Strategic Global Intelligence Brief for May 31, 2019

Short Items of Interest—U.S. Economy

More Tariff Threats

The imposition of tariffs has become the go-to strategy for the Trump administration—regardless of the issue. Distress over the trade deficit with China results in a set of stiff tariffs, irritation with European policy begets tariff threats and now the ongoing concern over immigration has Trump threatening tariffs on goods from Mexico. Thus far, these moves have yielded little other than economic disruption and increased stress on the U.S. consumer. Tariffs are taxes. They are paid by the people who buy the goods that have been affected by the tariff. That means the U.S. consumer. The nervousness within the investment community of late has been propelled by the threats of constant trade wars involving the U.S. The impact of all these additional taxes are starting to be a factor for consumers and business in general.

Q1 Was Good but Not as Good as Thought

The first revision to first quarter GDP numbers indicates that growth in Q1 was not quite as robust as was first thought, but the decline was slight. It was at 3.2% and now is at 3.1%. That is still quite robust for what is often the weakest quarter in a given year. If there is any concern at this point, it is that data showed less business investment, lower corporate profits and reduced consumer spending than was originally assumed. Not that the dip was all that significant, but it has created some worry about what second quarter will ultimately look like as all this slowdown was towards the end of Q1.

Global Growth and the Fed

Somehow, many fail to notice how engaged the U.S. is in the global economy. As has been repeated many times, the export sector of the U.S. economy is 15% of the nation's total GDP (over $2.7 trillion). What happens with the global economy matters and things are not looking good internationally. U.S. tariff policy has triggered many trade wars, which has not helped matters. This has the Fed worried about the pace of the economy later in the year. That may influence their thinking on rate cuts. The Federal funds rate is still very low. Hawks within the Fed would still like to see it go up, but if global economic angst continues, the Fed may consider a rate cut.

Short Items of Interest—Global Economy

Flight to Safety Accelerates

Bond yields are crashing all over the world as investors begin to worry that Trump is determined to start a trade war with every nation on the planet. In the course of a week, he has threatened China, Japan, U.K., Germany, France, EU in general, Mexico, Canada and Turkey. The German 10-year bond is at an all-time low and the U.S. 10-year is not far from its own record. The investment community is getting very nervous. This kind of attitude can be a self-fulfilling prophecy.

North Korean Executions

North Korea's Kim Jong Un has executed several high-ranking officials who had been engaged in talks with the U.S. They were deemed to have failed to get an agreement with Trump. Confirmed reports indicate that the five negotiators (including special envoy Kim Hyok Chol) were detained at the Mirim Airport and killed. It remains baffling that any reasonable person in the world would wish to trust North Korea's President.

Latin American Economic Woes

This year is not shaping up well for the nations in Latin America. The two largest economies (Mexico and Brazil) both experienced decline in the first quarter. There is not much confidence regarding a comeback given the fact that commodity prices have been down at the same time that both nations are dealing with low rates of productivity. Mexico is also getting hammered by trade hostility with the U.S. The latest slam has been the threats of higher tariffs. Brazil had hoped that closer ties would develop between Trump and Brazil's President Bolsonaro, but that has yet to transpire.

Could This Be a Trend?

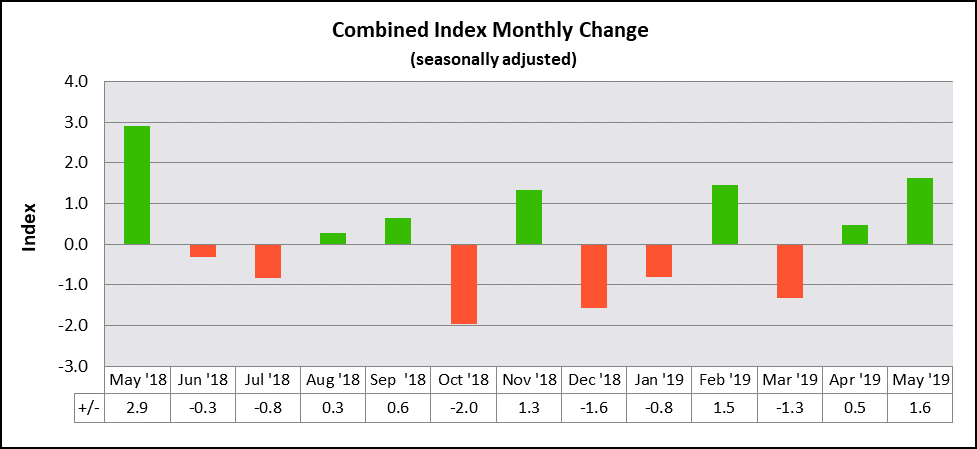

It's probably not a trend, but for the second month in a row the Credit Managers' Index (CMI) showed improved readings. What follows is the executive summary of the CMI for May. If you want to see the entire report—complete with all the nifty charts and tables, you can find it on the NACM website. Look for the Credit Managers' Index.

Analysis: It might be useful to remind those who follow the Credit Managers' Index just why this is such an important tool for assessing the state of the economy. Why do people pay so much attention to the CMI and the index that inspired it—the Purchasing Managers' Index (PMI). It really comes down to four factors: timeliness, accuracy, lack of bias and predictive ability. Both indices track changes in the economy on a monthly basis, reflect consistent data from contributors, remain free of the bias that often occurs when someone is trying to manipulate outcomes and do a good job of predicting what is to come. The CMI is even better at this than the PMI given the reality of a credit manager's life—they are always more concerned about what is to come than what is happening right now. They want to know what shape a company will be in when it is time to pay the debt owed—30, 60, 90 days (or more) ahead.

This month's CMI is trending in a positive direction for the second month in a row. This has not happened since August and September of last year. May's reading for the combined score was 55.7, up from 54 last month. The last time this reading was this high was in November of last year when it hit 55.8. The index of favorable factors rose pretty dramatically from 60.1 in April to 63.8 in May. Again, the last time numbers were this good was November 2018. There was not a dramatic improvement as far as the unfavorable factors, but they still had a small rise from 50 to 50.2.

There was even better news in the breakdown for each sector. The sales category jumped from 61 to 65.9, a reading as good as those seen last year when numbers averaged in the high 60s (May at 69.6, June at 69.6, July at 63.9, August at 65, September at 68.8). The reading for new credit applications shifted up as well from 59.7 to 64.2 (the highest point in a year). The data on dollar collections moved from 59.1 to 59.8—not a big improvement, but very solidly in the expansion zone (a reading above 50). The amount of credit extended also saw a tidy gain (60.6 to 65.4)—as high as that nice set of readings in November of last year.

There was generally good news for the nonfavorables, but the changes were not quite as dramatic. The rejections of credit applications reading fell a little, but remained in the expansion zone. It was at 52 and slipped slightly to 51.8. The accounts placed for collection also fell a bit—from 48.5 to 47, which could become a bit of a concern. This is essentially the last stage as far as credit is concerned and signals that something more drastic may be coming, such as bankruptcy. The disputes category stayed almost the same as it had been the previous month as it went from 48.5 to 48.6. The big improvement was in dollar amount beyond terms. It had been at 47.6 and this month it tracked at 51.3. In contrast to the news on accounts placed for collection, this reading suggests some companies are catching up with their credit obligations. The dollar amount of customer deductions remained very close to last month's readings with a score of 49.3 compared to 49.7 in April. The filings for bankruptcies reading also remained close to what it had been the month before (53.9 to 53.3).

The Purchasing Managers' Index this month fell pretty dramatically (and the New Orders Index fell even further), but both remained solidly in the expansion zone above 50. The readings from the CMI suggest that there may be less gloom ahead than might be indicated by the PMI as the favorable numbers all tracked strongly positive. The two indices seem to agree on current conditions and indicate that many companies are struggling with some of the economic headwinds related to trade concerns and a slower-spending consumer.

Manufacturing Sector

Last month, the manufacturing sector slipped a little while the service sector experienced some growth. The primary reason there was a hitch in the manufacturing sector is thought to be the issues of a trade war and the potential impact on U.S. exports and imports. There has also been some concern regarding a slip in consumer confidence given there continues to be confidence in the job market. The numbers from the latest Purchasing Managers' Index have been far weaker than was the case just a few months ago, but they are still in the expansion zone. The changes in the CMI have been far more subtle.

The combined score for the manufacturing sector was 55.4 this month as compared to 53.7 last month. This is the highest reading notched since November of last year when it hit 55.6. The index of favorable factors rose sharply and jumped back into the 60s with a reading of 63.1 after last month's 58.9. The last time this reading was that high was in November of last year. The index of unfavorable factors rose very, very slightly from 50.2 to 50.3, but the important note is this reading is still in expansion territory, if by the narrowest of margins.

The data from the favorable category was quite positive this month with all of the readings in the 60s. The sales mark reached 63.3 after sitting at 58.6 in April. This is the highest level reached since last November when it hit 64.2. The new credit applications also moved back into the 60s with a reading of 63.9, up from 59.8. The dollar collections data improved from 58.6 to 60.5 and there was a similar move from the amount of credit extended as it went from 58.5 to a whopping 64.6. The last time this reading was this high was (surprise!) in November. Last month, all the readings were in the 50s and this month all are back in the 60s.

The data from the nonfavorable categories is not quite as good, but there is nothing catastrophic. The rejections of credit applications shifted down slightly from 53.1 to 52.5, but remained in the expansion zone. The accounts placed for collection also slipped, but only by a small amount (49.3 to 49). The category is still below 50 where it has been since February. The disputes category improved, but stayed in contraction territory as it moved from 47.7 to 48.2. The dollar amount beyond terms broke away from the contraction zone with a reading of 51.8 after 48.5 the month before. It is a good sign that slow pays have not been quite the issue they had been. The dollar amount of customer deductions slipped deeper into contraction territory with a reading of 48.4 as compared to last month at 49.5. This category has not been out of the contraction zone for almost three years at this point. Filings for bankruptcies skidded a bit, but stayed in expansion territory as it moved from 53.3 to 52.

There has seen some mixed activity of late as there have been government moves that have been a clear benefit to some sectors and a clear inhibition to others. The steel and aluminum tariffs have been good for producers of the metal, but not great for users. The tariffs on China have been good for some of those that compete with Chinese firms, but bad for those that source from China or those that sell to China and are encountering their retaliatory tariffs and restrictions.

Service Sector

Last month, the service sector was on something of a roll. It seems that this has extended into this month as well. The sector is a broad one and is always hard to identify just which part is creating the growth, but it has been clear that retail has been strengthening alongside the construction sector. There have been signs of a slowdown in home building, though. That might figure into future months. Meanwhile, the summer travel season is about ready to start. It traditionally boosts retail activity.

The overall index for service increased from 54.4 to 55.9, the highest point since November of last year (a VERY good month). The index of favorable factors jumped from 61.3 to 64.6 and the index for nonfavorable factors escaped the contraction zone by moving from 49.8 to 50.1.

The favorable categories generally improved as sales moved from 63.4 to 68.5. This was a striking improvement and may end up being a bit of an anomaly when future readings are factored in. On the other hand, there have been similar numbers in past months as the readings hit 69.4 in September of last year and 70.1 in June. The new credit applications category also shifted up pretty dramatically as it went from 59.6 to 64.6—as high as it was last May when the reading was 65.1. The dollar collections data slipped a tiny bit and that is a small concern. It was at 59.6 and is now at 59.1. These are obviously very robust numbers still, but this is an all-important marker for the status of credit. The amount of credit extended shifted up sharply as well (62.7 to 66.3). This marks a return to the range that was common from May through November of last year.

The nonfavorable categories were similarly mixed. The rejections of credit applications improved; a good sign given there were more applications. There are times when the number of applications increases, but there are more rejections. This signals that many applicants are not qualified and are desperately seeking somebody who will offer them credit. The accounts placed for collection sank deeper into contraction territory. This may be the most concerning of all the readings. It was at 47.7 and is now at 45.1. This category has been in contraction for the majority of the last year (June of 2018 was the only exception at 52). There are clearly many companies now struggling with their debt and credit status. The disputes numbers also slipped, but only slightly, as they went from 49.4 to 49. The dollar amount beyond terms reading improved quite a lot and actually escaped the contraction zone with a reading of 50.9 as compared to 46.7. This was the first time this category had been in the 50s since the 54.3 notched in November of last year. The dollar amount of customer deductions also moved into expansion territory with a reading of 50.1 compared to 49.8 the month prior. The filings for bankruptcies stayed very close to April's 54.6 with May's 54.5.

Retail has been solid thus far this year, but jumpy. The tariffs that have been indicated in the U.S.-China fight have not focused on retail activity until this latest round and have only started to have an impact. The consumer is spending a little less on big ticket items like vehicles, but more on "little luxuries," such as clothing and some sporting goods. There have been big retail gains for gas stations, but department stores are not as robust as would have been expected.

May 2019 versus May 2018

Dare we say that we might have a trend? Just considering the possibility will now probably jinx the whole thing; however, there are signs some of this momentum will certainly carry forward through the bulk of the summer. If there are warning signs ahead, they seem to be toward the latter part of the year.

Decisions, Decisions

It is amazing how many of these we are called upon to make on a daily basis. Most are fairly minor—choices that do not really have life altering implications, but it is somewhat intimidating to realize how many of these seemingly small decisions really will have a major impact on one's future. I have become much more aware of the decisions I make when it comes to the food I eat and have shifted a lot of behaviors. Gone are the sugary things, the sodas and the salt-laden offerings. In their place are veggies, fruits and water. Then there are the attitude choices. As we get the garden in shape, we made the conscious choice to stop laboring in it and just sit back with a nice glass of wine and actually enjoy it!

Watching a show on wild weather brought home the importance of choice as well. Each segment featured people who made the wrong choice at the wrong time and nearly paid a fatal price. Steering the car into a brush fire when a turn the other direction would have been the correct decision. Electing to finish a run despite the arrival of a massive thunderstorm resulted in getting hit by lightning and losing a leg. In reality, we can't always make the right call. Most of us do the best we can with the information at hand. More often than not that information is inadequate. I suppose the crucial thing is understanding one's priorities. If health is most important, it is easier to choose to eat right and exercise. If the welfare of loved ones is a priority, it is easier to avoid situations that might compromise that security. On the other hand, if the priority is impressing one's buddies, it is likely that some pretty idiotic decisions will be made. This is why the most famous last words are "watch this" or "hold my beer."

Credit Managers' Index for May

This chart is the monthly tally of the Credit Managers' Index ups and downs. It is good news that three of the last four months have been in positive territory and generally trending in a direction that promises more gains. There is still a wide disparity between the favorable and unfavorable sectors, however, which continues to signal that many companies are struggling to one degree or another. This is concerning as that kind of vulnerability can drag the index down in a hurry if there is a dip in the levels of sales or applications for credit—not to mention the all-important dollar collections.