Strategic Global Intelligence Brief for June 21, 2019

Short Items of Interest—U.S. Economy

Reduction in Jobless Claims

There continues to be good news on the employment front despite the occasional bump in the data. Last week, there was a slight increase in the number of first-time jobless claims, but this week, the number fell slightly. The end result is a stable level of employment. The challenge as far as employment is concerned is not that there is a shortage of jobs. There is instead a surplus of jobs that has reached well over a million. The issue is that companies are struggling to find the people with the qualifications they need. This is one reason the Phillips Curve has not been reliable as far as estimating wage inflation. Many less qualified people are getting hired and are being paid less than would be expected until they gain the experience they need to command a higher wage.

Fed Keeps Current Rates

The Fed has completed its June meeting and did what was generally expected—i.e., nothing. There were very few who asserted the Fed would decide to lower rates as it has been signaling all along this would not be the month it elected to shift. The interesting aspect of the meeting was the rationale developed to justify a rate cut in the future should that decision be made. It will come down to the global economy—if it continues to sag, it will drag the U.S. economy down with it to some degree. That would provide enough threat to U.S. growth to justify a rate cut. The unstated factor to watch is tariff policy. The U.S. has threatened tariffs on almost every nation, but has followed through on very few. If some of these stick, the global economy stutters and U.S. exports will suffer as a result.

Backtracking on Drone Issue

The Iranians claim the surveillance drone they shot down was over their territorial waters, while the U.S. insists it was over international waters. The initial reaction from the U.S. was a bellicose assertion that Iran "had made a very big mistake" and some inferred this would be sufficient provocation for U.S. retaliation. Today, the statements from the White House suggest Iran may not have done this intentionally. That appears to be an attempt to ratchet down tensions. The oil markets have been all over the place for the last two days.

Short Items of Interest—Global Economy

Putin Reacts to Popular Anger

For all the gains Russia has made in terms of regaining its global influence, there has been nothing much to show for Putin's efforts on the economy, and the average Russian is fed up. There have been five consecutive years of falling income at the same time that prices have been rising. The fact is Russia has been described as a "gas station masquerading as a country." With oil prices in steady decline, the country has lacked the income needed to improve the lot of the average person. Putin is now admitting something has to be done, but there have been no plans described. Frankly, there is nothing much that can be done until and unless oil prices go up.

Japan's Consumer Price Inflation Dip

The rate of inflation has fallen again, not necessarily a good thing. The core rate is now at 0.8% annually. Just last month, it was at 0.9% per year. The headline rate is just as low at 0.7%, down from 0.9% the previous month. The effort to steer away from deflation has been very challenging no matter what the Bank of Japan has tried to do. The sense is there will be a tax hike later in the year, but this low level of inflation has made that move a bit more complicated.

Tories Narrow the Field

The race to replace Prime Minister Theresa May as leader of the Conservative Party and thus the new prime minister of the U.K. has been narrowed to a run-off between Boris Johnson and Jeremy Hunt. The choice could not be much starker—a leading Brexiter and the man who describes himself as the "serious candidate."

Fresh Signals Regarding China

If the critical issue for the Fed and others worried about global growth is the chance of a deal between China and the U.S. that averts a trade war, then there appears to be more encouraging news on a daily basis. First, it was a softening of the rhetoric aimed at China in advance of the G-20 meeting. This more conciliatory tone has been adopted by the Chinese as well. There had been a hint that President Xi Jinping would refuse to meet privately with Trump, but the Chinese have since insisted this was not a consideration. The next signal came from Robert Lighthizer—the chief U.S. negotiator. He will be meeting with his Chinese counterpart prior to the Xi-Trump meet. He suggests this will be to "work out some details."

Analysis: If this is all to be believed, it would suggest that a deal is working out that allows both nations to essentially declare victory and move on. This doesn't mean an end to trade tensions or even that prior tariffs will be lifted, but it may mean that the draconian steps threatened by both nations will be abandoned—at least for now. It is likely that bashing China will remain part of the Trump strategy just as bashing the U.S. will remain part of Xi's political arsenal. The point is that these exchanges will be mostly bark and very little bite. This seems to be what the global markets are assuming as they have been having some good days of late despite some negative news on other fronts.

The assumption at this stage is that the two leaders will end their meeting with an agreement to resume formal talks, but it is unlikely that anything definitive will emerge other than a delay in imposing harsher tariffs on one another. This would temporarily provide some relief for U.S. farmers that want to sell to China and U.S. firms that want to source from China. A more permanent solution seems pretty distant at this stage, but the global markets are happy enough to see a cease fire at this juncture. The rest of the G-20 attendees will also be happy to see this truce as well and can be expected to make their opinions known.

Mexico Approves USMCA

The supposed replacement for NAFTA has been approved by the Mexican legislature by an overwhelming majority. The USMCA was created by the Trump team as a revision of the agreement that Trump had called the "worst trade deal ever." The vast majority of analysts in the U.S., Canada and Mexico have held a much different opinion and have credited NAFTA with allowing significant expansion of the economies of all three nations. It is useful to review the origins of the North American Free Trade Agreement (NAFTA) as this has bearing on what has been suggested as its successor. Thus far, the prospects for its passage through Congress or the Canadian Parliament are relatively bleak.

Analysis: In the mid-90s, the U.S. faced a new threat to its economic position—hard as this is to believe these days. There was serious concern that the European Union would come to usurp the U.S. position as the dominant economy, the euro would emerge as the new global currency and the development of new markets in Asia and elsewhere would be the task of Europe. The EU was new and exciting and dynamic. Much of its strength was based on a division of labor between the northern Europeans and those in the southern tier. Germany, the Netherlands and the Scandinavian countries invested in Spain, Italy, Greece and others or used migrant labor from East Europe (especially Yugoslavia). This proved to be a potent combination and was pressuring the U.S. companies who found no effective way to compete other than to decamp and move production to Asia, Latin America and other developing regions. That was when it was considered urgent for the U.S. to match the EU advantage by creating its own trade union that would unite resource-rich Canada with the low labor and production costs of Mexico and the business and investment community of the U.S. There were those who asserted Mexico would siphon jobs from the U.S., but the reality is that those manufacturing jobs were leaving anyway. The only question was whether they would go to China or elsewhere in Asia or to Mexico. In fact, most were lost to automation and robotics. Mexico buys close to 90% of all its imports from the U.S. and China buys less than 8%, so it seemed a pretty logical decision to favor Mexico.

Fast forward some 25 years and the EU is not so intimidating. The U.S. now has a solid manufacturing platform in Mexico, but much in the way of manufacturing has returned to the U.S. as more and more companies opt for robotics and technology to gain and keep an edge. The myth of the "giant sucking sound" persists and continues to be good campaign fodder, but the reality is that NAFTA has been a bulwark against the expansion of China and Asian business. The USMCA is supposed to continue that trend, but there are questions that have made its passage problematic in the U.S. and Canada. There are those who want it weaker and those wanting it stronger. All will be measuring the political impact of their position. Most assume Canada will pass it if there are dispute resolution provisions that do not favor the U.S., but Congressional passage relies on satisfying the union-oriented Democrats and the isolationist Republicans. That will be no easy task.

Venezuela Destabilizes All of Latin America

By any definition, Venezuela is a failed state—along the same lines as one of the classic collapsed regimes in Africa such as Zimbabwe or the Democratic Republic of the Congo. By the end of this year, there will have been in excess of five million people who will have fled Venezuela to escape the violence, street crime and persistent poverty. The vast majority of these refugees have ended up in Colombia, but no nation in the region has been immune from this exodus. Analysts have been asserting that Venezuela will require decades to rebuild from the debacle of Chavez and Maduro, but now it is thought that Colombia, Brazil, Ecuador, Guyana, Surinam and many others will be suffering the impact of the crisis for years. There are far too many people arriving with little more than the clothes on their backs and there are no job opportunities for the majority of them.

Analysis: The political fear is that one of two things start to emerge. The first is that drug gangs and other violent groups will find ripe recruiting opportunities with these disaffected people. They are already signs that drug cartels are rebuilding in Colombia and there are further signs that groups seeking to emulate FARC are forming. This sets up a backlash from the right-leaning nationalists that resent the influence of the migrants and would seek a more violent and forceful response to the refugees. The profound engagement by China and Russia in Venezuela also causes concern as there is fear that both of these nations may seek to meddle in the affairs of the other nations in the region. There had been hope that a nascent coup attempt by Juan Guiado would succeed, but with Chinese and Russian money, it was thwarted and the wind seems to have gone out of the opposition.

Pretty Much as Expected

There was not as much drama at this week's Fed meeting as some had expected, but there were certainly some odd discussions as the Federal Open Market Committee (FOMC) deliberated over what to do about interest rates. There was a decision to stand pat despite the not-so-veiled threats from Trump. If ever there was a case to be made for Federal Reserve independence, it would be this president. He has asserted that he wants to fire Fed Chair Jerome Powell or at least demote him. Neither of these actions are seen as part of the president's purview as Congress makes the final decisions on who is on the Fed. Trump has tried to place ideological allies on the Board, but this has been a recent development. Up until the last several months, the choices Trump made were quite mainstream. He elevated Powell to Chair and selected Randy Quarles, Richard Clarida and Michele Bowman. Last year, two of his other selections ran out of time for their consideration, but were also mainstream (Marvin Goodfriend and Nellie Lang). It was only this year that Trump has tried to place more unusual candidates. They were rejected early (Herman Cain and Stephen Moore).

Analysis: The issue that has raised Trump's ire is the unwillingness of the Fed to lower interest rates in response to some slowing of the economy. It is the contention of the Trump White House that pulling rates down to 2.25% or 2% will prove dramatically stimulative, but analysts and economists do not agree. It is certainly true that some additional borrowing might take place, but coming down from an historically low rate is not going to change many business strategies. On the other hand, the lower rates are still causing concern over issues like inflation, an inflated stock market and savings. One of the members of the Open Market Committee is Esther George of the Kansas City Fed. She has consistently pointed out that historically low rates have encouraged very risky borrowing and lending. People are taking out big loans at low interest and investing in the markets. It is a good strategy as long as the market boom lasts, but should the momentum cease, these borrowers will be in trouble. So will the banks that loaned the money. She has also been very worried about the ability of small banks to make money the traditional way. There is no incentive for people to save at the bank or buy instruments like a certificate of deposit. George wants rates back to the point that savers get some kind of return and speculators have to be a bit more cautious.

If Trump was of the opinion that the Fed would be cowed by threats, he was likely disappointed in the outcome as the vote was nine to one in favor of keeping rates just where they are. The lone dissenter was St. Louis Fed Chief James Bullard. He is somewhat mercurial and is neither a reliable hawk nor dove. His contention is that a real trade war is imminent and will be waged throughout this year and next as it will make good political fodder. The rest voted to stay where they are. That includes ultra-hawks like George and doves like Charles Evans in Chicago. At this point, there is no sign of buckling under White House pressure.

The statements coming from the FOMC hint that a rate cut is not out of the question later this summer or early fall. The determining factor will be the status of the global economy. The U.S. economy continues to grow at a respectable rate, but the threat comes from the potential for a protracted trade war. The pessimistic assert the China-U.S. dispute will not be settled anytime soon and the tariffs and trade restrictions will compromise global growth as well as growth specifically in the U.S. The more optimistic assert that much of the trade dispute is posturing on the part of both the U.S. and China and that a deal will be struck. The Fed is essentially waiting to see which of these two positions are most accurate.

It Seems Like It Has Been Hours

Wasn't it just yesterday that I was complaining about airlines? Does this seem to be a theme of mine? Do I perhaps spend way too much time on these giant aluminum tubes? Over the years, I have declared that I would never stray from the secure cocoon of Southwest Airlines, but sometimes I am forgetful and naïve and try another. This week it was Delta as I needed to get to Savannah from San Diego and then from Savannah to Minneapolis. Southwest doesn't serve Savannah, so it was Delta or nothing. I should have chosen the nothing option. Due to a host of organizational breakdowns exacerbated by weather, I was stuck in Atlanta until 1:45am and arrived at my hotel at 4:30am. Seems Delta had no pilot for that flight so we had to wait four hours for them to find one with the qualifications to fly that specific plane. One was found at home in Orlando so we had to wait for him to make it to Atlanta.

The whole sorry experience was an exercise in how to do things incorrectly. First, create a fleet of planes that not everybody can fly and which can't be serviced at most of the airports they fly to. Second, have an antique boarding system that turns the process into a rugby scrum. We had a very narrow window to get everybody seated so we could close the doors and keep the cabin crew from timing out. We made it with two minutes to spare as people wandered all over the plane trying to remember that 19 comes after 18 and not the other way around. Top all of this off with surly gate agents and a flight crew that didn't want to take off as that meant they would be able to head to a hotel.

The next time I have Savannah or any other non-Southwest destination, I will stick to my vows—"take Southwest as close as I can get and drive the rest of the way."

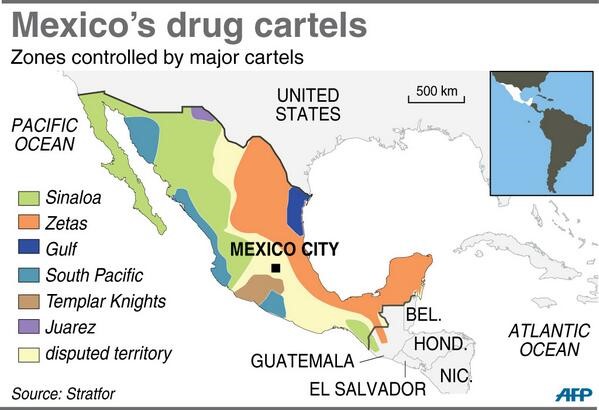

Mexico's Drug Cartels

As the U.S. and Mexico work towards trying to figure out a workable new relationship in the era of Presidents Trump and Andrés Manuel López Obrador (AMLO), there are old issues that will continue to vex. Not the least of which is the drug gang situation. It is no accident that the two largest cartels in Mexico are the ones that border the U.S.—Sinaloa cartel and the Zetas. The Mexican position is the U.S. is more responsible for these gangs than is Mexico because the drug consumption is in the U.S. The Mexican police and military fight internal corruption as well as the gangs. Now the great hope is the new National Guard—trained by elements of the U.S. military. The assertion that this group will be assigned border duty along the Guatemalan frontier is not going down well in Mexico.