Short Items of Interest—U.S. Economy

Fed Expectations

By the time you read this, the Federal Reserve will have made its decision regarding interest rates. The consensus view this week has been that the Fed would drop rates by a quarter point in response to the declines noted in the global economy. Even today, there have been dissenters from both directions—those who think a bigger cut is warranted and those who fail to see a reason to cut the rates at all. The fact is the Fed is not getting strong signals from the U.S. economy—one way or the other. The jobless rate remains very low and there is no inflation—something that is not supposed to happen. The bigger question is what is expected from cutting rates when they are already very low.

No Progress in Trade Talks

To the surprise of pretty much nobody, there was no progress at all with the resumption of trade talks between the U.S. and China. Trump made certain of that with a tirade against China as a "rip-off" just as the talks started. His assertion that China was not buying U.S. farm products was untrue as China has been aggressively buying agricultural output in recent weeks. China's reaction to the tweets was expected and hostile. Most observers expect nothing from these talks—now or in the future. Trump gets political mileage from attacking China and President Xi gets mileage from resisting U.S. pressure. China is also clearly waiting to see if there is a new government to deal with next year. Despite the collapse, there has not been a promise to impose the new tariffs.

Farm Export Recovery Still a Long Way Off

China has been buying U.S. soybeans again, but the levels are still far short of what they once were. In 2018, the exports were in excess of six million metric tons. At the start of this year, that had fallen to zero. Today, the U.S. exports around a million tons. Meanwhile, the Chinese have almost quadrupled imports from Brazil. This is a relationship that does not seem to be a temporary one. The U.S. farmer has likely lost the bulk of the Chinese market forever—regardless of the trade talks.

Short Items of Interest—Global Economy

Unemployment Crisis in South Africa

The challenges for South Africa's President Cyril Ramaphosa are myriad; it is hard to separate them by priority. Much of his time has been spent fighting elements of his own party as he tries to root out the corruption that set in under the previous president. The biggest economic challenge is the unemployment rate as it has now hit 29%, the highest level seen in several years. The population is desperate for work as rates this high also mean that wage hikes are nearly out of the question.

Mexico Stagnates

When Andrés Manuel López Obrador became president, he did as all politicians do—he promised great things and growth. He asserted that 2% expansion would be his target. Thus far, he has failed miserably to deliver. The country barely escaped formal recession with a second quarter growth number of just 0.1%. This comes after a first quarter in negative territory. The most worrisome part of this anemic performance is that it comes as the U.S. economy has been relatively strong and when there has been no real economic shock for Mexico to deal with. Any further global slowdown will plunge Mexico into full recession.

Eurozone Growth Falters

The overall slowdown in the global economy is taking a toll on the eurozone as well. Growth has fallen to 0.2% and the threat of real recession is looming. The interruption of trade patterns has been the most significant issue. China and Japan have slowed and the fight over Brexit shows no signs of ending. The U.S. has been a less attractive trade target as well—partly due to threats of tariffs and partly due to the slower pace of growth. The country that has been hit the hardest is Germany, but France has not done much better.

CMI Joins the List of Things to Worry About

The data that has been emerging over the last few weeks has been creating some levels of concern. It is still a matter of whether one is a glass half empty type or a glass half full, but there is more ammunition for the pessimist these days. The Purchasing Managers' Index (PMI) is down, housing is off, earnings are not meeting expectations and global growth is stalling. On the other hand, there has been something for the optimist to focus on as well. The rate of unemployment remains as low as it has been in decades and there has been decent growth thus far this year. The latest edition of the Credit Managers' Index (CMI) can be added to this list as there has been both encouraging data and readings that have caused some level of angst. What follows is the executive summary of this month's report. We prepare this report for the National Association of Credit Management and more CMI details (such as the accompanying charts and graphs) are available on the website.

Analysis: This has been a year that tests the mettle of an economist and illustrates why the meteorologist remains such a kindred spirit. The expectation at the start of the year was that economic decline was both inevitable and imminent. The impact of the 2018 tax cuts had faded, consumers were losing confidence and headwinds from trade wars and slower segments of the economy (such as housing) would have an impact on everything from employment to the stock market. Yet, here we are at the mid-point of the year and the data still points to a decent growth rate for the U.S. economy. The worrisome part is that some of the more reliable future indicators, including the CMI, are starting to falter.

The combined index dropped this month as it fell from 55 to 53.4. This is still not as drastic a decline as has been experienced by the Purchasing Managers' Index which tumbled to an even 50, but it is still the lowest reading since January. January's 53.4 had previously held the record as the lowest reading seen since 2017. In the last year, the combined index has only been lower than 54 a total of three times. The index of favorable factors took the biggest hit by dropping from 61.4 to 58.6. This measure has only been under 60 a total of four times in the last year; this month's reading was the lowest of them all. The index of unfavorable factors stayed close to what it had been the month before with a reading of 50, down from 50.7 in June.

Breaking down the factors that go into the favorable and unfavorable categories illustrates the problems affecting the credit sector. Sales slipped from 60.4 to 58.4, nearly as low as it was in March of this year. It seems a long way from the 65.9 notched in May. The new credit application numbers fell a little from 62.4 to 60.8, but this category remains respectable. The real concern is with the dollar collection numbers as they have tumbled from 60.3 to 56.6, back to the readings last seen in March. The amount of credit extended also fell quite a bit and hit 58.7 after having been at 62.5 the month before. This marks the first time this category has been under the 60 line in over a year. There is simply not as much credit on offer these days.

The breakdown of the unfavorable factors also provides some insights. The rejections of credit applications stayed almost the same as it had been in June (up from 52.4 to 52.6). That is good news given the decline in the number of applications. It means those applying are generally qualified. The accounts placed for collection is not such a good news indicator as it has plunged out of the expansion zone (a reading above 50) deep into contraction territory. The reading now is 46.2 from the previous month's 50. This would be more alarming if this category had not generally been in the mid-40s for most of the year. The disputes category actually improved and left the contraction zone with a reading of 50.5 down from 48.6 the month before. The dollar amount beyond terms got mired even deeper in contraction with a reading of 46.1 after being at 49.8. The dollar amount of customer deductions gained a little ground and moved further into expansion territory with a reading of 51.2 compared to 50 in June. The filings for bankruptcy numbers remained almost exactly where they had been with a reading of 53.2 compared to last month's 53.5. The issues that have contributed to more accounts out for collection and reduced dollar collection have not become serious enough to boost the bankruptcy numbers. What is of some concern is many of the bankruptcies are taking place with larger companies and they have tended to come in the retail sector as well as in industries that rely heavily on global trade—import side or export side.

Manufacturing Sector

Much of the manufacturing data of late has been contradictory. There have been gains in categories such as durable goods orders (once one separates out the aerospace data), but factory orders have been weak. The level of capacity utilization remains close to the preferred range between 80% and 85%, but the numbers slipped a bit. The data from the Purchasing Managers' Index has been teetering on the edge of contraction and now there is a substantial tumble in the Credit Managers' Index. There are really no simple answers here, but the most often cited is volatility. There are too many unknowns at the moment—everything from the potential impact of an expanded trade and tariff war to the travails of the Boeing 737 Max. Add in labor shortages and the looming reality of a truly nasty election year, and businesses in general are uneasy

In July, the combined score for the manufacturing sector dropped to the lowest level since January. It now sits at 53.2. At the start of the year it was 53.1. This is certainly lower than it has been in recent months but not all that much lower as the high point was reached in May with a score of 55.4. The index of favorable factors dropped precipitously from 60.4 to 56., the lowest reading in several years. It is worth noting that in January the reading fell to 57.7 and subsequently recovered to 60 the next month. The index of unfavorable factors fell only slightly from the month before and most importantly managed to avoid sinking back into contraction territory. It is sitting at 50.8 after June's 51.3. The current reading is about where it has been for the year (49.9 in January, 51.4 in February, 50.7 in March, 50.2 in April, 50.3 in May).

The details in the subcategories tell a pretty compelling story. The sales reading stayed much as it was with a 57.6 compared to 58.5 in June. The category of new credit applications shifted down a little to 60 from 62.5. The big changes were with dollar collections and amount of credit extended. The former saw a plunge from 59.2 to 54.7, which is worrisome as it suggests that income flow is weakening fast. The trepidation among some companies is manifesting with their reluctance to offer as much credit as they have in the past. The drop in the credit extended subcategory went from 61.3 to 54.7. It is important to note that all these readings are still firmly in the expansion zone, but the trend is certainly not encouraging.

There was some similar movement of note in the unfavorable categories and there has also been some encouraging news. The rejections of credit applications stayed almost the same as the prior month with a reading of 53.4 from 53.8. The accounts placed for collection stumbled quite a bit. This seems consistent with the decline in dollar collections noted above. The reading last month was a healthy 53.5 and this month the reading was a miserable 46.7. The disputes category actually improved and entered expansion territory for the first time since March with a reading of 51 up from 48.3 in June. The dollar amount beyond terms slipped back into contraction territory with a reading of 48 after June's mark of 50.2. This was no surprise given the issues with dollar collections and the increase in accounts out for collection. The dollar amount of customer deductions improved quite a lot from 49.8 to 52.7, and that was a bit surprising. The filings for bankruptcies data improved slightly as well, as the reading went from 52 to 53.

The bottom line this month is that some important warning signs are starting to flash. The decline in dollar collections is an immediate concern. If one combines the increase in collection activity as well as slow pays, the future looks considerably less optimistic.

Service Sector

For the service sector, the summer months can be vexing for those that depend on retail. It is too early for the holiday season to influence, although the back-to-school activity starts to gear up by the first of August. It is too late in the year to be dragged down by bad weather and the impact of tax time. Consumers are still spending, but their focus is on services as opposed to goods—they are traveling and vacationing so money goes to lodging, meals and entertainment. Retailers feel the pinch, but anything connected to leisure time gets a boost. The data this month shows decline in some areas, but not as dramatically as was demonstrated in the manufacturing sector.

The combined score slipped a bit from last month's 55.1 to 53.7 this month, but in March that reading had fallen to 52.6, so this month looks solid enough. The index of favorable factors stayed in the 60s with a reading of 60.5 after hitting 62.4 in June. Again, this is far superior to the readings last March when the numbers fell to 57.7. The index of unfavorable factors slipped into the contraction zone with a reading of 49.1 (same as last March) and a bit lower than it was in June when it hit 50.2. The sense is there was more stability in the retail sector.

The sales data fell from 62.3 to 59.3, a significant drop but not as low as was seen in March (that was not a good month). The new credit applications stayed in the 60s with a reading of 61.6 after resting at 62.4 in June. There was some concern as far as dollar collections are concerned as this number fell out of the 60s with a reading of 58.4. The decline was not as dramatic as the decline in the manufacturing sector, and once again the reading in March was far worse at 55.5. The amount of credit extended stayed fairly consistent with a reading of 62.6 compared to June's 63.7. That was markedly different from the experience in the manufacturing data.

The rejections of credit applications remained stable as well with a reading of 51.9 compared to the 51 noted in June. The accounts placed for collection numbers slipped deeper into contraction territory with a reading of 45.7 compared to 46.6 last month. This is not the trend line that anyone wants to see at this stage, but it would appear that most of the companies struggling with this situation are in retail. The disputes category improved a little and left the contraction zone with a reading of 50 up from 48.8 in June. The dollar amount beyond terms slipped very badly. This is the worst of the unfavorable readings. It was at 49.3, within striking distance of expansion, but now it is plunging with a reading of 44.2—by far the worst mark in over three years. There are many companies suddenly facing cash flow issues and falling swiftly behind in their obligations. The dollar amount of customer deductions slipped into contraction as well, but not as drastically as the numbers went from 50.3 to 49.7. The filings for bankruptcies also slipped, but still the numbers are in the mid-50s with a reading of 53.4 compared to 55 last month. The fear is that all those slow pays will soon become collection issues and the next step after that will be bankruptcy filings.

All eyes will be on August sales and the levels of consumer confidence in the months ahead. If the coming holiday season is a weak one, there will be a lot of retailers in trouble. Many of them are already reeling from the impact of expanded online competition.

July 2019 versus July 2018

This was most definitely a down month and one that was led into these doldrums by the manufacturing sector. The service side was more mixed, but retail doesn't appear to be as healthy as preferred as it prepares to enter the all-important holiday period.

Overheard Conversations

I would like to say that I am not one to eavesdrop, but that would be a big lie. I am a chronic snoop; this is what provides me with the fodder for this part of this newsletter after all. I don't try to be obnoxious about it, but I figure that if people are talking in public, they have to assume somebody will hear them. The other day I heard an exchange between a couple of employees at a home improvement store. One was a young man with all the accoutrement of the age—tattoos, piercings and a man bun. The other was a mature woman. She was in full gripe mode as she expressed her annoyance at customers interrupting her. She was sitting in customer service (ironically enough) and was taking her blood pressure while snacking. She was quite upset that people kept coming to the counter and asking her questions. Could they not see she was busy? "How rude, how inconsiderate, they all just hack me off."

The young man stood there for a moment and then spoke up. "It looks like you are having a bad day, but why are you taking it out on these customers? They just want to buy what we sell. No customers—no job. I like them. I like solving their problems and I like getting paid. If you want to be left alone—quit this job and stay home. Don't jeopardize my job and the jobs of everyone else who works here."

It was at that point I asked the tattooed kid to help me figure out how to kill bag worms and found him to be a wealth of eagerly offered knowledge. I assured him that his cranky colleague will not discourage me from shopping there as long as there are people like him.

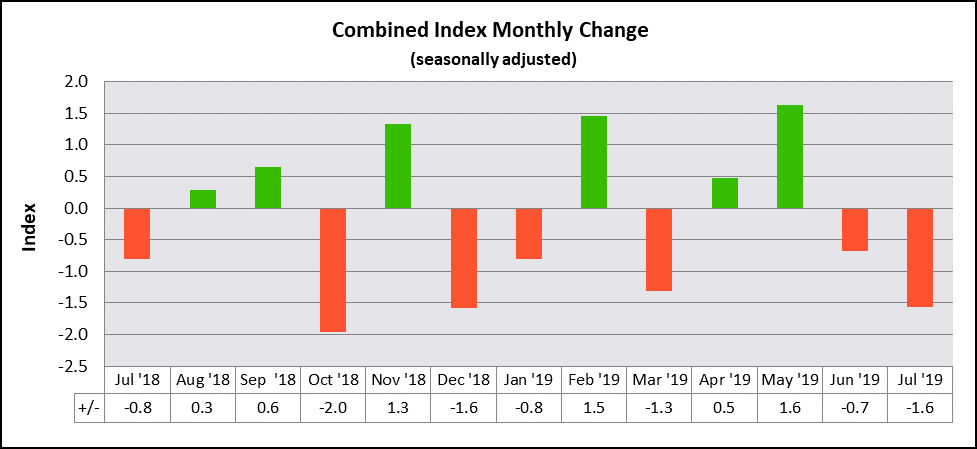

CMI Combined Score for July

The combined chart readings for the CMI indicate that this has been a year with more than usual volatility, but over the last several months, there have been more down indications than encouraging ones. Of the last 12 months, there have been seven that have trended in a negative direction and six trending positive. The good news is that overall readings have stayed above 50 throughout even as there have been some sharp declines in the unfavorable categories.