Strategic Global Intelligence Brief for March 5, 2019

Short Items of Interest—U.S. Economy

Decline Noted in PMI

The latest data from the Purchasing Managers' Index (PMI) shows another month of decline. There is not yet a sense of crisis as the numbers are still well into the expansion category (over 50), but the highs that were reached only a few months ago now seem a distant memory. Last month, the reading was at 56.6 and now it is sitting at 54.2. The decline was greater than had been expected, but it is likely that there were some temporary factors at work as well as some that are longer term. The cold weather of the last few weeks and the incessant snow has been disrupting travel. That has caused shortages and bottlenecks and has even caused plants to shut down for short periods. It is presumed there will be fewer Arctic blasts in March, April and May. The other factor that may help with a rebound would be a deal with the Chinese that results in fewer tariffs and other trade restrictions. That seems more likely now than in past weeks.

Not Much Change in Trade Numbers

Despite the drama and histrionics, the Trump effort to reverse the U.S. trade deficit has been largely unsuccessful. This is not unusual as many presidents before him have tried to do the same thing in different ways. The reality is that changing trade patterns will always be slow and halting. The company that is buying from China (or any other nation) undoubtedly did their due diligence before starting. They know the price they will pay, the total landed cost, and they know the people with whom they will be working. A relationship has developed. It will likely take more than higher prices caused by a tax to alter that relationship. Many Chinese suppliers simply reduced their prices to offset the tariff and maintain that relationship. There are also many things available from China that are available elsewhere. This will mean buying continues regardless of the tariff costs.

Drop in Personal Income

For the first time since 2015, there has been a drop in personal income, but the majority of this decline was due to somewhat unusual factors. There was a decline in dividend income as a result of some of that market volatility and there was a fall in farm income that was quite dramatic. The dividend issue is not likely to continue into the coming year, but farm income will still be challenged. Income from the usual sources rose dramatically in December. That will likely continue into this year, but at a somewhat subdued pace as compared to last year.

Short Items of Interest—Global Economy

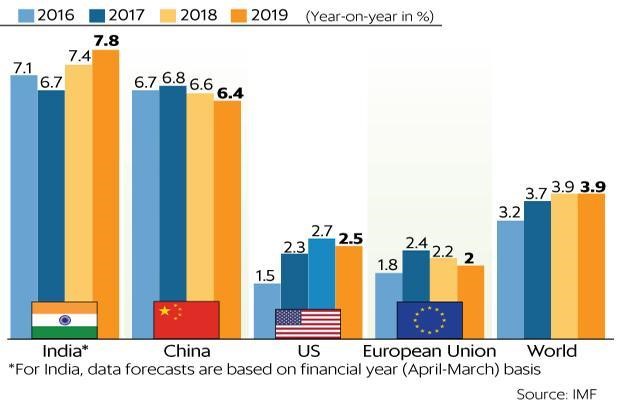

China Downgrades Projected Growth

The slowdown in China is real and causing a lot of concern in Beijing. The latest projections for growth have been ratcheted down again to somewhere between 6% and 6.5%. This is very close to recession in the Chinese context. This is a nation that has to add 1.4 million jobs every month to keep pace with population growth. That really can't be accomplished with growth near 6%. The trade war with the U.S. gets some of the blame for this reduction, but the bigger issue is that most of China's major trade partners have been experiencing slower growth and are not buying from China as they once were.

Biggest Global Threats Change

Not that many years ago, the major threats to the world as identified by the military and intelligence community were war and terrorism. Not that these are not still in the mix, but at the top of the list is climate change and the situations that follow from it. There will be more explosions of deadly disease, more wars over water and other resources, more episodes of mass migration (which also leads to civil strife), more natural disasters (which leads to more mass migration). The overall conclusion is that climate change will trigger many of the traditional threats the world has been coping with for years. The places that will be most affected include Africa, South Asia and Southeast Asia, but there will be impact in Latin America and the developed nations will be severely taxed trying to cope with the challenges presented.

Macron Launches Attack on Populism

Emmanuel Macron became the president of France because of who he was running against. That reality was acknowledged by Macron at the time and has been reinforced by many of his actions since. He was the alternative to the far-right National Front candidate Marine Le Pen. Many millions in France voted against her as much as they voted for the unknown Macron. His position was that Le Pen was a reactionary; one who did not really represent the French. Since his victory, he has struggled to maintain that support base as the voters have now had more time to evaluate the man they elected. He has been accused of being elitist and unsympathetic to the travails of the average French citizen with the imposition of a gas tax designed to help push France further towards a "green" transportation and power production stance. The people paying that tax are not opposed to that green future, but reject the notion they should be the ones to pay for it. He has been on the back foot since the start of his term as he has been attacked by both the left and the right as they seek to put their own people in place in the future. Now he seems to be taking the initiative with a proposal that looks similar to the ones he used in the campaign against Le Pen.

Analysis: The European elections are coming up and it appears the populists have focused a lot of energy on expanding their influence here. The Euro-Parliament is an odd body; often the place for those who enjoy making long speeches more than actually governing. It is actually quite powerless in a direct sense as it is not allowed to compromise the sovereignty of any of the EU members. It is a platform for politics and for fringe politicians to address their issues. Many nations do not really take the institution all that seriously. It is still a good place to make a point, however, and Macron has a point to make.

His platform calls for aggressive European unity in the face of all the populist ferment in the region. He has called attention to the mess that Brexit has caused in the U.K. He cites this as an example of what happens when the populists get the public to turn on the accomplishments of the EU. His positions include fighting the cyberattacks that have been undermining the legitimacy of the election process, developing an industrial policy to counter the influence of China and the U.S., and the development of a comprehensive set of policies to address climate change and other environmental issues. This is all activity that has been done by the whole of the EU and demands a return to faith in its institutions.

This not a popular position—at least not at first blush. The point he has been making is that many of those populist movements and governments that have appeared in Europe of late have created far more problems than they have solved.

India and Turkey Become Latest Trade Targets

India is now the fastest-growing economy in Asia with a pace of 7.5% compared to the 6.2% that China has fallen to. This has been due to India's swift moves to pick up market share from China, but that strategy may have just hit a major bump. The latest trade salvo from Trump has been directed at India and Turkey. They will both lose their protected trade status in the next 60 days. India has been accused of pursuing market barriers and making it hard for U.S. companies. Turkey has been sinking in the estimation of the U.S., while Trump has been fighting with Reccip Tayyip Erdogan over a host of issues.

Analysis: Although India does have policies that make doing business tricky for some U.S. companies, there has been a long history of U.S.-Indian cooperation with many U.S. operations ranging from manufacturing to service centers being based there. There have also been much closer ties between the U.S. and Narendra Modi since his election a few years ago. Reports suggest India was not expecting this move. It is particularly distressing as India and Pakistan find themselves at odds again. The U.S. is an important trade partner. There had been an expectation that tariffs on China would make it easier for the Indians. Now this is not certain as the U.S. moves deeper and deeper into ultra-protectionist mode.

The situation with Turkey is more personal for Trump as Erdogan has been fighting the release of various religious activists that are accused of supporting a coup against Erdogan. The fact is Turkey remains a major military ally and key to the U.S. position in the Middle East. Granted, Erdogan has been deteriorating into petty tyranny and has attacked the Kurdish allies the U.S. have been backing in Iraq and Syria, but it seems unwise to cut ties with Turkey altogether. It is also possible this trade status is a bargaining chip.

Trade Deal in the Works?

To be honest, nobody really has a clue at this point. For months it has been the policy of the Trump team to demand very deep and permanent changes in the Chinese system before much ground would be given, but that position seemed to weaken in the last week. Suddenly, the demands for structural reform were missing and the emphasis was on issues like protection of intellectual property, halting the theft of U.S. technology and expanding what China buys from the U.S.

Analysis: China had already agreed to buy more from the U.S. so this part is easy enough. There have also been promises over the years to respect intellectual property. China has the laws if it ever chooses to enforce them. The question is whether it means to this time. The betting is China is a bit more serious this time as it now has technology it wants protected.

Good Week for Data Releases

Of course, every week brings new sets of data as the U.S. is nothing if not prolific when it comes to assessing itself and producing reams of statistical analysis. It also goes without saying that not all of what is produced is of the utmost importance, at least not to the majority of those who are following the twists and turns of the current economy. This is a week where much of the data is relevant to most everyone and thus eagerly awaited. Not that this material is the definitive last say on the status of the economy, but it will certainly show whether some trends are continuing or reversing. On Wednesday, March 6, there will be the Commerce Department's release of international trade data and the Federal Reserve will release its latest edition of the Beige Book. Thursday will feature the Labor Department's labor productivity numbers and on Friday they release the latest job numbers.

Analysis: Trade has been at the center of the Trump strategy since he took office. His moves in this area have been among the most controversial. The fundamental premise has been that the U.S. economy has been at a trade disadvantage for many years. This has caused the loss of jobs and a lack of growth. Too much is being imported and too little exported. It has been enough of a problem to affect national security. The Trump administration is certainly not the first or only one to point this out or to take steps to address the issue, but the tactics employed are somewhat unique. Heavy emphasis has been placed on trade barriers of one kind or another—tariffs and restrictions of varying kinds. The question is whether these tactics are working—has the trade deficit improved or worsened or remained about where it has been.

At the start of the process, the deficit worsened as companies rushed to get product delivered before the tariffs were imposed. The U.S. was flooded with imports for a few months, but this was expected to be a short-lived phenomenon—at least up to the point that these tariffs went into effect. In fact, there was a decline in imports in November—a reduction of 2.9%. Unfortunately, the export side of things didn't look much better. That pattern is expected to have continued into December and January. The initial conclusion is that the trade deficit is continuing to widen despite the restrictions on trade with the Chinese. It seems importers are finding other sources for those products that are getting hit with tariffs. At the same time, the U.S. has been affected by the tariffs and restrictions imposed on the U.S. in retaliation for the trade attacks initiated by the U.S.

The Beige Book is the regional roundup of economic activity pulled together by the 12 Fed districts. It is not the most definitive of research as much of the data comes from the various business groups that advise the Fed banks, but it does provide a nice snapshot of the regional economies. If there is some weakness or strength emerging, it will likely show up in these reports. Thus far, there has been a hint of worry in the air. Most of the economic data has been pretty solid for the last several months—2018 was a very good year and there has not been a marked decline from that pace in 2019, but that has not been as encouraging as one might expect. There are several issues creating concern within the overall business community. These have the potential to drag down economic progress later in the year. This issue of the Beige Book will shed some light on whether this attitude is continuing to develop.

Next up is the productivity assessment from the Labor Department. It will be examined with a fine-tooth comb. Three factors will be of particular interest. The first is that there was a great deal of capital investment in 2018. This should start to translate into higher productivity numbers by this time. The capacity utilization data has continued to fall just short of the range considered normal (between 80% and 85%), but the trend has been upward. The second factor is linked to the job market. There will be more of this data released by the Labor Department on Friday. The hiring over the last few months has been more aggressive than expected, but there is a problem. Companies that had been struggling to find qualified people to hire have given up and started hiring people they know they will have to train. These new employees will actually drag down productivity for a few months as they face that learning curve. The third aspect of productivity to watch will be whether any of the global trade wars have had an impact as sources are shifted and many imports have become expensive.

The last data release for the week is the one that looks at jobs. After adding over 300,000 jobs last month, the expectation is the number of new adds will be about a third less at 185,000. The fact is there are currently over a million more available jobs than there are people looking for work. It is now a matter of finding the right skills or of having people in the right place at the right time. The overall rate of unemployment at the U-3 level is rising a little while the U-6 level is falling—people who were once labeled discouraged workers are getting back into the formal search for a job.

YIKES—What a Travel Saga

I am now officially on record as being sick to death of this winter weather. I had been somehow missing the worst of the storms for the last few weeks and my travel had not been all that affected. That luck ran out yesterday as Kansas City had its 183rd snow of the season. The original flight I had planned to Charlotte was canceled so I booked another one for later in the day. That one got me as far as Baltimore, but the second leg was canceled. Third try saw me with an itinerary that landed me in Indianapolis, Baltimore, Nashville and finally Charlotte. I could have flown to Tokyo in the time it was going to take. That plan fell apart and I booked two separate one-way flights—one to Nashville and then a second one to Charlotte.

While in KC I get the message that my Nashville flight would be 90 minutes late; that meant missing the second flight. As I was trying another tactic, they announced they would bring another plane over and it was back on time. Then they decided they had to wait for a flight from Denver as there were several passengers going on to Nashville. But no worries—all the Nashville connections would be held as well—including my flight to Charlotte. Our flight landed at 8:57 and the flight to Charlotte was supposed to leave at 9:05. I made my way to the gate to see them closing the door. "What happened to holding this flight?" "Oh, we never said THIS one would be held—there are only three of you going on." I was the last one to board and I could hear yelling as I sprinted down the jetway. The other two did not make it. Got a really fine middle seat in row 786, right next to a very drunk and angry man who kept harassing the flight attendant. Finally got to my hotel at midnight. Seriously, I am getting too old for this! I wonder if I can get an Uber that would take me from Charlotte back to Nashville and then to Palm Springs?

India as Trade War Target

It appears that President Trump has decided to add India to the growing list of nations the U.S. has decided to pick a trade fight with. This is despite the fact that the other trade wars have not worked out as planned and have done more damage to the U.S. than they have helped. Of course, there are always some sectors of the U.S. economy that will benefit from the barriers—those that compete directly with the country that has been hit with trade restrictions. There is a good deal of competition with Chinese companies but relatively little with India. This is not a nation that provides much manufacturing or food to the U.S.—they are mostly interacting through their service sector. In past years, the U.S. would be seeking closer ties with a nation like India but those days seem to be over.