By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Where Is the Wage Inflation?—

One of the laments from the economic community has been the apparent demise of the Philips Curve. This tool has been around since the 1950s. It stated logically enough that when the rate of unemployment fell, there would be wage inflation as there would be fewer people seeking jobs and they would be in a position to command higher wages. This has not been the case this time despite jobless rates as low as they have been in over 30 years. This has been blamed on everything from retiring Boomers to the lack of qualified people to hire, but another factor may be playing a role. The quit rates have been low as well. In a robust economy, that is rare. It seems people are reluctant to leave their jobs—either because they like where they are or because they are being held by some other factor. There is often the need to stay in a given community to take care of relatives.

Energy Slump Affects Manufacturing and Vice Versa

In many ways, these industries are highly symbiotic. That has meant troubles in one are affecting the other. The energy sector (especially the production of oil and natural gas) relies on the growth of manufacturing to create demand for its output. By the same token, the manufacturers need a healthy energy sector to create demand for the things they make for that industry. As manufacturers have been struggling against limited demand internally in the U.S. and trade issues, they are not demanding as much from the energy community. They are buying less from the industrial producers—a not so virtuous circle.

Retail Numbers Are Encouraging

If there is one thing that can be said about U.S. consumers, it is that they are a resilient lot. The data would suggest consumption should start tailing off—tariffs, manufacturing slowdowns, political worries and so on. The latest retail numbers from October suggest that none of this is bothering the consumer so far. It has been a good season with a strong Halloween and a good beginning to "Blackvember." This is the week that some new consumer confidence numbers emerge. We will see if that mood is expected to last through the remainder of the season.

Short Items of Interest—Global Economy

Escalation in Hong Kong

The end game may have started as the clashes in Hong Kong start to resemble a siege. Students have taken up positions in the university and the police have launched an all-out attack that has involved some of the Chinese military. The students are calling for more protests, which will likely fill the streets. That makes a real confrontation more imminent. If the past activity of the Chinese authorities is any indication, there will come a point when the police and military seek to put an end to this any way they can. It is not going to be pleasant.

Corruption in Mexico

Unfortunately, Mexico has been no stranger to corruption over the years. This issue has driven the success of politicians such as current President Andrés Manuel López Obrador. As the leftist mayor of Mexico City, he made a career of going after corrupt politicians and business people as well as some of the drug gangs. He promised the same activity when he became president, but there are now accusations that he has limited his anti-corruption activity to those in the opposition and has overlooked the activity of those connected to his party and government.

Business Community in U.K. Worries About Extremes

The business community in the U.K. is at a loss and so is much of the electorate according to the polls. The statements from various organizations representing the business community are warning against extreme positions being taken by both the Conservative and Labor parties. They have both swung to the extremes of their support base. That is not considered good for the economy.

Latest Dispatch from the Front

Each month, we put together a collection of indices and readings that are of interest to the general manufacturing community on behalf of the Chemical Coaters Association International and the Industrial Heating Equipment Association. The areas of interest range from the commodity side to the demand side and provide a fairly basic assessment of the economy as it pertains to their business interests. This is the executive summary and some excerpts from the report. Let me know if you want to see the entire report with all the nifty graphs and charts showing historical trends over the last 12 months.

Analysis: The data news has not been encouraging of late and the headlines have been bleak. The economy has been slowing to the point that some are seeing a recession as a possibility. There is also the fact that politics has been rearing its ugly head. Election years tend to depress consumers, businesspeople and investors alike. The two parties try to outdo one another with tales of gloom and doom unless you vote for them. The sense is the world is teetering on the brink. Before readers start to go out on that ledge over the fact that eight of the 12 indicators are trending in a negative direction, this month it should be noted many of the index readings that turned negative are only slightly down and many are still higher than they have been much of the year. There is an overall sense that economic trends are slowing down and that businesses (and consumers) are starting to get more cautious, but there has yet to be a full-on retreat.

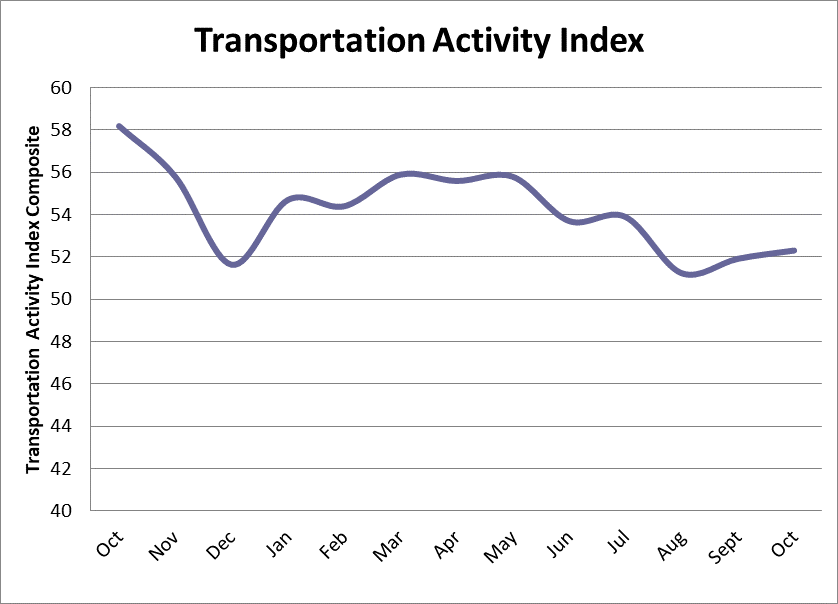

We shall start with the good news; it will not take too long. The four index readings that trended in a positive direction include metal pricing, the new orders index from the Purchasing Managers' Index (PMI), capital expenditures and the transportation activity index. Although these are the only ones that trended in a positive direction, they send some very important signals. The price of metals has been erratic; even this month there are as many that are trending up as are trending down. The issue seems to be production as there has been reduced demand for copper, aluminum, steel and the others, prompting producers to limit output in an effort to boost prices a bit. The new orders index from the PMI is starting to come out of the contraction zone although it remains under the 50 line. The overall PMI has been in the doldrums for three months, but maybe the improvement in the new orders data will signal a reversal in the months to come. The capital expenditures numbers are better than expected given the data on capacity utilization, but it seems there is still a demand for replacement equipment even if there is less demand for new equipment to support growth. The transportation sector is mixed, but there has been growth in the trucking area as would be expected during this transportation-heavy time of year.

So much for the good news. Now we try to make sense of the negatives and point out they are not all that bad. There has been a decline in sales of automobiles and light trucks, but only a very small one. The demand for vehicles has been consistent for well over a year, which was not expected to be the case. Consumers are still buying cars and trucks (the U.S. is still only 25th in the world as far as number of cars per person). The new home sector has been sluggish, but that likely has more to do with the time of year than anything else as mortgage rates remain low and prices have dropped in some key markets. The real problem is a shortage of construction workers slowing the pace of new home building. The rate of steel consumption has also dropped as the manufacturing sector falters at the same time that major construction activity stalls. The biggest consumer of steel is public sector construction. It has been a long time since infrastructure got the attention it deserves.

The rate of capacity utilization has slipped further away from what is considered ideal, but even with this latest reduction, the numbers are not that far off. Ideal is between 80% and 85%; right now, the level is at 78%. The impact on makers of machinery has been seen in the weaker durable goods numbers as well as the slower pace of factory orders. These have not been massive drops. There is no sense of an impending crisis, but this kind of weakness doesn't leave much wiggle room should there be a real recessionary trend. There has even been some decline in the appliance data as inventories are way down from where they once were. The overall sense of trepidation in the industrial sector is driving most of the current level of angst. The final negative note is seen in the data from the Credit Managers' Index, but even here, the news is not all that bad as there was some improvement over the previous month. More importantly, there was good news in the favorable readings and slightly less weakness in the nonfavorable categories.

New Automobile/Light Truck Sales

The consistency of vehicle sales continues to baffle analysts to a degree. On the one hand, this seems pretty consistent with the assessment of consumer mood, but on the other hand there have been enough headwinds to have slowed down sales by this point. The usual reasons for purchases of vehicles have not been manifesting in the manner they once did. There has been no radical change in the price of fuel to push people towards fuel efficient models, but there has not been a drastic fall in the price either. Given the saturation of the car market, it would have been a safe bet to assume vehicle sales would be slumping, but the reality is the U.S. ranks only 25th in the number of cars per person—439 per thousand (Italy is at 600 and Germany at 520). The newest concern for carmakers is the fact that Gen-Z buyers seem to be the least interested in buying cars. That has not affected overall sales drastically as yet, but is becoming a factor.

New Home Starts

There was an unexpected boom in new home starts at the end of the summer, but that enthusiasm has since faded a little and the pace has returned to more expected levels. The sector as a whole remains steady enough as the drivers for home building and ownership remain strong. The mortgage rates are slightly higher than they have been, but remain near historically low levels. The price of homes seems to have stabilized in most markets and the consumer seems pretty confident as a result of the continued low rates of joblessness. The only real fly in the ointment has been the continued labor shortage in many major markets. There are not enough construction workers to keep pace with demand. That has made new home construction very slow. This pace has forced many potential new home buyers into the existing home market as they can't wait the two years or longer to get a home built. The good news for the market is that Millennials are finally starting to move out of multi-family units to the traditional single-family home.

Steel Consumption

The level of steel consumption has been declining over the last few months. It has now sagged to the same point reached at the start of the year when the primary concern was the impact of the steel tariffs. The current slide is connected more to demand than to supply. There has been a pronounced decline in the manufacturing sector indicated by slippage in the rate of industrial production, capacity utilization, durable goods orders, the PMI and other measures. This slide has been global causing a significant impact on steel output. Add in the slippage in construction and there are some real warning signs manifesting as far as overall demand for steel going forward. All of this has contributed to a slip in the price of steel even as the expectation had been that tariffs would drive costs significantly higher. The only sector showing much growth has been in vehicle manufacturing, but even here, the growth has been somewhat anemic.

Industrial Capacity Utilization

There continues to be a slide in the rate of capacity utilization although the numbers are still far from catastrophic. The "ideal" rate is between 80% and 85%. When the rate is below 80%, as it has been for much of the last few years, it is indication that companies have capacity they are not using—they have slack. They are thus very unlikely to add new capacity in the way of new machinery or new people. They will even start thinking of ways to reduce that capacity through making machines redundant, laying people off or withdrawing from some markets. It is not until the capacity utilization numbers get close to 85% or higher that companies start to consider adding to their inventory of machines and people. A few months ago, the data was seeming to trend a little closer to that ideal position, but has since been losing ground.

PMI New Orders

There has been a great deal of concern over the performance of the Purchasing Managers' Index of late. For the last three months, it has been trending in the contraction zone with numbers as low as 47.3. The contrast with just a few months ago has been stark as there were numbers approaching the 60s. The new orders numbers had been well above 60 a year ago, but have been steadily falling since then and had trended below 50 since August. If there is a good news element to any of this, it would be that the numbers have risen just slightly this month with a reading of 49.1 compared to the numbers in the 47 range. Given that the new orders data is usually seen as an indicator, the fact that it has been rising a bit is encouraging and may signal a reversal in the overall PMI down the road.

Capital Expenditure

On a more positive note, there has been a little more activity in terms of capital expenditures (cap-ex). They are not at record levels by any stretch, but they have been moving in the right direction to be sure. The fact that cap-ex has been improving at the same time there has been a decline in capacity utilization would suggest there is motivation to buy machinery for replacement purposes rather than for the purpose of expansion. The fact is much of the machine inventory in the country requires replacement at frequent intervals and companies can't put off these acquisitions indefinitely. There has not been much evidence of new business motivation for capital spending, but that may also just be a sign of some general levels of caution in the industrial community

Taking Inspiration Where One Can Get It

This is the time of year for the onslaught of catalogs and I have to confess that I peruse these just to be aware of the plethora of devices and products on offer these days. How else would I know of the existence of Sean the Sheep lawn ornaments? I also discover that I can get all the knowledge and wisdom I need for life just by reading sweatshirt and T-shirt sayings. One of my favorites was the one that read "In Order to be Insulted I Need to Value Your Opinion of Me. Nice Try Though." I am going to take this one to heart. I get my fair share of criticism, but when I really think about it, I really could not care less what some of these people think. I shall save my sense of inferiority for when people I respect think I am a loon.

Another one I like is "The only thing all your dysfunctional relationships have in common is YOU." I know people who can't seem to get along with anyone and seek to blame this on others. Maybe they ought to look in a mirror? Then, there are those that truly inspire me to strive for improvement—such as "I want to be the man my cat thinks I am." Maybe some people have an aloof and scheming feline, but that is not my clowder [group of cats]. The looks I get from Scoot melt me every time and all five cats look to us for reassurance and security constantly. Finally, there are the sayings that just seem to sum everything up: "Some Days It Is Not Worth Chewing Through the Restraints."

Transportation Activity Index

The movement in the transportation index was slight, but at least it was in the right direction. The sector has always been seen as something of a harbinger of things to come, but there are nuances within the different modes of transportation. The most sensitive is air cargo or any kind of expedited freight as this only comes into play when there is some urgency with the shipper. In a generally slow economy, there is not that much urgency on display. The rail sector is most sensitive to sectors like manufacturing, utilities and agriculture as these sectors demand bulk shipments. The trucking sector is the most connected to the consumer as it is supplying the retailers as well as the consumer directly. This sector has been showing the most significant expansion of late as this is the season for UPS, FedEx and the like.