Strategic Global Intelligence Brief for June 7, 2019

Short Items of Interest—U.S. Economy

Anemic Job Totals

As was widely expected, the job data was weaker this month as there were only 75,000 jobs. This is more anemic than had been anticipated (the estimate had been gains of around 150,000 to 180,000). The slowdown in hiring is not a big shock given the manufacturing sector has been slowing for months. The fact is there are not that many people available to hire. This has limited the capacity for job gains. There is also evident caution in business circles, such as concerns over the impact of trade wars.

Fed Debate

There was an almost immediate call for the Fed to shift its interest rate policy as soon as the jobs numbers came out. Isn't this proof the economy is teetering on the brink? What more proof is needed to convince the Fed? Thus far, the Fed has maintained a cautious stance. This was quickly reiterated by many within the Fed leadership. The debate is well underway and there has been an acknowledgement that conditions are not as positive as they have been. The response of New York Fed President John Williams is close to a universal statement. He understands the threat and realizes the Fed needs to be prepared, but there is no immediate urgency.

Corporate Debt, Low Rates and 'Carnage'

One of the chief concerns of the central bank hawks is corporate debt. The ultra-low interest rates that have dominated over the last decade has resulted in heavy borrowing by companies that are not well positioned to withstand a recession or even a fairly mild downturn. These companies have been staying afloat with loans. Should the economy stutter, they will be hard pressed to keep up with their obligations. That puts the banks that made those loans vulnerable as well. If there is a downturn, it will likely accelerate fast, as these companies will be in real crisis almost immediately.

Short Items of Interest—Global Economy

China Intensifies Nationalist War on the U.S.

The response to all the tariff and trade threats made by the U.S. has been an intensification of nationalism and anger at the U.S. The government has been feeding this trend with more focused and intense propaganda and aggressive censorship. It has not quite gone so far as referencing the U.S. as "running-dog imperialists," but it is coming close. Just as the U.S. has elected to portray China as the implacable enemy, so has China retaliated with attacks on U.S. companies doing business in China. The once positive attitude towards the U.S. has all but vanished as far as the average Chinese consumer is concerned.

Duterte Dynasty in the Making?

Rodrigo Duterte is at the mid-point of his six-year term as president of the Philippines. He has not altered much from his aggressive and confrontational policies. He continues to focus on drug gangs and other criminals despite evidence that many of those the police and vigilante squads attack have nothing to do with drugs or crime. His daughter—Sara Duterte—has now started to emerge as his successor. She ranks first in polls that look at candidates for the presidency in 2022. She has been functioning as the "first lady" and has been every bit as pugnacious and confrontational as her father.

'State Actor' Behind Tanker Attacks

Last month, four oil tankers were attacked with mines and suffered extensive damage. A report from the United Arab Emirates to the UN has concluded the attacks had to have been carried out by a government as opposed to some group of terrorists as the operation required the placement of mines by an underwater attack force. The unnamed state is Iran. There is evidence more such attacks are planned.

D-Day Tensions

The 75th anniversary of the D-Day invasion of Europe should have been entirely devoted to the sacrifices made to rescue the world from the madness of Nazi Germany. Thankfully, it seems most of the day was indeed focused on that dwindling population of men and women who survived and can testify. But politics will always find a way to intrude and so it was with this commemoration. French President Emmanuel Macron presided over the ceremonies and was appropriately solemn and grateful, but this was also an opportunity to remind Europeans of the importance of unity and to try to bring Trump back into the fold to one degree or another. Bridges between Trump and the other European leaders have been thoroughly burned. Germany's Angela Merkel has made her feelings known and so has Italy's Pedro Sanchez and Britain's Theresa May. There is no love lost between Trump and the leaders of the EU as he has consistently supported those that would break up the EU. At one time, Macron believed he would be able to develop a special relationship with Trump on the basis of their similarities as outsiders trying to shake up the political establishment. Those days are largely gone as Macron has been unable to bring Trump to his way of thinking on issues that range from Iran's nuclear aspirations to climate change. In between the photo ops that marked the solidarity between France and the U.S. were tense moments as Macron tried again to influence Trump's thinking on some key issues.

Analysis: The U.S. position on Iran and climate change remain at odds with those of Macron and the majority of other Europeans, but these are not the hot button issues right now. The key source of tension is economic and once again revolves around trade and tariff threats. In the last several months, Trump has threatened to impose tariffs on European cars and car parts. There have been suggestions that other products could be included. This disturbs the European automakers as well as the domestic automakers in the U.S. who purchase these parts. Macron urged Trump to move away from these threats.

Another key issue was Brexit and Trump's overt support for a complete break from the EU by the U.K. This position was amplified when Trump was in Britain. He expressed support for Boris Johnson and even Nigel Farrage. This was seen as interference in British politics. Macron has been trying to keep Trump engaged with the traditional allies for the U.S. in Europe and tried to remind him that a new generation of leaders will be emerging in the EU—an opportunity to start somewhat fresh. Merkel is on her way out and will be replaced by Annegret Kramp-Karrenbauer, Theresa May is stepping down and may be replaced by Johnson (but that is not certain). There will be new leaders at the EU as well. It is not clear that anybody in Europe is set to be a boon companion for Trump although some of the populist leaders in nations like Poland, Hungary and Italy are seemingly cut from the same cloth. Macron is deeply opposed to the populist vision and wants to keep the U.S. in its traditional supporting role. That is not going to be an easy task.

Draghi Prepares One Last Salvo

Mario Draghi is coming to the end of his tenure as head of the European Central Bank (ECB). The race to replace him has been intense. The current favorite is the head of the German central bank—Jens Weidmann. He is a typical German hardliner on issues such as inflation. Should he get the nod, the expectation is he would pursue a hawkish agenda. This has led to speculation that Draghi will follow through with his assertion that the ECB needs to engage in another round of stimulus to counter the impact of the slowing global economy. He has indicated he wants to resume the bond-buying program and he is also leaning towards an interest rate cut. The ECB has the same challenge the Federal Reserve has—rates that are already very low so it is not clear what real difference they will make as far as economic growth is concerned.

Analysis: The central banks of the world are getting on the same page for the most part. They see a lot of threat developing as the year goes on. The slump in the global economy has become an immediate threat as most of the assessments hold that growth will shrink to no more than 3% for the year. Many see the numbers as even smaller. Trade wars are at the top of the list of concerns. Many are comparing the current mood of protectionism to the "beggar thy neighbor" policies of the 1930s that ushered in a global recession. The sense is that steps have to be taken now if that development is to be held at bay. At the same time, there is the old frustration that comes from fiscal inactivity. The legislatures in the U.S., Europe, Japan and elsewhere remain reluctant to spend more and tax less—steps that traditionally come into play when economies need a boost.

More Fun and Games Over Tariffs on Mexican Goods

It still remains unclear whether there will be a 5% tariff imposed on all goods that Mexico sells to the U.S. on June 10, but signs suggest this has been just another example of "tariff theater." Many companies assumed this was a feint from the very beginning, but many others have been forced to consider their strategy in the event it actually happens. The negotiations have continued. It now appears Mexico has agreed to some moves that might satisfy Trump for the moment. As with all the other tariff threats that have poured from the White House, there will likely never be a complete solution so that the threat can continue to hang over Mexico.

Analysis: The bottom line is this tariff is overtly political and has nothing whatsoever to do with economics or business. There are plenty of situations that might justify protectionist moves from the U.S. although the time for these decisions would have been some 20 years ago. A universal tariff is just nonsense as it affects a wide range of products the U.S. needs and is in no position to produce itself. This is a tariff aimed at political pressure on Mexico over Central American immigration.

At some point, something else will have to be tried to deal with this massive issue. The U.S. can't accommodate the hundreds of thousands of people that are trying to escape their circumstances in Central America, but it is painfully apparent that current tactics are failing miserably. Stopping this exodus is not possible regardless of walls and border agents. The impetus for the migration has to be addressed so that the flood of people halts. That means looking at the situation facing people in Guatemala, Honduras, El Salvador and Nicaragua. Maybe, it is help to destroy the drug gangs, maybe it is aid to build a viable economy there, maybe it is helping provide safe havens in these nations. All that is known at this point is that current approaches have failed.

Feeling an Impact Yet?

The jobs report comes out later today. The expectation is all these headwinds that have been under consideration will finally start to take a bite out of job growth. The survey done by ADP already showed a sharp decline in private sector hiring. This is generally seen as a good preview of what the Labor Department will release. That said, the ADP report has not always matched the final total as closely as would be desired. There have been several other interesting data releases this week—some very encouraging and others that add to the general sense of angst about the rest of the economic year. There has been an unexpected and more than welcome boost in the rate of worker productivity. There was also a reduction in the trade gap. The volatility of the stock market had been taking a toll on households, but there has been a recovery in overall household wealth.

Analysis: Productivity numbers have been a concern for quite a while. The usual pattern had not been manifesting as low levels of unemployment generally coincide with increased productivity. This data is a measure of workers output per hour. When business has been careful with hiring, there is not a lot of surplus in the workforce. The challenge of late has been that many companies have been hiring people with less than ideal or relevant qualifications. They will need to be trained and educated before they are able to fully contribute to the company. That is assuming these newly qualified workers are not poached by some other company. The other key factor in terms of productivity is investment in machines and technology. There has been a slow set of gains as far as capacity utilization, but the levels are still not quite at the ideal position between 80% and 85%. The latest numbers are therefore encouraging as they show a gain of 2.4% over last year. It seems that more capital investment has been taking place and some of those less than qualified workers hired in the last few years are now more experienced and able to contribute at a higher level.

There will be several things to watch for in the job numbers. The government will be adding significantly to its payroll through the bulk of this year as it begins the process of taking the census. There will be thousands of jobs added, but these are not permanent. This year the government will be hard pressed to find sufficient numbers of people to fill those positions and will have to rely on part time help draw from the retired population as well as those people who have elected to stay out of the workforce so they can take care of children or elderly relatives. The expectation is the private sector will still have hired between 150,000 and 190,000 people. It will also be important to look at wage gains. This has been the missing piece thus far. The expectation has long been that low levels of joblessness leads to higher wages and ultimately wage inflation, but wages have not spiked as expected. That motivation for inflation has been weak. The expectation is there has been a 3.2% gain in wages, a more dramatic change than has been seen for a while. It will also be important to note what jobs are being filled. It is expected there will be fewer manufacturing jobs as the supply of qualified people continues to be an issue. The weakness in the job sector for the last few years has been the fact that most of the new jobs have been in the lower-paid service sector as opposed to the better-paid sectors like manufacturing, transportation, construction and the like.

Another interesting piece of data is the improvement in the trade deficit. This development comes with a caveat. The deficit shrank by 2.1%, about the only good news as both exports and imports fell dramatically. Both imports and exports fell by 2.2%; the decline in exports was the steepest since January of 2016. The fact is trade wars and tariff wars have already taken a big bite out of both the export and import numbers. The U.S. is buying less from overseas (especially China). That may be good news for domestic producers competing with the world, but the slowdown in the international economy has also negatively affected the ability of U.S. companies to sell to these other nations.

Road Warrior (Literally)

The term "road warrior" is not always 100% accurate. Often it is applied to flying hither and yon. Perhaps it would be more accurately described as "air warrior." On occasion, I really am on the road as I was this week with talks in Wichita and the Missouri Ozarks. Both of these presentations involved a three-hour drive to get there and a three-hour drive back home—a total of 12 hours of highway time in two days. This provides an opportunity to get a glimpse of the world as well as familiarity with local NPR stations. I am prepared to make three observations based on these two trips.

The first is that this year's flooding has been real. I have not seen so many flooded fields and swollen rivers in years. I would have seen crops coming up by now, but the productive farms were few and far between on these trips. The second observation is that people love to express themselves with roadside signs. There were signs that opposed development, abortion, the UN, Trump, PETA and space invasions (my favorite). The third observation is that local NPR stations offer a lot of variety. I heard programs that are not on my local source. Many were quite engaging—notably the one from the University of Missouri focused on global journalism. Then, there was the program that looked at "Dad jokes." My favorite was as follows: "Went on Amazon and bought a chicken and an egg—we'll see."

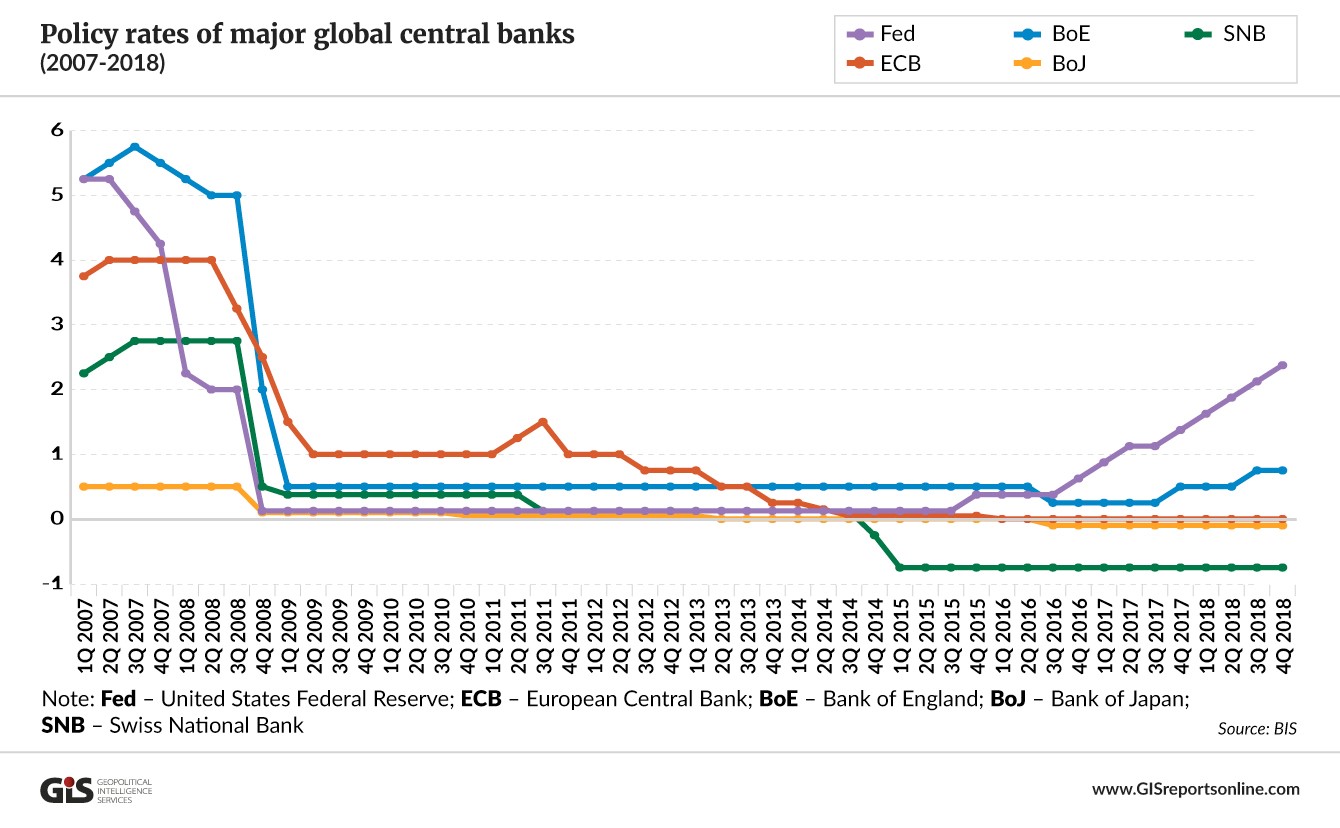

Policy Rates of Major Global Central Banks

The rate policies of the major central banks once diverged quite a lot, but in 2008, they started to work in conjunction with one another as the world faced recession. They started to diverge again as the recovery got under way, but they all seemed to be heading back up. That trend is now eroding and the banks are all starting to consider reductions in rates as a means by which to forestall a recession or serious downturn.