Strategic Global Intelligence Brief for June 26, 2019

Short Items of Interest—U.S. Economy

Durable Goods Orders Down Again

For the third time in four months, the level of durable goods orders has fallen. That is yet another sign of overall weakness in the manufacturing sector. There was a very weak Purchasing Managers' Index (PMI) number reported earlier and there have been significant reversals in other measures that trend the industrial community. The numbers are not pointing at a full-fledged recession as yet, but that possibility is now under discussion. The durable numbers are often affected by airplane orders. This has definitely been an issue of late. The Boeing 737 Max mess has taken a huge bite out of this sector as there have been no new orders since the investigation started. If there is any good news, it is that Boeing can and will fix the problem and sales will resume. The plane is still a very valuable asset; demand is there once the plane passes muster.

CBO Predicts Higher Deficits

The U.S. now has one of the highest deficit levels in the industrial world and the Congressional Budget Office (CBO) indicates it is going to get worse. It stands at 4.2% now and will increase to 4.5% by 2029. The 50-year average has been 2.7%. Economists have asserted for years that a deficit that exceeds 3% is dangerous and leads to hyper-inflation and a recession on top of that. The U.S. is facing pressure from higher Social Security and Medicare payments as well as a rapidly mounting level of debt service. At current rates, the U.S. will have a total debt load that is 144% of its total GDP by the year 2049.

Mixed Housing Messages

The pace of new home construction has slowed consistently through the first part of the year. That is a trend that will continue. At the same time, there has been a decline in the pace of home prices with a few notable exceptions in the fast-growing cities. On the other hand, there has been a spike in permits. The majority of these have been for more moderately priced starter homes. Mortgage rates are down slightly and there has been a little less activity in the multi-family sector. The pace of building in the high-priced sector has slowed, but is still significant.

Short Items of Interest—Global Economy

Europe Prepares for Long Heat Emergency

Europe is facing one of its most brutal summers in decades. The heat that arrived earlier than usual is expected to be far more dangerous and extensive than has been the case in decades—temperatures well above 100 degrees for days on end. This hits a region where air conditioning remains spotty and most people have few means by which to escape. The toll on infrastructure will be great as well—roads and bridges are suffering as well as train tracks, airports and buildings. Farmers are watching their crops burn up and water shortages are showing up all over the region. In addition, there are increased concerns regarding forest fires like the ones that hit Greece and Italy last year.

Little Foreign Investment in U.K.

The Brexit mess has all but killed interest in foreign investment in the U.K.—at least for the moment. The fact that nobody knows what the outcome will be has the investor on edge, but once the dust settles, there could be a surge as British business will be cheap to purchase. The expectation is that companies will seek to buy British capacity on the cheap, but none of that transpires until an agreement is in place.

Denmark Gets a New Government

After some weeks of wrangling, the Danes have a new coalition led by the Social Democrats. They agreed to weaken their anti-immigrant policies in order to gather support from three left-leaning parties. Now, the nation has the youngest prime minister in its history. Mette Frederiksen is 41. She led her party to its best showing in years. All of a sudden, the traditional center-left and center-right parties are making a comeback in European politics as the populists fade.

What Can Central Banks Really Do Right Now?

For a variety of reasons, there has been a great deal of attention focused on the central banks of late. There is the obvious issue of interest rates and the other tools these institutions have at their disposal, but it seems to go far beyond the question of whether monetary policy is loose or tight. The political implications of bank policy have become front and center in the U.S., Japan, Europe, India, Turkey and elsewhere. Some of this is to be expected given the role these banks play in the conduct of economic policy, but lately the pressure has been much more intense than is normally the case. It seems central banks have been made into scapegoats or have been expected to do more than their mandate. Ideally, central banks are designed to work in tandem with the legislature/executive of a given nation. They have a simply stated mission, but one that can be very difficult to execute. They are to manage monetary policy in such a way as to ensure economic stability—not too much inflation and not too much joblessness. They are designed to be immune to the pressures that affect the elected officials. As has been demonstrated repeatedly, the elected representatives nearly always err on the side of pushing inflation—they have never met a spending program they didn't like and they always want to offer tax cuts.

Analysis: There is always tension between the politicians and the central bankers—especially when there is a difference of opinion over what the economic policy should consist of. The Federal Reserve has been under attack from President Trump for months as he asserts interest rates are too high at 2.5%. He maintains that the slower growth in the U.S. is due to these higher rates and has threatened to fire Fed Chief Jerome Powell. He has tried to place allies on the Fed's Board of Governors, but with little success.

The European Central Bank (ECB) is in the midst of figuring out who replaces Mario Draghi as the leader when he retires next year. The favorite is Jens Weidmann the President of the German Bundesbank, but he is a very controversial figure who has long been critical of the ECB's stimulating strategy. He has opposed lower rates as well as the bond-buying program that Draghi advocated. His advance would signal a radical change in ECB strategy. This has been virulently opposed by the southern tier nations in the EU as they have been the biggest beneficiaries of ECB policy.

The Reserve Bank of India has been in turmoil as members have been resigning in protest of Prime Minister Narendra Modi's interference. Modi has been trying to browbeat the bank into slashing rates as a means by which to boost economic growth, but the members of the bank's board fear this policy would unleash rampant inflation—a problem in India already. There is a similar contest of wills taking place in Japan as the government of Prime Minister Shinzo Abe has been pushing the Bank of Japan to push rates lower. The Bank of England (BoE) faces a set of challenges as the issue of Brexit looms at the same time that BoE Governor Mark Carney has announced his plans to step down. The British economy is set to slow down due to the Brexit mess. The only question is by how much. The worst-case scenarios assert Britain will fall into actual depression. Even the less dramatic assumptions have the economy slowing to almost zero. The BoE is expected to do something to help, but it is unclear what it can do given that rates are already low.

The fact is much of what has to be done to "fix" these economies has to be done by the legislatures and the executive branches, but thus far they have been unwilling or unable to take the necessary steps. Most of these countries are facing budget deficits and high debt loads already, so they are limited in terms of what they can spend to encourage economic growth. They are unable to do much with taxes either. Steps that could be taken are politically unpopular. The U.S. has a labor shortage issue that has limited expansion and productivity that could be addressed though immigration, but that has become anathema to the GOP. Britain could clear the way towards economic growth by settling the Brexit crisis, but the Tories are unwilling to do so. Japan tries to boost the economy one day and then panics over tax revenues the next. It moves to boost consumer spending taking place at the same time that taxes are being raised. All these banks are protecting their independence, but the pressure keeps mounting.

The Importance of the G-20 Meetings

Every meeting of the G-20 is important simply because these 20 nations constitute almost 80% of the global economy. These get-togethers provide an opportunity to meet and coordinate and vent. The members vary in size and importance and have some radically different outlooks on the global economy—especially this year. Members include Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, United Kingdom, United States and the European Union. There are always a host of subplots and special meetings that take place either formally or informally as world leaders have an opportunity to talk to each other more casually and somewhat out of the presence of the press and other leaders from their own countries. This year there are a number of these meetings that will take center stage to one degree or another.

Analysis: At the top of that list will be the meeting between President Trump and President Xi Jinping of China. Both the U.S. and China have made it clear this will be a vital opportunity to make progress on trade talks, but neither leader has dropped much of a hint as to what their ultimate position will be. The fact that there had seemed to be a deal in the works just a couple of months ago suggests there is a framework for some kind of compromise, but both men have been reaping domestic political benefits from this standoff. Neither nation has really felt the impact of the impasse yet, but both know there will be a price to pay sooner than later. The sense is there will be a ceasefire of sorts as there will be a delay in imposing additional tariffs pending further negotiations. This allows both Xi and Trump to essentially declare victory and then move on. Not that this kind of decision really helps the business community in either nation as there will be no resolution and no way to plan for the future.

A second and less formal meeting will be between Trump and Prime Minister Narendra Modi of India. There was to have been a high-level meeting between the two a few months ago, but that was postponed due to the Indian election—one that Modi swept decisively. The U.S. has been putting pressure on India of late—reducing some of their trade advantages and demanding that their markets be opened up to U.S. goods. India would like to supplant China during this period of Sino-U.S. tension and the U.S. seems to have some interest in this as well. Trump and Modi are cut from the same populist cloth to a degree. This may give them an opportunity to engage.

One of the surprise moves is that Mexico's President Andrés Manuel López Obrador doesn't plan to attend. He has a radical agenda in mind for his nation and doesn't consider Mexico a nation that gets much from these meetings. He has been singularly uninterested in global affairs as he pursues a more domestic agenda. Other meetings that will be watched closely involve Turkey's Recep Tayyip Erdogan and the European leaders. There will be also attention focused on Brazil's President Jair Bolsonaro. Many of those in attendance have big political challenges at home and will be seeking some ammunition at these meetings. Britain is essentially without a leader at the moment. That complicates any opportunity to talk with the other Europeans in attendance.

Peace in Afghanistan?

There are statements coming from the U.S. State Department and Secretary of State Mike Pompeo that suggest a peace deal may be worked out in Afghanistan before their presidential elections in September. The U.S. negotiator has been talking to the government and to the Taliban for the last year. He has indicated that some progress had been made, but has not revealed much more than this. It seems the U.S. has reduced its demands considerably over this period of time. The only real demand retained is any new government that includes the Taliban will have to pledge the country will not harbor terrorists that threaten the U.S. All of the other reforms that had once been part of a deal seem to have been abandoned—women's rights, democratic process, independent judiciary and so on. The Taliban would be free to bring back the policies it pursued prior to the U.S. invasion.

Analysis: To note that supporters of the U.S. are bitterly disappointed at this stage would be an understatement as the U.S. now seems determined to just get out of the country and leave it to its own devices. The only limitation is that the country cannot allow itself to be used as a threat to the U.S. The critics point out this goal was accomplished more than a decade ago. The assumption is that the U.S. wanted to remake the nation into a modern society. Many have asserted this was an impossible goal from the start, but over a decade and thousands of lives have been lost in the attempt.

Deterioration of Consumer Confidence

The level of consumer confidence has started to react to all the angst showing up regarding the economy. Levels have fallen to a point not seen in over two years. The expectation is this trend will continue as long as there is concern about trade wars and the erosion of the job market. This latter issue is a little perplexing as the unemployment rate is still historically low. The problem is that job gains have slowed down a little and that worries people. Some are convinced the slower pace of job growth will soon translate into actual job loss. The most immediate concern is the trade war as people are now convinced they will be seeing price hikes, and soon.

Analysis: As we have noted many times before, the levels of consumer confidence change quickly. Consumers are fickle and highly reactive. It doesn't take much to get them excited or depressed. The high levels of confidence evident for the past few years were propelled by the low rate of unemployment and the strength of the stock market. There was also enthusiasm generated by the rise in home values. Now there are worries about all three of these motivators and the consumer is expressing a more dubious attitude towards the future.

Selling Through Harassment and Annoyance

Yesterday was robocall hell. It seemed the phone just blew up with all the unwanted calls—the home phone and the cell phone. I even got a robo text. These infernal solicitations are ludicrous in the extreme. The heavily accented "Microsoft" guy that tells you something is awry, the harassing voice telling you the IRS is after you. I kind of understand the logic behind these calls. These callers seek the morons who believe them so they can steal their information. The ones I do not understand are the ones who seek to sell me something. Is this a technique that actually works? Harass people and annoy them and you have a loyal customer for life? If this works, why don't we see it at our retail outlets?

You would walk in the door and some guy would race over, knock you to the floor and sit on your chest yelling that they have a sale on used odor eaters or slightly chewed bubble gum. Every attempt will be made to make the decision to enter that store the worst one you ever made. Does this encourage you to spend? It seems the unsolicited callers think that getting somebody angry at them will boost sales. Either that or they are really calling and pretending they are from this or that company when they secretly work for the rival company. I just want a robocaller of my own that determines where that call came from and calls it every second of every day for the next century.

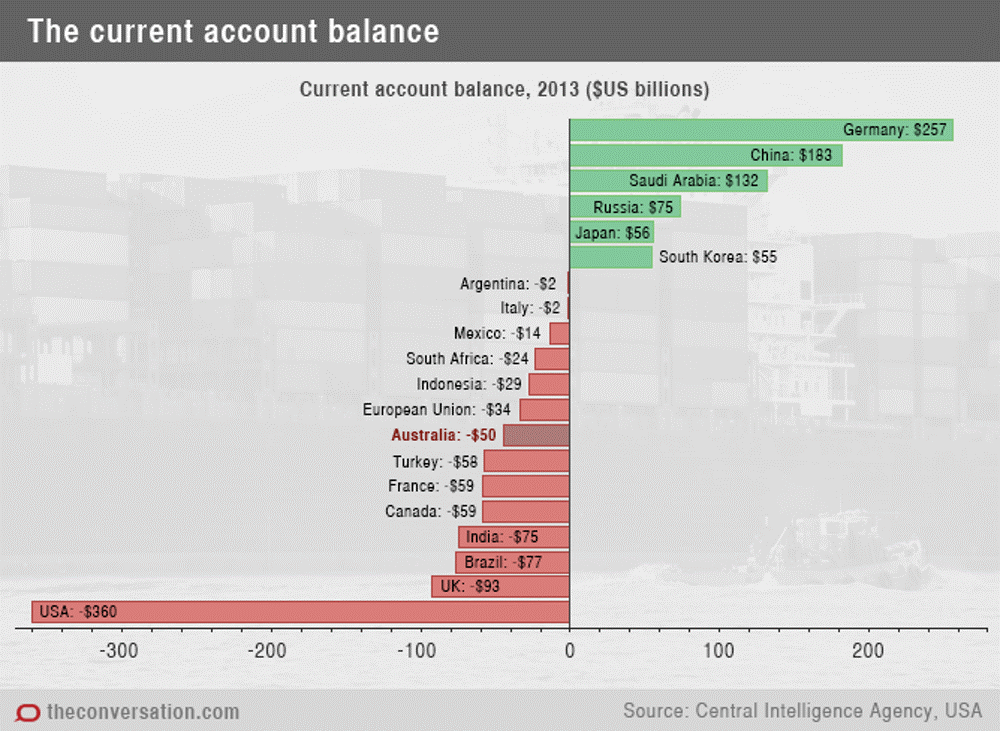

Current Account Balance by Country

As the G-20 states get together there will be conversation regarding their relative economic position. There are many ways by which to measure this, but one way is to examine the current account balance to see the national debt situation of each of these nations. One thing is pretty stark and alarming—the U.S. is in the worst position of all 20—far worse. The current account balance is utterly unsustainable except that this measure is in dollars and therefore the U.S. has an advantage the others do not. The U.S. just "prints" more of those dollars as needed.