Strategic Global Intelligence Brief for June 28, 2019

Short Items of Interest—U.S. Economy

Which Trump Showed Up at G-20?

In the days that preceded the meeting of the G-20, the tone struck by Trump was confrontational and angry. The accusations were pointed and directed at allies like the U.K., Canada, Australia, Japan and the EU in general. The sense was that Trump was coming to demand major changes and was prepared to launch new trade wars. Then he arrived at the meeting and it was all smiles and reassurance. The impending tariff war with China was postponed indefinitely, Canada and Mexico were assured that the USMCA was still a priority and the Europeans were spoken of as close allies. Nobody knows from one day to the next what the U.S. plans. If the goal is to keep everybody off-balance, it is safe to say that Trump has succeeded.

Meanwhile—Back at the Congressional Ranch

The Mexican legislature has passed the USMCA, but it may be a long while before the pact emerges from the U.S., or Canada for that matter. The Democrats in the House have been somewhat silent on the issue up to this point, but Speaker Pelosi has now articulated what is expected before this agreement has a chance of passing. The list is long and complex with provisions that address labor rights, environmental concerns and trade priorities. Some of these provisions will be welcomed by Canada and Mexico, but not all of them. There will certainly be opposition from the Republicans in Congress as well as the White House. Nobody expects this to come to a conclusion until after the 2020 elections.

Huawei May Be Deal Breaker

The expectation is that the U.S. and China will resume trade talks. This has essentially been agreed to already by the U.S., but both nations still have demands that must be met. At the top of China's list is the treatment of Huawei. It is not absolutely clear what the Chinese are demanding, but the bans on the company will have to be lifted to some degree. The U.S. ostensibly objects to Huawei on national security grounds as there is the fear that China will be able to use their technology to spy. China has suggested it can insulate Huawei from political interference. Then it becomes a matter of whether the U.S. can trust the Chinese.

Short Items of Interest—Global Economy

Leadership Battle in Europe

Two key posts have to be filled in Europe, and soon—the head of the European Commission and the head of the European Central Bank. The contest is really between the heads of France and Germany as both President Emmanuel Macron and Chancellor Angela Merkel want their people in place. The most likely scenario is still that Jens Weidmann from Germany heads the central bank while Michel Barnier takes the EU helm, but neither Macron nor Merkel have been willing to sign off on this. One of the key considerations is the ability of both eventual leaders to contend with the U.S. and Trump.

Russia Lambasted at G-20

President Vladimir Putin's dismissal of traditional liberal values at the G-20 meeting has been met by a concerted reaction from most of the other attendees. The exchange between Putin and Prime Minister Theresa May could not have been colder as she glared at the Russian leader with disgust. Several other delegates turned their backs on him, but others seemed determined to engage—China's President Xi Jinping, Trump and India's Prime Minister Modi all seemed far warmer in their conversations.

Debt Crisis Deepens in U.K.

For the 10th straight quarter, the average British household has spent more than it earns and the gap has widened every quarter. This makes these households very vulnerable to any sort of downturn as they will not be able to service their debt. That the debt has been accumulating during a period of relatively high employment and economic growth points to potential issues when the Brexit-prompted crisis arrives.

Latest Credit Managers' Index Shows Mixed Results

Each month we review the data collected by NACM to put together the Credit Managers' Index. This is an index that was modeled on the Purchasing Managers' Index and has proven to be a reliable predictor of economic trends—even giving an advance look at what the PMI is indicating. What follows is the executive summary—to see the whole CMI report go to the NACM website and search for the Credit Managers' Index.

The last month has been a bit ragged as far as national data is concerned. Some of that concern has started to appear in the latest Credit Managers' Index (CMI). In addition, the Purchasing Managers' Index (PMI) for this month shows the lowest reading seen in over 10 years—barely above the threshold for contraction at 50.1. This is just for the manufacturing index as the service version has not yet been released. There have been other warning signs—durable goods orders are down and so is capacity utilization. The dip in the overall CMI looks pretty positive in comparison to other economic trends as it slipped only slightly from 55.7 to 55. The drop in manufacturing, however, was more pronounced.

The index of favorable factors stayed comfortably in the 60s, but there was a slight decline in the numbers from last month's 63.8; it is now at 61.4. The index of unfavorable factors improved by a bit moving from 50.2 to 50.7. The bad news is the two-month positive trend has ended, but the good news is there has not been the dramatic decline seen in some of the other indicators.

The news from the favorable categories continues to be fairly decent even with the decline. The sales numbers are now at 60.4, close to the average seen over the last few months. The new credit applications data also slipped back to what was expected with a reading of 62.4 compared to 64.2 the month prior. The dollar collections data improved a little. This is always very good news to a credit manager. It was at 59.8 and is now at 60.3, the highest reading since November of last year. The amount of credit extended slid from 65.4 to 62.5, but this is obviously still well into expansion territory (a reading above 50).

The improvements in the nonfavorable categories were subtle, but overall there was some gain and stability. The rejections of credit applications improved from 51.8 to 52.4. This is always a good sign when overall applications are down. It means those seeking credit are more creditworthy. The accounts placed for collection also improved and escaped the contraction zone. The last time numbers for this category were in the 50s was in September of last year. The reading this month was 50 and last month it was at 47, a pretty substantial improvement. The disputes category stayed right where it was last month at 48.6. This remains in contraction territory, but not quite as deep as has been the case earlier in the year. The reading for dollar amount beyond terms fell from expansion territory with a reading of 49.8 compared to 51.3 in May. This is a concern as slow pays are often the first sign of some impending trouble. The dollar amount of customer deductions entered expansion territory for the first time since February with a reading of 50, up from 49.3. This is another early warning sign and could be the start of more serious issues. The filings for bankruptcies saw some minor improvement (53.3 to 53.5). The important point is that this category has been comfortably in the expansion zone for well over a year.

Generally speaking, the data this month trends positive albeit at a slower pace than was attained earlier. Given the CMI often predicts the behavior of the PMI, it will be interesting to see what happens in the months ahead. Will the PMI slump continue or will there be a recovery sooner than later? The news conveyed by the CMI has been a little mixed of late, but the nice recovery in the nonfavorable categories has been encouraging. There were only two categories that were in the contraction zone this month; last month there were three. That is a trend one can only hope will continue.

Manufacturing Sector

For the last several months, the manufacturing sector has been credited with fueling the economy in the U.S. and the world as a whole. At the same time, the biggest threats to the global economy have also impacted the manufacturing industry. Most of the concerns have revolved around the effect of the trade and tariff wars. Manufacturers were initially hit by the steel and aluminum tariffs, but then came the attacks on China, Europe and Mexico (among others). These are markets that the U.S. manufacturer needs, so the U.S. is affected indirectly. The Chinese slowdown has meant China buys less from other nations, which are often the markets for U.S. exports. This angst is starting to show up in measures like the Purchasing Managers' Index and this month's CMI.

The overall score slipped, but not dramatically, as it went from 55.4 to 54.9, still higher than at any point since November of last year. The index of favorable factors remained in the 60s, but fell a little from 63.1 to 60.4. The index of unfavorable factors improved and clawed its way further into expansion territory with a reading of 51.3 compared to May's 50.3.

The sales data fell quite a bit from the previous month's reading as it dropped from 63.3 to 58.5, but this was more in line with the data seen over the last several months. Last month looks like the anomaly. The new credit applications shifted slightly downward with a reading of 62.5 compared to 63.9 in May. The dollar collections data slipped out of the 60s, but only by a hair, going from 60.5 to 59.2. The amount of credit extended also downshifted a little (64.6 to 61.3). The good news for this set of readings is that all are very comfortably in the expansion zone—two are in the 60s still.

There was a bit more variety with the unfavorable categories. The rejections of credit applications ticked upward a little with a reading of 53.8 after 52.5 last month. This is always a positive sign as it suggests that more of the applicants are qualified and successfully getting the credit they have requested. Accounts placed for collection saw a nice jump back into the expansion zone with a reading of 53.5 up from 49 in May. The disputes category stayed roughly the same with a reading of 48.3; May's reading was 48.2. It is close to leaving contraction, but has a way to go yet. The dollar amount beyond terms fell a little from the 51.8 noted last month, but it is still in expansion territory with a reading of 50.2. The dollar amount of customer deductions rose a bit, but still sits in contraction territory with a reading 49.8, up from 48.4. The filings for bankruptcies stayed right where it was last month with a reading of 52.

Thus far, the worries that have affected the industrial community have not sent the manufacturing economy into a tailspin. The threats posed by the trade and tariff wars have been put off a number of times as there have been exemptions granted to major steel exporters to the U.S. (Brazil, South Korea). It is expected that both Canada and Mexico will be next. The European tariffs have been delayed and the threats to Mexican business have not materialized. Even the most draconian of the restrictions on China have been put off for the time being.

Service Sector

The changes were minor as far as the service data is concerned—almost no change in the overall score from last month as it dropped from 55.9 to 55.1. This is consistent with much of the other national data that has been produced of late. There has been relatively little movement in the big service areas such as retail and construction, although there are signals of a decline on the horizon with new home starts down and consumer confidence waning. The index of favorable factors slipped a little, but stayed in the 60s with a reading of 62.4 after one of 64.6 in May. The index of unfavorable factors also remained about the same with a reading this month of 50.2 compared to 50.1 the month before.

When one looks at the breakdown within each category, there is more variety. The sales data was very high last month with a reading of 68.5. It fell back to more normal levels with a reading of 62.3. The new credit applications shifted down a little as well with a reading of 62.4 compared to the 64.6 seen in May. The dollar collections data improved though—good news for the credit managers. It was just shy of the 60 mark in May with a reading of 59.1 and is now standing at 61.4. The amount of credit extended slid a bit as it went from 66.3 to 63.7. All in all, this month was weaker than in May, but the numbers have remained solidly in the 60s, which is certainly growth.

The shifts as far as the unfavorables were not quite as dramatic. The rejections of credit applications remained very close to 50, the line separating expansion from contraction. It was 51.2 last month and 51 this month. Given the slowdown in applications, it is good news that rejection levels have not worsened. The accounts placed for collection reading remained in the contraction zone, but improved a little as it went from 45.1 to 46.6. The reading of 46.6 was the lowest in two years. It is encouraging to see it start to recover a little. The disputes category slipped a bit as it moved from 49 to 48.8. This is often an early sign of some trouble down the road. The dollar amount beyond terms reading fell back into contraction territory with a reading of 49.3 as opposed to the 50.9 that was registered last month. This is another of those early warning readings that often signals bigger issues down the road. Those slow pays become collections far too often and some slide as far as bankruptcy. The dollar amount of customer deductions improved a little, certainly encouraging as it went from 50.1 to 50.3. There was also some additional good news coming from the filings for bankruptcy category as it moved from 54.5 to 55. Even with all the trepidation, there are not as many companies throwing in the towel. That is something that usually happens in retail right after the conclusion of the holiday season as companies soon know if the business they did during that period was enough to keep them afloat.

The test for the service sector will come this summer as many of the major categories are going into their peak seasons. Retail and entertainment as well as travel all wait for the summer months. This is also a peak time for much of the construction sector.

June 2019 versus June 2018

Last month, we were grasping at straws and thought we might have the beginning of a trend, but that didn't last long. This month, there was a substantial decline in the manufacturing sector and a minor one for the service industry.

Is Liberalism Dead?

According to Vladimir Putin it is. The Russian president is rarely interviewed at length in the western press but in a long exchange with the Financial Times, he opined that this is now the age of nationalism and populism. The dominant political ideology since the end of WWII has faded and been replaced by one that features antagonism towards immigration and multiculturalism. He cites the rise of leaders such as Viktor Orban in Hungary, Matteo Salvini in Italy, Boris Johnson in the U.K. and Donald Trump in the U.S.

Analysis: The challenge for business is that populism is very often anti-corporate whether it stems from the right or left.

Cat Surfing

I am really not sure why I do this to myself, but I have a habit of trolling through the websites that feature cats in need of new homes or rescues of one kind or another. I really do have plenty of feline company with the current five and am well aware that we have been spectacularly lucky with all the new integrations we have gone through. The five all hang out with each other and each new arrival has been welcomed—especially the new kid who is now about eight months old. Still, I look at these faces and want to adopt them all. I wonder if six or seven cats would brand me forever as a lunatic. Fortunately for my reputation, my wife maintains the household sanity. She patiently points out that I am the traveler, while she has the honor of taking care of the crowd much more than I do.

I suppose my interest is motivated by curiosity as well as concern. I do enjoy seeing the notations that accompany some of those pictures—announcements that this cat now has a new home. It is especially reassuring when it is a cat that has been featured on the site for a while and now seems to have found the perfect owner. I don't worry so much about kittens—their cuteness will be their advantage. The older ones are the heart breakers. This also becomes a worry for me when I think about my five. We have one that is 19. All of our cats have lived to at least 16 or 17 or older. I look at Seamus, the kitten, and think that he has a good 16 or 17 years ahead of him. That means I need to hang in there until I am around 80, or he will one day be one of those elder statesmen that sits in a cage waiting for a new person. Just another reason to take care of my health!

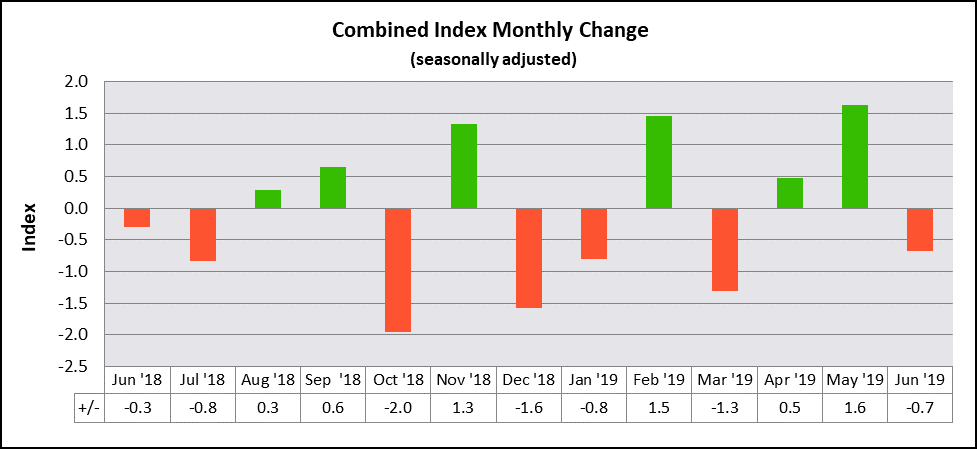

Credit Managers' Index Combined Score

This chart is from June's Credit Managers' Index—the overall index score. This has been a very volatile period with no discernible trends. The best that has been seen thus far has been a couple of consistent months, although it was somewhat encouraging that there had been three good months out of four until the latest data came in. There is some solace to be taken by observing that the scores this month were very close to those of last month.