By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—US Economy—

Virus Crisis Number One

As the reaction to the virus crisis expands, it has become abundantly obvious economic collapse is very likely. There are sectors that will be in bigger trouble than others. At the top of the list will be small business. If Seattle is any indication, the toll will be extreme. In many respects, the city has been at the epicenter of the U.S. outbreak and has been more aggressive than many other communities as far as enforcing "social distancing." The small business community is already reporting a major crisis. The expectation is some 30% to 40% of them will be forced to shut down in the next two to three months. This creates a crisis for employees, suppliers, banks, landlords and ultimately consumers. The larger companies have the resources to recover should the crisis ebb in the summer—many of the smaller companies will not last that long.

Virus Crisis Number Two

The law enforcement community is preparing (to the extent it can) for an explosion of crime. There will be many people suddenly confined to their homes and under a great deal of stress so the expectation is domestic violence will swiftly escalate. There will be more people in dire financial straits; they will be more likely to turn to crime to survive. Drug use is already spiking as people are not handling the stress well. There are already incidents of altercations between people with different attitudes towards the crisis. Those wearing masks are being attacked by people who think this is all a hoax. Those refusing to comply with the warnings are under attack from those who consider that attitude to be a threat.

Virus Crisis Number Three

Lingering doubts about when the crisis is past will play a huge role as far as recovery. The latest polls suggest very few people in government have any credibility left with the public. The constant denial of the problem has now given way to declaring a national emergency. The upshot is people have no idea what or who to believe. At some point, it is assumed some kind of "all clear" will be sounded, but that will not mean there are no more cases. Will the public be willing to go back to old patterns right away? The polls suggest they will not. Most are now asserting they will not want to go back to normal for many months.

Short Items of Interest—Global Economy

China Plunges into Depression

If China's experience is any indication of what the rest of the world faces, the next several months are going to be very rough indeed. Every indicator for China has collapsed to record lows. The Purchasing Managers' Index is down to the 30s, industrial production numbers have never been lower, exports have all but halted and now there have been massive job losses. The estimate is that almost 40% of the population in Wuhan is now out of work. There remains a faint hope that recovery is possible this summer, but that all depends on a consumer willing to get back in the game—not something that can be assumed.

Calls for Eurozone Coordination

Every nation in the European Union is now engaged in some kind of stimulus effort, but there has been almost no coordination as it has been an "every nation for itself" reaction. Some states such as Italy and Spain, are fighting a health challenge that has overwhelmed their capabilities. Other states, such as Germany and Sweden, are facing more of an economic threat as they seem to have a better handle on the health issue.

Where Is the Reaction in the Developing World?

For the most part, the COVID-19 threat has been to the developed world in the north. Latin America, South Asia, Africa, etc. have seen less. Is this due to the lack of reporting or does the temperature have some role to play? This has been a focus for the health authorities of late.

Global Recession Is Certain—Question Is How Long It Lasts

This crisis is thoroughly unprecedented. It has left the analysts more than a little flummoxed. It was only a week ago there were legitimate questions as to whether the COVID-19 crisis would trigger a recession. Now it is quite obvious one has already begun and engulfed the entire world. The questions now are how bad will it get and how long will it last. Neither of these will be easy to answer. A major part of the problem is the majority of the damage done to the global economy has been self-inflicted. There can be ferocious arguments over whether these responses are justified, but the fact is these steps have been taken and the damage has been done and will continue to be a factor.

Analysis: As is usually the case, there are basically three scenarios—the good, bad and the ugly. Even the good option is really not all that good and the ugly is really, really bad. At this juncture, it is nearly impossible to give percentages as to which of these are the more likely. In a month or two, that will become more apparent.

The "good" scenario holds this virus threat fades within the next month or two—by June or so. This means new cases decline radically and the health system has a chance to catch up. The ability to test will ramp up. The most vulnerable will be identified and the system will be able to cope. This would mean a cautious return to normal with reduced restrictions and the opening of schools and businesses. The challenge at this point will be the attitude of the public. Will they believe all is now well? Will they return to their old patterns or will they still be hoarding toilet paper and avoiding the rest of the world. It may be end of summer or even later before confidence is restored.

The "bad" scenario holds that virus outbreaks continue at a rapid pace for the next several months—into the summer and even later. This will likely mean an even tighter containment effort—akin to what was implemented in China. The shutdown in the affected regions closed ALL business and confined the entire population to their homes. Italy has already come very close and the U.S. has now tried to ban gatherings of more than 50 people which effectively ends anything approaching normal life for the next two to three months.

This leaves the "ugly" scenario. This will mean a total shutdown of anything that brings people into contact with one another—whether this be small groups or simply one-on-one interaction. Business will be forced to close altogether and everyone goes into quarantine. This means deaths are skyrocketing and panic is out of control. It will undoubtedly mean using the police and military to enforce the isolation. It MUST be pointed out that NOBODY in the U.S. has called for this level of response, but it must also be understood that China has turned to this extreme in places that have been hardest hit.

Fed Engages in Emergency Moves

There was little choice as far as the Federal Reserve is concerned—in fact there has been little choice as far as any of the central banks. Rates are being slashed to zero. Every measure that can be taken is now being implemented. There will bond buys and actions akin to the three rounds of quantitative easing that took place a decade ago. The frightening aspect of this strategy is that even as these moves are being made, there is little confidence that they will have any impact at all. It is simply not that kind of economic issue.

Analysis: Lowering central bank interest rates is a strategy designed to encourage bank lending in a time of economic insecurity. It presumes business will take advantage of the low rates to expand and that consumers will react to lower rates when they want to buy a house, car or any other purchase. Lowering rates does nothing when the issue is people afraid to leave their homes, go to work or to travel anywhere for any reason. Even direct spending from the government will have a limited impact as people are still not going to engage in consumer activity. The very core of the U.S. economy is consumption. This has all but ceased.

Who Gets Hurt First?

This question has already been answered. There are sectors of the economy that have been crushed by the outbreak to the point their survival is in jeopardy. The travel industry will be in crisis for the next several months. Right behind it will be the entertainment sector. Even should the official ban be lifted (and that is a big if at this stage) the majority of people will stay away for perhaps months. The retail sector is getting hit hard now. That will accelerate as will the damage to the restaurant sector. These are businesses that operate on very narrow margins at the best of times. Many will not survive two more months of isolation.

Analysis: In truth, every part of the economy is going to be hit by this. At this stage, it is not the virus itself that will be doing the damage, but the reaction to it. The facts have not changed as far as who is most vulnerable to the disease. It is a threat to the elderly and those with compromised immune systems or existing lung issues. Unfortunately, this group numbers in the millions. To protect them requires extreme measures. These measures may or may not work as far as limiting exposure, but what is certain is that these steps will plunge the U.S. and the world into a real depression. Several medical commentaries have suggested this is akin to amputating a person's legs in order to halt the spread of gangrene. It has to be done if the patient is to survive, but the "cure" itself will be life altering and ensures nothing will be the same.

The 'Real' Threat to the Global Economy

There will be many reactions to the sudden and unexpected loss of business in dozens of sectors in dozens of countries. Given the anticipated loss of economic activity due to the enforced shutdowns, the business community will have to weigh its options for survival. In past crisis situations, the first action taken has been to lay off millions of workers. Most companies do not have contingency plans that prepare them for this kind of abrupt reduction. They will turn to cost reduction as a first line of defense. There will be reductions in acquiring production material of course—there will be little demand to meet. Along with that reduction will come reducing the size of the workforce, and perhaps radically. As with all the other reactions to this crisis, there are several scenarios. How quickly the economy will be able to bounce back will largely be determined by how the worker reduction is handled.

Analysis: That these layoffs are coming is not in doubt. In fact, they have already started. By the end of this month, it is expected that millions of people will have lost their jobs. The first place this will occur will be in the sectors initially affected (travel, entertainment, etc.). The spread will be rapid and will affect manufacturing, construction and even health care to a degree. The worst-case scenario holds that those fired will simply be dismissed with no provisions for rehiring. The decision will simply be to cut the workforce loose and start over in a few months with new people. This is the usual pattern for business as the layoff decision is usually based on some kind of economic slump expected to last indefinitely. This crisis is different or at least it could be.

If the business community really accepts the assertion that two months of draconian response will turn the tide and allow them to get back to normal activity, they will not want to lose the skilled and trained workers they now have. This would mean instead of firing people outright they will engage in furloughs, temporary dismissals and other techniques that allow them to hang on to their employees until business resumes. The decision will be based on whether they believe "normal" returns in two months. It will matter how easily they think they can replace the fired workers.

The vast majority of low-paid workers with limited skills will simply lose their jobs. They will have to hope a recovery happens in a few months as they try to find new jobs. The sectors that do not expect a rapid recovery will also fire people outright. The sectors that expect a bounce back this summer will try to hang on the workforce, but will still try to reduce what they are paying them with forced unpaid leave and other techniques.

Estimates are still all over the place with a very wide range. The optimists hold that the rate of joblessness will likely go up to perhaps five or six percent. The pessimists hold that seven or eight percent unemployment is more likely—at least in the short term.

Britain Takes a Very Different Approach

The majority of the global response has been similar—some combination of isolation and self-quarantine. The U.K. has chosen another path; it has been judged to be extremely risky. There will be no attempt to limit crowds or to isolate on a grand scale. The idea is that as more people are exposed, there will be more recoveries and the virus will fade out as there will be more people with the immunity that supposedly comes from having had the virus once already. The notion is there will be a dramatic peak as far as infection goes and then a rapid decline.

Analysis: The critics point out two problems. The first is there are already cases of people getting re-infected after they have had the virus. This has been rare, but it has happened. The second and bigger concern is there will be a dramatic spike in the death toll in the short term. Even the British admit they expect between 300,000 and 500,000 people will die as the virus spreads. Their assertion is that even with containment efforts there will be at least that many killed and the containment efforts will only add economic calamity to the set of bad outcomes.

This will be an "experiment" with immense impact. If the U.K. has the same rate of infections and deaths as those nations that are shutting their economies down, it will call into question the whole isolation approach. Future response to outbreaks could shift to accepting a certain death toll and an emphasis on trying to treat victims as opposed to trying to keep people from contracting and spreading. It remains to be seen whether the U.K. will stick with this strategy as the number of deaths and serious illnesses mount. The pressure on Prime Minister Boris Johnson's government will be immense to follow the patterns of other nations. That pressure will mount if the isolation tactic works and other nations see an improvement in the next month or two.

Speaking

We have been listing the upcoming speaking engagements as there have been readers interested in the opportunity to attend some of these events. Thus far, there have been 11 presentations canceled or postponed until later this summer and into the fall. It is impossible to say which of the remaining meetings will take place, but it would be a good bet to assume all will be canceled in the coming days. There seems little point in listing these until there is some assurance they will not be cancelled.

Handling a Crisis

By the time people reach adulthood, there are certain things they know (or at least they should). One of these things is summed up in the phrase "life is what happens when you are making other plans." We simply do not know what is going to happen to us tomorrow, next week, next month or in the next five minutes for that matter. That is why we try to build in some ability to respond to the unexpected—the whole notion behind insurance. Some of us are more diligent than others about this (doomsday preppers are feeling very smug right now). Business is all about contingency plans and preparation for the worst. The question we need to ask collectively is why our elected officials are seemingly unaware of this need for strategic response.

Despite the last 10 years of outbreaks (SARS, MERS, Zika, Swine Flu, Avian Flu, Ebola, Marburg, etc.) the U.S. has cut funding to the public health system. Some of these decisions to gut the system were Trump's, but Congress acted to reduce funding as well. State legislatures cut funding and so did many cities. Today, we face a pandemic with no ready means to test people, insufficient capacity to care for those who are ill, no vaccine, no treatment and no way of really stopping the spread. Would more money and resources have made a difference? It is impossible to say given that nobody had dealt with COVID-19 before, but it has to be assumed that a two-month delay in responding and a complete lack of a contingency plan hasn't helped.

There are lots of important issues for candidates to be discussing between now and November. At the top of the list now are two questions to ask of everybody who intends to lead. No. 1: If you have been in office these past few years, why did you allow the U.S. to be this vulnerable to a threat we have seen coming for decades? No.2: If you are elected (or reelected) to office what do you intend to do about this vulnerability?

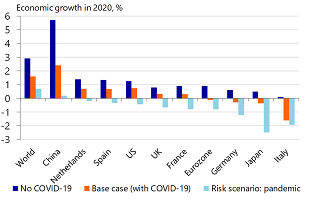

Economic Growth in 2020

Might as well continue with our cheery issue. The estimate as far as economic fallout is for global growth. For all intents and purposes, the entire world will be in recession territory for the entire year. That assumes there is something of a turnaround on infection rates this summer. The light blue line on the extreme right is the one that suggests this crisis doesn't ebb in the next eight to 10 weeks.