Strategic Global Intelligence Brief for March 9, 2020

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—US Economy—

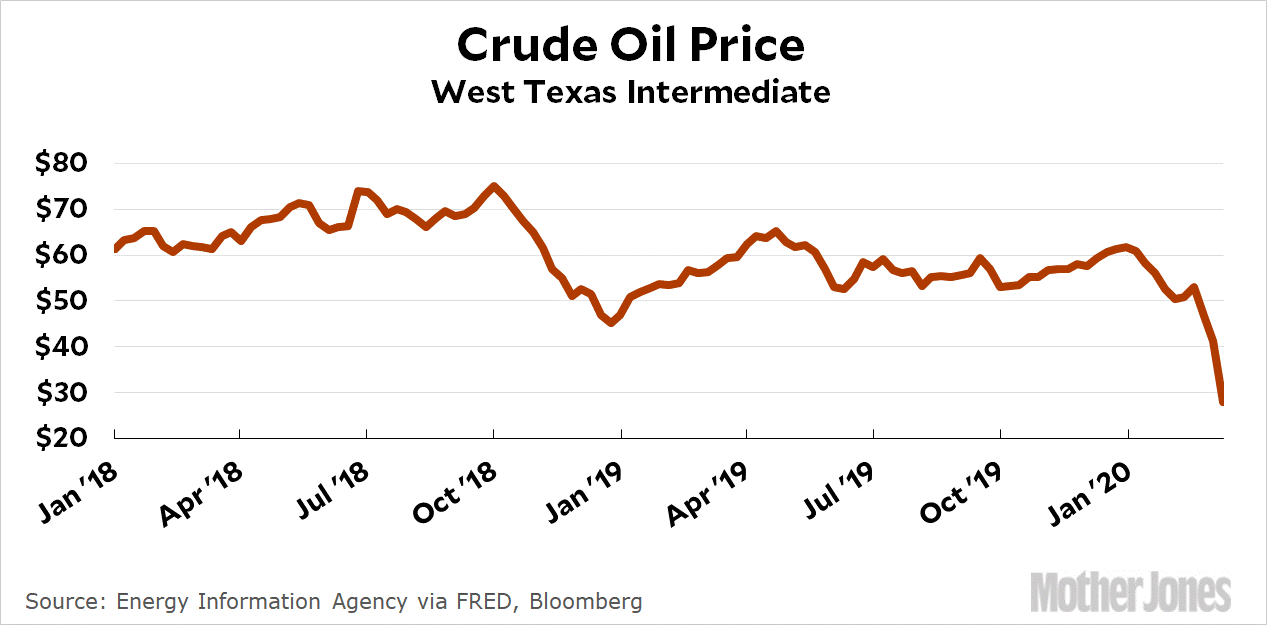

Virus Ripple Number One—Oil

The price per barrel of oil has crashed to levels not seen in decades as demand has collapsed for the commodity. The most significant decline has been in China, but there has been substantial reduction of demand in the U.S., Japan and Europe as well. If there is a silver lining in the short term it is that prices at the pump are also falling, but that could well be temporary as the natural response to prices this low will be to cut production. When there is a recovery of demand, there will likely be a supply crunch. Then the prices will rise sharply. It is early to speculate, but if there is a rebound in demand later this summer, the per barrel price might hit as high as $100 for the first time in years.

Virus Ripple Number Two—Metals

The shutdown in the Chinese economy has crushed demand for a wide range of metals. That has combined with slower production in the U.S. and Europe to push the prices down in the same pattern as has been seen with oil. The same reversal will be seen later this year as the production cuts of today result in shortages later and subsequently higher prices. Many companies are starting to stockpile at these cheaper prices, but nobody really knows when the virus scare will end and production can start to return to normal levels.

Virus Ripple Number Three—Travel

The most immediate crisis has been in the travel sector. Airlines are flying half empty planes, cruise ships are on the brink of shutdown, entertainment centers are watching attendance numbers plummet. This has been described as the worst crisis for the industry since the 9-11 attacks. The irony is that cruise ships, airplanes and other conveyances are likely far safer than the average grocery store. The cruise lines are checking each passenger for any signs of infection and have scrubbed every inch of the ship. The grocery store does no such checks. Every person that walks in the place is touching every piece of produce, shopping carts and everything else.

Short Items of Interest—Global Economy

ECB Faces Threat of Eurozone Recession

Just as the coronavirus (COVID-19) threatens those with an underlying condition, the economic impact will be far worse for nations that are already stressed. That certainly describes the state of the European Union these days. There had been assertions that a recession was likely this year before the added pressure of the virus outbreak. Now the question is not whether there will be one, but how deep and how long lasting it will be. The European Central Bank (ECB) is now faced with the question of how it counters this decline. It is missing the tools it would really need as interest rates are already very low. It is a crisis like this that has been worrying hawks for years. There is simply no central bank ammunition left for this crisis.

Italy Imposes Massive Quarantine

The hardest hit nation in Europe is Italy. That comes as no shock to those who have been watching the nation's health issues over the last few years. The population of Italy has been getting older (especially in the north) and every year the flu hits very hard. In a study conducted by the Health Ministry covering 2013/14 and 2016/17, there were 5,290,000 cases of the flu and 68,000 deaths. Thus far, there have been 7,000 cases of COVID-19 and 366 deaths (all of whom have been at risk due to age or previous ailment).

Chances of Global Recession

The possibility of a global recession existed prior to the outbreak, but the chances were judged to be less than 10%. As the virus hit China, that possibility jumped to around 20%. Today, there are estimates of a 50% chance of a global recession with some almost certain of the development. It all comes down to when the disease peaks and, most importantly, when governments end their extreme response. The fear of the virus is intense. Right now, this has done far more damage than the disease itself.

Last 'Normal' Month for Credit Managers' Index?

For the remainder of this year, the economic data will be seen as either pre-virus or post-virus. The economic impact has been at least a hundred times more severe than the health impact. This will be playing out in the numbers for the next several months and possibly longer. This is the February CMI reading and it looked pretty healthy. It is a safe bet to assume that the version that emerges in March will be considerably less optimistic.

At the start of 2020, there were essentially two schools of thought as far as the progress of the year's economy. The more optimistic looked at the situation at the start of the year and noted there were some very positive indicators—low levels of unemployment, a robust stock market, a loose money position by the Fed, high rates of consumer confidence and so on. The GDP numbers came in better than expected. The pessimists noted there were headwinds to be wary of—trade fights, political instability, reduced levels of business investment and continued distress in the manufacturing sector. It looked like a balance of opinions, but now there is the threat from COVID-19 and its impact on China and global supply chains. Is the Credit Managers' Index lending support to either position at this point? The growth shown last month faltered a bit, but the data still remains strong, so it may be too early to draw many conclusions.

Analysis: The combined CMI score remained very close to what it had been in January—slipping from 56.4 to 56.2, both months higher than any in the past two years. The index of favorable factors remained exactly where it was the month before at 62.2, but there was a very slight decline in the unfavorable factors (52.6 to 52.2). The bottom line is there has been very little change despite the factors that might have affected the business community. This is not to say that next month will not show reaction to all the global angst over the spread of the virus, but it is not showing up yet.

The sales numbers actually improved to 64 from 63 and now sit near the high point reached in August of last year. The new credit applications reading was also higher than it has been since June. Last month, it stood at 61.1 and is now at 62.2. The dollar collections number fell fairly dramatically, however. That will be a development to keep an eye on. It was sitting at 61.7, but has declined to 58.8. This is not a drastic decline as the reading remains higher than in December, but this is the fifth-lowest point reached in the last 12 months. This seems to signal that more companies are starting to guard their cash flow. The amount of credit extended improved a little from 62.9 to 63.6. If it were not for the fall in dollar collections, the entire favorable category would have improved.

The rejections of credit applications improved by a significant degree—moving from 52 to 53.8, good news given the increase in applications for credit. The accounts placed for collection stayed the same as the month before at 50.6—in the expansion zone (a reading above 50). The disputes category declined a little but is still in expansion. Last month, the reading was 52.4 and this month it is 50.3. The dollar amount beyond terms also slipped a bit but still stayed comfortably in the expansion category going from 54.2 to 53.5—similar to the high reached in August. The dollar amount of customer deductions fell as well, but stayed in expansion territory (52.5 to 51.5). There was a similar slight decline in filings for bankruptcies as it went from 54.4 to 53.5. The important takeaway is that even with the declines noted, all of the categories are in the expansion zone for the third month in a row.

Manufacturing Sector

As for the manufacturing sector, there has been a real slump over the last several months—at least according to some of the measures. The industrial production numbers have been down and there was a slide in the level of capacity utilization. For five months in a row, the Purchasing Managers' Index (PMI) was in contraction territory. That slide in the PMI ended last month. There have been a few other suggestions that manufacturing has started to make a bit of a comeback. That is also showing up in the CMI as the decline has been very slight.

The combined reading moved down a bit from 56.5, but at 55.9, the reading remains one of the highest in the past year. The combined favorable index stayed right where it was—at 62 for the second month in a row. The combined index for the unfavorable factors slipped a bit from 52.7 to 51.8, but remains in the expansion zone and higher than it was in November of last year. Manufacturing most definitely has been facing some serious headwinds, but there are still sectors that remain relatively healthy. The slump has been pronounced in sectors connected to the aerospace industry as well as the agricultural sector, but automotive has been holding more or less steady. The worry now is that interruptions in the Chinese supply chain will have a negative impact.

Sales improved over last month and the current reading is as high as it has been in a year—even exceeding the 65.3 set in August. It is now at 65.7 after reaching 63.8 in January. The new credit applications data also improved to 61.4 compared to 60.2 the month prior. The dollar collection numbers fell quite a bit (62.9 to 58.3). That is a concern going forward, but is still high and on a par with the numbers seen at the end of last year. The amount of credit extended improved from a reading of 61.3 to 62.8, which indicates continued substantial requests for credit.

The rejections of credit applications data improved from 52.5 to 53, a good sign when coupled with the increase in applications and the amount of credit extended. It indicates that those looking for credit are creditworthy and not searching frantically for someone to offer it to them. The accounts placed for collection slipped very slightly, but essentially remained right where it was last month, and in the expansion zone (from 51.8 to 51.4). The disputes number slipped quite a bit, which might suggest companies are getting somewhat concerned about their cash flow and credit position. It was at 52.5 and has now fallen into contraction territory with a reading of 48.9. The dollar amount beyond terms stayed almost exactly where it had been and is still in expansion with a reading of 54.2 compared to 54.3 in January. The dollar amount of customer deductions also fell back into contraction with a 49.8 report after last month's 51.1. This is still fairly close to expansion, but certainly trending in the wrong direction. The filings for bankruptcies number declined a little but remained firmly in expansion territory with a reading of 53.3 compared to 54.2 previously.

Service Sector

In contrast to the shifting activity in the manufacturing arena, the service sector has been calmer. The big retail season has come and gone and there is not a lot that will be driving services until later in the spring when there will be more action in retail, construction and the travel and entertainment sectors. The threat from COVID-19 may well be felt here first as there will be an impact on everything from consumer goods supply to reluctant travelers and people seeking to avoid crowds. This has not started manifesting as yet.

Sales remained very close to last month's levels with a reading of 62.3 compared to 62.2 in January. The important factor is that this category remains in the 60s. The new credit applications number showed improvement as it went from 62 to 63.1. There was a drop in dollar collections, as there was in the manufacturing sector, but it was not quite as dramatic as it went from 60.5 to 59.3. The amount of credit extended remained exactly where it had been with another reading of 64.5—just slightly off the pace set in November of last year when it hit 66.9.

The rejections of credit applications improved quite a bit. This comes at the same time that there was a hike in applications. The new number is 54.6 after January's 51.5. This is especially good news as there is often a slump in the retail community right after the holidays. It has not really manifested this time around. The accounts placed for collection number was very close to last month's reading, but was up slightly at 49.8 as compared to 49.3. The important factor at this point is that these readings remain in contraction territory. The disputes reading slipped from 52.3 to 51.7, but stayed in expansion. There is evidence that service sector business is looking to protect cash positions as well. The dollar amount beyond terms numbers fell slightly as well—from 54.2 to 52.8. Again, the important part is these readings are still firmly in expansion territory. The desire to protect cash has not caused too many companies to delay their response to their creditors. The dollar amount of customer deductions remained almost exactly where it had been with a reading of 53.2 compared to 53.3 in January. The data for the filings for bankruptcies category slipped a bit from 54.6 to 53.4, but the reading remains firmly in the expansion zone and is not causing much concern.

Services will likely see a spring rebound in the next month or two, but there will be many keeping a close watch on the COVID-19 virus to see what effect it has on consumer behavior.

February 2020 versus February 2019

There was not much variation between last month and this despite the various headwinds that had been predicted. The service sector is always slow this time of year and, thus far, manufacturing is holding steady enough with all eyes on the impact of the virus outbreak.

There Is Actually Agreement on Some Issues

The splits between the Democrats and Republicans on the issue of the economy are apparent enough—the splits within the parties are as wide as they have been in years with a far left in Sanders vs. the mainstream, while Trump vacillates between ultra-nationalist protectionism and orthodox GOP logic. A poll in USA Today found that among voters of both stripes, there is considerable unanimity regarding what the economy needs to prosper. We can only hope the politicians wake up to this at some stage.

Analysis: The top three steps the government should take to boost the economy include creating retraining programs through community colleges and trade schools (88% of Republicans, 84% of Democrats and 77% of Independents). Number two on the list would be to decrease the costs of higher education (72% of Republicans, 85% of Democrats and 74% of Independents). Third on the list of priorities is to upgrade public infrastructure with emphasis on transportation (83% of Republicans, 85% of Democrats and 74% of Independents)

For the last decade or longer the issue has been abundantly clear, but very little has emerged at the federal level to address the issues of workforce development and infrastructure. The bulk of the attention focused on training has been from the state and local governments. Infrastructure has been basically stalled by the lack of funds from the federal government.

Affected by Stupidity

This newsletter is likely to make me few friends and is likely too harsh, but the issue has bothered me for a long time. It seems that too much of the world we live in has been geared to accommodating stupid people. From the need for detailed instructions on how to use a step ladder (complete with detailed warnings) to the panic buying of toilet paper sparked by coronavirus hysteria. I hasten to assert there is a major difference between ignorance and stupidity. We are all ignorant when it comes to many, many things. This situation can always be corrected by setting out to educate ourselves until we are no longer ignorant. Stupidity is defined as "behavior that shows a lack of good sense or judgment." And it seems that no amount of education or exposure to facts can dent the beliefs held.

I really do not want to dismiss the concerns over the COVID-19 virus—it has killed people and will continue to kill people. It is something we all need to reckon with, but we now know a lot more than we once did. It is a danger to those who have been compromised by respiratory issues and to the elderly—the majority of the affected population will not face life-threatening symptoms. Do we all need to be careful, to wash our hands, to steer clear of people who are sick? Of course, we do. Just as we would if our goal was to avoid the flu or a cold. Is this disease justification for ushering in raw panic and the collapse of the global economy? No—I argue that it is not. Hoarding toilet paper, wearing flimsy paper masks, refusing to buy Corona brand beer, spraying random strangers with Windex because they sneezed is the behavior of a stupid person. I am distressed that these are the people who are driving the panic response.

Crude Oil Prices

These are grim days for the oil sector as there is now a full-on war between the producers. The impact will be felt most in the U.S. The rise of the U.S. as a major oil producer has come at the expense of the other top producers in the Middle East and Russia. Now that demand has fallen off due to the COVID-19 scare, they see a chance to attack. Saudi Arabia and the other Gulf oil states can still produce more cheaply than the U.S. They are now flooding the world with cheap oil in order to put immense pressure on U.S. producers—many of which will not be able to stay in business with demand this low.