmental impact is concerned. It also makes it abundantly clear that nothing much can be accomplished by any one nation alone. The effort to address the impact has to include every nation just as every nation can expect to be affected.

It is interesting this report was released in the first place given the position the majority of the GOP has taken on the issue. There is still a rejection of the whole notion of climate change and an insistence that steps to address the problem will slow the economy. This report does not seem to have been changed by the White House, but there have already been criticisms from some in the GOP and in President Trump's tweets. The report was buried in the sense it was released on Thanksgiving and thoroughly out of the news cycle, but it will doubtless be brought up in weeks and months to come.

The three main solutions presented include: (1) imposing some kind of fee or tax on the emission of greenhouse gas; (2) setting regulations as to how much greenhouse gas can be produced; and (3) spending federal research and development money on clean energy. The first two solutions are often addressed through some kind of carbon exchange system that allows companies that manage their output to sell their spare "pollution permissions" to other companies. Also, the U.S. economy would be able to grow as it becomes a leader in these technologies allowing them to be marketed to other nations facing the same issue.

Isolation

Being around family made me think of how isolated many of us have become and how this has likely led to our seeming inability to interact with one another without hate and anger. My family is made up of some very different people with some very different opinions on a whole host of issues. There are all branches of political, moral and social thought. Under any other set of circumstances, I doubt these people would want to be in the same room with one another. But they are family and that means they know each other in deep and complex ways. Frankly, many families are just like this. The guy you disagree with on almost every political issue is the same guy who would give you the shirt off his back. We know our family members as whole people—that means we love them for who they are.

Once upon a time, I think we knew our neighbors this way. Not anymore. We are cocooned by social media and our independence from others. We don't know our neighbors or even the people we work with beyond a very superficial level and we don't need them anymore. The neighbor is the guy who had the yard sign for the candidate you hated. Now you hate the neighbor as well. When I was a kid, we had a guy in the neighborhood who seemed to be angry all the time. He railed against the government nonstop. He might have been shunned and probably would be today, but he happened to be a whiz at small engine repair. Everybody in the neighborhood took their machines to him. It was a bonus that nothing delighted him more than fixing stuff. When he was so occupied, he didn't indulge in ranting and raving.

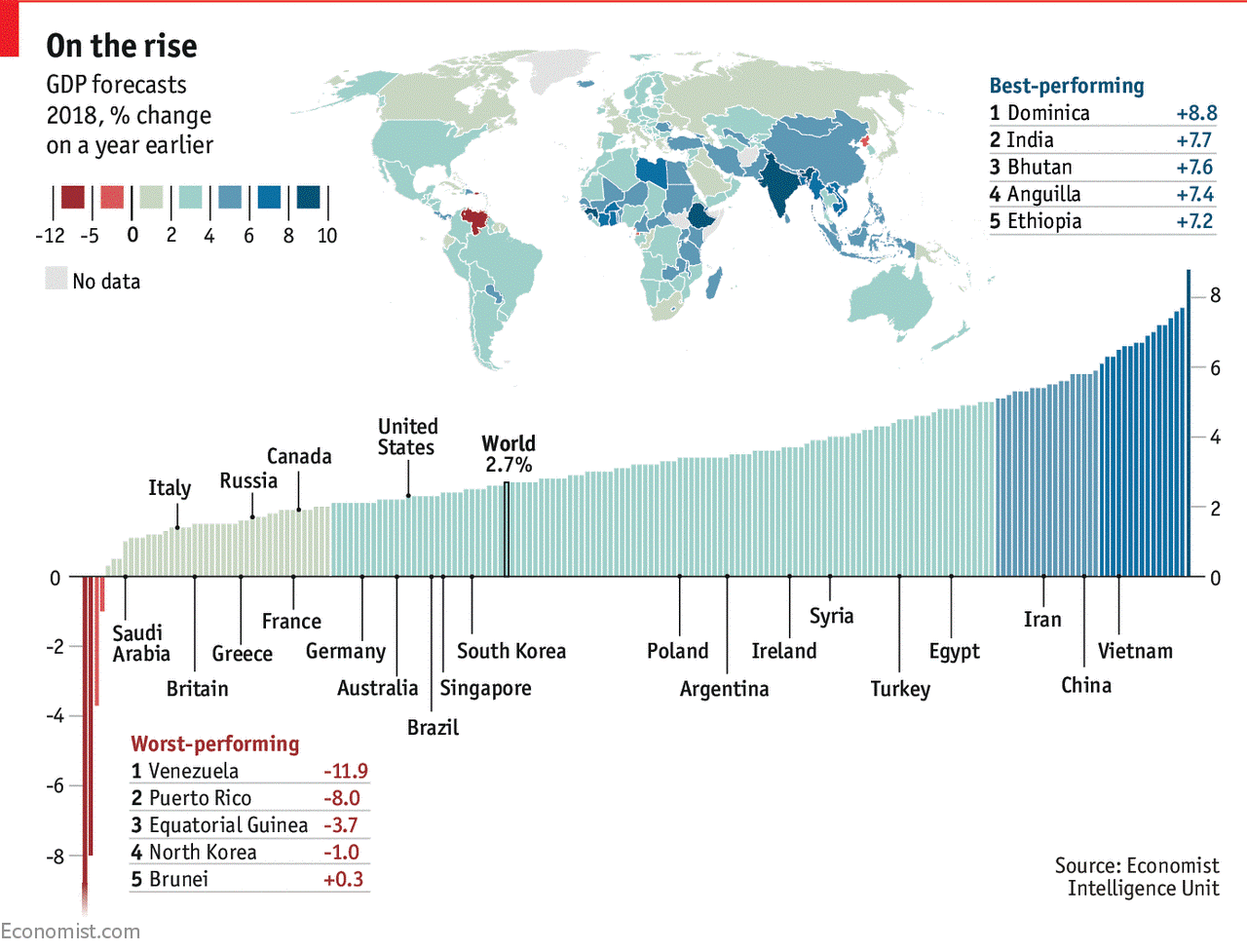

GDP Forecast

The chart below was released at the start of the year and was a forecast of where the world's economies would be at the end of this year. It has proven to be quite accurate. Most of the nations ended up about where it was assumed they would be. As is usually the case, some of the fastest-growing economies have been among the least developed. They are growing from a very small base to start with and have small GDP numbers. Any change at all can propel them either dramatically up or down. It is the impact that a company hiring 20 people has on a town of 1300 vs. New York City. The most significant of the fast growers is India. This is a massive nation that needs a major change in its economic prospects to see growth this fast. They overtook China and with the looming trade war between the U.S. and China, India stands to reap even more benefits.