Strategic Global Intelligence Brief for March 25, 2019

Short Items of Interest—U.S. Economy

Inverted Yield Curve Arrives—Time to Panic?

When there is an inverted yield curve, there is a school of thought that assumes a recession is imminent—after all the last seven recessions have featured just such an inverted curve. This is when the 10-year bond yield falls below that of the three-year bond. The inversion essentially means investors think the Fed will lower rates, the current three-year rate will not be sustained through the full 10 years and the 10-year bonds discount the average short-term rate. There are several factors that might affect the situation: (1) the Fed can cut rates when there is no threat of recession as it has done before; (2) the inversion doesn't tell when this recession is supposed to arrive as in some cases it has taken two years; and (3) the system has not worked at all to predict recession in other nations such as Japan and Europe.

Chicago Fed President Predicts Low Rates Until 2020

This comes as little surprise as Charles Evans is one of the more consistent rate doves on the Fed. He has stated many times that rates should not be hiked. Now that the economy has been faltering a little, the likelihood of a rate hike is even more remote. The fact remains that most of the Fed decisionmakers will be paying attention to inflation threats. If they start to manifest, the reluctance to raise rates will tend to evaporate—even for the doves like Evans.

Workforce Participation Numbers Remain Stable

The expectation has been that workforce participation would decline by now—simply due to demographics. The number of people eligible for retirement has surged as the Boomer generation has entered its 60s. The economy has been doing well enough that many of those who would be retiring are not. Many who did retire are coming back into the workforce. This has kept the rate of workforce participation close to 63%, almost three points better than had been forecast.

Short Items of Interest—Global Economy

Oil Prices Hikes May Start to Fade

The month of March has been a busy one for oil prices as they have been going up steadily and now sit comfortably in the 80s. The decisions by OPEC and Russia to restrict production has been paying off and there had been solid demand on the part of oil consumers. This latter factor is starting to fade, however. Last week was the first week in some time that oil prices started to fall a little. The global markets have been agitated and most have fallen. There are also more reports of sharply falling economic growth numbers in Europe, Japan and China. It appears the U.S. will be seeing slower growth than originally expected as well.

French Protests Refuse to Let Up

The left wing was largely left out of the last election as their standard bearer was the deeply unpopular sitting president, Francois Hollande. He did not even make it to the second round. This left the voters with the choice of radical right-wing Marine Le Pen of the National Front and Emmanuel Macron of the center right. The left has now dedicated itself to opposing Macron on virtually every front. This has made progress very hard for the president as he faces strong opposition from both the right and left.

Coalition Politics Likely to Emerge Again in India

In the last election, the Bharata Janata Party (BJP) under the leadership of Narendra Modi pulled off an electoral feat that is rare in that country. The BJP was able to rule without a coalition partner as it swept the polls. The elections coming up will likely change that situation and the BJP will have to find partners in the legislature if it wants to continue to rule. This means it will be pulled in some new directions by the demands of these partners and likely will have to give some leadership positions to the heads of these smaller groups.

Will It Be Cobots That Take Over the World?

The rise of automation and robotics has been controversial everywhere in the world as it has been welcomed as both blessing and curse. The U.S. manufacturing sector was moribund and on the precipice of extinction in the late 1980s and early 1990s as there was no way that U.S. firms could compete against low-wage nations as long as the majority of factory work was going to be done by hand. As the robot revolution took hold in the U.S., the competitiveness of the American firm improved dramatically and the sector is moribund no longer. The U.S. manufacturing sector all by itself accounts for $2.8 trillion of the U.S. GDP. That makes manufacturing larger than the GDP of France or India. The controversial part is that robotics and automation have been largely responsible for the loss of some 20 million jobs in the U.S. manufacturing sector—a far larger number than those lost to migration to other countries. It has not been a giant sucking sound that has cost jobs—it has been the whirring and clanking of a machine.

Analysis: This has been a difficult tradeoff for the U.S. and other developed nations in Europe and Japan, but in a heavily populated nation such as China or India, this transition could be crippling and intensely destabilizing. Countries with massive populations have to keep these populations employed or risk intense political unrest. They can't ignore the advances of technology either. That has led them to explore what has been termed "cobots." These are machines that are designed to work with and alongside people as opposed to replacing the human factor outright. China has been at the forefront of this development as a market that was worth about $60 million in 2017 is now worth around $190 million. Within the next few years, the global market for these cobots is expected to be close to $9 billion. This is a fraction of the size of the robotics market, but it is expected that nations such as China, India and Indonesia will work to actively promote the growth of the cobot to avoid the potential for millions of layoffs and reduced hiring overall.

Cobots are not designed for the kind of businesses that now embrace fully robotic strategies, but are rather pointed at small- and medium-sized business. These smaller companies are dominant in most of the developing world and play a huge role in the developed world as well. They are designed to assist people in certain tasks—often those that are repetitive or those that involved heavy lifting and other manipulations. The aim is to make the individual more flexible and to expand the range of tasks they can be asked to perform. This presumably provides them with greater job security rather than less.

For those seeking a parallel to this development of cobots, look no further than the impact that computers and cell phones have had on the average office. Administrative assistants are far rarer than they once were and perform very few of the tasks they once had responsibility for as people have learned to do far more online than ever before. When someone is asked to perform a specific duty, they have a wide set of options as far as getting help. The spread of cobots has been gaining speed with populous nations in the lead, but this technology is making inroads into the developed world as well. Some see this as having application in people's homes as they use these cobots to help with their everyday tasks.

Trends in Housing to Pay Attention To

Should you want to spark a lively debate at your next party, try bringing up all the changes that have taken place in the housing sector in the last few years. What was once a fairly stable business with some measure of predictability has been shifting and changing as fast as any sector one could care to bring up. Just consider some of the behavioral shifts that have taken place in the different demographics. The members of the Boomer generation are seeking some combination of Club Med and the ER TV show as they abandon their traditional single-family homes in favor of some kind of assisted living. Gen-Xers are not interested in their parent's homes, which is leaving a large stock of existing housing, but often not in the areas that are preferred by the Millennial buyer.

Speaking of Millennial buyers, they are still vexing the home builders and others in the real estate arena. They have been slow to buy homes as they have been slow to start families. There has been some evidence that the older members of the cohort (those in their 30s) are starting to act more traditionally, but they are still likely to be engaged in buying at least one less home in the course of their lives and they are still expressing a preference for multi-family housing.

This year, the housing sector started to lose momentum—actually this process started in 2018. The price of homes started to rise far faster than inflation would suggest. That indicates there are factors at work other than just hikes in prices. The bottom line is new home builders have been favoring the larger home over the so-called starter home. The market for the bigger house has been more or less solid while the headwinds have been affecting the traditional home.

There are perhaps three emerging trends that are rooted in economic shifts and changes. The first is the move away from the traditional home to the larger home as the standard project for new home builders. The second is the transition that Millennials are expected to make as they age and pursue more traditional economic goals. The third is the transition from the Baby Boomer's housing preference to that of the Gen-Xer and the Millennial.

The move towards the larger and larger home is not that hard to figure out. This is the direction the market has been moving for several years now. The people who would likely be interested in that "starter home" will be the most sensitive to changes in the economic environment. They have been hit by everything from higher-priced homes to demands for higher down payments to higher mortgage rates. Lately, the mortgage rates have fallen a little, but that has been a somewhat recent development. Fortunately, some of the other factors have been pointing in a more positive direction. The most important determinant as far as willingness to buy homes is job security. The low rate of joblessness has favored home buying, but many of the people that would ordinarily be in the market for a home are so saddled with debt they have been forced to put their home buying plans on hold.

The weakness in all this is that higher-priced homes react to different inputs. The most important factor for that cohort is the stock market. As the market gains, there are those who feel much wealthier and able to upgrade, but when stocks decline, people feel far more vulnerable. There is also a longtime concern based on what happens as people seek to leave that bigger house behind in favor of that assisted living option. These are not going to be ideal for the market seeking cheaper housing. There is a risk these homes will be unsellable for years.

The second issue rooted in economic issues will be the response of the Millennial. Will the cohort end up emulating Gen-X or Boomers as they age? Will they start families, albeit late? The evidence is mixed. Some have gone down the same road as their predecessors, but many have reached their 30s and are still living in lofts, eschewing children and favoring much smaller homes in urban areas. There are other factors at work which will impact decisions about homes. The average Millennial stays in their job for less than three years as compared with 15 years for the Gen-Xer and 35 years for the Boomer. If one doesn't expect to be employed by a given employer for more than three years, there will be natural reluctance to settle in a given home or even community. The Millennial emphasizes experience buying over buying things. They value community more than those in the past.

This leads to the difference in what is expected in a home. Boomers value substantial kitchens, ample storage for large purchases and large yards. The Millennial wants kitchen gadgets but they don't cook much and need little space. Storage is not as critical as this generation is not the accumulating generation. They are substantially less interested in lawns and all the maintenance that involves. The Millennial does more small-scale entertaining. When they have families, they are small. They are more mobile and want to either rent or buy something that can be sold quickly and easily. Thus far, economic issues have been relatively benign and the housing market thrived for many years. The question now is whether higher rates of inflation and perhaps a recession in 2020 will trigger a negative reaction in housing. These shifts have only started to manifest and the threats may stall, but for now they are worth monitoring.

Analysis: It often seems there is an obsession with housing and housing data, and there is. There are few sectors of the economy that have such profound impact on so many industries and on the majority of the population. It is the most common store of value for the average person—more than their savings or their investment in the stock market. It is also an industry that has tentacles in dozens of sectors—from banking to construction to manufacturing as the factories churn out the things people use to build their homes and items they will subsequently put in them. The real estate business alone employs tens of thousands. Then there will be the legions of people who will be charged with maintenance and repair. And lest we forget, it is the property tax that supports the majority of local government and local school districts.

Farm Prices and Flooding

As the middle of farm country looks at the impact of the massive floods, there are naturally many concerns expressed by those affected directly and by the consumer who is looking at significant delays and losses in terms of food output. Will these floods cause food prices to jump? For the most part they will not, although there will be areas that may see hikes. The fact is most of the nation's farmland has not been adversely affected by these floods. Furthermore, there are many other countries that produce food that can be obtained by the U.S. should the need arise.

Analysis: The bigger issue is what this latest setback does to the overall farm economy. The first thing to note is the affected region is a fraction of the total farm community in the U.S. Most states have not been affected at all. The second thing to note is farming has been under intense pressure for years. That has meant most of those watching their land flood right now have little in the way of reserves. The rate of farm bankruptcy will be far higher than usual along the flooded rivers and perhaps even in areas unaffected by the flood. The most damaging development for farmers this year has not been the flooding, but the trade wars that have cut the U.S. off from its biggest markets. U.S. soybean farmers have been blocked from selling to China and there are restrictions in place as far as selling to Europe and Japan as well. Trade is the lifeblood of U.S. agriculture. It has been badly impacted by decisions made by the White House.

A Somber but Beautiful Day

The Liberty Community Chorus held its latest concert and the theme was a Holocaust Remembrance. The music was written specifically to remember and honor those millions that died. It was a truly odd experience to have such sublime and beautiful music wrapped around the stories and comments of those that suffered.

There is a tiny minority of fools that insist this is all a hoax—idiots that rank up there with the members of the Flat Earth Society. This kind of delusional belief bothers me far less than apathy and ignorance. The fact is that too few people really have a sense of what happened and why. The Holocaust must always be remembered because the conditions that led to it exist today and another such atrocity is all too possible and even likely if we ignore the lessons we should have learned long ago.

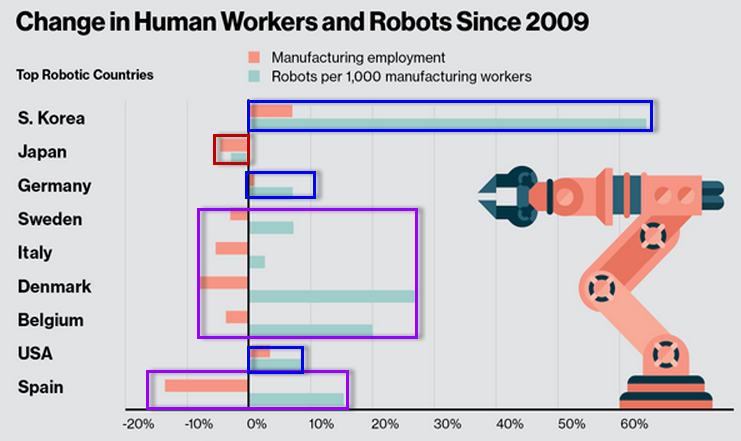

Change in Human Workers and Robots

It is fairly obvious that robots and technology have been remaking the manufacturing world, and at a rapid clip. The most aggressively robotic nations have seen growth in the technology at the same time that people are becoming less and less a part of the modern manufacturing operation. The labor shortage affecting manufacturing is related to this problem as the people that are needed today are those that have the technical knowledge to work with these robot-driven operations. These are not the same people who once worked in these factories.