Strategic Global Intelligence Brief for March 13, 2019

Short Items of Interest—U.S. Economy

Inflation Threat Remains Tepid

Economists have been accused of being more than a little like Cassandra with their repeated warnings of events that nobody chooses to believe until they come to pass. Inflation has been on the minds of analysts for several years now as the ingredients seem to have been in place for a while. They are: low levels of unemployment, commodities in short supply and an abundance of spare capital after over 10 years of central bank stimulus. The latest data shows that even with all this in place, the threat remains remote. There was no spike in the Consumer Price Index despite some hikes in the price of gasoline, housing and food. That doesn't mean there is no threat from higher inflation later, but for now, the situation is not imminently threatening.

Vehicle Tariff Plan Faces Opposition

Trump has often referred to himself as "tariff man" as this has been his favorite tool to alter trade patterns. The imposition of steel and aluminum tariffs have had mixed results, but there was generally support for trying to protect the U.S. metal production sector. He is not getting anything near that level of support for his efforts to target vehicle imports from Europe. There has been focused opposition from the car makers and from European allies, but there has also been resistance from within the GOP and among consumers. This would be a very unpopular move; one that could likely backfire badly.

Will They or Will They Not

The truth of the matter is nobody is privy to the details of a trade negotiation or any other such exchange. By now, everybody knows that much of what is released publicly is part of the process of positioning and looking for leverage. One headline says that a deal between the U.S. and China is imminent and the next one states the whole thing is about to fall apart. The supposed issue now is whether the U.S. will be allowed to reimpose tariffs and other sanctions if it is felt that China has been failing to keep its promises. China wants talks before any such decision is made, while the U.S. wants to be able to act unilaterally. In many ways, this is really a battle over semantics as there is nothing to stop the U.S. from any action and nothing to stop China either.

Short Items of Interest—Global Economy

Decline in Chinese Birth Rate

China already has a major problem as far as its workforce is concerned. The population is among the oldest in the world and the education system has not been able to keep up with demand for skilled workers (a lament shared with the U.S. and many other nations). The one-child policy skewed the population towards males. Now many millions of men are unable to find a spouse. The next challenge is that having and raising a child has become prohibitively expensive. It has limited family size even further. China is running out of young workers, and very quickly—not a good sign for the future.

Brexit Crisis

The showdown comes closer and closer as there has been no budging by any of the parties to this debate. The EU will not change its position and the forces in the U.K. Parliament will not alter their stance either. The last plan put forward by Prime Minister Theresa May has gone down in flames. A vote for a hard exit will also likely lose. It appears all that can be done at this stage is to get an extension and possibly demand a second referendum on the whole issue. The alternative is a no-decision period of chaos.

Scandal of Privilege

Some high-profile people have been caught in a bribery scheme involving their children and entry into prestigious schools. This is not a recent issue and neither is it unique to the U.S. The frantic grasping for elite education distorts societies all over the world as schemes are employed by the privileged to make certain that privilege is maintained and handed down to their progeny.

A Look at the CCAI/IHEA Index Data

It is that time again—the monthly report from the Chemical Coaters Association International (CCAI) and the Industrial Heating Equipment Association (IHEA). Both of these groups represent companies that are in the metal sector—either heat treating metals or chemically coating them. They are especially active in the automotive sector, but touch every sector of the manufacturing community that engages with the metal business.

Analysis: This month's index has been a little like the overall economy of late. There is a little something for everyone. Six of the indicators trended positive and six trended negatively. You can decide for yourself whether you are a glass half-empty or glass half-full kind of person. What has made looking at the economy tricky of late is that there have been big swings in the data—not just little marginal changes. When something has gone south, it has been drastic. By the same token, the good news swings have been dramatic. This has been described as a transition year (but then they all seem to be). The 2018 economic growth improved from incentives like big tax cuts, while this year has been facing drags from trade wars and tariff complications.

The six indicators that trended negatively include a couple that have been expected and some that have not been all that worrisome until now. The new automobile/light truck sales reading tilted down a little, but it has not been a total collapse by any stretch. For months now, there has been a sense that this sector would start to cool, but the consumer kept powering along. Now it seems this slowdown may be upon us as banks are worried about who they are lending to and consumers are becoming a bit more cautious. The biggest drop was in new home starts. That doesn't come as a big shock either. The fact is that homes are getting too pricey for the first-time buyer. Even with lower mortgage rates, there has been a slowing of demand for single-family homes. Even the multi-family units are showing some signs of decline.

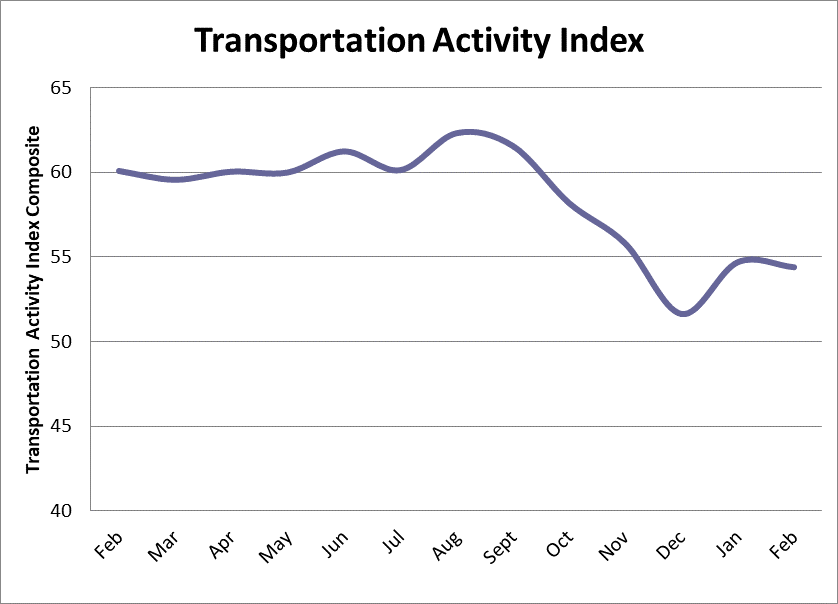

There was a dip in the rate of capacity utilization, but nothing dramatic. It has been almost to 79% (with normal rates being between 80% and 85%), but it fell back into the 78% range. There was a similar dip in the PMI New Orders index, but it is far from in the danger zone. It remains in the middle 50s and thoroughly in expansion territory (as is the overall PMI number). It is a far cry from the 60s enjoyed just a few months ago, but not at a crisis level. The real worry is whether this trend continues down or starts to get back to more robust growth numbers. One of the more profound drops was in the capital expenditures data, but some of this seems related to end-of-year activity as purchasers take advantage of the year-end tax breaks. There was also a lot of buying by companies to beat the tariffs. When that ended, the numbers fell. The transportation activity index also showed some weakness, but it was not that dramatic and seemed to reflect seasonal issues more than substantive change in the economy.

The positive trends included the metals, such as steel. Consumption of steel was healthier than it had been. Most of that seems due to the expansion of both public sector construction and commercial activity. The carmakers are not playing as big a role as they once did and machinery usage has been flat, while energy sector use has generally been up. The other metals have seen their prices trend up on better demand in the tech sector and within some of the specialty markets such as health care.

Both durable goods orders and factory orders were up. Much of that has been attributed to the impact of the trade and tariff wars. There has been a lot of advance purchasing in order to avoid getting hit with higher prices should the tariffs be imposed. This will likely lead to some issues down the road as many companies will be stuck with inventory they can't sell. There will also be a drop-off in both durable goods and factory orders. Much of the gain in this month's durable goods numbers came from an increase in airplane purchases. The appliance data shifted positively as there was finally a convergence of the unfilled orders numbers and total inventories. The data from the Credit Managers' Index also improved a little and got the overall index back on track. The best numbers were in the favorable categories (dollar collections, new applications, sales), but even the non-favorables showed some improvement. Several of these readings are still below 50, but even those have been showing small signs of improvement (accounts out for collection, disputes, slow pays, bankruptcies).

New Automobile/Light Truck Sales

The automotive sector is flat—at least it has flattened out at a rate that is not disastrous. It is not the engine of growth that it once was or was expected to be. In all honesty, the assessments of the automotive sector have been predicting this decline for some time, but the consumer managed to keep the pace up far longer than many had assumed. There have been several components involved in this extended ride. Part of the issue now is how long these factors last. The most important of these has been consumer demand. Thus far, this has held steady, but there are some tremors that might shift the conversation. Gas prices are headed up as OPEC and Russia are cooperating to get the per barrel price up again. That may make the bigger SUVs and trucks less appealing; however, the automakers don't really have a lot in the way of fuel sippers these days.

Another big boost to the sector has been the availability of bank loans now that people are paying on their vehicles for six years and more. The move out of mortgages left lenders with a void. They have been filling it with car loans for several years now. This last year saw far more car loans in delinquent status than ever, however. It seems car buyers are falling into the same category as the home buyers 10 to 15 years ago. The lenders are scraping the bottom of the barrel as far as loans are concerned. That is creating a crisis for their books. It means fewer cars sold in the near future.

New Home Starts

Any way one looks at this, the data is not good. The bottom seems to have dropped out of the new home market, which certainly doesn't bode well. On the other hand, there are some factors to be taken into consideration that might take some of the edge off these bad results. The most obvious is it has been a very long and hard winter that has interfered with the housing market in almost every region of the U.S. The Northeast and Midwest have been pounded by one storm after another. Even the warmer weather states have had too much rain and other impediments. Add in some of the chronic issues such as limited availability of workers and the steady increase in the price of homes that served to discourage the first-time buyer and one has the recipe for a slowdown, but probably not a full-scale collapse.

The most important factor as far as home buying is concerned is the unemployment rate. As long as people feel secure regarding their levels of job security, they are more likely to be in the market for a house or some kind of upgraded domicile. As has been the case for the last few years, the Millennial remains the mystery. There has been more interest in buying a traditional single-family home among the older members of this cohort—those that are in their 30s. The younger ones are still holding off on starting families and moving out of the multi-family units.

Steel Consumption

The tariffs and trade wars have been waged for over a year—at least as far as steel is concerned. The consensus view is that the strategy has not worked very well. There were expectations that were likely unrealistic from the start. It was assumed that steel from the U.S. would be more competitive than steel imported, but that always assumed the steel and aluminum required was indeed produced in the U.S. In many cases it was not. The industry has not been eager to start producing that specialty steel until and unless they have some assurance these tariffs will stay in place for years. It was also predicted that those nations that produced steel would find ways around the tariffs, and they have. They are producing products made of that steel and have been selling them into the U.S.—slamming U.S. manufacturing from two directions. There has also been the practice of shipping steel products to a third country that is not subject to the tariffs. The bottom line is as it has always been—tariffs very rarely work as intended. They are a tax. We all know by now what companies and people do when confronted with a tax—they find ways to avoid it or limit it.

The good news is that consumption has been rising in part due to the expansion of both public sector and commercial construction. This market could expand dramatically if there really is a decision on the part of Congress to invest the planned for $500,000 billion in infrastructure. Unfortunately, the "Congress watchers" estimate that no more than $100,000 billion will be spent. Even that is anything but assured.

Industrial Capacity Utilization

It was so close! Last month the reading for capacity utilization jumped to almost 79%. That is pushing on the bottom of what would be considered normal (between 80% and 85%). Now it has slipped back a little to levels last seen last September and October. This is certainly not a catastrophic decline, but it is interrupting a nice little trend that had been building towards the end of last year. The numbers suggest there is still slack in the economy, which is interesting given the low rate of unemployment. One would assume that a rate of under 4% would signal full employment and therefore tight capacity, but the issue has been not only the number of hires but the quality of those hires. The pattern of late has been to hire warm bodies with the hope they can be trained to the point of productivity later. The technology has, to some degree, outrun the ability of people to operate it. Productivity numbers were better this month as more equipment was added, but the efficiency desired has not quite manifested.

PMI New Orders

The nice little bounce-back the PMI New Orders index experienced last month was short-lived, although the numbers are not all that alarming at this point. The Purchasing Managers' Index (PMI) is still firmly in the middle of the 50s indicating solid expansion. The overall PMI also fell this month, but still hung on to that expansion territory. Granted this latest reading is a far cry from the nearly 65 notched just about a year ago, but these are not yet numbers that would cause much anxiety. The bigger issue is why there has been a decline in the readings that are generally more future oriented. The simple answer is caution. Not only has the business community been showing signs of nervousness about the remainder of the year, there has been worry in the ranks of the consumer as they try to anticipate what to expect in terms of inflation and jobs. Right now, things look pretty solid. That is why the PMI has not really fallen very far, but a shock to the economy could send the readings into the contraction zone pretty swiftly.

Among Those Things I Rarely Think About

This morning I was woken by tornado sirens. This is not something too common, but given that I live in Kansas, it is not all that unusual either. At home, I know just what to do. We herd the feline five into the fortress we built under the garage. At the time we didn't really think about what this was—just seemed like a good use of the space under the three-car garage, but by the time our builder was done, we had a civil defense-rated space that we subsequently made into a replica of a French village square. We have books, games and some food. We are ready. The sirens in question this morning were not at home—they were in Ft. Worth and I was in a high-rise hotel.

What was I supposed to do with this information? It dawned on me that I had no clue what my expected course of action should be. Do I head for some shelter somewhere? Do I stay put? It was apparently not a warning sufficient to warrant alerting guests, so I just flipped the TV on and noted that the storm was not all that close to downtown. It just got me thinking again. I have been at hotels where there has been a major watermain break in the dead of winter—that lobby was an ice-skating rink. I have been in hotels that caught fire (minor incident in the kitchen) and hotels that experienced blackouts. Maybe I should have a plan or two. Like most people, I pay little attention to all those instructions on what to do in an emergency, but this morning I did a review of my options and vowed to make sure I had my sweat pants and sweatshirt handy—just in case.

Transportation Activity Index

The Transportation Activity Index showed a small dip after the recovery noted last month. Still, the numbers are down from what they had been a few months ago. That is consistent with the overall economic activity that has been noted this month. The biggest dip was seen in ocean cargo as this is the sector most affected by trade disputes. There was also some slowing in the trucking sector, while rail has been carried by utility demand that stems from the colder than expected winter. Air cargo has been hit hard for months, but there is no sense that this will reverse any time soon.