Strategic Global Intelligence Brief for March 13, 2020

By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—US Economy—

Reactions

There may still be a good bit of debate over who is and who is not at risk from COVID-19, but there is unanimous agreement that the virus has devastated the global economy. The issue started out as a supply chain crisis stemming from the shutdown in China, but now the reactions to the outbreak have meant massive economic dislocation. The central banks around the world are slashing interest rates, opening up liquidity, buying bonds—anything they can think of that might provide any sort of stimulus. The Trump White House has promised some kind of stimulus through tax cuts, but nothing has emerged as policy. Congress seems ready to release a package of tax cuts and spending efforts, but it may too late for the hardest-hit industries. The markets staged a brief rally, but few expect this to last long in the face of the coming containment efforts.

Layoffs on the Way

Hundreds of companies are warning they will have to start laying people off by the end of this month. This is mostly in sectors such as transportation, entertainment and hospitality as these have been the businesses hit the hardest by the new isolation procedures. The retail sector will likely be next and perhaps manufacturing if the consumer starts staying away from the stores in large numbers. The estimate is unemployment rates could climb as high as 6% in the near term, but many of these workers would be hired back once the crisis has passed. Optimistically, that rehire process would begin later in the summer.

Testing Update

From the start of the virus crisis, the most consistent critique has been the slow pace of testing. Almost three months into the crisis there is still no widespread plan for testing, even in the areas where the virus has been identified. There has been a declaration from Trump that testing will accelerate, but no specifics have been offered. There is a new test that reveals results 10 times faster than the one used in the U.S. Germany has been using it for weeks. Its widespread deployment would help identify the most-at-risk regions.

Short Items of Interest—Global Economy

China Virus Data

It would appear the Chinese have turned a corner on the virus as there has been a drop in new cases that takes the number of new infections into the single digits. The fact that President Xi Jinping visited the region personally suggests the Chinese think the major threat has passed. The situation in Italy has worsened, but Germany still seems to be well under control. The focus for most nations continues to be on the at-risk population of those over 60 and those with compromised immune systems.

Oil War Continues

There is no sign that Saudi Arabia or Russia intend to reduce the pressure they have placed on the oil world. They have cut prices and stepped up production, and they have declared they are not backing away. Part of this has been to preserve cash flow at a time of reduced demand, but the bigger part of the plan is to put immense pressure on rival producers such as the oil shale companies in the U.S. There has been no real reaction from the U.S., but severe criticism has come from states such as Canada, Norway and the U.K.

Massive Reaction in Europe

The extreme measures taken by Italy to halt the virus spread are now being taken by most of the other nations in the EU. France and Spain have already pushed ahead on travel restrictions. It is assumed some 190 million people will soon be required to halt all normal activity—including travel or going to work. The EU is now prepared to spend virtually its entire budget on the crisis. This creates major concerns regarding the ability to deal with any other issues—such as immigration and infrastructure. Europe is already on the brink of recession. This could well push them into a full-blown depression.

Last Look at the World When It Was Normal?

The collection of indices we put together for two industrial organizations reflect the data collected prior to the worst of the coronavirus outbreak. It is almost a snapshot of the world pre-crisis. The overall sense was that things had been going pretty well prior to COVID-19. That offers some solace as it might suggest that when the crisis is declared at an end, there would be a chance for the economy to rebound a little. What follows is the summary and some excerpts from the report prepared for the Chemical Coaters Association International and the Industrial Heating Equipment Association.

Analysis: The numbers revealed in this month's index will someday be remembered as the "good old days." This will be the last version that can be termed "PCV" or pre-corona virus. For the next several months, the data is going to look very bad. It will be important to look back on the last couple of months and remember that conditions looked pretty decent at the start of the year. There has been a lot of discussion about how healthy the fundamentals have looked in spite of the crisis, but that was before the reactions started all over the country. The next month will show drastic reductions in business activity in many sectors and the job losses will start to mount. The hope on the horizon is that COVID-19 behaves like others of its kind and starts to fade as the weather warms. If the worst of the impact is in March and April, the recovery will be obvious by June and July.

This month reveals only four indicators that are trending positive and eight that are trending negative. The semi-good news is that several of the negative readings are only slightly in that category. The fear is that next month the decline will be more noticeable. The four that are providing a positive outlook include new automobile and light truck sales—a very solid signal that consumers are still into their new rides. There was also a nice boost in steel consumption. That suggests there has been more construction activity taking place in the public sphere. There were some improved numbers with appliances as there continues to be more demand than there are inventories to support it. Factory orders were also up slightly as consumers have remained active despite the threat.

Now, the not so good news. The big declines were seen in the readings for metal prices (and commodities in general) as well as capital expenditure, credit and transportation. The only one that really crashed hard was capital expenditure. That is partly due to the slump in manufacturing that started last year. The majority of this slide has been in terms of buying machinery. The metal prices have been dropping (except for gold). That is related to loss of demand. Oil has been particularly hammered because there has been an oil war launched by Saudi Arabia and Russia at the same time. The credit managers are still seeing decent numbers in the favorable categories such as sales, applications and dollar collections, but the unfavorable factors are trending down with more disputes, bankruptcies, slow pays and other issues. Transportation feels the pinch of lost business first. This time has been no exception.

The other negative trends have been a little less dramatic. The housing market still remains healthy, but new home starts are trending down despite the lower mortgage rates. The high-end homes have been appealing to those buyers who have been making money on the markets; that run has now ended. The other homebuyers are put off by higher prices. The level of capacity utilization has been sinking, but it is still not far off the pace considered normal. The trend had been better a few months ago, but has not been ideal lately. The durable goods numbers are off, but that is still largely connected to the issues faced by Boeing and the overall aerospace sector. The other elements of the durable goods sector look OK for the time being. The data from the Purchasing Managers' Index had finally started to show some rebound after sitting in contraction territory for several months. Now, the numbers have slipped back into the 40s, which will likely continue.

It is hard to say what these numbers tell us. This is uncharted territory for the U.S. What started as a supply chain crisis provoked by the outbreak in China has exploded into a crisis that has all but shut down the entire U.S. economy and ended the bull market run that had lasted longer than any since the end of WWII. The impact has been staggering as the U.S. seems to have missed the opportunity to deal with this at an early stage. The contrast has been with Germany as they have 1100 cases and two deaths because they started testing the vulnerable population immediately upon noting the outbreak in China and took steps to isolate and protect those at risk. The U.S. (and many other nations) waited for weeks and months to react. The most optimistic assessments have this crisis lasting until early to mid-summer.

New Automobile/Light Truck Sales

The analysts have been predicting the end of this run for over two years now. So much for our forecasting abilities. Everything seemed to point to a breaking point for the consumer—people were hanging on to their cars for at least 11 years, the saturation level was as high as any nation in the world and there was not much that differentiated the various models. There was not even pressure from the price of gas as it has been staying low. The consumer was also enjoying a low rate of unemployment and low interest rates. These have all been a factor in prolonging the demand for vehicles. Whatever the cause, the impact has been clear enough—automotive sales have been stable. That has meant the whole sector has been stable. The importance of the vehicle manufacturing sector is hard to overestimate given that for every person working in an auto-assembly plant there are 17 people whose jobs depend on that assembly. There could well be a drop in demand in future months, but for now, the sector is stable enough.

New Home Starts

The housing sector has been a definite bright spot for the economy the last few months. That remains the case even as the current data show a dip. These are still the highest numbers seen in several years. There are many factors that should continue to propel the market going forward, but there are also some potential problems emerging. The main driver has been a shortage of housing in several key markets—the fast-growing cities such as Nashville, Austin, Seattle, Atlanta and others. The millennials are now in their 30s and ready to buy that single-family home, but there is still solid demand for the multi-family unit. The crisis that has gripped the markets is having a profound impact, and from multiple directions. The reduction in bond yields and the cuts in the federal funds rate have driven mortgage rates down, but the cratering of the stock market has negatively affected those who have been purchasing the higher-end homes. They have been reacting to the growing market. Now, they are not experiencing that growth. The ongoing issue in many markets has been the profound shortage of workers to do the construction of new homes.

Steel Consumption

The level of steel consumption has been improving for the last several months, which has been somewhat unexpected. The three areas that drive steel use include construction, automotive manufacturing and general appliance/durable goods manufacturing. All three are doing better than many had anticipated. The biggest factor as far as construction has been an increase in public sector activity. Although the federal government has not stepped up to address the deterioration of the public infrastructure, there has been reaction by states and local governments. That has led to more demand. The auto sector has been holding its own, which contributes to demand as well. The general manufacturing sector is the smallest share, but in that category are those that demand many of the specialty steels. Thus far, these are doing well—especially in medical manufacturing and food-related equipment. The big slowdowns have been in the energy sector as well as aerospace, but the latter is not all that significant to the steel sector.

Industrial Capacity Utilization

The most worrisome development over the last several months has been the decline in the rate of industrial capacity utilization. This dip has not reached a real level of crisis as the numbers are still in the high 70s, but as we have pointed out, the "normal" rate is between 80% and 85%. When the rate is below 80%, there is slack capacity. That will mean that companies will not feel the need to add new machines or new people. When the rate is above 85%, there will start to be bottlenecks and shortages and an impetus to add capacity. It has been a long time since the rate was at the upper end, but it was only a few months ago that utilization was in the right range. These readings suggest a sluggish manufacturing sector. That is likely to be the case going forward—with or without the added stress of the virus panic.

Capital Expenditure

This may be the most distressing of the readings encountered this month. It is one that stands to get worse as the months progress. The business community is at a virtual standstill and that has crushed the incentive to engage in capital spending. The fact that capacity usage numbers are down illustrates that business is not thinking much about expansion—either in terms of machinery or real estate. This is a category that started reacting to the COVID-19 crisis very quickly. The issue is not related to health, but to the extreme measures taken to ostensibly contain it. The suspension of travel has dented business. Now there are shutdowns taking place that affect areas with very little (if any) exposure. The good news is that expenditures were up the month prior. Even with the recent decline, the current status is not extreme.

PMI New Orders

The data from the Purchasing Managers' Index (PMI) had finally managed to crawl out of a five-month period in contraction territory with a reading of 50.9. There has been a similar pattern as far as the new orders index was concerned. It had fallen into the 40s last August and has been languishing there for the past several months. In January, it broke back into expansion territory with a reading of 52, but has now slipped back into the contraction zone with a reading of 49.8. The likelihood is this decline will extend through the next few months as the virus issue affects the overall business community. The new orders data is generally seen as the harbinger of things to come. It worries analysts that there has been such a rapid and dramatic fall since the peaks last year at this time.

Struggling

To note that the COVID-19 crisis has presented the U.S. (and the world) with an unprecedented challenge would be the understatement of the century. It is a health battle, an economic threat and a political issue—all wrapped in one. I have a personal stake in all this (as does everybody else). There is the desire to remain healthy, but there is also the fact that five of my speaking gigs have been canceled. I expect all of those due to take place in March and April will also vanish. I have been focused on the massive economic damage that has been done and will continue to be an issue. It is safe to assert we will be facing a near recession this quarter—the only real question is how long it lasts. I maintain that by mid-summer the situation will have started to reverse, but that depends on somehow getting an "all clear" statement and believing it.

There are extremes as there always are. There are those who assert this is a modern-day plague that will infect billions and kill millions. Then, there are those who somehow assert it is all a hoax perpetrated by liberals or Russians or aliens. Neither is even remotely correct. I understand that 85% of those who get the virus will experience little more than bad cold or flu symptoms. I also understand that people over 60 and with weak immune systems are at far greater risk. It comes down to what we are willing to do to protect the vulnerable. It gets personal at this stage. Two years ago, I was undergoing treatment for throat and tongue cancer. Chemotherapy every week and radiation every day. I lost 60 pounds in two months and was as exposed and vulnerable as one could get. If this virus had been around at that point, I would have been in the strictest quarantine for at least three or four months. That period of my life was one of the roughest I had ever experienced. I can't imagine how much worse it could have been.

I am not happy with losing business and I am certainly not happy about the blow this has inflicted on the economy. I am appalled at how poorly the government reacted to this threat and remain frustrated with the chaos and the overreaction by those hoarding toilet paper, but if the alternative is to condemn the elderly and sick to a virus that destroys their ability to breathe, I am willing to tolerate the disruption.

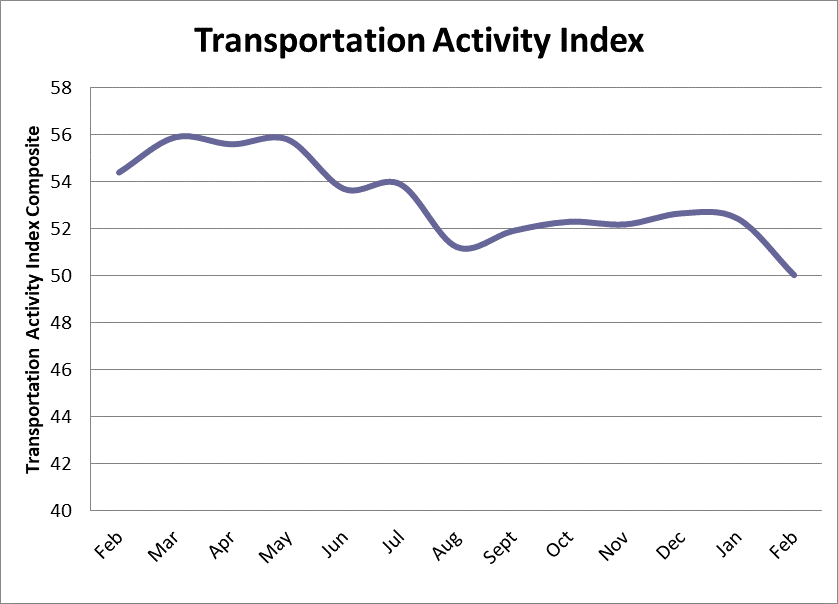

Transportation Activity Index

The canary is on life support. If the transportation sector is still playing the role of the bird in the mine—it has obviously stopped singing—not a good sign. The crisis for the freight sector got under way when the primary issue was the supply chain crunch in China and other Asian states. The lack of imports was noted right away. In subsequent weeks, there has been reduced productivity in almost all sectors—leaving the transportation providers with very little to do. This was an accelerated rate of decline; it is going to get far worse as long as the reaction verges on panic.