By Chris Kuehl, Ph.D., NACM Economist

Short Items of Interest—US Economy

Fed Reacts with More Liquidity

While Congress seems bogged down once again and may be delayed by several days and perhaps weeks, the Federal Reserve jumped back into the fray as Monday dawned. The latest actions are similar to those taken as the economic crisis of 2008 took hold. The Fed has declared it will buy $375 billion more in treasuries and another $250 billion in mortgage-backed securities. The banks have been locking down similarly to what took place at the end of 2008. These Fed moves have been intended to loosen that credit. The problem is banks are not getting many requests for loans as business isn't confident in the attitude of the consumer. The consumer is in shock as they contemplate losing their jobs. Even if they wanted to spend, the places they would go have all been closed.

Missing the Recession Antidotes

In past economic downturns and recessions, there has often been a sector that has done relatively well. People seek solace and relief from the stress of that economic crisis. They have traditionally turned to entertainment and escape of some kind. They go to movies, casinos and sporting events. They go to bars and clubs and they go out to eat. They seek human interaction as they are scared and worried about their future. Now all of these outlets are shut off and people are ordered to essentially sit at home and panic. The fear has no place to dissipate and it builds. Those in the mental health community are starting to sound an alarm as they expect everything from suicide to domestic abuse rates to climb.

Job Losses to Hit Record Levels

The Trump White House has tried to get the states not to release their unemployment numbers, but this "advice" has not been heeded. The data that has started to come out suggests layoffs will have already reached record levels—two million by this week. The number of claims for unemployment have never been this high; the system will be utterly overloaded. This means people will be waiting weeks and perhaps months for their benefits to start. The layoffs have been thus far concentrated in sectors such as travel, entertainment, food service, hospitality and retail. The manufacturing and construction sectors will follow shortly.

Short Items of Interest—Global Economy

Europe as Epicenter

The virus threat has been fading to some degree in Asia. China has reported a steep decline in new cases and there has been an expansion of recovery with some 65% of those affected now cured of the disease. Now, the threat is concentrated in Europe. Italy has seen the largest number of deaths, while Spain experienced a 26% increase in just two days. Many of Europe's political leaders are now in isolation or have contracted the disease. Those who reacted quickly are faring better than those whose response was delayed. The U.S. response has been slower than it has been in Italy and Spain.

Trade Restrictions Proliferate

One of the longer-term impacts will be seen in the global trading system. The threat of the virus has all but ended global travel as nations work to ensure there is not a second round of infection triggered by travelers. The export sector has also collapsed as more and more nations adopt a fiercely isolationist approach. Those nations dependent on foreign trade are seeing even greater threat to their economies—Germany is 55% dependent on trade and France is close behind. The U.S. is 15% dependent on exports. Very little has been done to protect the trading system. That will further delay economic recovery.

Oil Prices Drop Again

The failure of the U.S. Congress to reach a deal has caused yet another drop in the oil market. It may be weeks before there is a rebound this time. The demand side for fuel has collapsed and looks to stay in the doldrums for the next few months.

Can the US Adopt a German Model to Deal with Economic Panic?

For reasons that shall remain ever murky, the U.S. is not good at copying what other nations so. There is always some claim that somehow the U.S. is different or the circumstances are different, but there is always a sense that American leaders resent taking an action that some other nation engaged in first. That especially seems to be the case when the idea comes from Europe. As the world tries to deal with the economic disaster that has accompanied the COVID-19 panic, there is a strategy the Germans have employed for years. It has been copied by many other nations—in Europe and around the world. It has yet to be suggested in the U.S.—at least by the politicians. It is called Kurzarbeit.

Analysis: Loosely translated, Kurzarbeit means shorter work time. The plan is simple enough. It has allowed Germany and other nations that have used the system to rebound quickly after an economic crisis. The plan allows a company to send workers into a part-time role and even to have them return home for a period while the government pays them what they were earning. In most cases, the employees are moved to half-time work so the company pays half their salary and the government pays the other half. The result is nobody's financial situation changes—they make the same income they always made and can participate in the economy the way they always have. At the end of the crisis, the company is not faced with the task of hiring new employees and training them. They simply bring their workers back to full time and resume operations as they were doing before the crisis.

The U.S. leaves companies with a miserable choice. The decision is between keeping everyone working as long as the company can or losing the talent needed when economic conditions improve. Inevitably the best of the laid-off workforce is lost forever as these are the ones who can find new jobs. The workers that are fired are left to apply for unemployment compensation which is nearly always a fraction of what they had been making. If the aim of the financial boost is to maintain consumer spending, the U.S. system is wholly inadequate.

The additional advantage to the system of Kurzarbeit is companies retain maximum flexibility during a fluctuating economic crisis. They are not mandated to move people to half time or quarter time—they can decide how long they need to reduce work time and can bring back as many as needed and when they are needed. This allows for a graduated response to economic conditions.

How Singapore Escaped the Worst

The first place COVID-19 appeared was in China—everybody knows this by now. What is generally less known is that Singapore was the second with cases appearing in early January. This city state is one of the most densely populated countries in the world, but to date there have been two deaths. Both took place this past weekend—both had contracted the disease outside Singapore. The rate of infection is among the lowest in the world. What have they done differently than many other nations?

Analysis: Analysts from the World Health Organization point to Singapore and assert it did all the right things and in the right order. The borders of the country were closed immediately upon learning of the outbreak in China given that fully a third of the population of Singapore is Chinese and have extensive contacts into parts of China that had been infected. The country immediately engaged in widespread testing and closely monitored those who were carriers. The population deemed at risk was tested very quickly and repeatedly, and were treated aggressively. The message from the government was unified and consistent. People were told very specifically what to do and what not to do. The decision to limit contact in large groups was issued early and enforced. People were issued very specific guidelines regarding personal hygiene.

There are advantages that other nations do not have. This is a small nation of around six million people, but it is also a densely populated place where strict social isolation is challenging. The population has lived under a semi-autocratic regime for decades and has long been accustomed to following strict rules for behavior (one can still be arrested for littering). The most important lesson to be learned from Singapore is preparedness. Several years ago, the country grappled with one of the most threatening outbreaks of SARS and reacted by strengthening its public health system. There has long been an official pandemic response agency. The country has stockpiled the equipment it assumed it would need at some point. There has been no shortage of test kits, no shortage of respirators or protective gear. The government long ago adopted the German system discussed above. Life in Singapore is not normal at the moment, but the economic and health damage has been limited.

What Do the Worst- and Best-Case Scenarios Look Like?

As is nearly always the case, the most damaging part of the COVID-19 crisis is the uncertainty. This is what makes the issue worse than some natural disaster such as a hurricane. In the latter case, we know the damage right away and can start dealing with it—no matter how bad. The virus outbreak is like a war—nobody knows how long it will last or how much damage will be done. If we knew that six weeks of shutdown would do the trick, we could all look forward to May and a return to normal, but what if the shutdown lasts until June or August or October or March of 2021? In the most general of terms, there are two alternatives—an optimistic one and a pessimistic version.

Analysis: The pessimists look at a year from now and see over two million deaths in the United States alone—far beyond the death toll that is reported annually by outbreaks of the flu. Hospitals are utterly overwhelmed by the influx of sick people. That costs even more lives as there will be an inability to deal with other issues such as heart attacks, strokes and even injury. There is a social breakdown as people refuse to continue to live in isolation. That accelerates the spread of the virus while inviting conflict between those who want to maintain the protocol and those who don't. The authorities will step in with ever more draconian steps such as were employed in China—placing those that test positive in detention. The economy will utterly collapse into depression with quarter after quarter of negative growth rates. The efforts of the central banks will not be enough and the fiscal side will be unable to keep up. Handing people a check for $1,200 is not enough when they are out of work for months—a minimum wage earner making $15 an hour will make $1200 in two weeks and nobody in government is suggesting a $1200 payout twice a month. The majority of small businesses close permanently and layoffs result in jobless rates close to 20% or higher. The disease doesn't die off in warmer weather. The vaccine is delayed or is ineffective and the whole infection process ramps up again when winter arrives.

Now that you are thoroughly depressed and ready to try living off the grid somewhere, it is time to look at the optimistic scenario. By March of 2021, life has returned to normal as the virus dissipated by the early summer of 2020. The combination of lockdown and the natural dissipation of the virus as temperatures warmed resulted in a sharp decline in infections by the end of May 2020. The second wave of infection that arrived as the temperatures cooled was blunted by the fact many had developed immunity. It was discovered that many more had immunity from the start. Effective drug treatments were developed so those who got sick would survive. The death toll remained in the thousands and concentrated in the vulnerable populations such as the elderly and those with respiratory issues. This meant a concentrated focus on that population with aggressive testing and early treatment. By the start of 2021, a readily available and effective vaccine had been developed. The economy sustained a body blow in the spring and summer of 2020, but rebounded strongly by the end of the summer as consumers rushed to resume their old patterns and investors hurried to scoop up bargains.

Which of these will come to pass? This is simply not known at this point, but based on past pandemic scares, the betting leans towards the more optimistic scenario given the efforts that are underway. The moves to slow down the virus are essentially designed to buy time for more permanent response. The virus threat will not be eliminated until there are effective treatments and ultimately a vaccine. So, the goal in the meantime is to reduce the immediate pressure on the health care system and limit casualties.

Political Paralysis Worsens Situation

It has become impossible to look to the elected officials in Washington for help at this point. Despite a total collapse of the stock market, an economy plunging towards depression, millions of people thrown out of work, tens of thousands of people infected with COVID-19 and a near nationwide shutdown, Congress has been unable to stop fighting with one another long enough to act. The bailout package has been stalled as Democrats and Republicans continue to attempt landing ideological blows against one another.

Analysis: Democrats object to a provision in the plan that provides the Treasury Department some $500 billion that could be used to make loans to business and even to other political jurisdictions. This sum is about twice what Treasury Secretary Mnuchin asked for and Democrats have referred to it as a "slush fund." The GOP has objected to measures that would tie government help to agreements not to lay off employees. This has been the approach taken by many governments in Europe—offering business help only if they preserve jobs.

The inability of Congress to act under these circumstances triggered global markets to fall even further. Oil prices dipped again and so did other commodities. The most worrisome aspect of this crisis has been the fact that leadership has been non-existent. The warnings of a viral outbreak were sounded months ago and ignored by the Trump administration—denied even through most of February. Congress has been unwilling or unable to take even the simplest step to limit the damage and the economy is in free fall. There has not even been a national response to slowing the spread—only states and cities have been able to move towards isolation— as if viruses plan to observe state and community borders. The messages from government officials have been contradictory and often incoherent. That has left people to get their guidance from Facebook.

Reactions

There are two kinds of people in the world—at least as far as reactions to chaos are concerned. I have been watching this from afar as I note all the comments pouring from Facebook and other social media. There are those who abandon all shred of civil behavior and revert to their college dorm days. It seems pointless to clean one's house when nobody is coming over. Take out containers start to pile up, the only decision is when to change from day pajamas to night pajamas. Then, there are those who careen off into the other direction.

I spent the weekend cleaning and organizing my garage. I dug through every drawer and grouped all the stray nuts and bolts. New slots were created on the peg board and new shelves were installed. Things I had been searching for over the last year magically reappeared. I found things I didn't even know I had. Now, I have several of them. I have to confess I am something of a control freak and chaos bothers me. I am not obsessive about this—really. It is just that I prefer some order to my existence. It is the reason I shy away from situations where I am not in possession of my faculties. When faced with the vagaries of life, I tend to seek solace in knowing where all the screwdrivers are.

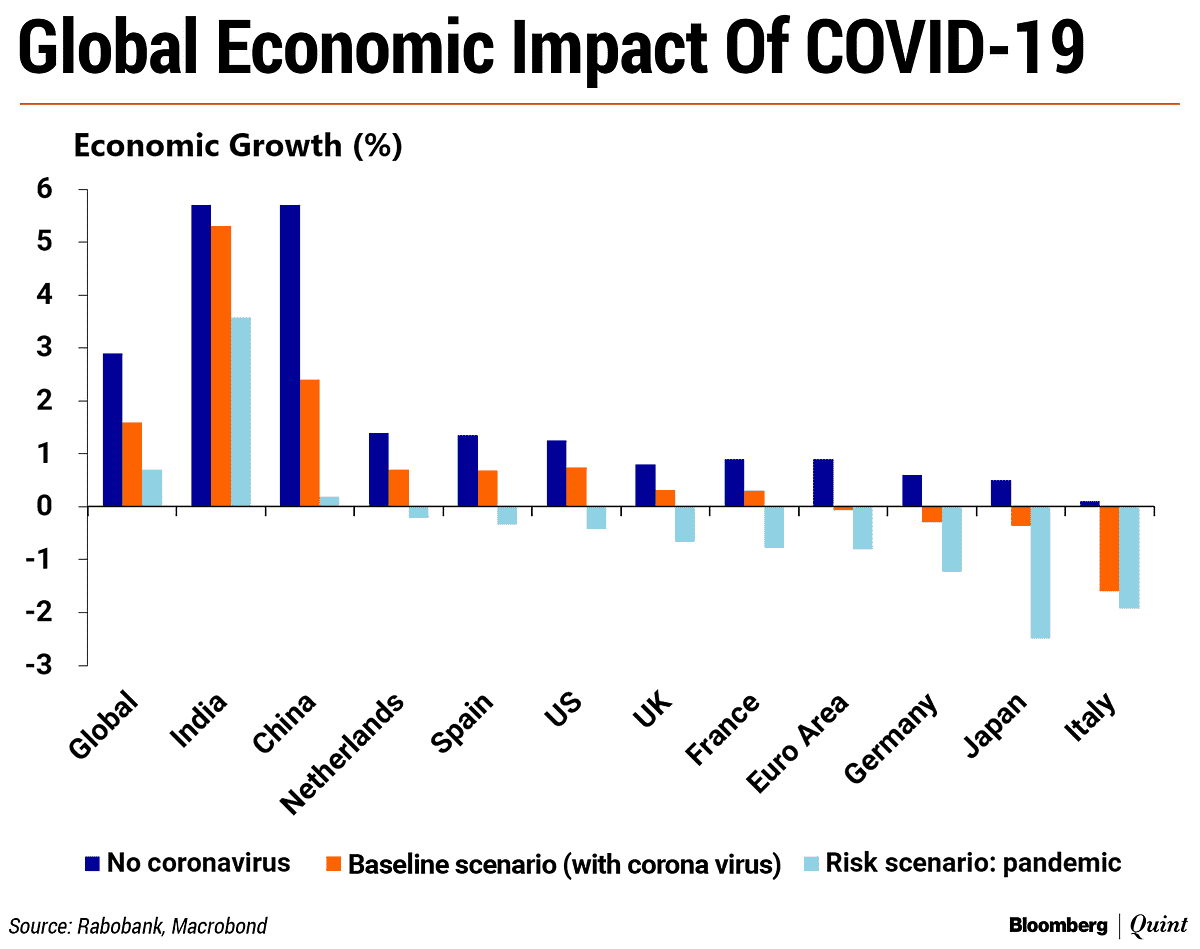

Global Economic Impact of COVID-19

This is not the cheeriest of charts, but it certainly points at the risk. The majority of nations will be facing recessionary conditions this year if the pandemic is not slowed to a significant degree.