Strategic Global Intelligence Brief for May 8, 2019

Short Items of Interest—U.S. Economy

Consumers in the Cross Hairs

There is no guarantee Trump will follow through with his tariff threats, but the actions can't be ruled out either. If the 25% tariff is imposed on this $40 billion worth of goods from China, the most immediately affected will be the U.S. consumer. The tariffs imposed in the past have mostly focused on industrial goods. These have only had indirect implications for the U.S. consumer. The tariffs proposed for this round will be on consumer goods that appear in the retail outlets of the U.S. The impact of the tariff will depend on how the suppliers react. Some will pass on the cost of the tariff and risk losing market share, while others will elect to absorb the tariff so that they can continue to be competitive. It will also depend on whether there are alternatives to the Chinese offering.

Return of the Ex-Im Bank?

After four years, the U.S. Export-Import Bank may be allowed to function again, but the battle to keep it alive will continue as Congress will have to reauthorize it in September. The Ex-Im Bank had been a very effective tool for stimulating exports as it arranged for countries to get low interest loans to buy American goods. The loans were regularly paid back in full and allowed major U.S. companies like Boeing and Caterpillar to compete against the likes of Airbus and Komatsu. Without the Ex-Im Bank, it has been harder for big and small companies to compete against the heavily subsidized companies of Europe and Japan.

Changes in Eligibility

The White House has introduced a plan to change the eligibility standards for welfare programs that range from school lunches to Head Start programs. The requirements for entry into these programs will be severely restricted with the intent of reducing the number of recipients. The assertion has been that people are taking advantage of the current system, but others assert that the system is not comprehensive enough. This confrontation is pitting most city leaders and school officials against the federal government.

Short Items of Interest—Global Economy

Erdogan Arranges a 'Do-Over'

The leader of Turkey has transitioned completely to become a true autocrat. For some 15 years he could at least brag that he won his elections, although many pointed out that he worked hard to rig them. The last election saw his party lose the capital of Ankara as well as Istanbul. That sent him into a fury. These elections were deemed fraudulent and new ones were arranged, but the opposition is fighting this to the bitter end as Erdogan appears ready to do everything possible to undo what the voters did.

German Industrial Resilience

The latest data on German industrial production improved by 0.5%. That was not anticipated given the gloom and doom expressed by most of the polls. According to these surveys, the manufacturers were depressed and so were consumers and investors. Now it seems that people are talking a more angst-ridden game than reality justifies. The export sector is alive and well and even consumers are still spending through their apparent gloom.

Rise of Nationalism in Middle East

There has never been a shortage of identity politics to deal with the Middle East, but in past years the focus has nearly always been on tribe or religion. The conflict between different interpretations of Islam run the deepest, but clan affiliation has been a close second. The national borders have always been seen as arbitrary—the creation of European colonial powers. That has been changing as nationalism has grown in importance. Saudi citizens thinking of themselves as Saudi, Kuwaiti citizens as Kuwaiti and so on. This just adds another layer of conflict and complexity as well as competing loyalties.

Escalating Tensions Over Iran

The Iranian government has started to renege on some of the nuclear deal it had agreed to in response to the U.S. decision to pull out of the agreement altogether. The Iranians made it clear this would be their course of action when the Trump administration elected to withdraw, but they delayed the decision for a few months at the request of the Europeans. The position of the European signatories was in opposition to that of the U.S. and there had been some hope this would be enough to keep Iran in the plan. That now seems less likely. In a nutshell, the Iranians will resume several of the activities that would be required to continue developing nuclear weapons capability, but still stop short of actually building the weapons. If the activity is resumed, it is estimated Iran would be less than a year away from having weapons capability.

Analysis: The original plan was for Iran to go through a number of phases designed to transition them out of global pariah status. The carrot in all this was economic—lifting the sanctions compromising the nation's economy. Fully 90% of the national income derives from oil; the sanctions have been squarely aimed at this sector. Most of the effort has been directed at limiting where Iran can sell its oil. In return for limiting their development of nuclear weapons capability, the sanctions would be eased. The Europeans have been OK with this measured approach, but the Trump White House has not.

There are at least three other areas of concern as far as Iran is concerned—at least as articulated by the U.S. The first is Iran continues to support insurgent groups the U.S. and its allies oppose. The money that Iran earns from oil sales will find its way into the coffers of groups like Hamas, Hezbollah and other Shiite-based radical groups. It seems the U.S. places a very high priority on ending that set of relationships. The second issue for the U.S. is Iran's opposition to Israel. There has been consistent hostility between the two nations for decades. Israel has promised preemptive strikes against Iran's nuclear program while Iran backs the Hamas organization in its fight against Israel. The third issue is Iran has often taken a position on oil production that goes counter to the preferences of the U.S. as it has been aggressive in terms of hiking oil prices. The challenge for Iran is that it can't afford to cut production as a means by which to push per barrel prices up—it needs the revenue too much. In addition to these issues, there is the fact that Saudi Arabia and Iran are longtime rivals, while the U.S. counts the Saudi Kingdom as an ally.

The U.S. has moved to tighten the sanctions imposed on countries that seek to buy Iranian oil. This has created consternation within Iran and among some of those that buy from Iran. The U.S. has further ramped up the confrontation by moving naval assets into the area and threatening further deployment of bombers. The assertion is there have been provocative moves taking place in Iran. That most likely refers to the ramping up of activity that can impact weapons development. The deployment of U.S. bombers can be seen as a not-so-veiled threat to strike against some or all of these facilities. This would be a clear act of war and retaliation would be expected. The question is whether the Russians would step in and maybe even the Chinese given their need for Iranian oil.

Here We Go Again

Let us begin with the most obvious of observations. Trade negotiations are by their very nature complex and convoluted. Even when the two parties to the talks are fundamentally friendly to one another there will be intense jockeying for position. These talks are an exercise in special interest tactics and strategy as every affected part of a business community strives to get their position upheld. The importers are at cross purposes with the domestic producers, while consumers clash with producers. Everyone struggles to find some advantage or fend off some disadvantage. The U.S. under Trump has completely switched from its traditional position as a free trade advocate to a nation committed to varying levels of protectionism. There will be some parts of the economy that benefit from this approach and others that suffer. The challenge of late is that Trump has been consistently inconsistent. That makes it nearly impossible for the business community to develop strategies of their own.

Analysis: The relationship between the U.S. and China is about as complicated as one can get. Right now, the U.S. is facing immense difficulties in terms of trade relations with close allies such as Canada, Mexico, Europe and Japan. China is in no sense an ally and never has been. In every other respect other than trade, China is best characterized as an enemy as there are deep political and ideological differences, ample opportunities for military confrontation and even historical reasons not to trust one another. The economic connections have been propelled by mutual dependence, but this is a situation that neither the U.S. nor Chinese leadership is happy with. China needs the U.S. consumer, but Chinese President Xi Jinping would much prefer a consumer class in China take the lead as far as building the nation's economic future. The U.S. needs the low-cost productivity offered by China to satisfy the demands of its voracious consumer, but Trump would much prefer that Americans produce everything they need. Neither desire is practical as China's consumers are far from ready to carry the weight of the economy. That means the export sector will dominate for decades to come. U.S. consumers are not interested in paying thousands of dollars more each year so they can get socks and T-shirts made in the U.S.

The world in general has been upset with Chinese trade practices for years—this is not just an objection from the U.S. The Chinese government does a miserable job of protecting intellectual property rights and has resorted to industrial espionage to get hold of technology from other nations. The system is a totalitarian one. That has allowed a level of worker exploitation that gives the country an edge as far as global competition. There is no doubt that doing business with China involves considerable risk, but there is also no doubt that it involves high profit potential. The trade talks conducted between the U.S. and China have been marked by a whole series of fits and spurts—one step forward and two steps back and then another step forward. Only a week ago, the word from the U.S. negotiating team seemed to be a positive one as the talks were down to some nitty-gritty issues over which of the tariffs to remove first. Suddenly, there was the usual flurry of tweets and the whole process seemed to blow up with Trump threatening imposition of renewed and expanded tariffs. This was ostensibly motivated by the Chinese attempting to renegotiate provisions that had already been agreed upon, but even the trade team asserted this was not true and China had not been reversing their previous course.

The rationale for this latest outburst is known only to Trump, but the conjecture centers on three possible motives. The first is this is just hardball negotiating tactic with Trump trying to apply maximum pressure at the last minute in order to extract another concession or two. The second suggestion is Trump wants to keep this confrontation intact for the purposes of electoral politics. His political base is virulently anti-Chinese and could interpret any kind of deal as a capitulation. Trump may prefer a failed deal to be politically superior to a deal that doesn't completely favor the U.S. The third motivation may be related to some of the noneconomic activity evident of late. The U.S. has suddenly become far more confrontational as far as military activity is concerned. One of these actions involve sending a flotilla of U.S. warships into the disputed sections of the South China Sea—an action that has enraged the Chinese military and prompted them to issue threats and warnings. Despite all this latest bombast, the outcome of the action is hard to gauge as Trump has a long history of backing down on threats. Trump fails to follow through most of the time, which may well be what the Chinese anticipate. Thus far, they plan to send negotiators to the U.S. for more discussion and have not decided to walk away. On the other hand, they will not risk losing face by appearing to knuckle under to this kind of tactic.

Global Markets Stutter

The breakdown in talks between the U.S. and China may or may not be real—it remains to be seen whether the tweets from Trump are serious. The global markets are reacting with caution at this point as there is more fear of uncertainty than anything else. The pattern in the past has been for strong statements to be replaced by climbdowns. That could well be the situation this time. On the other hand, this may be one of those moments when the U.S. follows through and these tariffs will do some real damage to both the U.S. and China.

Analysis: The challenge for some in the U.S. has been to separate the bombast from reality. Trump continues to assert that somehow the Chinese government pays the tariff cost directly to the U.S., but that is not how it works. The tariff is imposed on companies that want to export to the U.S. They will then have to decide what to do. They can raise their prices to cover the tariff cost and risk losing market share, or they can absorb the tariff cost themselves in order to maintain a position in the U.S. market.

Reactions to Labor Shortage

Over the last few weeks, I have spent quite a lot of time talking to people in a wide variety of sectors about their most pressing issues. I expected there to be some significant variability according to whether they were in manufacturing or health care or retail, but that has not been the case. Everybody is worried about their labor force. Most see it as a real crisis and the issues are varied. There are too few people with the right qualifications (especially troublesome in manufacturing and construction). There are too few people willing to work in generally low-wage environments such as food service or retail. There are too many key people retiring and nobody qualified to replace them. The list goes on and on.

Analysis: There are certainly no easy solutions (they would have been implemented by now). There seem to be just three immediate options. The first is to retain those one already has. That may take the form of higher pay and perks of various kinds. This has involved everything from schedule flexibility to helping pay for education. The second approach has been to engage in nontraditional recruiting. This has meant drawing people out of retirement, looking at people with criminal records and immigrants. The latter option has long been a favored tactic, but has become far harder in the current political climate. There is a third option gaining momentum. It is substituting technology and robotics for people in as many ways as possible.

Bonding Over Animals and a Nice Rendition of Moon River

Given the number of times I have complained and griped about the airline experience and the foibles of my fellow travelers it is only fair that I provide some counter commentary when warranted. I have to admit I enjoyed the last leg of my journey back home on a flight from Denver to KC recently. It started when I took a seat next to a woman with a small poodle in her lap. Turns out this was a real service dog—one that reacts to her diabetic episodes. He was a real cutie and friendly. That sparked a nice long exchange regarding our pets as it turned out she was also fond of cats. Lots of picture sharing and anecdotes.

Then it got better. At one time, the Southwest flight attendants strove to be entertaining to a degree. It was common to hear some jokes and even some songs. Somewhere along the way many of them stopped this. All I hear now is the droning monotony of instructions that often border on the absurd. My favorite is the refresher course on gravity at the end of a flight when we are urged to be careful opening the overhead bin. This amuses me given the way luggage is packed in these compartments. On this flight, I got some of that old Southwest spirit back when the flight attendant sang Moon River in its entirety. She had the right voice for it too. I was suddenly transported back to the days of Audrey Hepburn and all was right with the world. I thanked her profusely for making a routine trip delightful. I am easy to please—give me a friendly poodle and a golden-throated flight attendant and I am good to go.

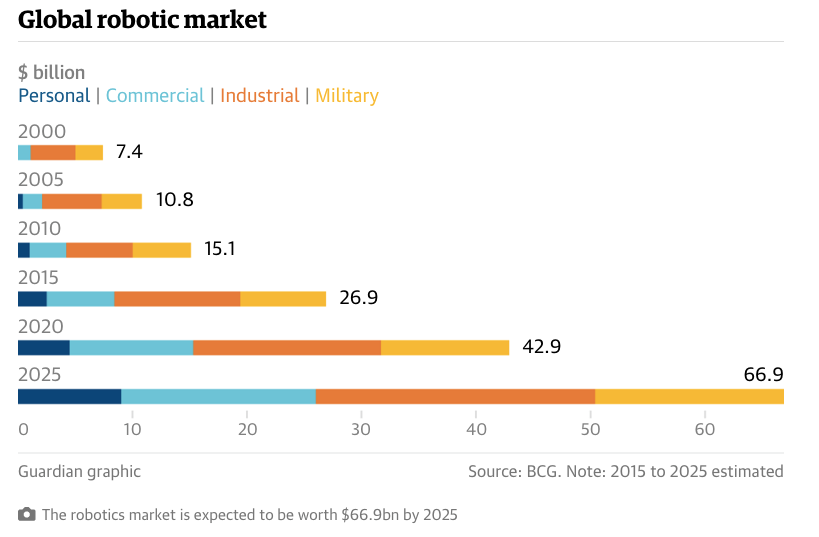

Global Robotic Market

The robots are coming—that is certain. The projections vary somewhat, but all suggest near exponential growth in the next few years. By 2025, the machines will be ubiquitous and highly personal. The latest trend is the robot designed to work in close coordination with a person almost as an assistant. This will involve the workplace at first, but will soon enter the more personal spaces. This is already evident with the use of assistants like Siri and Alexa and any number of machines that respond to voice commands. It is only a matter of time before the machine is humanoid in appearance and carries out assigned tasks.