Short Items of Interest—U.S. Economy

Industrial Production Is Up

For the fifth straight month, the rate of industrial production has risen. It has been due to the surge in manufacturing activity. The category of industrial production is a three-legged stool that includes activity in the mining sector as well as utility activity. There was little growth to speak of in either of these categories so that left manufacturing as the driver for the economy as a whole. The good news is that manufacturing has been doing well some months after the impact of the tax cuts have been reduced. This is now reaction to real demand. That puts the rebound on more solid footing. It is expected both of these categories will see some additional growth.

Gen-X Gets Stuck

The focus always seems to be on some other cohort. The Baby Boomers were the consumers that had driven the economy through most of its post-war fazes. The world they grew up in was replete with growth and optimism, but also worried about the new threats of the Cold War. Now the Gen-Xers are watching the rise of the Millennial and even Gen-Z. The Gen-X nightmare may have only started to manifest. They will be the parents whose kids may never move out. Now they are facing the fact their parents could well end up living with them as well. This could also mean that Gen-Xers do not get the promotions they have been seeking as the Boomer shift continues.

Midterms and Business Angst

The outcome was not quite what had been expected by either the Democrats or Republicans. The "blue wave" was certainly present in some areas, but not to the extent that had been assumed. The shift in Congress has been profound to be sure, but it doesn't herald a whole new leadership. Business is often non-partisan and simply craves a stable environment. The fear is there will be even more uncertainty and confusion as Democrats are strong enough to throw plans out of alignment, but may not able to usurp any of the real power. The expectation is for more gridlock, and over an even greater variety of issues.

Short Items of Interest—Global Economy

Israeli Government Near Collapse

Under the best of circumstances, the Likud coalition is fractious and unpredictable as it is loaded with parties that have only one interest. They are willing to bolt at any time and feel they are not getting the attention they deserve. The latest division has been caused by Netanyahu's agreement to a ceasefire with Hamas and other factions within the Palestinian community. This prompted the resignation of the extremely bellicose defense minister who hails from a virulently anti-Palestinian position. The fact is that Netanyahu is only barely holding his party together. If it collapses, the country will be facing another vote that could put the Labor Party in some kind of control.

2020 Free-for-All Shaping Up

It is certainly early days yet, but the fact is American election campaigns never really end. The race for 2020 is well under way. At the last count, there are over two dozen Democrats who have indicated interest and at least five Republicans who intend to challenge Trump. There is the usual array of Senators, Representatives and Governors, but also several who have never held office but plan to emulate Trump's path as they are all very wealthy and able to finance their own bid. The global community is more likely than ever to try to play a role even though it knows it is expected to stay neutral.

Germany Starts to Look at Merkel's Successor

The three candidates to take over the Christian Democratic Union are Friedrich Merz, Annegret Kramp-Karrenbauer and Jens Spahn. They are now starting to spar in public. Thus far Merz is seen as the front runner, but Spahn is the youngest and appeals to a key constituency.

Will Theresa May Survive This? Will Britain?

Clearly, nobody expected this process to be easy. To be honest, few expected the British public to vote the country out of the EU at all. It was assumed there was legitimate frustration with the rules of Europe, but that people would weigh the advantages and disadvantages and come to the conclusion that staying engaged made more sense than outright rejection. Ever since that vote, emotions have been running very high as the Euroskeptics have been pushing their scorched earth objective, while the bulk of those who voted for separation have been changing their minds. There has been an impasse for months. Finally, the two sides reached a deal that everyone knew would not really satisfy anyone. It keeps the U.K. connected to the EU in some form of a customs union, but this comes with European restrictions that infuriate the pro-Brexit wing of the Tory party.

The issue of Northern Ireland got a temporary solution, but the threat of a hard border remains. The Europeans are in no mood to grant the British any of the advantages of EU engagement as long as the U.K. refuses to adhere to EU rules and norms—especially those that concern the movement of people. The average Brit who voted for Brexit was doing so in reaction to immigration. The last thing anyone wants to see is the U.K. government capitulating and allowing thousands of migrants to relocate in the country. The EU has been adamant as immigration has become the No. 1 issue for the whole of Europe. There is no tolerance at all for deviation from EU policy.

Analysis: When May reached the deal, there was no doubt it was deeply flawed and was never going to be more than a temporary stopgap—basically a means by which to call a truce for a while as talks continued. The hope was that the rest of the British political community would see it that way as well. From the start, she has tried to present the deal as the best that can be expected at this point and has been trying to assure critics this is not the final word on the subject. This argument has essentially been rejected by those that support Brexit. They assert that temporary solutions have tended to become permanent ones and they find this agreement unacceptable on several levels. Within hours of May briefing her Cabinet there was a revolt. Key members of the group resigned—including the chief Brexit negotiator. Dominic Raab protested the deal throughout and has taken the dramatic step of leaving his position altogether. Many other members of the Euroskeptic wing of the Tory party have reacted similarly. There is now an enormous rift that may well cost May her position as prime minister. There have been calls for a no confidence vote and there are clearly those who want her job and see an opportunity to oust her. She has been trying to appeal to the British public, but the mood is decidedly sour. The majority of the population now thinks leaving Europe was a bad idea, but they remain as opposed to immigration as they ever have. Most voters are just sick of the whole discussion and want it to go away.

If this all falls apart and the U.K. ends up stumbling out of the EU without a discernible plan, there will be significant repercussions for Britain, Europe, the U.S. and the rest of the world. The pound has already taken a beating and has sunk to levels not seen in years. The result will be far more expensive imports for the U.K. and a likely surge of exports as the currency weakens. Given that Europe will not be the market it once was for the U.K., the trade will have to shift. The most likely change will be to expand relations with the U.S. and nations in Asia. That is a prime reason the British are talking about joining the Trans-Pacific Partnership (or more accurately the successor group that has formed since the U.S. pulled out). The British are going to be isolated from their usual trading partners. That will require a radical shift. The process will not be swift. That will put immense pressure on the economy with some asserting a recession is now imminent and it will likely be both deep and long.

The odds are against May at this point as there has been no real support from any of the key players. The pro-Brexit forces are in full voice and are demanding that she resign so that one of their own can become PM. The anti-Brexit forces are nearly as vocal in their opposition as they see this as an ideal time to rethink the whole situation and entertain the notion of coming back to Europe with some changes to soothe the opposition. The problem with this position is that the Europeans have shown no desire whatever to welcome the U.K. back.

Imports Surge in Anticipation

It is as predictable as heat in the summer and cold in winter. When a company expects to see prices start to rise, there will be an attempt to protect against that hike. The most common technique is to build inventory while the prices are still low. That has been the pattern thus far as companies anticipate the continuation of the trade wars with China and Europe and nearly everybody else. The U.S. has transitioned from being a leading advocate for open trade to one of the most protectionist nations in the world. That has every company engaged in global business on edge.

Analysis: There are all kinds of challenges that stem from this strategy. In the short term, there is more spending on these imports than would normally be the case. That means less money for other purposes. There is some evidence that all this accumulation has been affecting everything from hiring decisions to the potential for acquisitions. Longer term, there is the issue of being stuck with too much inventory. The assumption is that all this accumulated material and commodities will be consumed, but there is a real danger of that stock remaining on the books for months and months before it can be consumed. The other issue is that there will be a very sharp drop off in import activity as soon as those tariffs kick in. That leaves a lot of companies in distress as their business drops off.

The Great Trade Debate

Much has been made of the tactics and strategies employed by Trump when it comes to trade. He has been as negative toward rivals like China as he has been towards ostensible allies. His approach has been to demand deals that clearly favor the U.S. and he has not been shy about using intimidation and threats. This is not an approach unique to Trump. It has always been one of the two prime motivators for trade relations. The assumption here is that trade is always about winners and losers. The object of the game is to get what one wants and to ensure that others do not. It is about leverage and exploiting advantage. This was the dominant school of thought for centuries and was an integral part of the mercantilist philosophy. In many respects, trade and business was considered an extension of warfare by other means.

The other motivation for trade is rooted in cooperation and finding mutually beneficial relationships that further the bigger goals of economic growth. This approach grew out of the experiences of the Second World War and the Great Depression. It was judged that selfish motivations led to nationalism and an aggressive set of policies that ultimately led to war on a grand and vicious scale. If there is no room for any but the winners, there is inevitably a conflict. The whole rash of international institutions designed to direct and control the global economy grew up as part of this move to broaden the concept of winning and losing so that everyone was able to win.

Analysis: These concepts have never been in such stark contrast as they are now. Trump has taken the U.S. a long way toward that confrontational school of trade, but he is not the only one. The British mired themselves in Brexit over this issue, while populists have taken control of governments in Italy and Brazil. There are also strong nationalist tendencies in China. That is a prime reason China has largely ignored the entreaties of the international institutions. The motivation for this kind of approach is easy enough to understand from a domestic political point of view. Trying to create a system that has something for everybody will inevitably mean there will be those that get left out to some degree. The manufacturer that maintains a competitive position in the world by outsourcing will leave domestic workers in the lurch. A country that chooses to abandon production of something that can be produced more cheaply elsewhere is doing its consumers a great service, but at the expense of others.

It is not necessarily inevitable that trade wars become real wars, but the threat is there. A nation that finds itself cut off from global growth and unable to satisfy the needs of its population will be forced to take drastic action in some other way. This may stay at the level of tit-for-tat trade restrictions, but there is the very real possibility that military force will be applied. It is often forgotten why the Japanese elected to attack the U.S. at Pearl Harbor. The standard assertion of this attack being unwarranted and a surprise doesn't really hold water. The U.S. had been engaged in sinking oil tankers taking product to Japan. The thinking in Tokyo was that an assault on the U.S. fleet would discourage that activity. The issue for Japan was trade and economics. Most of the world's confrontations have their roots in economic issues. That creates some deep concern regarding a new Cold War with China.

Shifts in the Oil World

The U.S. is in the throes of another oil boom—not quite as dramatic as the one that was fueling the economy a few years ago, but certainly significant. The first big play in the oil shale world was propelled by the smaller start-ups that were willing to take the big risks, but now that those investments have been made and have paid off, the major oil companies are taking a far bigger share of the business than used to be the case. That will likely mean a bit more stability. They will be able to ride out the volatility that used to snag the small operators.

Analysis: The latest inventory numbers were something of a surprise as they were more than had been expected. The U.S. producers have been gearing up in anticipation of OPEC electing to reduce output. This has been a technique the OPEC states have used for many years when the wanted to see prices go back up. It is essentially creating a shortage situation. That reduction in capacity would translate into higher prices. Now that the U.S. is the world's largest producer of oil, the leverage of OPEC has been blunted in some respects. The U.S. can and will make up the difference as far as production is concerned. With inventory levels already high, the likelihood of higher-priced oil diminishes. The challenge for the U.S. is that it now benefits from higher oil prices as much as the OPDEC states do. It becomes a balancing act between the producers in the U.S. and the consumer who wants to see lower prices at the pump.

Kindness of Strangers

The drama played out in front of the hotel and would have been worthy of a YouTube video. There were three burly construction guys working on the sewer system—heavy equipment of all variety dealing with something that was down a big hole. Only none of the three was too concerned with the task at hand. It seems a couple of kittens had sought refuge from the chilly night by going into the hole. One was apparently injured in the process. Now these guys were trying to extricate the frightened cats, but they kept just out of reach. Two guys came over from the hotel with food. That was enough to entice the injured one and he was brought to the surface. Now that left his buddy. Nobody had a clue what to do next, but a guy in a suit walked up to investigate. Seems he is a cat guy like me and with barely a second's hesitation he jumped in the hole. The workers were now worried he would be hurt and they would be in trouble for not stopping him. About 10 minutes later he climbs out with the kitten in hand and a suit that would need a lot of attention before it was fit for the public again. What next, he was asked? "Guess I have a couple of new cats. This is how I get all of them anyway—rescues of one kind or another." Off he went to the vet in his stinky suit—two bedraggled, but visibly happy kittens in his grasp.

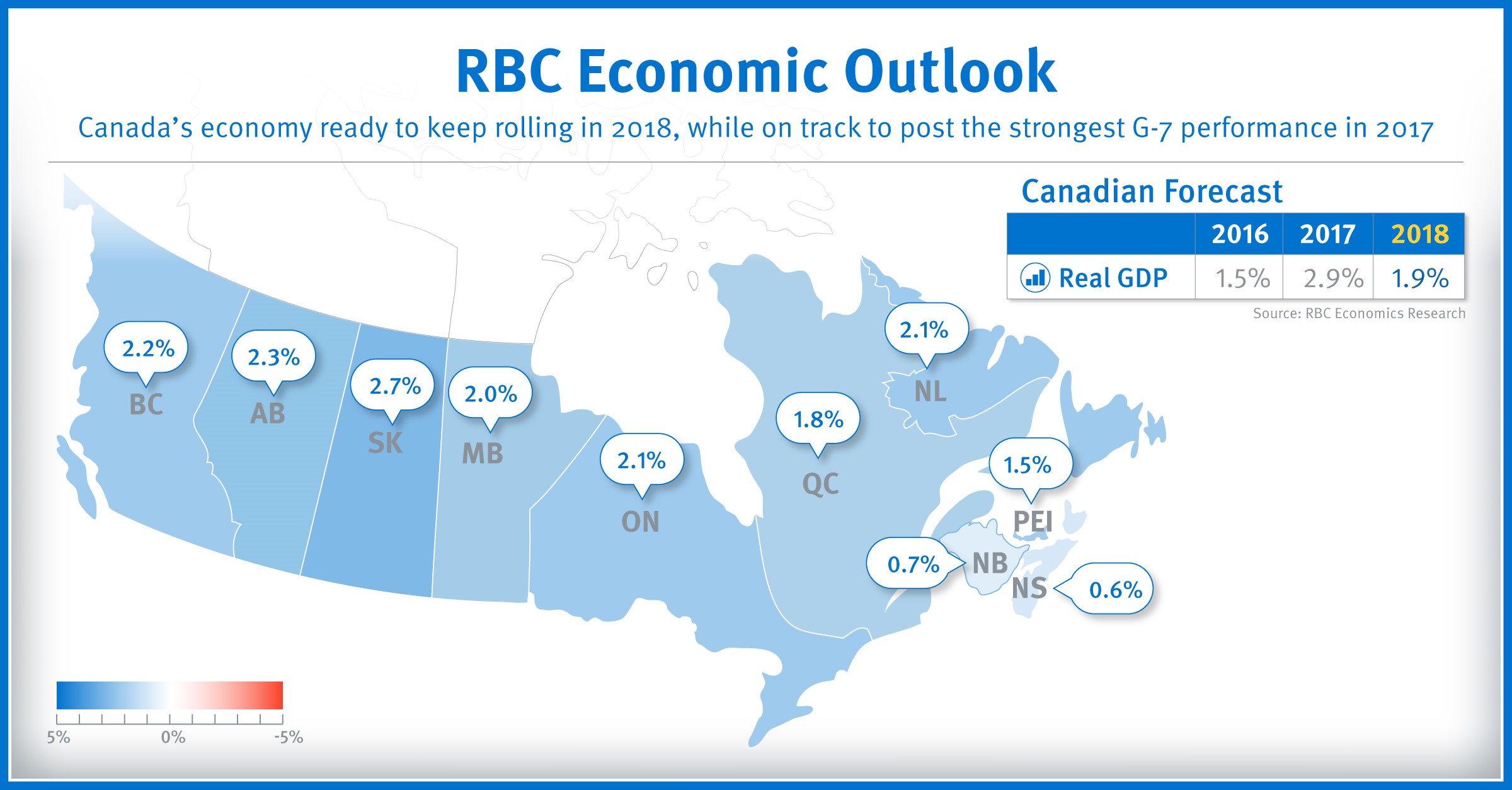

RBC Economic Outlook

We are not always as aware of what is taking place with our neighbor to the north, but it is certainly a major consideration for the majority of U.S. companies as Canada is almost always the No. 1 or two trading partner for the U.S. There are 23 states that list Canada as their No. 1 trading partner. That trade cuts across a variety of sectors from manufacturing to agriculture. The growth rate for Canada is solid if not actually robust. It is slightly less dynamic than the growth rate for the U.S., but nearly twice the rate that Europe is sporting at the moment. The trade disputes between the U.S. and Canada seem to have retreated to a degree. The new USMCA gives Canada quite a bit of what it has asked for during the talks. Domestic content rules on vehicles will ensure that Canada gets a share of the automotive market. The opening of the dairy market to the U.S. was a concession, but Canada seems OK with it.