Strategic Global Intelligence Brief for March 6, 2019

Short Items of Interest—U.S. Economy

Will a Deal With China Mean Much in Short Term?

It looks more and more likely that a deal of some kind will be struck between the U.S. and China over trade and tariffs, but the solution does not appear to be a definitive one—one that will have an impact on the global economy. If a deal is brokered, there will be a boost in global growth as some of that trade uncertainty will be removed. The deal on the table, however, is subject to quarterly review and these tariffs and trade barriers could reappear at a later date. Nobody will be in a position to relax and expect the current situation to be maintained. The Organization for Economic Cooperation and Development (OECD) is not even altering its projection for global growth at this point—adopting a more cautious approach based on how these two states conduct themselves over the course of the next few months.

ISM Reports an Improvement in Service Sector

The latest report on manufacturing from the Institute for Supply Management (ISM) was not very encouraging as it fell a little from the readings the previous month and now sits as low as it has been in over a year. In contrast, the service sector data improved quite a bit and now sits at 59.7—right on the edge of the 60s. This is up from 56.7. Analysts had expected to see some improvement this month, but nothing this dramatic. It seems that retail grew better than had been expected and health care continued its pace of growth. The importance of the service sector is hard to overestimate as it accounts for over 80% of the U.S. economy and 85% of jobs. Consumer spending has long been the driving force in the U.S. economy. Two-thirds of that spending is on services as opposed to goods.

Corporate Debt Levels Cause Concern

The head of the Federal Reserve Bank in Dallas has been sounding the alarm on another kind of debt other than that of the U.S. The long period of very low interest rates has been convincing many companies to borrow far more than they might have in past years. That level of corporate debt is much higher than it was even a few years ago. The amount of corporate bonds outstanding has gone from $2.2 trillion in 2008 to $5.7 trillion this year and it just goes up from there. This is making these companies very vulnerable in the event of a recession; even more vulnerable if inflation causes the Fed to hike rates. The Dallas Fed member has been hinting that this situation will affect his opinion on issues like rate hikes down the road.

Short Items of Interest—Global Economy

Bolsonaro Unleashes Police in Brazil

During his campaign to become the next president of Brazil, Jair Bolsonaro made violent crime a major focus. That emphasis has continued as he has taken office. He declared early in his term that he was taking inspiration from the president of the Philippines. Rodrigo Duterte gave the police and vigilante squads complete freedom to deal with the drug gangs and anybody suspected of a connection. In a matter of months, there were some 60,000 killings and they continue to this day. The same thing is happening in Brazil as the police have been given permission to shoot and ask questions later. These have essentially been executions of those suspected of being involved with drug crimes and other issues.

Slower Growth in South Africa

This was supposed to be the year South Africa experienced some of that growth they once sported. Jacob Zuma and his kleptocrats were gone, which was supposed to usher in a new era. It has not been that easy. Growth has been an anemic 0.8% and may fall further this year as the nation has struggled to get its export levels back up. They are not seeing the demand from China they once did and the rest of Africa has been moribund as well.

China Reduces Growth Projections

China is now admitting that the trade war has been hurting its economy. It now expects no more than 6% growth this year.

North Korea Rebuilds Missile Site

From the very start, President Trump's approach to North Korea has had its supporters and detractors. It has been a very high stakes game as the Pyongyang regime has been among the most volatile and potentially dangerous in the world. Prior to the summit meetings between Trump and President Kim Jong-un, it appeared that some kind of full confrontation was inevitable. North Korea was regularly firing "test" missiles over Japan and South Korea and overt threats were made as far as attacking U.S. territory in Guam, Hawaii or even the Pacific coast. The world was on edge. About the only thing the U.S. could do was to threaten annihilation should North Korea engage in more provocation. In truth, that was not even a realistic option as it would have meant going to war with China as well. Trump engaged with Kim directly and tried to substitute a charm offensive for military stand-off. For over a year that seemed to have the desired result as the North Koreans appeared ready to exchange their nuclear weapons program for the lifting of sanctions and other types of economic aid. Critics of the Trump approach accused him of being naïve and egotistical. The Kim regime could never be trusted to make good on its promises and the U.S. just looked weak.

Analysis: It has been reported by the intelligence community that North Korea has launched an aggressive effort to rebuild the missile launch site it ostensibly destroyed last year. The progress has been swift; it is estimated that it will be usable in just a few weeks. Since the first summit in Singapore, the Kim regime has not followed through on any of its promises to dismantle its capabilities. That failure to comply was a major reason Trump walked out of the latest summit in Hanoi. The collapse of the latest meeting is behind the North Korean decision to rebuild that facility. It has become a game of who has the most leverage and who is willing to go how far.

Kim is convinced he has the upper hand and can force Trump back to the table. He wants the U.S. to drop the sanctions and to provide aid. He wants an end to U.S. cooperation with the South Korean military in addition to the many other concessions he has demanded. If these are met, he will consider making good on his pledges. He is convinced China and Russia will back him and he is likely correct. Trump thinks he has the upper hand as the sanctions are still in place and there are still credible threats to the Pyongyang regime. He has flattered and cajoled Kim. That has been taken by the North Koreans as the U.S. being cowed by them. Trump's walkout was not expected and left Kim embarrassed. Now he is retaliating.

The U.S. has a couple of options at this stage. The first is to treat this as a temporary setback and try to get another meeting on the agenda—probably not a sit-down between Trump and Kim, but one that involves high level officials such as Secretary of State Mike Pompeo and Kim's foreign minister. There may also be some kind of veiled military threat that reminds the North Koreans that the U.S. has the ability to attack these installations—the approach that Trump had been advocating before the summit idea was broached. Much will depend on the position taken by the Chinese as they are the stalwart ally of Kim. If they get actively engaged, the U.S. will have far less wiggle room. The Chinese just might take a stand as a way to gain some leverage over the trade talks.

OECD Downgrades Eurozone Growth Again

The last report on the growth prospects for the eurozone was not very good. Now it has become even bleaker. The latest assessment from the Organization for Economic Cooperation and Development (OECD) holds that growth will be just 1% this year and perhaps 1.2% in 2020. This pace has not been seen since the depths of the recession. It seems unlikely that the nations of the eurozone will be able to do much about it. The downgrade applies to all the member states, but some experienced more pessimistic interpretations than others. The most disturbing part of the report holds that Germany will see growth of around 0.7%—very weak. Given that Germany is the engine for the rest of Europe, this does not bode well.

Analysis: There is no great mystery as far as the decline in the eurozone. This is a region that depends heavily on exports—Germany is over 50% reliant on those exports. Nearly everything that can go wrong with global trade has. Brexit means that Germany loses a key trade partner in the U.K., Chinese economic slowdown has hammered German companies who had invested heavily in that market and the U.S. has been hostile to the Europeans in general and towards the Germans in particular. The opportunities to trade with fellow eurozone members has been constrained as several of these economies have been struggling. Finally, there is the fact the German consumer has become ever more cautious and worried about the future.

Consumers Are Taking the Hit

This is certainly no big surprise when one considers what a tariff actually is. The term is clear enough, but many fail to understand that it is simply another way to refer to a tax. There remains a misnomer about who is paying that tax and how. Polls suggest that a sizable number of people believe that somehow China itself is paying this tax to the U.S. and therefore the U.S. is making money from China directly. This is certainly not how tariffs work. The tariff is designed to change the incentive pattern of trade. If a company in the U.S. is looking at purchasing a product from China, it is because they can obtain that product more inexpensively than if they bought it from a company in the U.S. or some other nation. The Chinese item would have to be very cheap in order to still be a bargain once shipping costs and other expenses are added in. If a tariff is imposed, the price of that Chinese-made good goes up accordingly. That would presumably mean fewer people will prefer the Chinese good. This only works if there is an alternative to the Chinese good and if the alternative good is now cheaper than the Chinese offering.

Analysis: Tariff strategies break down in a number of ways. The first problem is the most obvious. What happens if the good is not produced anywhere but China? There are millions of items that are now made exclusively in China as they have taken dominant positions as far as market share. This is not to say that some company in the U.S. can't decide to start making these goods, but is there really enough incentive for an American company to invest in making twinkling Christmas lights or cheap T-shirts. If there is no alternative to the good that has had the tariff slapped on, the U.S. purchasers will buy it anyway and end up paying more for it due to the tariff. That added cost will be handed down to their customer.

A second way tariff strategies break down is that U.S. purchasers decide to keep sourcing from China even if there are alternatives in the U.S. or in other nations. They have a supply chain they understand and trust and they do not wish to disturb it. They have decided their customers will be able to pay the extra cost and they simply pass the tariff expense on to them. It is also possible that either the U.S. company or the Chinese company will decide to absorb the tariff themselves and reduce their profits a little in order to maintain market share. In past years, this tactic does not extend very long and slowly prices will start to come up.

The long and the short of it is that tariffs cause price hikes. That is their intent. In a perfect scenario, the tariff changes the balance by forcing buyers to source from the U.S., but in most cases the price still rises for the consumer as the U.S. provider will hike their prices almost to the point of the Chinese alternative. If the tariff on Chinese goods is 25%, the U.S. provider will very likely hike their prices by around 20% as they will still be cheaper than the Chinese alternative. The consumer pays more regardless. Recent studies have demonstrated that U.S. consumers have already forked over an additional $69 billion. This number will soon double or triple as the next round of tariffs will hit consumer goods harder than the previous efforts.

The effort to reduce the deficit with China and the world in general is important to a degree. The assumption is that tariffs will automatically result in more jobs in the U.S.; however, there is little evidence this will occur. The most likely development will be that other nations will send more to the U.S. and China will send less. The best method by which to reduce the deficit is for other nations to buy more from the U.S. That is much easier said than done. There are only a few nations that have a market for what the U.S. produces (outside of food). The U.S. has been trying to break down the barriers that have been erected against U.S. exports. While this has been hard to do, the impact on trade is far better than when the U.S. engages in the same kind of protectionism that it has been fighting in other countries.

Dramatic Increase in Size of U.S. Deficit

This is not coming as a great surprise to anyone who has been paying attention to the policy moves of the last few months. The budget gap in the U.S. has widened dramatically as there has been considerable spending at the same time that tax revenue has fallen by 15%. The reduction in taxes was quite deliberate and it can be argued that it served a purpose as a stimulant. Economists have had mixed feelings about the cut. Many argue that it came later than it should have. The impact was more along the lines of an economic "sugar rush" as the impact faded by the end of the year. The impact on the budget was clear enough as it seriously reduced the revenue raised. This would not have been a major issue had there been efforts to reduce spending to compensate for the reduced revenue, but the opposite took place with spending hikes put forward by Republicans as well as Democrats.

Analysis: A year ago, the government ran a deficit of $176 billion in the period from October 2017 through January 2018. This year during that same period the deficit was $310 billion—a 77% increase. There are some factors that led this number to be higher than it would ordinarily be, but most of that hike was due to additional spending on the military and interest on the national debt.

How long can the U.S. run deficits like this? In truth, the U.S. will always have the ability to sell Treasury bonds so it can keep spending—they are among the most coveted of investment instruments. The real issue is servicing that debt as it has become the fifth-largest segment of the federal budget. Each year, the U.S. is paying out close to $300 billion in debt service. That is a chunk of money not available for other priorities. The U.S. has the same options it always had when it comes to debt. It can cut spending enough to live within the means available or it can raise more money from tax revenue. The policy for years has been to do just the opposite—spend more, tax less and borrow.

Distractions

I have been spending time with a lot of old friends the last couple of days as I am attending the annual meeting of the Fabricators and Manufacturers. I have been interacting with these people for many years. It is like old home week when I get the opportunity to hang with them. After the conversations about business and the economy are exhausted, the conversation turns to spare-time activities. They most definitely run the gamut.

There are those who pursue a very active regimen of skiing and scuba diving. This contrasts sharply with my usual form of exercise—jumping to conclusions. I learn that my attraction to Hallmark movies and the Incredible Dr. Pol is shared by more people than I expected. It is just nice to see a show where absolutely everything works out in the end. My Doctor Pol watching has given me the confidence to pull a calf or treat the chokes in a horse and maybe even deal with uncooperative cats.

I learn that people collect the oddest things and they are devoted to some of the most hopeless sports teams in history. I get insight on what people read and what they have developed expertise in. I even find those that share my love of travel books that describe some of the most harrowing adventures imaginable. It makes my own travel issues pale in comparison. It is just rewarding to be around people long enough to get to know the real person.

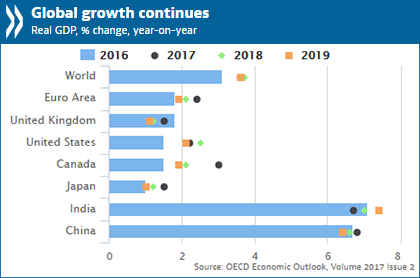

Global Growth

The Organization for Economic Cooperation and Development (OECD) has been termed the "rich nation's club" as it consists of the major industrial economies in the world. It is powerhouse as far as data collection and analysis is concerned and reports flow out of the group on nearly a daily basis. The chart shows that many parts of the world are expected to grow in 2019—with the exception of the U.K., Europe, U.S., Canada and China. These are some important players in the global economy. A slowdown here will have serious implications.