Strategic Global Intelligence Brief for July 26, 2019

Short Items of Interest—U.S. Economy

Not as Bad as Feared

As recently as yesterday, the estimate for Q2 growth was at 1.8% according to some analysts and economists. A few had the rate up around 2.5%, but the majority expected a fall to under that 2% threshold. The first iteration of the second quarter performance was respectable—2.1% growth. It is a far cry from the 3.1% pace set in the first quarter, but that was expected. The important thing is it was not as low as many had feared. Consumers were the heroes as they continued to pick up the pace in the face of all those expected headwinds. The fact is most of those inhibitions have yet to really play out. The trade and tariff wars have been much more bark than bite as the majority of these tariffs have not been imposed, although they remain on the table and may become a factor later.

Better than Expected in Q2 but 2018 Was Worse

With the numbers that came out for the second quarter comes the revisions to last year's numbers. The conclusion is growth in 2018 was not as good as had been thought. There was an assumption that the momentum from the start of the year was enough to carry growth through the rest of the quarters, but the reality is growth started to stumble as soon as the third quarter. By the end of the year, growth failed to stay in the 3% range. It has been the goal of the administration to see consistent growth above 3%, but even with the tax cuts and additional spending, that goal was not reached.

Durable Goods Gain

After two months of decline, the level of durable goods orders came back up, and fairly sharply. Thus far, all the activity seems to be in the aerospace category. The two months of down data are connected to the issues surrounding the Boeing 737 Max. The production of that plane has been stalled and so have orders. This month, the aerospace sector staged a rebound due to the Paris air show as this is the event that stimulates the most buying. Even the 737 Max had orders. The assumption is Boeing will eventually get the plane back in the air with all the proper permissions and many airlines will be eager to start making up for lost time.

Short Items of Interest—Global Economy

Erdogan Continues to Pressure Central Bank

The Turkish central bank cut interest rates as has been the demand of the business community and Erdogan, but the cut was not deep enough to satisfy the president. He has been blaming the struggles of the Turkish economy on the rates, but that is not an opinion shared by most economists. The central bank has tried to hold the line on inflation and worries that even this latest cut may be too much. Turkey's bigger issues revolve around alienating many of its trading partners.

Currency Manipulation

Trump has been asserting that every other country in the world is actively trying to manipulate their currencies so they can gain a trade advantage against the U.S. It is certainly true that the dollar has been gaining strength against virtually all other currencies and it is equally true this makes U.S. exports more costly, but there is no evidence at all of a deliberate policy. There has been no artificial buying or selling. The dollar has gained for old-fashioned reasons. The U.S. stock market has been on fire and everybody wants a piece. Then, there is the fact the U.S. has slightly higher interest rates. The dollar is not so much strong as all the other currencies are weak.

Impact of Iranian Sanctions

The new sanctions imposed on Iran are not having much additional impact as Iran already has to deal with a stringent set of restrictions. The impact is being felt by other nations in the region—UAE, Kuwait, Qatar, Oman and others that have been serving as conduits for trade into and out of Iran.

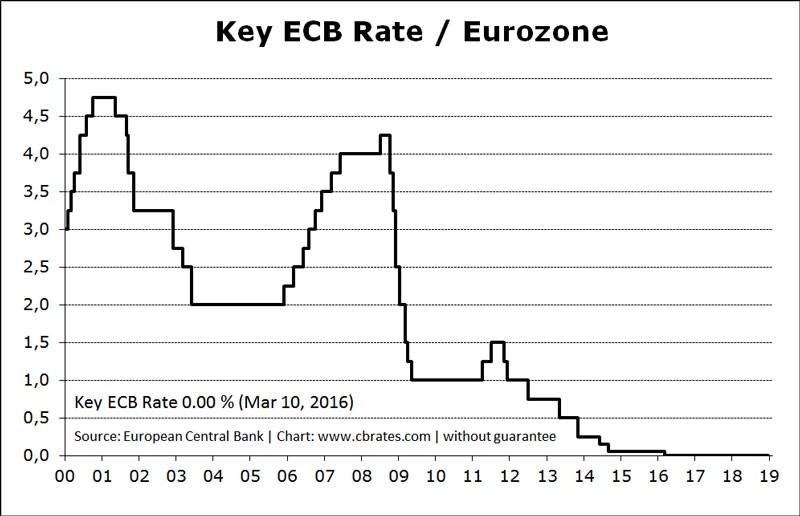

How Relevant Will This ECB Move Be?

The head is on his way out, but he is not leaving quietly. European Central Bank's (ECB) Mario Draghi has all but promised a major move towards stimulating the eurozone economy next week, although he has still not provided all the specifics. The investment community has obviously decided this is a done deal as they have driven bond yields to near all-time lows. It is certain that interest rates will be dropped, but it is still a bit of a mystery as to how far down they will go. The bigger question is whether there will be other steps taken to boost the economies of Europe. The latest data from Germany has been deeply concerning as there is no expectation that Germany will be able to pull itself out of the mire—much less pull the rest of Europe along. The list of nations facing an impending financial crisis is long and getting longer. Draghi seems determined to put some measures in place prior to handing the reins over to Cristine Lagarde.

Analysis: The yields on the German bond have fallen to yet another all-time low of 0.46%. That compares with a rate of 0.6% just last October. What is worse is there is no reason to expect that tumble to stall anytime soon—the German economy is looking stressed for the remainder of the year and well into 2020. The investors are starting to get interested in Italian bonds again as they now expect the ECB to resume some version of its bond-buying program. That would mean a market developing for these bonds again. Currently, they are nearly useless and can be had at a very low price. All of this has meant the euro has tumbled against the dollar again—down by 3% thus far this year, and at its lowest point in three months.

The question that hangs over all of this ECB activity is whether it will accomplish anything at all. The fact is that central bank activity is limited in terms of its ability to push growth. This is a point that has been harped on but bears repeating given the incessant pressure placed on the banks by politicians and many in business. It is especially disingenuous for the political leaders to place this kind of pressure on the central banks as it is fundamentally the responsibility of fiscal policy to boost economic growth. This policy is squarely in the hands of the legislatures and the executive branch. Monetary policy is intended to be a braking mechanism more than it is an accelerator.

The ECB is going to do what it can to make access to money cheaper with the hope that banks will elect to lend more. That hope is based on the business community wanting to borrow. In order for central bank interest rate cuts to have any kind of impact, there has to be desire to both lend and borrow. The current rates have to be seen as some kind of inhibiting factor. If the rates are too high for companies to justify the debt, the central banks can lower the rates to the point that debt makes sense. Very few would argue that rates are prohibitive at the moment. There is plenty of access to capital, so it is hard to see how slightly lower rates will make a big difference. In fact, many analysts are fearful that lower rates will only encourage bad behavior.

Those pushing for rates to trend higher rather than lower are not arguing that inflation is an issue at the moment. Basically, inflation remains nearly non-existent, and this has been a shock. The rationale for higher rates rests on other factors. The first is that cheap money has allowed risky activity in the stock market. Investors can borrow a lot of cash and put that money in a very lively market, make that loan money back and then some, turn around and do it again. A big reason for all the frenetic market activity is all that borrowed money. All of this works until there is a serious market correction. Suddenly, the bottom will drop out. The other issue is that low interest rates make it hard for small banks to make money from deposits. That has forced banks into much riskier strategies.

The point is interest rates and access to capital are not the problem as far as growth is concerned. It is not even clear that dramatic spending by the government would really accomplish all that much. The challenge now is that additional spending and deep tax cuts will add significantly to already very serious debt and deficit issues. That limits the gains that might have been made. The primary issue that has inhibited growth has been the uncertainty over global trade and global growth. The global business community is trying to adjust to this new trade reality, but the changes have been halting and unpredictable. China is the No. 2 economy in the world and has developed into a major engine of global growth. That it has slowed to levels not seen in over 25 years means it is no longer providing the boost it once did. Add in a dramatically slower Europe and a slowing U.S. economy and a downturn is imminent—one on which lower interest rates will have little impact.

Will Brexit Provoke Another U.K. Election?

The statements from Prime Minister Boris Johnson of the Conservative Party have been about what was expected. There has been bombastic assertion that he will break the deadlock on the issue and that the U.K. will exit from the EU by the October 31 deadline, regardless. The problem is that nothing substantial has changed. Johnson asserted the Europeans "must" return to the negotiating table. Within hours, the European response was an emphatic—NO. There is absolutely no support for a repositioning and Europe seems quite content to watch the U.K. crash out of the EU with no agreement at all. Johnson still faces opposition within his own party and certainly faces opposition from the Labor Party (although it has plenty of internal divisions of its own). He even has to contend with the more radical positions on Brexit from Nigel Farrage and his Brexit Party (once known as the Republicans).

Analysis: What are the real options that face Johnson? One is the distinct possibility that nothing will be accomplished by the time of the deadline. The other is to get a new deal from the EU and then to push it through Parliament. Neither of these actions seem likely at this point. Europe is in no mood to accommodate the bombastic and critical Johnson. Those who oppose him in Parliament have their eye on the next election and hope they can hang a big failure around his neck. If Johnson can't budge Europe and can't work out something that pleases the Euro supporters, he will have little choice but to call for a new election. That is a very high risk move for him. Johnson may have been able to drum up support in the Tory party, but his national poll numbers are miserable. The only thing that saves him at this point is that Labor Party Leader Jeremy Corbyn's numbers are just as bad if not worse.

The second possibility is that somehow Johnson succeeds in spite of himself. This would be a scenario in which the Europeans agree to re-open negotiations and then make some key concessions on issues such as Ireland and trade between the EU and U.K. The next step would be getting that new plan through the Parliament. That would involve winning the support of those who really want a clean break and those who really want to stay in the EU. The chances of Johnson pulling this off are very slim given his limitations as a diplomat. It is far more likely that he angers all the people he needs support from. If this scenario comes to pass, there will be a desire to call an election so the Tories can reap some rewards and exploit the weakness of the opposition.

The most likely situation at this juncture is a snap election that throws the Brexit issue back to the public, albeit indirectly, as they will not be engaged in a referendum, but in voting for either a Labor alternative or a Tory one. The looming danger from a new election is unleashing some very ugly politics. The debate in Parliament over Brexit has become an economic issue primarily, but that is not how the issue has been framed in the public eye. To the majority of pro-Brexit voters, this is still about immigration and cultural threats. It will very quickly descend into nationalistic rhetoric and racism. That will further polarize the politics of the day. The election will devolve into a contest between populist right and populist left. The vast middle of the electorate will be facing very unappealing options.

Spain Faces Another Election

The talks between the Socialists and Podemos have broken down again and Prime Minister Pedro Sanchez has been unable to form a working majority in Parliament. This may mean Spanish voters will be facing another election. It is unclear that voters would provide results that differ appreciably from what exists now. The Podemos demands have been steep—they want a number of very prominent positions in the government—far in excess of what their parliamentary numbers justify. Sanchez and the Socialists are refusing to cede that kind of power. The betting by Podemos is that Sanchez will buckle rather than risk losing seats in the election, but polls suggest that more people back his position than not. The public does not seem ready to return to the center right. Many now see Podemos as less of a populist standard bearer and more as grasping politicians.

Analysis: The Spanish economy has been performing far better than had been expected; all this turmoil threatens to derail that progress. On the other hand, there are many in the business community who have been pointing to the policies outlined by the Socialists as major inhibitors to future growth. The fear is that Sanchez will agree to some of the more radical positions taken by Podemos to win their support without putting their leaders into those prominent roles. There are already plans for a higher minimum wage, higher taxes and expanded social programs. Podemos has asserted that taxes on corporations can be hiked dramatically and they have no fear of additional debt and deficit.

Aid to Farmers—Too Little and Too Late?

The farm sector has been slammed this year from a number of directions. The trade war with China resulted in the imposition of import tariffs by China that reached $60 billion. That would have been a hammer blow all on its own, but then there were the massive spring floods that prohibited farmers from planting. The response from the USDA has been to allocate $16 billion in aid to the affected farmers.

Analysis: When the loss from trade is $60 billion and the weather-related losses are estimated at twice this number it is hard to see that $16 billion in aid will accomplish much. The majority of this assistance is likely to go to the largest operations given the steps that will have to be taken to get access to that aid. The farm community has been upset with the trade restrictions faced all over the world. There has long been concern the U.S. does very little to protect that market. It is not only hard to sell into China now, but it remains hard to sell to Europe, Japan or dozens of other states that protect their own domestic agricultural producers. These restrictions can be handled by U.S. farmers in most years, but when there are other challenges, the capacity to react is reduced.

Humor Breaks

There is a great deal to be outraged and angry about these days. I find myself reacting almost every day to some new outrage and it can be mentally exhausting. This has made every opportunity to laugh all the more precious. Much of that laughter is generated by members of my own household—especially with the arrival of a new kitten. This one has been a real clown. But there are other sources available with the growth of YouTube. What interests me is the kind of thing that evokes laughter. I find some things utterly hysterical, while other attempts fall flat or are actually pretty annoying.

My favorite stuff tends to be that which focuses on the absurdity of the everyday. The guy describing his life complete with the weird reactions of his relatives. The observant person watching these crazy vignettes playing out in front of him every day. The self-deprecating observations. I can relate to these stories. My friend related his experience of combing his long-haired cat shortly after having repaired something with super glue. I leave that one to your imagination. The humor that leaves me unamused is that which insults and hurts and comes at someone's expense. When I need a guaranteed laugh, I have my reliable sources—Pink Panther movies, Victor Borge, Tim Conway, Steve Martin and Johnny Carson. Just mentioning them gets me to smile.

Key ECB Rate

The ECB rates have obviously been a lot higher in previous years and there are still those that lament the fact that rates were allowed to fall as low as they are. The previous bottom was seen as around 2%, but the persistent slow growth that has marked the eurozone seemed to justify the rates as low as essentially zero. Now that the ECB is talking about a rate cut, there are questions regarding how—they are already at rock bottom. This is the reason that negative rates are now under discussion despite the risks implied in such a radical shift in central bank thinking.