Strategic Global Intelligence Brief for November 12, 2018

Short Items of Interest—U.S. Economy

Dollar Surges

As much as the U.S. would like to see imports decline and exports surge ahead that will be hard to pull off as long as the dollar keeps getting stronger. The dollar has been hitting highs not seen in 18 months. That is making it very hard on exporters at the same time it makes imports easier to sell in the U.S.—regardless of all those trade and tariff threats. The power of the dollar is due to at least two major factors. The first is there has been real chaos as far as Europe is concerned, and that worries investors. Germany is now in a post-Merkel position. Nobody knows what this will mean. Italy is a mess and risking outright EU censure. The Brexit talks get nowhere. The list goes on and on. Meanwhile, the U.S. Federal Reserve is preparing to keep hiking rates. It is about the only central bank with that policy in place at the moment.

Oil Starts to Climb Again

It seems predictions change from one week to the next when it comes to whether oil will get to the $100 per barrel level again. The march seemed pretty steady a few weeks ago. Then, the U.S. backed off on the Iran sanctions for a while and the price fell again. Now, it appears OPEC is close to reaching a deal that pulls more oil out of the system. Russia is now expected to join the deal. This cuts the global supply enough to pull prices back up. The $100 barrier seems less intimidating than it was once.

California Fires

The wildfires savaging California are intense and have ignited a political firestorm that is just as intense. The debate over the biggest fire disaster in the history of California has quickly escalated into an ideological battle. On one side are those who assert this is the outcome one would expect due to climate change as this area has been in drought for years. The other side rejects the climate change assertion and blames the state of California for bad management of water resources and the forests. Threats from the White House have been issued as far as financing the fire control effort. The local fire-fighting authorities point to a simpler issue—heavy rains in the spring led to significant growth which then died during the drought and provided unprecedented levels of tinder. Mostly they would like people to argue later and focus on fighting the fire today.

Short Items of Interest—Global Economy

Turkey Circulates Proof of Saudi Hit Squad

One of the more astonishing parts of the Saudi effort to play down their role in the murder of the dissident journalist is their seeming ignorance of the role of Turkish intelligence. No country gets as much attention from the Turks as Saudi Arabia. There have been spies at work figuring out the Saudi's every move. Of course, they would have the Saudi consulate bugged—the only shock is that Turkey only has audio and not video. They are now making that tape available to countries all over the world. It confirms the fate of Jamal Khashoggi at the hands of a Saudi hit team.

Japan Likely to See Growth Stumble

The latest figures for Japan are due this week, and they will not be happy ones. The country will have shrunk its GDP growth by over 1% due to a combination of natural disasters and economic crises. The storms and earthquakes attacked parts of the factory sector as well as tourism and exports in general.

Chinese Stimulus

In response to the threats from the U.S., the Chinese government launched a series of efforts designed to bolster the economy. The success of that effort will be judged later this week with the latest release of data. Most are asserting China was able to insulate the economy to some degree, but there will still likely be some evidence of a slowdown. The next challenge for China is to keep the stimulating from overheating and creating bubbles.

Report From the Front

Each month, we do a series of index reports for a pair of industrial organizations (Chemical Coaters Association International and the Industrial Heating Equipment Association). This has also been the month I have had contact with steel makers through the American Institute of Steel Construction (AISC) and steel users through Fabricators & Manufacturers Association (FMA) and others. It's a good month for getting feedback and opinion. What follows is the executive summary and some of the specific commentary.

This month has a little something for everyone. There are readings that suggest the economy remains strong and vibrant going into the holiday season, but there has also been enough to make the pessimists feel justified in their gloom. This has been an uncertain time, part of which can be attributed to the elections. Now that these are over, that level of uncertainty remains in place as nobody really knows what the strategy will look like—from either Democrats or Republicans. There are many possibilities under discussion, but only a few will be of much benefit to the business community. The data that trended down this month generally has more of a future orientation. These are the most sensitive to the lack of clarity.

Analysis: Of the 12 indicators, only five are in positive territory and seven are trending in a negative direction. It is important to point out that many of these readings are changing only slightly from what they had been, but others saw major shifts. Those are the more significant. The five that provided positive news included the resilient New Automobile/Light Truck Sales index as it continued to trend in a positive direction despite the assertion by many analysts that it is due to correct any day now. The consumer still wants their new vehicle. Nothing yet seems to dissuade them. Another piece of positive news came from the capacity utilization numbers, although to be honest there was no gain to celebrate as the index stayed precisely where it had been the month before. The good news is the numbers remain close to the numbers considered ideal as far as capacity goes (80% to 85%). The third index number trending in a positive direction was durable goods. This seems to be related to more demand from aerospace and some of the growth sectors in the industrial community such as oil and gas, and to some degree the health care sector. The importance of health care to the industrial community has been growing as there has been nearly as much investment in robotics and technology as there has been in manufacturing as a whole. There was a similar jump in the factory orders numbers as well. That may reflect a little more of the attitude in the retail community. Both of these sectors may have also been reacting to the promise of tougher trade relations and the need to get some business taken care of before they are a done deal.

The bad news data was more widespread, but it is important to note that even with the declines in some sectors, the overall status of these readings remains higher than it had been in several years. The most troublesome reading is coming from the housing sector as starts have been way down alongside permits and the sale of existing homes. The "headwinds" discussed all year have finally started to come to prominence and have affected both the starter home and the McMansions. The news as far as metals has been a little weak as well with steel consumption off from earlier numbers and generally lower metals prices. The steel costs are still far higher than they once were due to the tariffs, but the average hike has been over 40%. That has been motivated by capacity issues more than the tariffs for the moment. The issue now is demand more than anything. There has been a fall in that demand of late.

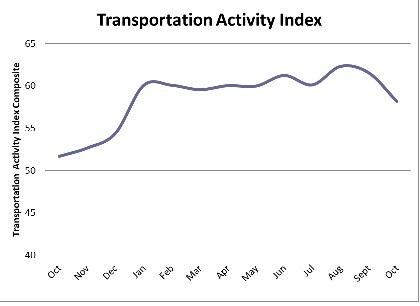

There has been a decline in capital expenditures, but it was not especially steep—over the course of the last few months it has been relatively steady. That pattern is expected to continue. A bigger issue is a decline in the Purchasing Managers' Index (PMI) and more specifically the new orders index. Right now, the overall numbers are still very healthy, but the trend is not what anyone wants to see extended much longer. The same pattern has showed up in the Credit Managers' Index—a decline but not enough to take the index out of the expansion zone for the time being. There is potential for a rebound as has been taking place all year, but there is also the possibility that conditions get far worse. The transportation index took a big dive as trucking demand fell off. Rail has been doing OK, but they are in between their busiest seasons. The holiday season will be good to the parcel carriers, but not so much to the longer haul companies as they have completed the majority of their shipments.

New Automobile/Light Truck Sales

The fact the auto sector keeps plugging along is no longer surprising anyone, but there are still questions about this resiliency in the face of all those "headwinds." To review, there was a sense that sales in the vehicle market would be slumping continuously since the slide that took place last October. The consensus view had been that consumers would be worried about higher interest rates and the potentially higher price of fuel. It was also assumed the auto sector had a glut on its hands given the fact cars and trucks and SUVs were lasting far longer than they once did. The average age of the U.S. vehicle fleet is now 11.5 years. Add in issues like potentially higher vehicle prices due to trade wars and the imposition of tariffs and the assumption is that this sector would at least slide a little, but it has not. In fact, this has been one of the longest periods of stability in years.

There is conjecture that consumers think conditions will be worse in the future and therefore are choosing to act now. They see that those tariffs will have an impact and so will changes in what used to be NAFTA. They know interest rates are going up and they know inflation is a credible threat. That may have them believing it would be wise to act now. On the other hand, they may not be thinking about any of this and are just reacting to the fact they feel secure in their jobs and simply want a new vehicle.

New Home Starts

The data from the housing sector has not been nearly as promising as far as far as the consumer is concerned—at least compared to the activity that has surrounded the automotive sector. There has been a slide in almost every measure of housing—from existing home sales to permits to new home starts. This has been a sector that has definitely reacted to fundamental changes such as higher mortgage rates and higher-priced homes. The market has been dividing for some time and each sector has been reacting differently. The starter home has become something of an endangered species as the younger homeowner is the most likely to be put off by higher costs and higher mortgage rates. There is also the fact that Millennial buyers are still not as interested in home ownership as previous generations have been. The higher-priced homes are still selling, but not as briskly as they had been. The only good news for the sector at this stage is unemployment remains very low and consumers have remained very confident about their financial future.

Steel Consumption

The steel sector is a classic combination of good news and bad. The good news is that tariffs placed on imported steel have allowed the sector to make some impressive gains. The calculus has been complicated so there is a lot of frustration within the steel consuming community. The assumption on the part of steel makers is that the tariffs imposed will not last long—a situation similar to the one that took place under Bush. They invested in capacity after the 2002 tariffs were imposed, but by the time the investment was complete, the tariffs had been lifted. Today, there is no desire to repeat this experience. That has led to real capacity constraints. This has, in turn, allowed prices to rise far past the 25% that would have been indicated by the tariffs alone. Steel prices have risen by as much as 45% and for some grades as high as 75%. There was a surge in consumption as the tariffs were being discussed and many users sought to get their supply in place before the price rose. That buying spree has basically ended. Now, there are steel consumers struggling to pay for what they need. At the same time, there has been a reduction in demand from some of the key steel sectors such as public sector construction and even vehicle manufacturing. There has been a steady demand for passenger vehicles, but these have far less steel in them than in previous generations. Meanwhile, the demand for farm machinery, construction equipment and freight equipment has been slumping. On the other hand, the demand has improved for oil field equipment.

Industrial Capacity Utilization

It has been tantalizing for months—data just shy of what would be generally considered normal. The supposedly ideal reading for capacity utilization is somewhere between 80% and 85% as this signals there is no real slack capacity, but at the same time the capacity is not so tight that there are shortages and bottlenecks that lead to inflation worries. For the last few months, the data has shown a capacity number in the upper 70s, still good compared to where it has been over the last few years. The issue at the moment seems to be that companies made investments at the start of the year in response to the tax cuts and other factors. They are now waiting to see if they will get the customer demand they need to justify that investment. It is also important to note this number is an average and that many sectors are already in that sweet spot between 80% and 85%. Some are actually beyond that point and facing issues of shortage and bottleneck. This has not pushed inflation aggressively, but it is a growing concern.

PMI New Orders

The slump in the overall PMI has been worrying. That concern has extended to the New Order index. The numbers are far from bad at this point—still well into the expansion zone above 50. The problem is trends are not heading up at this stage. They have fallen quite a lot from the highs notched even a few months ago. Given the PMI tends to signal what is happening in the economy as a whole, this causes a certain amount of concern should the pattern persist. It will not take many months with this kind of decline before the numbers are flirting with contraction. The fall in the overall PMI has not been as dramatic as the fall in New Orders, however. This creates some questions about the future. There have been many suggestions as to why the PMI is sagging at the same time that most of the other indicators are still trending in a positive direction. At the top of this list is the sense that many companies engaged in a lot of early activity and then slowed. Some of this buying was prompted by the tax cuts.

Metal Pricing

The price of most of the industrial metals has been falling since the start of the year, which has been a little perplexing. It is especially confusing with aluminum given the impact of the tariffs. The sense is most of this decline has been demand driven, a reaction to the fact that users of these metals have been having some issues of their own. Demand for aircraft has been a little uneven and there have been slumps in a variety of freight-related sectors. The push to buy ahead of the tariff rise on aluminum has not been as aggressive as it has been for steel, while some aluminum markets have stalled. Copper has been reacting to some of the lower pace for telecoms and other high-tech sectors.

Some Political Observations

The coarseness and anger that pervades society has become nearly unbearable. There seems very little concern for one's fellow man. Even as we enter the holiday season, it seems to be more of an effort every day to remain civil. There is real hatred in the world today and even more indifference. Much has been written urging people to find their generous spirit again, but for the most part, it has fallen on deaf ears. I had a conversation with a guy this week that gives one a small glimmer of hope.

He essentially stated it becomes easier to find ways to support strangers than those you know. He does all the appropriate giving his church suggests and has his own list of charities, but it dawned on him that all of this was at arm's length. What about his own neighbors—those people he actually knows? He set out to be a good neighbor regardless of who that meant he would help. He started with the guy most on his block disliked. He was the neighborhood pariah, arguing with people at every opportunity, hosting loud parties and so on. The starting point was the guy's lawn tractor. It had been sitting in the overgrown front yard for weeks. The guy I am talking to decided to investigate. He soon saw it was not in running order so he got his tools and set to work. Five hours later it was running fine. The guy gets home and sees the guy fixing the mower and demands to know what is going on. "Nothing just saw it was busted and that kind of stuff always drives me nuts, so I thought I would help—can't fix much, but I can work on mowers." The guy was flabbergasted and suddenly his mood changed as he brought out beers. The talked and each learned a lot about the other. Within weeks the guy cleaned up his yard and even moved his party inside at the next opportunity. Bottom line—we don't have to hate or even dislike one another.

The Transportation Index is a tool created to monitor the diverse world of transportation—all modes from ocean cargo to air cargo, trucking to rail. The dip in the transportation index was fairly profound and adds a little to the worry over the level of capacity utilization and the performance of the PMI. There is a certain level of slowdown showing up although it is not such that the whole economy is shuddering. It is almost as if there was a breather underway. The fear is this could expand and usher in a much slower 2019. For the most part, it seems the consumer is confident and poised to deliver a good holiday season, but that remains to be seen. The Black Friday sales are not quite the signal they once were, but all eyes will be on them anyway. The early retail returns have been good, but hardly great and somewhat less than had been anticipated.