Short Items of Interest—U.S. Economy

What Happened to Inflation?

Most economists (including us) called for some kind of inflation surge long before now. It seemed all the ingredients were there—most notably the low rate of joblessness. The old reliable Phillips Curve held that when the rates fell this low, it was virtually automatic that wages would rise and contribute to inflation. The Phillips Curve has not played out as expected—leaving a void. It seems many prices are simply not responding to the old laws. Sectors such as medical care have not responded as pricing seems immune to demand and supply. Commodities that should have risen are stagnant and global producers are not hiking prices in the face of tariffs as they are more interested in market share. The whole approach to inflation seems to be shifting.

High Expectations

Data will be released on both consumer spending and income tomorrow. The expectation is that both of these data points will see a fairly significant increase. The level of consumer income should be up by 0.4% and there is expected to be a similar hike in spending. This is counter to what was anticipated even a few months ago. It would seem the concerns over the trade war have yet to factor into consumer behavior, but this is likely because little of the trade and tariff threat has yet to emerge. Thus far, it has all been bombast and at the last minute the tariffs are delayed or altered. The wage hikes are the most interesting as that may signal that the low unemployment rates are finally starting to push wage inflation up.

ISM Readings Expected to Be Steady

On Aug. 1, the Institute for Supply Management (ISM) will release this month's data. The expectation is there will be relatively little change from last month. The reading fell to 51.7 in June, the lowest it has been in at least two years. The prevailing wisdom has it falling slightly to 51.6, but there are some analysts who think it may hit 51.9. Either way, the movement will be minor.

Short Items of Interest—Global Economy

Japan Lowers Expectations

The trade war between the U.S. and China has been having a much bigger impact on other Asian states than on either China or the U.S. Japan is one that has been hammered by the slowdown in China as well as renewed hostility from the U.S. The expectation for the Japanese GDP growth has been lowered to 0.9%, a far cry from what had been touted only a year or so ago. The Abe government has been seeking to hike taxes. This kind of export-driven slowdown is not going to make that task any easier.

IMF Shortlist Emerges

The Europeans are rushing to find a replacement for Cristine Lagarde. They seem to have narrowed the list to three. They want to settle the issue before the U.S. or other nations weigh in with suggestions that the next International Monetary Fund (IMF) head be other than European. The three front runners are now thought to be Jeroen Dijesselbloem—former Dutch finance minister, Kristalina Georgieva—chief executive of the World Bank and Otto Rehn—head of the Finnish central bank. None of these are part of the southern tier of states, however. That could prove a sticky problem in terms of winning support.

EU Response to U.K. is Firm

The approach that Prime Minister Boris Johnson seems determined to take is not having the desired impact on the EU—at least not yet. His comments out of the gate have been that the EU had better be prepared to open talks and concede to the U.K. and this "no deal" exit would hurt Europe more than the British. The EU response has been terse and verging on angry as they hold that they are not responding to bully tactics and are far more prepared than the British to deal with that kind of exit. The Johnson approach may be playing well with his core support, but not in Europe.

Rise of Extremism

The political debate in Europe and elsewhere has turned exceedingly nasty and has started to become a major concern for many countries. The rise of extremist politics in Europe has been occurring alongside the rise of populism, but the two are not inextricably linked except for the overall motivation for this political anger. It has been tempting to equate one with the other, but despite the overlaps, it is inaccurate to assert that every populist is an extremist or that every extremist is a populist. The threats have always existed in Europe and elsewhere—there have always been those who choose to express themselves through terror. Of late, the threats have become common and it has been very hard for law enforcement to determine which is a real invitation to violence and which is a political protest. There have been outright attacks on various minorities and others that the extremist elements have targeted, but there are also symbolic gestures of violence such as mock scaffolding calling for Merkel to be hung.

Analysis: In very general terms, there appear to be four varieties of extremist—at least as far as the law enforcement community is concerned. The "traditional" extremist is essentially a thug; one that loosely wraps their violence in political rhetoric. They often combine their threats with some kind of extortion scheme or they target victims for economic gain more than for political reasons. The second variety is the fanatic. They have been around for a long time as well. They have a long history of terroristic attitude and intent and are motivated by ideology, religion, politics and the like. The authorities are generally aware of who these people are or are at least familiar with the groups they belong to. These extremists are generally not successful in their planned attacks as they have been monitored and they are interfered with before the plots are carried out. This is obviously not always the case, but there are far more successful interventions than most are aware of.

It is not that the first two groups are not a threat, but they are generally known to the authorities and techniques for intervention are somewhat successful. The other two are newer threats and more complex. There has been a rapid growth of the "lone wolf." This is the person who has become radicalized or has just become so anger and disaffected that they choose to lash out in a violent way. The majority of these attacks are very small scale and many are threats with no intended action. They range from defacing buildings and hurling insults to beatings and murder. The targets of this violence vary with the supposed grievance. The majority of these attacks have been directed at members of religious minorities, refugees and migrants, members of the LGBTQ community, political activists and spokespeople for some offending cause. The attacks are not well planned and are random. It has been all but impossible to predict them.

The last group creates the most concern among law enforcement. These are the extremists who are going after political leaders and other prominent people. There have been more assassinations of political figures in the last year in Europe than in the last decade. Other targets have been religious leaders, journalists and even athletes and performers who have spoken out on some issue. There have been attacks on both the left and right wings of these extremist movements. The majority of the attacks have been carried out by those same lone wolf attackers.

U.S.-China Talks—Round 178

It has probably not been that many—it just seems like it. The latest episode is not likely to produce much, but at least the two sides are in some sort of conversation. The problem is there has been no real position change on the part of either the U.S. or China. The fact is that both President Xi and Trump are getting mileage out of this confrontation and there is little incentive to shift tactics.

Analysis: There is a school of thought that says Trump will engineer a deal when it is most politically advantageous to do so. The logic goes as follows. Assuming the economy of the U.S. is starting to stumble by the third and fourth quarter of the year, there will be a need to do something to bolster growth. The Fed will have already lowered rates and few expect that to have much impact. The chances for something dramatic from Congress remain slim as they will all be in campaign mode. There are not all that many moves that can be made by the executive branch on its own, but trade is one of them. It would be a good time to unveil a plan that settled some of the issues with China and watch that have a positive impact on trade and the U.S. economy. This could come at the same time deals would be reached with Mexico and Canada.

Adjusting by the Oil World

The winds of change are blowing. This is the week the oil companies report out and investors are eager to learn their plans for the future. The assumption is that oil is going to be heading the way of coal—losing market share as efforts are underway to reduce dependence. The oil companies are really energy companies. All have taken steps to shift to options such as natural gas or renewables. The question is how fast and how comprehensive the shift will be.

Analysis: The fact is oil will be a dominant transportation fuel for a long time to come, but its share of market is slipping. There are few who think it will ever be expanding again. The utilities are shifting away from coal to gas and there will be more moves to use gas as a transportation alternative. The electric vehicle has hardly taken over the market, but share grows every year, and at the expense of the gasoline-powered vehicle. The key problem for many of the big energy companies is that natural gas prices remain very volatile. That can mean profits can be very uneven. A natural gas project is far more expensive than an oil project due to this price volatility. It is assumed this will change as the fuel becomes more common and dominant, but that transition has an impact on the bottom line.

Signs of a Recession—Real or Not?

At first blush, it would seem there is no reason at all to expect recession—at least not within the next couple of years. The most recent economic data keeps pointing to healthy economic performance. There have been consistently low levels of unemployment, consumer confidence has remained high and there have been improvements in measures such as durable goods orders. It is clear, however, that economic conditions are not as robust as they were a few months ago. By now, everybody is well aware there are headwinds, but are any of these serious enough to warrant concern regarding a recession? For the most part, this worry would be for the true pessimist, but there are some early warning signals worth paying attention to. These indicators are far from guarantees, but over the years, there have been some pretty close correlations.

Analysis: The first of these is the transportation sector. This has been referred to as the canary in the coal mine due to the sensitivity to overall economic trends. Freight transportation is a very dependent sector—there is no point in engaging the services of a rail carrier, trucking company, ocean carrier or an air cargo operation, etc. unless there is a need to get materials together for production or a need to deliver a final product to market. The growth of transportation is dependent on the growth of other sectors. The slowdown will show up in transportation first. That is exactly what seems to be happening at the moment. For the past several years, my company, Armada, has put together the Transportation Activity Index, a tool created to monitor the transportation sector and the inputs that affect it. The system uses a diffusion index similar to that which is used by the Purchasing Managers' Index or the Credit Managers' Index. Numbers above 50 suggest expansion and numbers under 50 suggest contraction. As recently as Q4 of last year, the numbers were consistently in the 60s, but they started to slowly decline after the start of the year and are now sitting at 53.7. This is the lowest point since December of last year when the reading was 51.6. (December is nearly always a very slow month for freight transport.) It is certainly true that 53.7 is not recessionary as it is still firmly in expansion territory, but the trend is not what would be preferred. There have been other warning signs—everything from overcapacity in trucking to sagging demand in the rail sector due to harvest issues.

The second indicator that some have been referencing is the inverted yield curve. This is when the yields on long-term interest rates fall below the rates for short-term interest rates. This is not a normal state of affairs and suggests that investors are worried about the actions of the Fed. With the recent talk of lowering rates, they seem to have good reason for concern. The Fed has not really expressed fears of a recession, but it has also not seen a real threat from inflation and seems to think global economic growth has slowed enough to be a concern for the U.S. economy. It is not that an inverted yield curve causes a recession—it is correlated with one. It suggests investors are worried about the potential for a recession and believe the Fed (and other central banks) are going to take steps to thwart one. That includes lowering interest rates.

Then, there are the readings from the Purchasing Managers' Index (PMI) and the Credit Managers' Index (CMI). Both are at lower levels than has been the case thus far this year and are substantially lower than they were last year. The PMI is sitting right at the 50 point for manufacturing; teetering on the edge of contraction. It was less than a year ago when the PMI was in the 60s. The CMI has seen the same kind of decline—mostly in the manufacturing sector. Services are still relatively strong in both the CMI and PMI. That is certainly positive news given the importance of the service sector to the U.S. economy. It is important to remember that much of the service sector is in the service of the manufacturing sector—80% of those that work for the automakers are classified as service workers despite working for manufacturers such as Ford, Toyota, GM, Honda and the like.

Does any of this mean that a recession is imminent? Not really—if there is one thing that can be confidently asserted about economists and predicting recession it is that there is not much of a track record. For the most part, economists are good at stating the economy is in recession once one has started. It is very hard to predict future patterns of consumer and business behavior—especially given the role played by the global economy.

In Praise of Laziness

It is a rare weekend that gives one permission to engage in sloth. Most of these past couple of days were pretty typical. We had some housework to attend to in advance of the little birthday dinner we hosted and there was some yardwork on Sunday as I finally started to attack the section of overgrown chaos that was supposed to be a berry patch. That took what energy I had for the day and we were left with other options. We decided to binge watch the latest season of "Stranger Things" and consume all eight episodes. Spending the better part of Sunday in the comfort of my living room was actually pretty nice.

I am a restless sort, however. Even as I watched the show, I had my calendar out and was busy arranging trips and coordinating duties. I am not one who sits still very well. My wife is the same. It was probably three episodes in that we both stopped feeling guilty about not working. I listen to those who have mastered the art of relaxing and confess to some small amount of envy. I sit down for five minutes and think of 20 things I need to attend to. I have to be really tired in order to relax! During my recuperating from last year's health issue, I was sufficiently fatigued to relax. I wondered if this was going to teach me how to wind down. Thus far it hasn't as I am more restless than ever—determined to prove to myself that I am back to normal. On the plus side, I am getting that area cleaned out so we can install a pergola with places to sit and contemplate the garden—assuming we slow down long enough to engage in it.

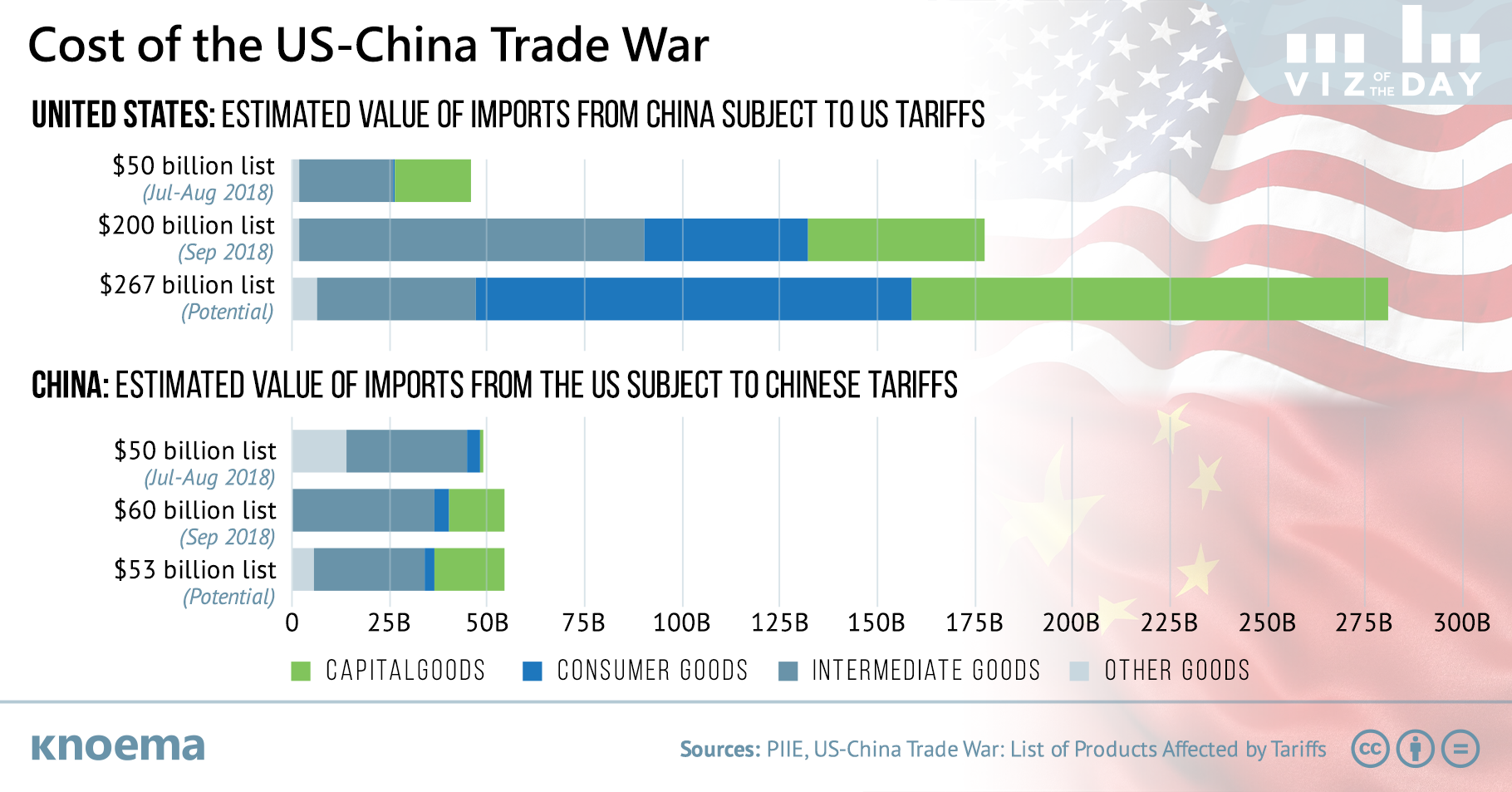

Cost of U.S.-China Trade War

There is a lot at stake in the U.S.-China trade confrontation. The latest moves by China have been to address the U.S. demand that it buys more from the U.S. and there was a spike in soybean purchasing as a result. At the end of the day, there is not all that much the U.S. can sell to China other than farm goods, although the Chinese consumer is starting to develop a taste for imported goods—both from the U.S. and from Europe.