Strategic Global Intelligence Brief for May 13, 2019

Short Items of Interest—U.S. Economy

Really Time to Understand What a Tariff Really Is

We all know what a tax is. It is the only certain thing other than death, or so we are told. We also know that the powers that be go out of their way to figure out new ways to describe that eventuality—it is a "fee" or "revenue enhancement" or a "tariff." It is indeed a tax and is paid by the same people who pay all the other taxes. The intent behind a tax is to either raise revenue or shape behavior. Most of the time, it does both—a high tax attached to cigarettes is supposed to discourage people from smoking and it raises money for the local government. A tariff is supposed to discourage the consumer from buying a product from another country by adding to the cost of that product. The tax is NOT paid by the foreign government nor by the foreign company. It is paid by U.S. consumers should they elect to buy the products on offer. If there are alternatives, the consumer will be likely to buy them, but often there are none available and the tariff burden is heaped squarely on the consumer. A tariff on Chinese goods coming to the U.S. is a TAX on U.S. consumers—plain and simple.

Why Did the Trade Talks Fail?

There are many theories regarding the collapse of the talks—especially when reports earlier seemed to suggest that a deal was imminent. The two most dominant are that neither Trump nor President Xi Jinping ever really wanted a deal as they were getting too much domestic political mileage from acting tough. This seems to be a bigger motivation for Trump as he sees this issue as helping him with his base. The other theory is that neither side really understood how their rivals negotiate. Those who have done business in China (or Asia in general) often have this challenge. Phrases mean different things in different cultures—saying a flat "no" is rare. More often a phrase such as "this will be difficult" means NO. A phrase such as "this is a possibility" also means no, but the U.S. negotiator interprets this as assent. It now seems those in the meetings have been talking right past each other.

Bailing Out Agriculture

It is abundantly clear that the farm sector will take the biggest hit from the failed trade deal with China. The Chinese have yet to announce the specifics of their planned retaliation, but it will center on their importation of U.S. farm goods as this is what the Chinese buy from the U.S. The farm sector is already reeling from the spring floods and other issues, so this abrupt loss of a key market will hurt. The White House has indicated a plan is being developed to bail out affected farmers, but there are no details as yet. It is certain this will involve buying output. That means another substantial increase in the size of the national debt and deficit with no real conversation as to what the government ever plans to do about this massive overhang.

Short Items of Interest—Global Economy

Chinese Options

China now faces two challenges—who to sell their stuff to and where to buy food. The former will be far easier to address than the latter. There has already been a dramatic increase in food imports from other nations. These markets will supplant the U.S. on a more or less permanent basis. Selling is another matter as no other nation or region has the consumer power the U.S. does. China will have to rely on its own consumers.

Trump Visits Hungary

The leader of the U.S. has rarely visited Hungary, but Trump has decided to do so. The fact that Viktor Orban is a populist in the same mold as Trump and has been at odds with Germany and France plays a major role. This is just the latest deliberate snub of what had been considered close U.S. allies as Orban has been coming under heavy criticism by the EU.

Attacks in Persian Gulf

Two Saudi oil tankers appear to have been attacked by Iranian vessels or by someone allied with Iran. There have also been accusations of sabotage by Iranian elements on ships belonging to U.S. allies in the region.

Germany Gets Export Boost

The majority of the analysts have been pretty pessimistic about the prospects for German exports, but thus far, the activity has been far more robust than expected. The gains this month were 1.9% above the pace set last year at this point and 1.5% better than last month. It had been expected that slower growth in the eurozone plus the challenges of Brexit would have pulled the pace down more than it has. Granted, the Germans have been diligent about seeking out markets to replace what they seem to be losing, but few expected the effort to yield this much this fast.

Analysis: Much of the German focus this year has been on Asia, and China specifically. The Germans are eager to provide an alternative to the U.S. as the tariffs take hold. The Asian economies have been all too willing to pick up the slack. That tactic will likely accelerate now that the trade talks between the U.S. and China seem to have broken down. The Germans are not capable of providing the consumer base the Chinese require, but they are certainly in a position to replace the U.S. as a supplier of machinery and tech. Germans are all too willing to do this—it's good business for them and has the added bonus of being irritating to Trump.

Now It's Really a War

There will be casualties, assuming this is not just another negotiating ploy of some kind. To note that the talks between the U.S. and China have been a political football from the start would be an understatement. As we have described many times, the U.S. relationship with China is always tense and complicated. In no sense is China an ally for the U.S. For the most part, the relationship with China has been hostile given our widely divergent political orientations and foreign policy goals. Furthermore, the U.S. is far from the only nation that finds itself in opposition to China and struggles to balance a complex relationship. For the Trump administration, China has become public enemy No. 1. There is no appetite for compromise within the ranks of those who support him. Making a deal that doesn't obviously favor the U.S. would be politically dangerous, but by the same token, the Chinese can't be seen as having capitulated to the U.S.

Analysis: The official word from the negotiators is that talks are ongoing and there remains an opportunity to reach a deal, but the decision by Trump to impose much higher tariffs on an additional $200 billion worth of goods is a significant escalation of the issue and makes such a deal that much harder to reach. China has responded as one would expect them to—it will retaliate with the imposition of its own tariffs. That would very likely set off a series of responses and counter responses from the two nations. What makes the current impasse harder to overcome is the accusation made by Trump that Chinese negotiators have been reneging on promises already made. There is no evidence of this. It remains to be seen whether China will really honor the commitments it has made as this has been an issue in the past, but there has been no backtracking on the promises made thus far and the Chinese are more than irritated by the assertion.

The Trump approach is based on the perception the U.S. has new leverage. It has been noted China's economy has been limping along over the last year (although the numbers have improved in the last quarter). Meanwhile, the U.S. economy has been performing very well with the unexpected 3.2% growth in the first quarter. This seems to give the U.S. the upper hand as it would mean China needed the U.S. more than the U.S. needs China. That is not a very accurate assessment, however. This round of tariffs will hurt the Chinese—that much is certain. It is also certain that these will hurt the U.S. as well—especially the consumer. The vast majority of the goods that will be affected by the additional tariff will be consumer goods. The hike will be felt squarely by those who buy these products. Up to this point, the tariffs have been on industrial goods and the consumer impact has been indirect. That is no longer the case. The major retailers have been fighting these tariffs as hard as they can. Now, they will have to decide what their next course of action should be.

Throughout the course of this war, there have been plenty of false starts and lots of disinformation coming from the Trump White House. The most egregious assertion has been that somehow the Chinese government is paying the U.S. money as if the U.S. suddenly had the ability to tax another country. This is not the situation by any stretch of the imagination. Tariffs are paid by those who purchase the good that is now carrying an additional tax. The producer or seller of the good that has been targeted will have to make a choice as far as reacting to the tariff. The simplest reaction is to hike prices high enough to cover the tariff, but that will mean their product will be more expensive. If the U.S. consumer has alternatives, the Chinese company will stand to lose market share. It may decide to absorb the cost of the tariff so that the U.S. consumer does not see a price hike, but that will not be a common or long-lasting response. For the most part, the goods affected by the tariff are not available elsewhere. That means the U.S. consumer will be forced to absorb the tariff cost. In simplest terms, the Trump administration just imposed a 25% tax on U.S. consumers. In time, there will be companies in the U.S. and elsewhere that will start to produce their version of the product that has been hit with the tariff, but this will not be a swift development and the prices of that alternative will be high as well. If the Chinese made good is 25% more expensive, the alternative good can be 24% more expensive and still a little cheaper than the Chinese good.

Then there is the fact that China will retaliate with tariffs and restrictions of their own. The U.S. doesn't sell nearly as much to China as China sells to the U.S., but there are several critical areas as far as exports are concerned. The most vulnerable part of the U.S. economy is the farm sector as China has purchased a great deal from the U.S. over the years. This is the sector that China will target; one that has been struggling with other issues this year. Even more challenging for the U.S. is the fact that many of the nations the U.S. sells to depend on selling to China. It is an issue that cascades quickly. If the Chinese economy slows appreciably due to this latest outbreak of trade hostility, they will be buying less from other nations in Asia or Europe or elsewhere. That will affect the economies of these other nations and they will be buying less from the U.S. Given that 15% of the U.S. GDP is dependent on exports, this will create a problem. That unexpected growth that took place in Q1 was largely due to export expansion. Now that growth is in question as far as the rest of the year is concerned.

As noted, the talks are ongoing and both sides seem to be leaving the door open for a last-minute agreement that averts the explosion of a real trade war. The fear is that both Trump and Xi have been backed into a corner where they will not be able to reach a deal without seeming weak. Neither man can afford for this to take place. Trump is focused exclusively on the coming campaign and keeping his base of support happy. Xi has opposition to his reform agenda within the ranks of the Politburo and can't afford to appear weak in his interaction with the U.S. It is also important to note there are other sources of conflict.

Taking the Credit and Blame

The comments made by Charlie Munger were right on point. He is the right-hand man for Warren Buffet and widely revered as the wise old head of the investment community at the tender age of 95. As the meeting of Berkshire Hathaway stockholders gets under way, he is inevitably asked what he thinks awaits the U.S. economy. He has been as clear as he always has been. The fundamental assertion is the economy runs according to the millions of decisions made every day by consumers and businesspeople who are trying to attract the attention of those consumers. He has made the point many times in the past and reiterated it this time—no president or Congress can be given credit for the performance of the economy at any given time. By the same token, they can't be held responsible if the economy falters.

Analysis: It is quite apparent that decisions made by political leaders matter to some degree. It is Congress that decides what taxes people and business will pay and it is the Executive and the Legislature that decide what regulations will affect the decisions people make. The president has authority to affect many decisions regarding trade and the overall business environment. There is always the "bully pulpit" that Theodore Roosevelt referred to. But these are almost entirely indirect motivations for the economy. What matters is the action of the 330 million consumers who are affected by a great many things.

Traditionally, the most important factors as far as consumer confidence is concerned have been the jobless situation and inflation. The average person is not interested in arcane data on capacity utilization or durable goods orders. They want to know two things. The first is whether their job is safe and the second is whether the prices of what they buy will rise or fall. A corollary of that last question is whether their pay will keep pace with any of those potential price hikes.

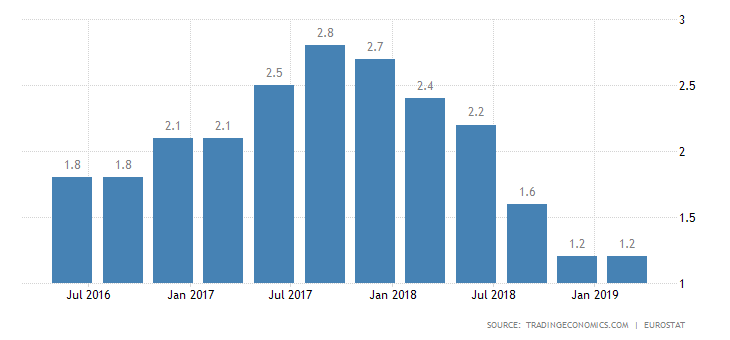

At this point, the answers to these questions have pointed in a positive direction as far as consumer confidence is concerned. The very low rate of unemployment is important for a variety of reasons. It is obviously good that people have jobs, but it also matters what psychological impact this has. If there are few layoffs and lots of hiring, people feel good about keeping their job or at least they are confident they can find another one if they need to. If inflation is low, the average person feels they can continue to afford their chosen lifestyle (even if they are not seeing the wage hikes they would like). The news on both fronts has been good—unemployment at a 50-year low and inflation that is not yet at the level the Fed would prefer. The problem is both of these situations are somewhat fragile. There are many reasons that joblessness might increase and there are many reasons that inflation might jump up. It will then be a matter of how the consumer reacts to these changes.

The most salient threat at the moment is the potential for an inflationary outbreak. This threat could emerge from a number of traditional and nontraditional sources. The most common would be pressure from rising commodity prices (everything from food to oil to metals and others) or from wages. For a variety of reasons, there has been less of that pressure than is generally the case, but the threat has not disappeared altogether. There is the potential impact of trade wars that drive up prices. There is also the worry that the years of loose monetary policy has left too much cash slopping around in the economy. Whether this rise in prices would be enough to affect consumer confidence is an open question.

Lots to Be Said Regarding Passion and Immersion

I really do enjoy what I do for a living—really, I do. I can't say that I am a big fan of the actual travel part as nothing has been done to make flying anything more than barely tolerable, but I like what I do when I get there. If there is a downside, it would be that my focus is largely on the foibles of mankind—political fights, economic policy that baffles and policy fights that make our fearless leaders appear to have the maturity of preschoolers. It can be exhausting.

I was presenting at a conference in Napa this week and the meeting featured a very nice dinner at a vineyard. The woman in charge and most of the staff were deeply and passionately involved with all aspects of the winemaking process. It was utterly delightful. Every little nuance was discussed—the varietals and why they are where they are, the preference for French oak barrels, the toasting process, the timing and so on. It was utterly refreshing to listen to this attention to detail. A very nice break from the routine I usually engage in. Of course, I bought some of that wine and will remember those conversations fondly with every sip.

By the way—I just felt compelled to include a rant about perhaps the most ludicrous design I have ever seen at an airport. San Diego features a system that requires connecting passengers (on the same airline) to leave the security area to get to the connecting gate where one gets to go through security all over again. Only there is no precheck process at this one, so one gets the opportunity to strip down and dump the contents of one's bag for inspection—all the while watching one's plane board without them. Takes a very special kind of moron to design something like that.

Growth of the Eurozone Economy

The growth of the eurozone economy has been weak for an extended period of time. There have been the occasional glimmers of hope from Germany and some of the other northern states, but the southern states such as Spain, Italy, Greece and even France have not been contributing. These numbers only stand to worsen as the Brexit debacle drags on. Most of the European states have accepted they will not be trading much with the U.K., but that fact has not quite sunk in as far as its impact on trade and the growth of their national economies.