Strategic Global Intelligence Brief for March 28, 2019

Short Items of Interest—U.S. Economy

Fed Pushback on Yield Curve Debate

As with most assertions regarding economic cause and effect, there are flaws in the logic. The belief is that an inverted yield curve is the precursor to a recession. While that has been true, there has always been a lot of variance. That recession may take two or three years to manifest. Each time the inversion has occurred, there has been a unique feature or two. The market assumption is this inversion will prompt the Fed to cut rates in order to pump up the economy and avoid recession, but the Fed is pushing back on this assumption by pointing out that rates are already very low and further reduction would have little impact. It also points out that inflation threats are far from non-existent.

Is Infrastructure Development Non-Partisan?

One would think so given that improving the infrastructure would help all levels of the economy. There has been a proposal to spend a trillion dollars on infrastructure by President Trump. Now, a trillion-dollar plan has been put forward by Amy Klobuchar—Democrat from Minnesota running for her party's candidacy in 2020. The fact is infrastructure always seems to be the ideal bi-partisan effort, but the devil is always in the details—especially when there is already a major debt and deficit issue that spending a trillion dollars will only exacerbate. What is in the plan? Roads and bridges, but where? Mass transit or highways? Is there money for airports and seaports? Does rural broadband count as infrastructure? Who gets the work and under what circumstances?

Trade Deficit Narrows

The expectation had been that the trade gap would widen by another $57 billion, but instead, the U.S. exported more and imported less, and the deficit shrank by 15%. The analysts had been expecting a reduction of the deficit, but were not sure when exactly this was going to be happening. The threats of tariffs on Chinese goods prompted many companies to buy as much as they could before the tariffs were due to arrive, but now this frenzy has calmed and most companies are sitting on some pretty substantial surplus inventory—thus making them less willing to buy more imports. Meanwhile, the U.S. has seen a sharp hike in exports for a variety of reasons—some of them seasonal.

Short Items of Interest—Global Economy

Labor Actions in Mexico

For the better part of the last three decades, the Mexican economy has been relatively free of labor strife. That has been a big reason so many U.S. and global manufacturers have chosen to set up operations there. In just the last few months, there have been over 1,000 labor actions as workers are demanding higher pay and other perks. The two factors that have fueled this development are the election of left-leaning President Andres Manuel Lopez Obrador and the demands for higher wages in Mexico that have become part of the new USMCA (formerly NAFTA) agreement.

Boeing Upgrades Software

The formal investigation of the two crashes of the 737 Max have yet to be completed. It is likely that Boeing will fight hard to contest the assertion that there was a fatal design flaw. Nonetheless, there has been a software update that deals explicitly with the issue. That has been seen as a tacit admission that something was amiss. The majority of industry assessments assert this problem was avoidable with proper training, but it has also been acknowledged that a glitch like this should not have been possible in the first place.

Eurozone Banks Get More Active

Lending in the core eurozone nations has picked up unexpectedly. That is seen as good news even if the lending has not improved in most of the southern tier countries. The business community is seeing reason to expand. Thus far, there has been willingness on the part of the banks to back these plans.

Oil and the Pivot Away From the Middle East

There are many reasons for President Trump's decision to back most of the more controversial elements of the Israeli government's policy. In just the last few years, the U.S. has recognized Jerusalem as the capitol of the country, accepted the Israeli position on ownership of the Golan Heights and has clearly backed the Israel position in the West Bank and settlement areas. Trump is close to Israeli Prime Minister Benyamin Netanyahu and Trump's base is decidedly pro-Israel and anti-Arab. Another factor has been the changing situation as far as oil production is concerned.

Analysis: In the simplest of terms, the U.S. no longer relies on nations like Saudi Arabia or the Gulf oil states or any other foreign provider of oil. The U.S. can and does produce its own oil and has become the largest oil producing state in the world. The need to pacify the Middle Eastern oil states is no longer a factor so the U.S. is free to engage in other initiatives. One of those has been to become much closer to the Israeli government.

Are We Really Headed for Imminent Recession?

The game of economic forecasting is fraught with trepidation given the importance events can play in altering the majority of these assessments. If there is anything approaching consensus on the immediate future of the U.S. economy, it is that it has become quite fragile. There are more than a few events that could drive the economy deeper into a slowdown; events that could boost growth for another few months or even a year. Longer term, it is more obvious that a slowdown is very likely, but it may not be one that falls to the level of a recession.

Analysis: At the top of the list of concerns right now is the inverted yield curve. The behavior of the 10-year bond and the three-month bond has long been considered a sure sign of an impending recession as there has been a period of inversion before every major decline. The inversion is when the yields of the 10-year bond fall below the yields of the three-month bond. The markets are assuming this will prompt the Fed to start cutting rates as it would be reacting to the possibility of a recession. As a predictor there are some flaws in this system.

The first is there is often a significant time lag between when the yield curve inverts and the recession starts—sometimes it may take as long as six-to-nine months. This is not an imminent warning and generally combines with several other indicators of a severe slowdown. Some are starting to appear, while others are not. The second potential flaw this time around is that rates are already very low and the Fed has little room to maneuver. Generally speaking, rates should be at least in the range of 4% to 5%. That would allow the Fed to make a meaningful cut. It is hard to see what a tiny rate cut would mean at this stage. The Fed seems limited to just holding steady for a while to see where the economy is headed. That said, there is growing sentiment that the Fed may have to lower rates this year anyway—even if it is mostly a symbolic gesture. The chance of a cut was set at just 11% a few weeks ago and now the analysts are setting the chances at around 56%.

There are other signals of a slowdown to consider. The Purchasing Managers' Index (PMI) and the Credit Managers' Index are both forward looking and considered very accurate and unbiased assessments of the current economy. The respondents do not fudge the data—it is simply a report on what is happening month-to-month as far as purchasing and trade credit is concerned. Both were at high points just a few months ago and both have seen precipitous declines since then. The PMI is now down to 54.2 according to the Institute for Supply Management and 52.4 according to HIS Markit. The good news is it remains in the expansion zone (anything over 50), but the bad news is that this index was tracking near 60 a few months ago. The even worse news is that the PMI data for Europe is even lower and sinking faster. The Credit Managers' Index also dropped again in March and is sitting at 53.6 after resting at 54.9 the month before. As with the PMI, the good news is that the numbers are still in the 50s, but the bad news is that there was a real dip in the negative readings that usually set off alarm bells—issues such as accounts out for collection, slow pays and disputes.

What makes anticipating a recession more than a little challenging right now is that for every negative indicator, there is one that points in a generally positive direction. The unemployment rate remains very, very low. Every month it seems employers are still adding workers. There have been hikes in terms of durable goods as well as factory goods and there has been steady performance as far as capacity utilization is concerned. There is momentum at work right now—reaction to the tax cuts of last year has faded somewhat, but the impact is still being felt. More importantly, the less-talked-about effort to reduce regulatory pressure has been fueling significant levels of expansion. Just the reduction of the Bank Reform Act impact has freed smaller banks to get engaged. They are generally the lifeblood of both manufacturing and the farm sector.

The bottom line may be that there really isn't one right now. The economy is capable of more growth albeit at a slower pace than was the case last year. It is also quite capable of falling off dramatically—perhaps even to the point of recession. There will be lots of attention focused on the continued behavior of the stock market, consumer confidence as well as actual behavior and there will be a lot of concern directed towards the global economy. A somewhat weaker U.S. economy will not be able to withstand a collapse in the global economy. Right now, that seems a distinct possibility.

What is Happening in the Farm Sector?

There have been a few comments from those who are not familiar with the farm economy that suggest the damage from the floods is overblown. They acknowledge that those directly affected are in serious trouble, but isn't there lots of land that is not flooded? Are we really in a broad farm crisis? The answer is yes, and for a variety of reasons that go beyond the impact of this spring's floods. That water has also affected transportation and the supply chain as crops that are not being planted now will leave a gap when it comes to livestock operations later.

Analysis: The real issue is the farm sector economy has been in a slump for over six years. This has been due to a wide variety of factors—weather among them. There have also been higher energy costs and subsequently higher costs for many inputs such as the fertilizers and chemicals used. Prices have also been affected by production in other parts of the world. For the last year, the U.S. farmer has been cut off from some of the most lucrative global markets by tariffs and trade wars. The situation gets worse every year as illustrated by everything from higher bankruptcy rates to more farms being sold.

In Defense of Capitalism

The trendy thing these days is to denigrate capitalism and to assert that every social and political problem that exists in the world today can be laid at the feet of this economic system. It was only a couple of decades ago that communism and socialism were to be consigned to the dust bin of history as these systems had been such demonstrable failures in the USSR, Eastern Europe, China, Vietnam, Cuba and many developing nations that pinned their hopes in these planned and state-run economies. Today, the attacks are being visited on capitalism by members of the left as well as the right. Populism in whatever form rejects the basic ideas of capitalism and substitutes direct government control in some form or another.

Analysis: Two recent books set about the task of answering a couple of very basic economic and political questions. The first: "Is capitalism the best economic system?" The second: "Does capitalism conflict with democracy?" Rainer Zitelmann, a German journalist and entrepreneur, has written many volumes. His latest is called The Power of Capitalism. His core point is made through an exhaustive examination of historical trends to point out it is the only system that has ever worked. He does not pour over the flaws and challenges, but if the goal of an economic system is to improve the lives of the people within a given society—all other systems have fallen short. Critics point out that he overlooks some key issues such as rising inequality and the over-concentration of wealth in society. Others point out he is correct in asserting that over time wealth dissipates and equality becomes more established. The situation today is far superior to what it was a century ago, but that progress is still too slow for the majority of a population unwilling to wait for a hundred years.

The second book is Democracy and Prosperity by Torben Iversen, a professor at Harvard, and David Soskice from the London School of Economics. They assert that capitalism is not only compatible with democracy—they need one another to function effectively. They have three core premises as far as their thinking is concerned. The first is government is key to making capitalism work as this is the entity that can ensure a competitive situation for business. Without the role of government as the establisher of rules and regulation, there is nothing to stop the bad actors from dominating the system. At the same time, the government has to be constrained lest it establish too many rules and regulations that throttle growth and expansion. The second point they make is that advanced societies have many engaged and educated people with a vested interest in a successful and growing economy who will tend to vote for those they consider economically focused. The third point is that advanced business operations depend on networks of people and talents and thus are not all that mobile. They will tend to stay where they are. That means a greater commitment to a given region and the politics of that region.

There are obviously parts of both books that will be challenged and arguments can be launched against the premise. As the U.S. starts to become embroiled in the mud wrestling match that passes for electioneering these days, it is useful to try to separate the inflammatory rhetoric of both sides from reality. The assertion that Democrats have all become socialists is inaccurate as even the most ardent of those on the left are really offering nothing more than welfare-state capitalism. The assertion that all capitalists are committed to putting all wealth in the hands of the 1% is equally absurd and overblown.

Trendy as the Enemy of Function

I admit that grousing about foolish design is kind of petty. There are certainly bigger issues to deal with and far more important concerns affecting mankind. That said, I continue to marvel at the decisions that get made by hotels, restaurants and other public spaces. Yesterday, I was in a very attractive hotel in Napa, but it was heavy on the attractive and pretty light on functionality. It started with the fact I could get no cell service as the hotel had built the place with acres of concrete to protect against earthquakes. I get that, but it would have been nice to know before spending half the night trying to get even one bar.

The two more salient complaints are common enough though. Chairs have been chosen to look trendy and stylish and have that Danish modern image. What that really means is that you slide off the plastic seat so one must struggle to stay at the desk. It is also amazing how many of these chairs are set so low one can't quite reach the computer keyboard. The desk is essentially a plank, barely deep enough to fit a laptop. The lamp is also "tres chic" but casts no usable light. I get it—this is Napa. One is not supposed to be working in one's room. This is a place to do wine tours. But if you are hosting business conferences, you have to assume that some of the attendees will be working at least part of the time.

We may not be able to end world hunger right away, but perhaps we can get hotels to feature adjustable desk chairs. We have to take our victories where we can.

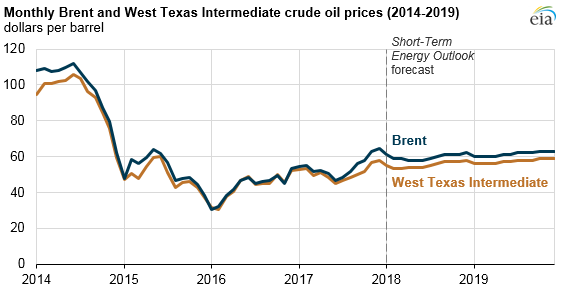

Crude Oil Prices

By most assessments, the price per barrel of oil is likely to stay in the current range for a good long while. This is likely due to the role the U.S. plays when it comes to current oil production. Even a few years ago, the announcement by OPEC that it was cutting production would have set the oil markets afire and prices would be soaring by now. Today, the fact is U.S. producers can offset whatever reduction OPEC and Russia devise—when they want to. They are waiting until prices get comfortably in the 80s and low 90s. At that point, they would kick into higher gear and do some profit taking.