Strategic Global Intelligence Brief for June 19, 2019

Short Items of Interest—U.S. Economy

More Distress in Housing Market

The level of housing starts fell in May by 0.9%—a not unexpected development, but certainly not a welcome one. The decline has been fairly steady this year and signals the overall housing market has continued to weaken. Several factors are at work. One of the most salient has been the higher prices for new homes. The starter home that sold for between $190,000 and $200,000 has been supplanted by homes between $250,000 and $260,000. The latest problem has been labor shortages that have stymied construction. The other issue is that new home builders are concentrating on the higher-end homes and demand for these varies with the performance of the stock market. There has also been a slowdown in the construction of multi-family units as more Millennials elect to live with their parents for an extended period of time.

Another Threat From Trump

The enmity between Trump and the Fed has continued to advance and new threats are being tossed around. The demand from the White House is that Fed Chair Jerome Powell and the Fed institute a rate cut immediately. Analysts are united in asserting that lowering rates from 2.5% will have little impact and may even do long-term damage. Trump has asserted he might fire Powell or he might demote him. It is unclear whether he has the authority to do so as provisions of the job assert that a Fed Chair can only be dismissed for "cause." That implies some form of wrongdoing—not disagreeing with a president. Most see this latest fulminating as another play to the "base," but to what purpose?

China Conciliation

While Fed Chair Jerome Powell is being called public enemy No. 1, the Trump position on China seems to have softened again. Presidents Trump and Xi will meet formally during the G-20 meetings. Trump has stated that talks have been going well of late and he expects a deal. That was enough to stimulate the markets, but the Chinese have not been as confident as they thought they were close before yet everything fell apart. Both nations have a reason to cut a deal as both are seeing economic damage, but Xi and Trump also benefit politically from the conflict.

Short Items of Interest—Global Economy

Backing Down for Boris Johnson

As happens in politics, firebrand critics are forced to moderate positions once they are the ones holding power. As a critic of Prime Minister Theresa May, Boris Johnson was prepared to advocate a "no deal" exit from the EU. Now, he is asserting May's deal can be negotiated and partially saved. He had been insisting that tax cuts for the wealthy were key to stimulating the U.K. economy and now this is described as an "ambition." In truth, most of the statements Johnson had made in the last year are starting to modify and adjust.

Problems in Global Retail

The pace of bankruptcies in the retail sector has surged in the last few months. The U.S. has seen more retail bankruptcies in the first quarter than it did in all of last year. The pace is similar in Europe. The sense is that shifts in supply have contributed more than reduced consumer mood. The online assault has been brutal in the U.S. and is hitting the EU as well. This year may be the turning point year for whole sectors of the retail community as well as the sectors that feed into it.

British Manufacturing Down

The pace of manufacturing in the U.K. is the slowest it has been in three years and is expected to fall further—assuming the worst of the Brexit outcomes. Many of these companies are already being excluded from European supply chains and have struggled to open up new opportunities in the U.S. and Asia. The auto sector has been hit the hardest, but aerospace is a close second. There has been an impact in most sectors with many companies deciding to relocate operations to Europe. That has impacted jobs.

Changing Positions on ECB Policy

The head of the German Bundesbank, Jens Weidmann, is angling to replace Mario Draghi as the head of the European Central Bank (ECB). He has the support of the Germans and their northern allies, but he is viewed far more skeptically by the nations of southern Europe. Weidmann has to overcome his past to garner further support. As head of the Bundesbank, he saw his role as that of critic and hawk. He was critical of the various stimulus efforts undertaken by Draghi—even at the height of the recession. In addition, he was a critic of the bond-buying program and other extraordinary moves. He was opposed to the lowering of interest rates and was an ardent critic of the various bailouts that were directed at Greece, Spain, Portugal and others. Now that he is being considered as the next head of the ECB, these positions are softening as he asserts his role would naturally change. As the head of the German bank, his concerns were strictly the concerns of Germany and his role was that of critic. As the head of the ECB, his issues would, by definition, be much broader.

Analysis: This is the week for some high drama within the ranks of the EU. Many top positions are set to be decided and Weidmann's chances have quite a bit to do with other decisions. The Germans also sought to place one of their own as the head of the EU, but Manfred Weber has been watching his popularity slip. This has created a dilemma for Angela Merkel. If she continues to battle hard for Weber, she will see support slip from Weidmann as many in Europe resent the possibility of Germans holding the top-two positions in the EU. Should she essentially abandon Weber, she will be in a better position to throw her full weight behind Weidmann.

The opposition from the EU comes primarily from the southern tier states. Spain, Portugal, Italy and Greece are worried that Weidmann would be a hard liner and would resist any sort of stimulus or further bailout. It is not that Draghi was considered a pushover, but he maintained an activist role for the ECB—especially in the absence of stimulation from the national legislatures. Weidmann has tried to explain away his prior opposition as appropriate to his role at the time, but there are those who insist this caution is really his natural state.

When Draghi put together the Outright Monetary Transactions (OMT) program, Weidmann was the only member of the 25-member board to vote against it. That was in 2012, when the recession was in full swing. He even argued in court that then OMT was not constitutional. This is not a position easily ignored by the nations that relied on that program. The fear is that Europe may encounter another down period and with Weidmann in charge, the response would be slow and help may not be forthcoming at all. On the other hand, he has supporters who assert it is time for the ECB to tighten up and remove itself from the overt stimulating game.

There is no love lost between Draghi and Weidmann and it has been clear Weidmann is not Draghi's choice. In a recent speech, Draghi asserted that Weidmann did a very poor job of explaining the role of the ECB in the European recovery and that this failure has contributed to the rise of populism, anti-European sentiment and distrust of European institutions such as the ECB.

Another (Controversial) Approach to Immigration

Both Europe and the U.S. face a major dilemma when it comes to stemming immigration. The pattern is far different than in the past as the majority of those seeking entry now are not really interested in coming for work. The bulk of illegal immigration into the U.S. for many years was of young men looking for work—usually temporary. They sent the bulk of their wages back home and usually returned home often. Now, the migrant is a refugee from violence and intense poverty. Whole families are coming with little desire to return home.

Analysis: The U.S. has largely failed to stem the tide with increased enforcement—the same experience Europe has had. Now the plan is to get nations where the migrants come from engaged. The U.S. wants to designate Guatemala as a "safe third country" and have would-be migrants held there while their applications for asylum are examined in the U.S. The vast majority will not be granted access and may become permanent "guests" of Guatemala. The problem is that thousands have fled Guatemala for Mexico and ultimately the U.S. The issue of drug gangs and other hostile groups have pushed many Guatemalans into a nomadic state. The majority do not want to go back for fear of reprisals. The U.S. has pressured Mexico to be the asylum nation, but the Mexican economy has been severely strained in terms of accommodating this influx—just as states in North Africa and the Middle East have been pressured by nations of the EU in an attempt to stem the recent tide.

Taxation Politics

There is very little that government does with a more direct impact on the conduct of business and the life of the consumer than setting tax policy. It can be argued that regulation has a slightly more direct impact—especially when the regulation is directly aimed at a specific industry or even company, but taxes shape many decisions. The rationale behind taxation is also very complex as there are motivations for a tax that are widely divergent. The central reason for taxation is to finance the activities of government. The aim is to find ways to get money from the population without doing too much damage to those paying the tax, but at the same time ensuring enough money is raised to fund the actions of government. The logical approach is to tax those that make more, but this group has been adept at avoiding some of that tax activity. The second major motivation for taxation is to shape behavior—taxing things that have been deemed inappropriate (cigarettes, alcohol, etc.). Tax breaks are designed to encourage people to do certain things (install solar panels, grow certain crops, etc.). Given the impact of taxation it becomes a key part of the political process. Thus, there is now intense conversation regarding tax policy as the next round of elections starts to loom.

Analysis: One of the topics will be the efficacy of the 2018 tax cuts. The plan was trumpeted by Congress and the president at the time as the shot in the arm the economy needed to shake off the recession. There is nothing unusual about cutting taxes during a time of economic stress—it is the expected course of action along with a boost in spending. The question at the time was whether the tax cut was coming at the right moment and whether it was aimed at the right sectors of the economy. The consensus view among economists was that the timing was off. The most effective point for a tax cut would have been much earlier—perhaps in 2015 or 2016. Growth was very anemic at that point and unemployment rates were high. Waiting until 2018 was not as helpful as an earlier move would have been as the economy had already been growing at a 3% rate and jobless rates were down to record levels. There was a burst of economic activity, but the impact was compared to a "sugar rush." It was not a long-lasting impact as the stimulating had faded out by the middle of the year. The bonus payments that triggered an expansion of consumer confidence turned out to be one-shot moves as few companies took steps to make permanent changes to what people would be paid. The move has also been criticized for the focus on wealthier taxpayers and corporations. The assumption was that companies getting tax breaks would engage in more investment and more hiring, but the impact was minor for a variety of reasons. The fact is that labor shortage has blunted the impact of additional hiring as companies have struggled to find the people they want to employ.

There will also be a political battle between Democrats in the House and Republicans in the Senate over the extension of tax breaks. These are breaks that are set to expire this year and cover a wide range of subjects. There are breaks for biodiesel production, short-line railroad maintenance, alcohol producers and a host of others. These are largely tax breaks that were intended to be short-lived, but those that receive them work hard to extend them. Often these are breaks that benefit a specific company or industry in a given politician's region. They have long been controversial among both Democrats and Republicans. There are also broader breaks such as those to companies offering family leave or companies that hire from disadvantaged groups. This will provide plenty of campaign fodder and will test the commitment many in Congress have ostensibly made to address the debt through reduced spending and the elimination of these tax breaks.

The bigger issue is the current approach to taxation. There are two very basic strategies and it has been difficult for Congress to make a choice. The first is when government essentially makes a list of all the things it wants to accomplish and then sets about raising the revenue it thinks it needs to do all these things. This is the rationale used most often in high-tax nations—extensive government services paid for by higher taxes. The other option is to decide how much taxation there is to be and then live within those means. That would mean holding spending to some limit and not borrowing in order to pay for more. The U.S. has essentially tried to implement both of these systems at the same time, which is simply not possible.

What Would Prompt a Rate Cut?

If the Federal Reserve were to lower rates, what would prompt such a move given it has been touting the need to hike rates for much of the year? Much seems to come down to what happens at the G-20 meetings. The sense at this stage is that Trump will be meeting with Xi at this conference. If there is an opportunity to settle the impasse between the U.S. and China, this would be it. If this encounter is unproductive, the assumption is the trade and tariff war will continue and accelerate. This slows global growth and that affects the U.S. This would mean the Fed would have a reason to push rates down even though these rates are low now. If the meeting is friendly and offers both men an opportunity to declare victory and leave, the Fed will feel better about staying with its existing plans.

Analysis: The Fed has been fairly explicit regarding the threats it considers serious enough to warrant a policy change. The U.S. economy itself is healthy enough and doesn't seem to need much additional stimulation. If the global economy starts to shudder, the U.S. economy will feel that pinch sooner than later. The Fed will react to global economic slowdown to some degree, but will likely adopt a wait and see position before shifting. Today's discussion from the Fed will shed some light on what it is are thinking as far as timing and urgency is concerned.

What Seems to Worry People

This has been one of those intense travel weeks and it is not over yet. On Monday, it was San Diego to speak to management accountants at their annual meeting. On Wednesday, it was to those in the manufacturing space. Thursday is Minneapolis with accountants again and Friday is San Diego, with credit managers in the pharmaceutical space. Very diverse sets of people, but certain themes are starting to manifest—at least in terms of what they want to know from an economist. Two stand out.

The first is labor supply and related concerns about succession. There has been a chronic shortage of people going into manufacturing, construction, transportation and many other fields for years. Worry about this is nothing new. What really hits many of these business owners is that they do not see their successor anywhere. The family isn't interested and there is nobody on staff that appears willing or able. The next generation of leaders looks to be scarce.

Then second fear is that politics has become too distant from reality. Both parties seem obsessed with winning and seem to pay no attention to what they are supposed to do for the population. Not that partisan attitudes are a new phenomenon, but it seems to many that people running for office used to have plans and goals. Today, the campaigns never end and few ever settle down to actually running the country.

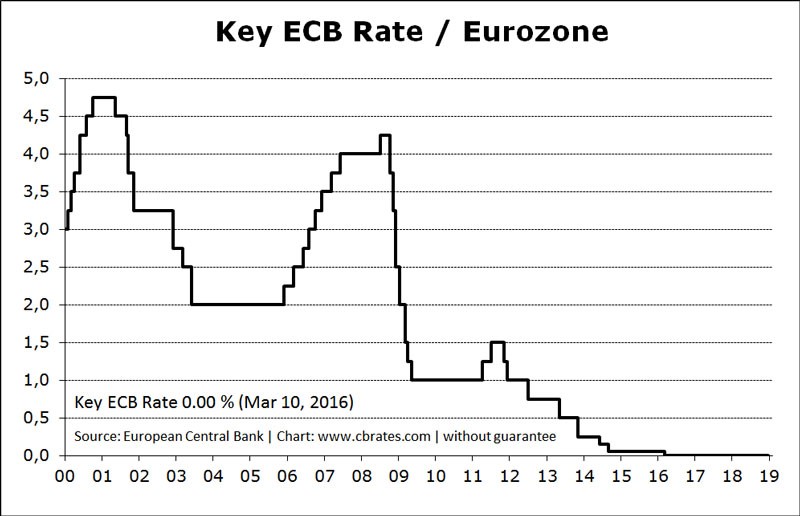

Key ECB Rate/Eurozone

As one can see from the chart, there was once a good deal of volatility with ECB rates and they have been traditionally higher. Even as the recession was biting hard, the rates did not collapse, but since 2015, they have been at rock bottom. Any conversation regarding lowering rates has to confront the state of current affairs—there is simply no real room to move.