Strategic Global Intelligence Brief for March 8, 2019

Short Items of Interest—U.S. Economy

Internal Retraining

Critics once assailed the majority of corporations for their policy of firing a group of employees and turning around and hiring new ones. The reaction by the managers was simple enough—they needed the skills of the new employees and no longer had a place for the old skills. Then, there was the fact that new hires didn't get paid what the older workers did. In a period of severe labor shortage that practice is becoming rarer. Companies are starting to look at their existing employee base and retraining them for the new jobs. The tricky part is deciding what to pay them while they are getting that training. They are not yet productive while they are learning, but they will be. It is very hard to ask people to take a pay cut, but this has been tried in several places with a promise of raises once the training period is over.

Jobs Report

The jobs report was a shock and a warning. The consensus view was that there were around 200,000 jobs added—less than last month's 302,000 and the 222,000 added the month before. This is not what the data provided. Instead of nearly 200,000 jobs there were just 20,000 added, paltry indeed. There were expectations of a robust month with hiring of people with limited skills, but that now seems to have slowed dramatically. Those who are being hired now have been out of the workforce for years and will be hard to integrate. It seems that companies are shying away from them even as they state they need more workers. There is also evidence that some sectors are getting more attention than in the past—lots of seniors returning to the workforce. They are often not paid as well as others as they do not want to interfere with their Social Security.

Where the Jobs Are

Employment is never universal and evenly distributed. Each market is quite unique. So when there is a report that says the unemployment rate is at 4% or 3.9%, it doesn't mean that every place in the country has that rate. Some will be higher and others lower. Generally speaking, there are some characteristics of a "hot" employment city in 2019. These are the places people should be thinking about if they ae seeking employment. Cities that are tech centers, college towns, cities with a big stake in the energy sector and cities with a large health care sector are at the top of the list, while cities dependent on agriculture are towards the bottom.

Short Items of Interest—Global Economy

Chinese Exports Tumble

Since Xi Jinping came to power in China, he has had a mission as far as the country's economy is concerned. He wanted to break the pattern of dependency that existed in a nation that lives and dies by the export. He understood that it was the export sector that got China to where it is today, but he always felt this was unsustainable in the long run. He wanted to build a consumer-based society where the domestic consumer plays the bigger role. The latest data reinforces that goal. Exports are way down. There are many reasons—everything from the trade war with the U.S. to the slowdown in the world economy that has affected the nations that once bought from China. This transition has not been easy.

Hungarian Leader Isolated

Viktor Orban has been a lightning rod for populist ideas in the former East Europe. He continues to push the envelope almost daily. There is now strong evidence Germany has had it with Orban and will pull away. He was once praised by the center right in Germany and is now condemned by the same people. They want him ousted from the European People's Party—the largest in the European Parliament.

Equality in France

A study has revealed that over 100 of the largest companies in France have missed their gender equality targets, and most by a very large margin.

Little Progress in U.S.-Europe Trade Talks

For the last year, the headline grabber has been the trade war between the U.S. and China. Of course, the ramifications of such a fight are serious. The rift between the U.S. and Europe has not attracted as much attention, which is odd. The U.S. and China have been at odds with one another for decades, and over a host of issues. There is no mistaking the two countries as allies. The Chinese consistently oppose the U.S. in the Security Council and have been a consistent thorn in the side of the U.S. when it comes to dealings with Cuba, Venezuela, Russia, Iran, North Korea and so on. China violates World Trade Organization rules with impunity and they have engaged in all manner of trade restrictions. The U.S. and China need one another to a significant degree, but neither nation is all that happy about it. Then there is Europe—a staunch and longtime ally of the U.S. which has backed the U.S. in almost every global diplomatic move. The ties are very deep and the business relationships are even deeper. It is confusing that so little progress has been made in reaching a deal and even more confusing that there is such deep distrust and animosity between the U.S. leadership and much of Europe.

Analysis: While attention has been on the potential trade ceasefire between the U.S. and China, there have been talks with the Europeans that have ended with no observable progress. There has not been a complete break down as yet, but these conversations have been fruitless thus far. The U.S. threats keep coming—mostly focused on the European auto sector. The latest salvo asserts that high tariffs will be imposed on cars and car parts from Europe. This would hit the eurozone economy very hard given the role that auto manufacturing plays. The threats have not ended there as other categories of European export have also been targeted.

The major sticking point is the same as it has been for years. The U.S. wants much more access to the European agricultural community and wants to sell everything from grain to meat to dairy and so on. The Europeans are still highly protective of their farm sector as this issue goes far beyond food security and profits. The rural community in many European states is protected as a cultural statement. There are many rules that prohibit even large European farming operations from developing and taking too much market share. There is no interest in allowing large farms in the U.S. that access. This has left the two sides at an impasse; one that few see a way to break.

The latest offer from EU Trade Chief Cecilia Maelstrom has been to set aside a bigger deal that includes the farm sector and focus on a much narrower deal that looks just at industrial policy. The assertion is that the U.S. has become so hostile to the EU that measures now have to be planned to rebuild trust. It is thought that engaging with just industrial issues would be a boon to both the U.S. and the EU.

For this approach to work, there would need to be a toning down of rhetoric between the U.S. and Europe. President Trump has made no secret of his support for the Brexit move by the U.K. despite the fact that many in Britain have changed their minds now that they see what a mess it has made of their economy. He has been at odds with Germany's Chancellor Angela Merkel and embarrassed President Emmanuel Macron of France when there was an attempt at rapprochement. These and other slights have soured relations. It will likely take a while to smooth things over again.

Return to Stimulus

It was only a few months ago that the world's central banks seemed to be in agreement as far as their future course of action was concerned. After nearly a decade of pulling out all the stops to get the eurozone economy functioning again, the European Central Bank (ECB) declared it was going to end its stimulative policy and would even consider hiking interest rates. The long-buried fear of inflation looked to be making an appearance. There were similar calls to traditional action on inflation coming from the Bank of England, Bank of Japan, Bank of Canada and others. The U.S. Federal Reserve had already started a series of rate hikes that were supposed to continue into 2019. As recently as six months ago, the prediction was that rates would be hiked at least three more times in the U.S. There were those who asserted that a fourth was not out of the question. The assessments all said essentially the same thing—conditions were ripe for inflation. There was very low unemployment, capacity utilization was up near normal levels, and most importantly, it looked like the global economy was booming, or at least it was looking healthier than it had been. My how things change.

Analysis: The European Central Bank now sings a much different tune as Mario Draghi has decided the slowdown that is taking place in the eurozone is not going to be short lived and stimulus is now called for again. That same message has been coming from the other central banks, although some of them had never quite given up their stimulating ways. Even the Federal Reserve has been backing away from the positions it outlined at the end of last year. The plan to hike rates again early in 2019 has been set aside. Most now think rates will stay about where they are for the bulk of the year. What happened? Did the threat of inflation simply vanish? Did something dramatic take place that convinced the central banks that something had gone awry?

It was, as always, a combination of factors. The inflation threat has not gone away, but it has faded to some degree as the factors that often cause an increase have not figured as prominently as would have been expected. Generally speaking, the drivers of inflation have been labor costs and commodity prices. Neither of these have been making the impact expected. This is not just a situation facing the U.S., it has been a global phenomenon. The Phillips Curve has described the connection between employment and inflation for years. The theory held that when the jobless rate was low, the potential for wage inflation increased. As the pool of applicants diminished, the employer was going to have to pay a premium to get the people they wanted. Not only would that mean paying starting wages higher than had been the case, but it would mean paying everybody more. The guy that had been making 10 dollars more than the new guy now finds that he is making only five dollars more and soon demands a raise so he doesn't lose his position. Then, there is the need to protect existing staff from being poached by companies that are needing to find scarce employees. It is easy to see how low levels of unemployment can push inflation. It hasn't happened this time as employers have struggled to find qualified people to hire. Those who are getting these new jobs are not being paid as well as would have been expected. Thus, there has been limited pressure from additional hiring.

Another factor that normally leads to higher inflation is an increase in commodity costs across the board. A booming economy will mean more pressure on the supply of these commodities and prices will go up. The fact is that several of the commodity groups have not responded as they might be expected to. Oil has been held down by the U.S. ability to provide the majority of the oil it needs on its own. There has been a hike in steel and aluminum prices due to the tariffs that have been imposed, but even this big spike has started to cool as producers started to realize they had started to price themselves out of their markets. There have been some price hikes, but they have not been enough to really constitute an inflation surge.

The most important factor has been the general lack of global growth. This has developed rather suddenly. The U.S. was barreling along at over 3% through most of last year, but slowed to 2.6% in the fourth quarter. The expectation now is that growth will be only around 2.5% for the remainder of this year. That is not exactly poor growth, but it is not the kind of robust activity that can carry the rest of the world. Europe is sagging to less than 1% growth with Germany down to 0.7%. This is anemic. China has just downgraded its growth to 6% after previously knocking it back to 6.5%. Outside analysts expect sub-6% growth by the end of the year. The fact is that growth has slowed worldwide. That reduces the pressure on inflation across the board. As for why that growth has slowed, there are many opinions. Most point to the protectionist policies pursued by Trump as they have turned the U.S. from a nation that stimulates trade to one that has become a drag on it. Others point to the impact of disputes like Brexit that threaten to ruin the U.K. and severely damage the Europeans. In truth it is all of these and likely more.

Productivity Growth Surprises

There had been a sense that productivity numbers would decline this time around. The idea is that many companies have been hiring people who are not all that qualified for the positions and therefore need to be trained. That means they will not be as productive now as they might be later. The data released yesterday showed a 1.9% rate of growth in the fourth quarter and the strongest period of nine-month growth seen in years.

Analysis: The reason that the inexperienced workforce was not a drag on productivity is that much of this gain has been attributed to the advances of robotics and technology. These machines have been doing what they are expected to—improving the overall productivity of a given workforce. The capital-intensive expansion has been paying off.

Fear and Politics

There are many things that motivate voters to make the choices they do. The challenge for politicians is sorting out what really matters. When there is no overarching fear, there is a need to manufacture one. It is actually pretty tough to get people to vote at all when there is a good economy and there is no imminent threat of war. The voter is basically satisfied and busy thinking about something else unless they can be ramped up. The U.S. has the right-leaning politicians focusing on issues like immigration and social change, while the left focuses on the evil rich. India's Narendra Modi is riding a patriotic wave due to the clashes with Pakistan and the British are decrying Brexit from both perspectives.

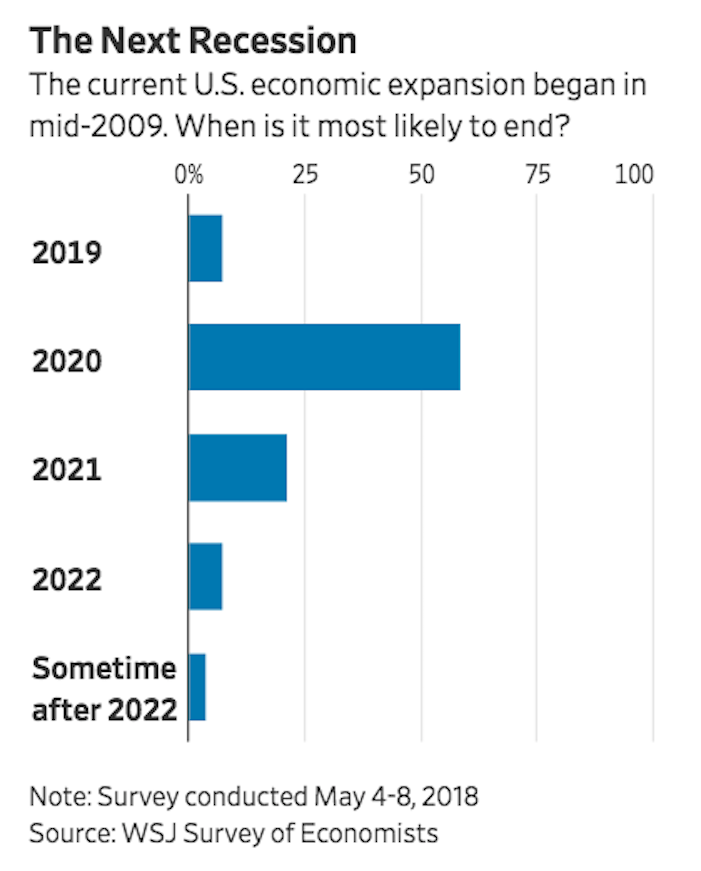

Analysis: All of these issues will tend to fade when and if there is an economic crisis. The question for both Democrats and Republicans is what 2020 will bring. Roughly half of economists assert that there will be a recession in play by the time of the election and economic issues will dominate. It is not clear who the voter will blame nor is it clear who they will trust to get the economy back to growth. If the current positions remain intact, it would be a contest between populist isolationism and progressive positions that will be branded socialistic.

Ever Adaptive Wildlife

By now, we have all heard of the advance of the coyote into our suburban neighborhoods—attracted by the little snacks that people have tied up on leashes in their yard. We see peregrine falcons using our skyscrapers as substitute cliffs and so on. Some of these adaptations go far beyond simply predatory behavior. As I have been writing this missive, I have had the opportunity to gaze out on the hot tub that is right outside my window at this very nice hotel in Desert Springs. At no point have I seen a human guest in that pool, but for the last two hours there has been a small contingent of ducks that have been preening and cleaning and swimming around enjoying the warm water and the jets. They keep going up to the water spouts, allowing the water to propel them across the pool before sailing back and doing it again. I swear it looks like a family has checked in to the hotel and taken the kids to the pool.

It reminds me of the story told by a guy at another meeting. He was at a lodge in the Rocky Mountains browsing the gift shop when he heard a snort behind him. A deer was quite politely trying to get past him to the back of the store where the woman running the place had a bucket of feed. In about a minute, four fawns wandered in behind the doe and made their way back (one did try to snag a package of Ding Dongs, but the shopkeeper retrieved it). She pointed out that they were there almost every day, but when the fawns get a little older, the trips stop until the next batch. A mom has to do what a mom has to do.

The Next Recession

To be honest, the economists of the world are often not as accurate as weather forecasters. On the other hand, when it comes to big events like a recession, the track record is not bad. The old joke is that economists have predicted 13 of the last three recessions, but actually the forecasts are pretty on target. It is the depth and length of the recession that can be vexing. It appears at this stage that a recession is in the offing in 2020, with over half of the business economists warning of this development.