Strategic Global Intelligence Brief for June 5, 2019

Short Items of Interest—U.S. Economy

Trade and Interest Rates

The Federal Reserve had been pretty adamant about its interest rate policy until the last few months. The logic was sound enough. The economy has been performing quite well and that is generally the precursor to a bout of inflation. For the last several decades, the Phillips curve has been prescient as far as inflation threats are concerned. It states that when the rate of unemployment gets low, the labor costs go up as employers will be paying a higher price for the available workers. That has not really kicked in as yet, but sooner or later it was expected to. In the meantime, the Fed has been well aware that global trade tensions can slow the U.S. economy. That has them worried about a recessionary slide. The attitude now is that trade policy may force a downturn and they may have to take action whether they really want to or not.

Women Vulnerable to Automation

For the last few decades, it has been the men that had the most to worry about from automation and robotics. The factory sector in the U.S. has been overwhelmingly male. In the last 20 years, there have been close to 20 million lost jobs—96% of them for men. The next wave of jobs replaced by automation will be largely held by women. The expectation is that close to 100 million women worldwide will lose their jobs. Many are in developing nations where industrial work is still done by hand—they will be replaced the same way that men were in the U.S.. The other vulnerable population will be those in clerical and support roles. The biggest employment decline in the U.S. has been among administrative assistants as technology supplants them.

Trump Throws in on Brexit

Trump has never made a secret of his dislike for the European Union and his support for Brexit. His position has always favored the hard exit that has been pushed by many in the Tory party. Now that it looks likely that Boris Johnson could be the next U.K. prime minister, Trump is offering a carrot. He has used his trip to the U.K. to make an offer of an expanded trade deal with Britain, but thus far there have been no details. The U.K. will need to find a new market once ties are truly cut with the Europeans. The U.S. will be the logical replacement.

Short Items of Interest—Global Economy

Gandhi Crisis in India

The crushing defeat of the Congress Party in the Indian elections was attributed to the fact that Rahul Gandhi is not a skilled politician and ran a very lackluster campaign. He has now asserted he plans to resign as head of the party, which has set off alarm bells in the party. This has been the party of the Gandhi family since India's inception—Jawaharlal Nehru, Indira Gandhi, Rajiv Gandhi, Sonia Gandhi and finally Rahul. The problem is that he never wanted this role and is desperate to leave it all behind. It will set off a massive fight to find a successor. This time it will not be a Gandhi.

Russia and China Bond Over Trade Fights

There has long been tension between China and Russia despite some factors that might have provided common ground. Even when both were communist nations, they were at odds as they competed for Asiatic influence. Today, they are deepening ties for the same reason they worked together during the Cold War. Both are under attack from the U.S. to some degree and are finding support from one another when it comes to resisting trade sanctions and other pressures.

China Has Rare Earth Threat to Wield

The trade war with China will cost the U.S. in some significant ways. It has already damaged farmers and is about to hit consumers. The biggest impact is yet to come if China elects to play that card. The U.S. depends on China for the rare earth metals that are at the heart of technology. The U.S. has rare earths of its own, but they have not been developed as the process is both expensive and environmentally destructive. It would take almost 10 years to replace China as a source.

How Likely Are Those Mexican Tariffs?

Here we go again. This has become a tiresome and dangerous pattern. It starts with a frustrated Trump who lashes out at a problem in an unorthodox way. His anger at Mexico over immigration led him to try intimidating the Mexican leadership with the threat of draconian tariffs. Unfortunately, this tactic also slams millions of Americans with higher prices, lost business and lost jobs. It is not even clear what is actually expected of Mexico. If the same pattern holds as has been in evidence with Canada, Europe, Japan and others, the tariffs will be delayed at the last minute with the threat remaining like a sword of Damocles.

Analysis: This time the policy is forcing many in the GOP to oppose Trump. They are well aware that these tariffs will hurt their constituents and it may not be worth the pain for these voters. Immigration is certainly a hot button issue for many, but it doesn't rank as the top issue for the majority of the population. For Republican voters, the order of importance is terrorism, the economy, social security and then immigration. For Democrats the issue of immigration is not even in the top 12. Their top issues are Medicare, health care in general, education and drug addiction.

Given the potential damage from a Mexican trade war, the sense is that something will emerge at the last minute that stalls the imposition of the tariffs, but that is not a certainty given the position that Trump has thus far taken.

World Bank Expresses Deep Concern

The new head of the World Bank is David Malpass who was picked by Trump to head the organization he has been sharply critical of in the past. His objections centered on what he once described as "social engineering." He was especially frustrated with the man he replaced. The previous head of the institution was Jim Yong Kim. His focus was on issues such as world health and educational development. Malpass (and many others) wanted to see the World Bank get back to its former set of priorities. The mandate of the International Bank for Reconstruction and Development (the formal name of the World Bank) was loaning money to nations to improve their economic development. It has been criticized in the past for focusing on large-scale projects like dams, roads and infrastructure when these projects may not be best suited for the country where they are taking place. It has been argued that this kind of development benefits the rich nations more than the poor ones as the bulk of the work is being done by western corporations. The World Bank has also played a major role as far as tracking the overall progress of the global economy. It is well respected for its data collection and dissemination.

Analysis: Malpass has recently issued several statements of concern over the state of the global economy and the weakness that has emerged as far as global trade is concerned. He has not directly attacked the protectionism of the Trump administration, but has come very close as the latest data shows a slower pace of growth for the world as a whole. The previous report indicated growth of around 2.9%. That has been downgraded to 2.6%. The factors responsible for this decline include a reduced level of business confidence, a reduction of global trade activity and overall lack of investment in the emerging and developing market. This was the major point made in the latest comments from Malpass. Although he has stopped short of directly attacking Trump's policies, the implications are clear enough. Protectionism is insidious and eventually shuts down much of the global economy. Ultimately, that creates far more problems than it solves.

He has been quick to point out that trade policies alone are not responsible for the slowdown globally Also, that bad governmental leadership in many emerging market states has as much to do with their economic woes as any other factor. He attacked poor business environments in many nations due to bureaucracy and says that labor and market controls are often stifling. The sense is that open and market-facing policies are much preferred and should be promoted by the World Bank. That would inevitably put the policies favored by the World Bank in opposition to the policies favored by Trump.

The majority of the international organizations that look at the global economy have taken strong stands and are opposed to Trump's incessant trade wars and extensive use of tariffs. They have opposed other nations that have used these techniques. The reports acknowledge the reasons behind the policies, however. The U.S. (and other nations) have been pushing free trade for decades and have been demanding that a level playing field be established. Unfortunately, many other nations have been far more protective and have worked to block U.S. business activity. In many respects, the U.S. has simply elected to emulate those nations it once opposed. As understandable as this tactic may be, it has very negative implications for the world as well as for the U.S.

German Business Community Turns on Merkel

The "grand coalition" between the Christian Democrats and the Social Democrats (SPD) has always been tenuous at best. The center right under Angela Merkel has been dominant in German politics for the better part of two decades, but has never had enough support in the Bundestag to govern without a partner. The center-left Social Democrats did not want to be left out of government so they agreed to be part of the Merkel coalition. Now, this arrangement is coming under attack from within both parties. The conservative elements among the Christian Democrats and the Bavarian Christian Union resent the concessions made to the Social Democrats and the left-leaning members of the SPD want to pursue a "purer" set of policies.

Analysis: Meanwhile, the business community is losing patience with both parties and is asserting that little has been done to deal with the expected downturn. The sluggish pace of German growth has been attributed to failures by the government to protect trade and to protect the factors that promote business development. Their pressure is seen as an attempt to shape the future policies of the new head of the Christian Democrats—Annegret Kramp-Karrenbauer.

Fed Anticipating a Recession?

The statements from Fed Chair Jerome Powell set the markets all a twitter. The assumption seemed to be that the Fed had suddenly shifted its position on lowering rates. This was taken as a good sign. There are, however, a few caveats to be aware of before getting all that excited. The first is the Fed has been sending these signals for several weeks now. The media and the markets have grown accustomed to the patterns set when an economist was the head of the Federal Reserve. When the statements were being made by the likes of Alan Greenspan, Ben Bernanke or Janet Yellen, the Fed chair was the leading voice in setting policy. That has not been Jerome Powell's role. He has been playing the part of spokesman and consensus builder. The policy directions are being set by the economists like Richard Clarida and Lael Brainard as well as various regional Fed chairs. When Powell started to talk about the possibility of hiking rates, he was reflecting the comments that have been made by several others in the Fed's leadership. The statements thus far have not indicated that a rate cut is guaranteed; it is certainly not considered imminent. The sense of the conversation is that Fed officials are seeing challenges ahead. Some of these could be serious enough to create downturn and maybe even a recession.

Analysis: The factors that are worrying some at the Fed are pretty familiar by now—the same list shows up when one tries to determine what is worrying the business community, consumers and the investors in general. The Fed is suggesting that it stands ready to take appropriate action, but those same statements have tried to make it clear that Fed action will be limited in its effectiveness—especially if there is a real recession. The Fed would be far more comfortable if rates were currently higher. Lowering rates from just 2.5% to 2% or even 1.75% is not going to open the floodgates as far as business investment. It is not as if there has been pent up demand for loans. The rates have been at historic lows for nearly a decade. Throughout the period of lower Fed rates, the chairs made repeated requests of Congress to kick into high gear and do what they could to bolster growth. For the majority of the recession, these requests fell on deaf ears. It wasn't until early 2018 that tax cuts were put in place. It is argued that these cuts came too late and focused almost exclusively on the wealthy. They lost most of their effectiveness before the year was out. If there was another downturn or recession, the Fed cutting rates by a half to three quarters of a point will not be enough to jump start the economy out of the doldrums. It will take Congressional determination to cut taxes on the middle-class consumer and it will take willingness to spend a lot more money even if that means borrowing more through the sales of more bonds. The fact is Congress is very unlikely to engage in either set of actions in an election year.

So, what is it that worries the Fed and everybody else? It would seem that the economy is doing quite well and there should be nothing but unbridled optimism at this point—unemployment at record lows, Q1 growth over 3%, consumer confidence on the rebound, a stock market that keeps hitting new highs. What's not to like? At this point the issue is the future, as many are concluding that the light at the end of the tunnel is really an oncoming train.

The angst starts with trade worries. The Trump tariff and trade policy has been hard to fathom. Fights have been picked with every major trade partner of the U.S. (China, Japan, Canada, Europe, Mexico, India and others). The rationale for the trade fights are all over the place—economic issues with Japan and Canada, fights over immigration for Mexico, political arguments with Europe, the makings of a new Cold War with China. The fear is that all these tariffs will crush global growth and this will blowback on to the U.S. The U.S. depends on trade for over 15% of the national GDP. That is direct impact. Indirect dependence is even more significant. If the global economy sinks into recession, it will drag the U.S. economy down with it.

The second worrying element is the advancing election year and the certainty that this will be the nastiest and most intense contest in decades. The members of Congress are going to be totally consumed with the election. Everyone expects a whole series of moves from Trump that will startle and frighten the markets. His behavior thus far has been unpredictable and it will only get more intense. If there is anything the overall business community dislikes, it is that kind of uncertainty.

Very Interesting Cat Research

I can just see the eyes rolling. All my dog people are taking this opportunity to go get another cup of coffee, but I have some cat folks that read this as well. They will doubtless find it interesting. It has long been asserted that cats are not trainable—not as much as their canine counterparts in any case. It turns out that training methods may be at fault. Dogs are highly food motivated and can be rewarded regularly with treats—no dog ever refuses one. Every member of a cat's staff knows they often disdain their food and can't always be motivated by treats. It turns out cats are more likely to be motivated by human contact. They are highly sensitive to that human interaction and work very hard to maintain it. They are not really all that aloof but react more like people than assumed.

Just as a person will attempt to attract the attention of another person—so does the cat. If a person is ignored by the object of their affection, the average person gives up and assumes they are not liked. It is the same with the cat. They will try to establish a relationship, but if they are ignored, they assume the effort has failed and they retreat. Once spurned or ignored, the cat concludes it is not wanted. The cat that is always interacted with and paid attention to becomes a very loyal and attentive companion. I can attest to that. We never fail to react when our feline five wants to play or get in laps or otherwise interact. All five are highly trainable. A simple "no" is all it takes to shape behavior. All five seek us out all day (and night). I am never more than a few feet away from one or the other of them and have to be careful to lavish attention on all unless I want to see some hurt and resentful stares.

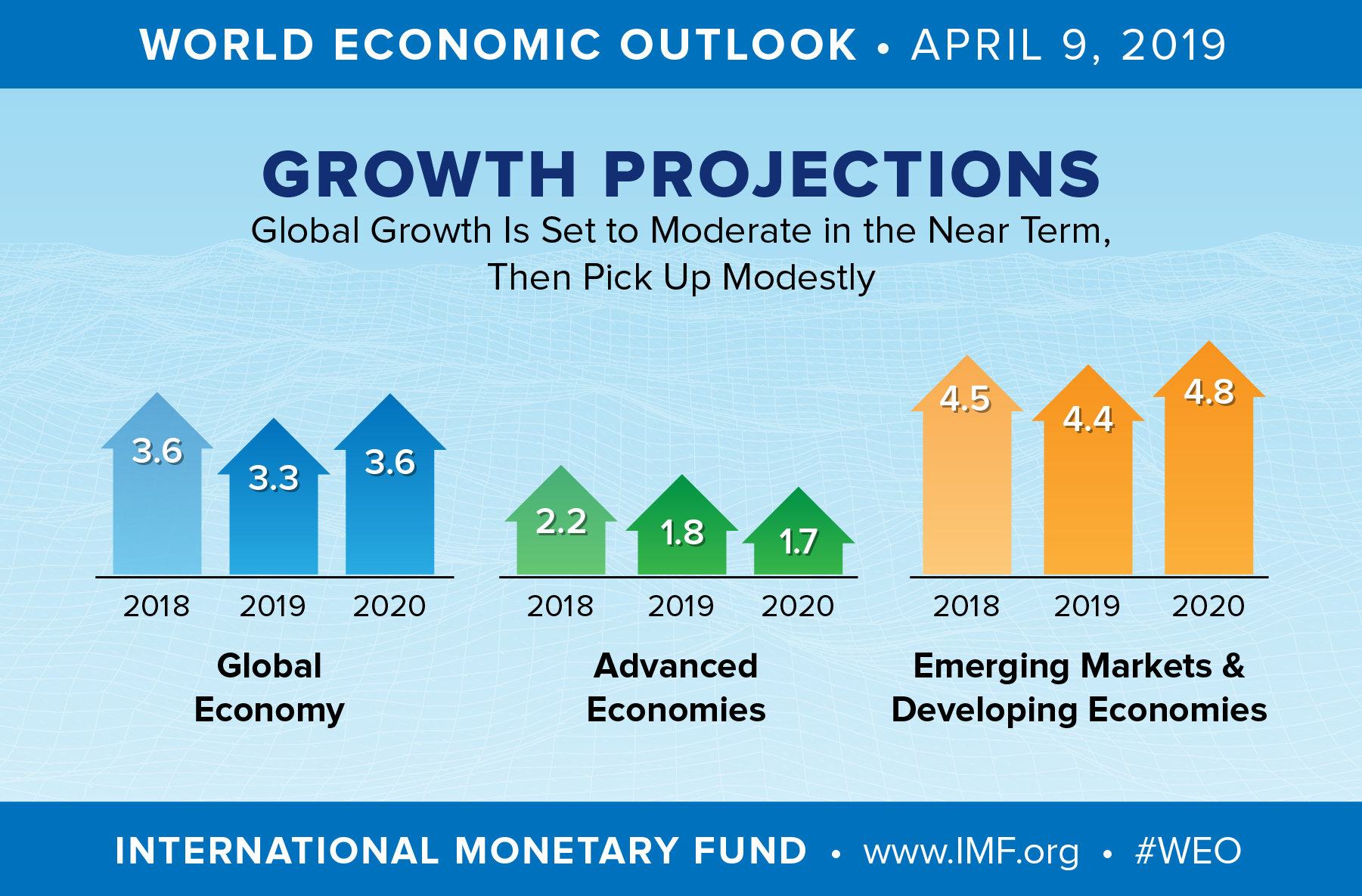

World Economic Outlook

There has been consensus among most of the organizations that seek to track the development of the global economy—2019 is going to be a weak year as compared to the 2018 data. The good news (sort of) is that 2020 is expected to be better, but not in the developed world as Europe is expected to be close to recession and the U.S. will be shrinking a little. The growth is supposed to be coming from the emerging market states, but this will not take place if there are more issues around tariffs and trade barriers.