Short Items of Interest—U.S. Economy

More Economic News on the Way

Later this week, there will be some additional data on job openings. The expectation is it will show there are far more jobs available than there are people to take them. Despite all the good news that has shown up in recent labor department releases, the biggest issue remains as it has been for years—too few people qualified to take the jobs on offer. There is no quick fix for this issue either. In past years, this kind of shortage was addressed through immigration or by luring people from the ranks of the unemployed. The vast majority of the immigrants coming into the U.S. lack even the basic skills needed to gain employment and the opportunity to pull people off the jobless roll is limited. In short, money has to be invested in training and a lot of it. To put it bluntly, the U.S. has to make training its future workforce the highest priority. Today, it seems that it remains the lowest.

Fed Minutes

The Federal Reserve will release its latest set of minutes this week. They should provide some insights into the logic surrounding the interest rates. A closer look will reveal some important information regarding how the Fed works. This is a consensus-based decision system where the members of the Fed Board combine with a rotating group of regional Fed presidents to reach a policy conclusion. There are members that play little role in that rate determination as this is not their job (Randy Quarles is the regulatory guy and Michelle Bowman is the small bank representative). They have opinions to be sure, but those of economists like Dick Clarida, Lael Brainard or Esther George, etc. tend to carry more weight.

Any Inflation Showing Up Yet?

By the end of the week, there will be new data on inflation, but nobody is expecting any surprises from either the Consumer Price Index or the Producer Price Index. The sense is inflation will remain low. The usual motivators for higher inflation have simply not been manifesting this year. The Phillips Curve is a measurement used to predict higher wages based on low rate of joblessness, but this time around, the connection seems to have been lost. The new hires are not commanding higher wages as they are often less than qualified and business has the option to add additional machinery and technology rather than people. The fact that commodity prices have stayed down has also contributed to the overall low rates of inflation.

Short Items of Interest—Global Economy

How Far to Push with Sanctions?

The logic behind stringent sanctions imposed on a nation that is not behaving as desired is that it is an alternative to war. The pressure is supposed to be on the government as it is assumed the population will demand a change or will overthrow the regime in power to escape the sanctions. This policy makes a huge assumption—that the population has any means by which to change that regime. Most of the time they do not regardless of how brutal the sanctions. The people of Iran, Venezuela, North Korea and others that have been living under sanctions are starving to death and enduring horrendous conditions, but the end of Ayatollah Khamenei, Nicolas Maduro and Kim Jung-Un is no closer.

Australia's Hard Line on Immigration

This nation has pursued an aggressive policy towards immigration for years—through both center-left and center-right governments. The perception is that Australia is far too small to accept the massive waves of migrants from Indonesia and other parts of Asia. Those that are caught are sent to island camps and held in situations close to what the U.S. has on its southern border.

Boeing Starts to Lose Significant Business

The U.S. airlines that fly the Boeing 737 have been patient and are waiting for the 737 Max to fly again, but other nations are starting to bail and are turning to Airbus.

Another Populist Experiment Ends?

The Greeks ushered in the era of the populist reformers a few years ago with the surprise election of the Syriza Party. It had been essentially a small protest party of the left, but after years of corruption, cronyism and a stagnant economy, the country was ready for a change to something new. Very few had any real idea what Alexis Tsipras had in mind, but the consensus view was the traditional center-right and center-left parties had not succeeded. From the start, the policies pursued by Syriza were controversial and confrontational—especially when it came to Greek relations with the rest of Europe. The Greek crisis dragged everyone in the EU into a series of financial disputes as the Tsipras government demanded relief from the debt that had burdened the country. The country received three bailouts; all three financed primarily by the Germans. These came at a price in terms of reforms and budget adjustments. Few were popular with the population. Pensions were cut and government programs curtailed. Granted, the Greeks had some of the most generous programs in the EU—retirement at 56, pensions that paid twice what was made while working, very generous vacation time that essentially gave some in Greece an extra month of pay. The problem was these benefits were not paid for with national income but by incessant borrowing. The only people who got these perks were government workers and those who belonged to the powerful unions. Over the last few years, the reforms have stalled and Greece has fallen further and further behind. The voters began to lose faith in the Tsipras plan and Syriza.

Analysis: The new prime minister is Kyriakos Mitsotakis from the center-right New Democracy party. In last weekend's elections, his vote percentage was 39.8% and Syriza fell to 31.5%. Mitsotakis will need the support of some smaller parties to put him over the 50% level, but he will likely get some defections from Syriza. The hard left had already eroded the Syriza party as they objected to the decision by Tsipras to start severe austerity programs as a condition for the last bailout. Meanwhile, the hard-right populists (Golden Dawn) failed to reach the 3% threshold for entering parliament.

Mitsotakis inherits a nation with a plethora of problems and very few easy answers. The unemployment rate is the highest in Europe at 18%. The taxes imposed as a condition of the last bailout are high and the population is not seeing much of that money since most of it goes to paying off debt. The new government has pledged to focus on jobs and gaining foreign investment, but neither of these goals will be easy to accomplish. The voting public remains very skeptical and impatient. The best and the brightest in Greece have fled to greener pastures and the immigration crisis has landed in the laps of the Greeks. They have tried to be hospitable, but the pressure has been enormous and Greece wants a lot more help from the EU.

To keep peace with the Greek population, the Syriza leaders put through a whole series of handouts and bailouts of its own, but these are frowned upon by the EU monitors that are watching what Greece does with the money it is getting from EU coffers. Mitsotakis will be expected to cut back on these handouts by the EU, but such a move will be very unpopular and could undercut his government even before it starts.

Unusual Set of European Leaders

Almost nobody saw this coming. After months of truly acrimonious debate, the Europeans have a slate of new leaders few had thought were even under consideration. The motivations for their elevation vary and the process has exposed just how divided Europe has become. The new head of the European Central Bank (ECB) is Cristine Lagarde of France. Currently, she is head of the International Monetary Fund (IMF) and one of the most prominent of European and global leaders. She is not an economist nor a banker—both thought to have been prerequisites in the past. What seems to be needed now is a very savvy politician with global clout. The new head of the European Commission is the relatively unknown Ursula von der Leyen from Germany. She is a true dark horse, but is very close to German Chancellor Angela Merkel and can be seen as the closest thing Europe would get to having Merkel. Charles Michel from Belgium becomes the head of the European Parliament and brings a reputation as a conciliator. Spanish Foreign Minister Josep Borrell has been nominated as the EU High Representative for Foreign Affairs and Security Policy. At age 72, there are some worries due to the grueling travel schedule. His term may be a short one.

Analysis: This is likely not an ideal slate, but it ticks many of the boxes. Lagarde is the star recruit, but it remains to be seen whether her style will mesh with the consensus-based decision-making that marks the ECB. Von der Luyen is thought to be a stalking horse for Merkel, but may strike off on her own at some point. Michel is good at balancing hostile factions, but can he get anything actually accomplished?

What Do These Job Gains Mean?

Remember all the dour assertions that accompanied last month's jobs data? The analysts were convinced that the bloom was finally off the employment rose and all those headwinds were starting to have an impact on the rate of job creation as well as the mood of the consumer, the confidence of the business community and the investor and so on. It appeared all the angst from the trade and tariff wars had started to manifest as business expressed a more cautious attitude. Then, we get this month's data and it seems all that trepidation was uncalled for. The jobs report was not showing a little rebound, but a highly significant one—a gain of 224,000 jobs at a time when the labor pool is as shallow as it has been in years. Does this mean that the economy is healthy and the concerns expressed last month were ill-conceived? Not really, the data reveals both good and bad trends and there will continue to be reason for caution going forward.

Analysis: One of the more important questions to ask is always what types of jobs these are. It is true job gains are signs of a healthy economy, but at the end of the day, the real reason economists get excited about the addition of jobs is this means the addition of consumers to drive an economy that is about 80% dependent on the activity of that consumer. The pay scale of the added jobs will rank as more important than the job itself. That is one of the cautionary notes this month. The majority of the new jobs were in the lower-paid service sectors such as health care, personal service, entertainment and food service. There were declines in the number of new manufacturing jobs, retail and construction. The most robust growth was in the health care sector and there was a mix of good and mediocre jobs. With the exception of those higher-paid medical jobs, the average pay of the service sector jobs this month was between 65% and 75% of the manufacturing and construction jobs. What makes this all the more frustrating is there continues to be demand for both manufacturing and construction workers (as well as for people in transportation and specialty sectors of the health profession), but there are far too few available that have the needed skills, experience or education.

The other factor that comes into play this time of year is the summer hire. The vacation season is well underway. That means more people are hired by the entertainment sector as well as by hotels, restaurants and other businesses that cater to the summer trips. These are nice jobs to have, but the majority are temporary. The issues that have been affecting the job market still have an impact—job shortage is not a worry, but labor shortage is. The fact the unemployment rate ticked up a little in the last report suggests there are still people who have been on the employment sidelines and now they are being convinced to come back into the search. It is significant that the majority of those who have been looking are people who have been retired, or those who have been staying home to raise children or take care of ailing relatives. The employers have become more accommodating in order to lure these people back to the workforce. The schedules are more flexible and, in many cases, there have been pay hikes and specific perks aimed at the group they are trying to recruit. This has included offering on-site childcare, transportation to and from work for seniors and the ability to choose shorter shifts.

One of the questions asked now that the immediate labor report has improved is whether this will affect the position of the Fed when it comes to interest rates. The assumption had been that last month's job report confirmed an economic slowdown and thus an excuse for lowering rates as a stimulating move. Now it appears the economy is not slowing quite as fast as was assumed. That will provide the Fed with a rationale for keeping rates right where they are for the time being. The global markets certainly seem to think this will be the case as they have all retreated a little on the assumption the Fed will wait a little longer to pull the trigger on a rate cut.

Stimulus Running Out of Steam?

The stimulus that was launched in early 2018 was supposed to have a bigger impact than it has—at least that was the claim at the time. From the start, there was skepticism regarding the effort as it appeared to have come too late to be that important. The economy in 2017 was already cooking along at 3% and didn't really seem to need the boost. There was concern this would be essentially a "sugar rush." Now that it has been well over a year, there are more flaws appearing.

Analysis: The plan was for the government to push some $300 billion into the economy through a variety of infrastructure programs and projects that would have both lasting value and would provide jobs. The only part of the spending that has taken place at the rate projected has been the military outlay. The infrastructure spend has been a tiny fraction of what was intended despite the increased demand for repair due to the storms and other disasters that have damaged already weak roads, bridges, airports, seaports and the like. The issue has been a lack of consensus on where that money should be spent and on what. Everyone wants a piece of the pie and will not support decisions that exclude their areas.

The stimulus that was created by the tax break worked for a few months, but as feared, the impact was limited. Now that many of these tax breaks are set to expire, the ability to expand through that stimulus has been reduced. From the start, the response from business was temporary. Very few elected to raise wages or add more people. Instead, they offered one-time bonus payments that affected the economy for only a short time. They might have hired more if they had been able to find the qualified people needed, but that was rarely an option.

Looking in All the Wrong Places

In order to protect what is left of my sanity, I rarely pay attention to the political messages in Facebook. I am mostly there for the cat videos and the updates on my friends and family. Against my better judgment, I am sometimes drawn to that other dialogue and become irritated in a hurry. It is not so much the sentiment and opinion—everyone is entitled to those. What drives me nuts is the insistence that we listen to people asserting authority on the basis of nothing. Why do we care one iota what some athlete, actor or singer thinks—anymore than we care about the statements from the guy at the convenience store or the woman in the office down the hall. They are as entitled as anyone else to those opinions, but they are hardly authorities or experts.

Lately, it has been the furor over the Betsy Ross flag. It was not designed by Betsy Ross and there is no definitive evidence that she even sewed one, although it is possible given that she was a Philadelphia upholsterer. The man credited with designing the flag was Francis Hopkinson. He also designed the first coin, the first paper money and was a signer of the Declaration of Independence. He was a lawyer and musician as well as author of satires. He never owned slaves and was considered an abolitionist. Ross was a Quaker and an abolitionist, but was expelled by the Quakers when she fell in love with an Anglican and married him. At some point, far-right groups decided to co-opt the "Ross" flag (along with the "Don't Tread on Me" symbol). These symbols were never intended to support their positions. The rest of us should not allow these historical symbols to be stolen in this way. Most importantly, we need to start paying more attention to our historians, scholars and even our economists! Either that or we start recruiting economists and scholars to sing or play quarterback, and believe me, you don't want that.

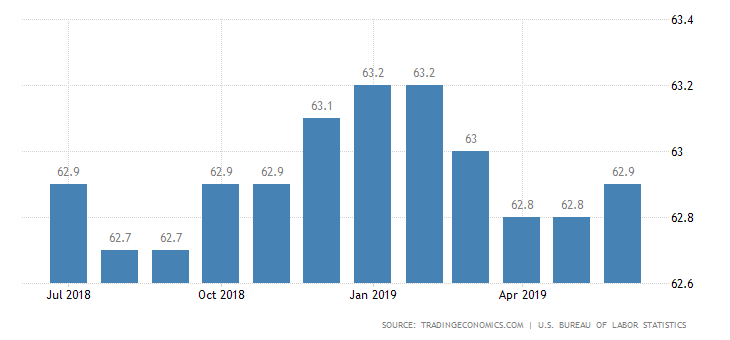

Labor Force Participation Rate

There is still a lot of confusion over what the labor force participation rate means. Part of the issue is politicians have tended to misuse the data and equate the rate with unemployment. The rate of unemployment is an entirely different measure. The participation rate is the level of people available for the workforce. Today, just under 40% of the eligible workforce is not engaged because they are retired, students, people who have chosen to stay at home with kids, people caring for their elders, people who have been incarcerated and so on. The rate was in the 70s some 20 years ago, but the rates have fallen as more people elect to retire.