Short Items of Interest—U.S. Economy

Bright Spot in Housing

There has not been much joy in the housing sector of late, but the latest data on new home sales has been encouraging. The existing home numbers have been down some as the typical buyer has been a little intimidated by higher prices and the challenge of getting a mortgage. The boost in the new home sector has been attributed primarily to the higher-end buyers. They have been motivated by the performance of the stock market. The consumer has been looking for some place to keep their money and property has been the most common alternative. This certainly does not mean the housing market is poised to recover the momentum of last year, but at least the big skid has slowed a bit.

On the Other Hand

Although the news from the new home market has been encouraging, the overall performance of the housing market has been miserable. That trend shows no sign of reversing. The existing home market has now declined for 16 consecutive months. The latest decline is 1.7%, faster than has been the case thus far this year. What makes this data more distressing is this is the prime selling season and numbers are supposed to improve at this time of year. The expectation is sales will weaken even further as the year progresses. Home sales falter when school starts up and the holidays start to loom. There are still hot markets such as Nashville, Austin, Seattle and others, but even here, there has been slowdown. The biggest declines have been seen in the very pricey markets on the West Coast, but so far there has not been a general decline in prices.

China Trade Talks Resume

One supposes this is progress, but expectations remain very low. The U.S. and China are back at the negotiating table, but neither side seems ready to give up any of their key positions. The suspicion is that both President Trump and Xi benefit from dragging this process out. Trump certainly doesn't want to appear to have caved in this close to an election year and Xi is getting a lot of support from the nationalists in China for standing firm against the U.S. It appears neither nation wants to expand the conflict, but neither do they want to ratchet back.

Short Items of Interest—Global Economy

Europe on Edge with Johnson as British PM

The majority of the European leaders have been polite but far from enthusiastic about the advancement of Boris Johnson. The expectation is that the Brexit talks will be even more awkward than they have been, and investors now seem to expect an abrupt U.K. departure. The big question is whether Johnson will forge a new relationship with Trump. In past years, Johnson has been highly critical of Trump, but lately, the relationship has blossomed. The problem now is that Trump is extremely unpopular in the U.K. and Johnson risks stirring up more opposition by getting too close to him. On the other hand, they tend to be kindred spirits when it comes to populism and nationalism.

Chinese Leaders Use Trade War to Their Advantage—There has been a long-standing conflict between the "liberals" in China and the "traditionalists." For the most part, Xi Jinping has sided with the traditionalists and the ideologues, but he also wants more economic growth from the Chinese consumer. The trade war has given the traditionalists ammunition to use against the liberals and their push to work more closely with the U.S. They can position the U.S. as wholly unreliable.

China Indicates a Role for Military in Hong Kong

The announcement has been chilling and sets up a nasty confrontation. China has now indicated it will not hesitate to send in troops to quell any sort of social unrest in Hong Kong. That amounts to a military takeover.

Very Bad News from Europe's Manufacturers

The latest data from the eurozone's Purchasing Managers' Index (PMI) is not encouraging in the least and has led to some pretty dire predictions for the region as well as the world in general. This data combines with the latest reports from the International Monetary Fund (IMF), Organization for Economic Cooperation and Development (OECD) and World Bank to paint a picture of decline as the year progresses. The big question is whether these declines will be able to drag the U.S. down with them. It is certainly unlikely the U.S. will have the strength to drag these other nations out of their lethargy. The PMI numbers for the eurozone are now sitting at 46.4, the lowest level seen in 79 months. The reading in June was worrying enough as it came in at 47.6. The hope had been that June was something of an anomaly and July would have improved a bit. The continued slide has many concerned that something endemic is at work and digging out of the mire will be very challenging.

Analysis: As is generally the case, the Germans and the French are the prime movers of economic activity in Europe. German manufacturing is hitting a seven-year low and the worst seems yet to come. There was a short-lived growth period for French manufacturing, but that has stalled. The issues pulling on Germany and France are not new, but there had been some faint hope that conditions were starting to stabilize and even improve, but that no longer appears to be a real possibility until some key factors are dealt with.

There are three issues that seem to be the most important as far as eurozone decline is concerned. It is important to note that while there has been a marked drop in the manufacturing sector, the service sector has been holding its own. The reading for the service sector PMI was 53.3, only slightly less than the 53.6 in June. These are still very healthy numbers. This matters as far as European economic stability is concerned as the service sector is by far the more dominant for GDP and employment.

The first issue affecting manufacturing is Brexit. The British have been among the biggest trade partners for the Germans over the years—No. 4 in terms of imports and No. 3 in terms of exports. The uncertainty over how the U.K. will leave the EU has been of great concern to German business. Now that Boris Johnson is set to become the next British prime minister, the sense is the U.K. will come crashing out of the EU with devastating impact on Germany as well as much of the rest of Europe. The German industrial community is expecting the worst and has been preparing to significantly reduce their activity.

The second issue is also trade related as Germany depends on exports to fuel the manufacturing economy. The top export destinations for German goods are all struggling to one degree or another. France is No. 1, followed by the U.S., the U.K., China and the Netherlands. All of these trading partners have been having their issues. France has been hit by strikes and some other factors that have affected productivity. The U.S. economy is healthy enough, but there have been new trade barriers appearing almost daily as the political shoving match between Trump and Chancellor Merkel continues. The Chinese economic slump has been a challenge for Germany as this was supposed to be their new market easing their dependency on Europe and the U.S.

The third issue has been a less engaged consumer. This is not unique to Germany as every modern state has been contending with the pattern shift by Millennial buyers. They are far more interested in purchasing services than goods. They are "experience buyers" and not "accumulators." This is one reason the service sector has been progressing while the manufacturing sector continues to languish.

India Still Gets in Its Own Way

There were supposed to be some winners from the trade war between the U.S. and China, and India was at the top of the list. It was assumed the Indian manufacturers would be able to swoop in and grab market share from the Chinese and many analysts bet heavily on rapid Indian economic growth. Thus far, this has not taken place as India's old issues continue to hamper their development. The Chinese are indeed losing market share, but not to India—at least not to the level that had been expected. Nations like Vietnam and Thailand have seen expanded opportunity, while India continues to weaken.

Analysis: The four issues that are most commonly cited include a dearth of risk capital, a lack of global competitiveness, a domestic economy that continues to slow and a bureaucracy that stifles innovation and expansion. The high cost of money and that bureaucracy has been a significant challenge as companies have been unable to move fast enough to exploit opportunities. The other chronic issue is domestic consumers do not contribute much to that growth and exports carry all the weight.

IMF Issues More Depressing Report

There used to be an assumption that Cristine Lagarde's personality was what drove the International Monetary Fund to issue such bleak assessments. This assertion was never taken seriously by anyone familiar with the workings of the IMF as these economic assessments were (and are) the collective analytical efforts of hundreds of economists employed and consulted by the IMF. Now that she has left the IMF to take up a new post as the head of the European Central Bank, the supposed influence of her personality would play a far reduced role. The latest IMF report is perhaps the most downbeat yet. Now people may start to think she was trying to put a brave face on data in the past. The reality is that the data speaks for itself. The global economy is stuttering and global trade is shrinking fast. The full impact of this slowdown is still some months away, but the developed world will certainly be feeling this shift in economic fortunes by the end of the year. Many countries are already seeing bad numbers and they stand to get progressively worse unless there are some significant changes.

Analysis: The assumption is that global GDP growth will be at 3.2%. That is 0.1% lower than the estimate in April. The growth rate last year was seen as one of the lowest in years and was a cause for significant alarm. That was when the rate was 3.6%. Now the alarm has started to reach panic levels. The level of global trade is falling even faster—down to 2.5%. That is a full percentage point lower than was predicted just three months ago in April. The slide is the most dramatic seen since the recession of 2008. Bear in mind that these are recessionary numbers when there is no recession to deal with.

The culprit remains as it has been for the last few years. Trade tensions are at the root of the global trade slowdown. At this point, the IMF sees only a potential for more problems given the politics of the day. The issues fall into three categories as far as the IMF is concerned. The first is the growth of isolationism and protectionism in most of the developed nations. There has always been a good deal of this behavior and it comes as little shock given the domestic orientation of most governments. They want to protect their national economies. That means protecting the business community so it can expand employment, pay taxes and otherwise contribute to development. The means by which this is accomplished vary. There will be direct and indirect subsidies, regulatory barriers to imports, support for exports, tax breaks, government projects, training programs and so on. The majority of these efforts are normal and create no real objections from the likes of the IMF, but extensive use of tariff barriers to block competition or heavy use of subsidies to support exporters will draw the ire of the IMF and other groups that support free trade. The perception is more nations are drifting towards extreme protectionism. That includes the U.S.—a nation that was once the most aggressive supporter of trade.

The second broad category is the use of trade as a political weapon. This is also a somewhat common tactic as the richer nations have long leveraged access to their markets. During the Cold War, any country that wanted to engage with the U.S. economy only had to prove it was anti-Soviet or anti-communist in general and it would be welcomed with open arms. Those that continued to engage with the USSR, Communist China, Cuba, Vietnam and other "pariah states" would be blocked from the U.S. and usually Europe and Japan to a degree. Today, the U.S. has used trade threats to pressure Mexico over immigration policies, Iran over support for Islamic radicals, Europe over their unwillingness to support U.S. sanction policies and so on. The U.S. has always used trade as a political bargaining chip but that use is far more common today.

The third motivator is related to the first rationale—protectionism. It is a specific effort to protect a specific industry sector that has been deemed critical to national security. In many cases, the assertion that something is crucial from a security point of view is not much more than a ruse. There are also sectors that really do impact the status of U.S. security. That was the rationale for trying to insulate the steel industry from foreign competition. There also appear to be legitimate reasons to protest the reach of Huawei tech company given the opportunity for China to exploit its omnipresence in the tech world. On the other hand, there are those that want Huawei reeled in because it is competing with them over the development of 5G technology.

Debt Deal Made—No Big Changes Expected

There was opposition to overcome, but it seemed certain that a deal to raise the debt ceiling was a sure thing. The old battles never materialized—no threats of a shutdown, no fulminating on the evils of running ever bigger debts and deficits. The fact is both Democrats and Republicans are more than eager to spend money like a drunken sailor on leave. The debt and deficit have both surged to all-time highs under Trump. The only difference between the two parties has been over where the money should be spent. The GOP favors more military spending and allocating resources to issues such as border security. The Democrats want more attention to social programs.

Analysis: The deal made will take some of the pressure from the economy as there will not be a shutdown crisis or an interruption in the outflow of government funds, but there is not a lot of stimulus contained within the proposal either. There will be an increase of 3.5% next year (around $44 billion), but only a 0.8% increase the year after. At least that is the story for now as there is nothing that prohibits Congress from changing the rules and allowing more spending later. There is also the matter of what to do with expiring tax breaks and tax cuts.

Hate and Fear

Scarcely a day goes by that we don't encounter another story of unbridled hate. It seems pervasive and I do not understand it—not even a little bit. I fully grasp not liking specific people who have done something to warrant my ire, but what I think is needed is a good old-fashioned national crisis.

I am always struck by the change in people's attitude when some bigger concern looms. Those who have been hammered by a hurricane or tornado or flood suddenly unite behind the need to survive this calamity. People stop checking to see if the victim's political views match theirs, they just pitch in and help. I have seen the photos of people filling sand bags side by side despite their obvious differences. All they were interested in at that moment was saving their homes.

We are capable of finding the bigger purpose and seeing people as complex. I have friends with radically different points of view on issues that matter to me. I don't choose to hate that person or even ignore those areas where we have common ground. We don't often get into conversations about what divides us, but when we do, we agree to be civil about it. I hope to change their mind and they hope to change mine. In the end, we manage to listen and then quickly shift to a topic we can agree on—usually involving the superiority of cats, the prospects for the Green Bay Packers or the value of Hallmark movies as a means to control one's blood pressure.

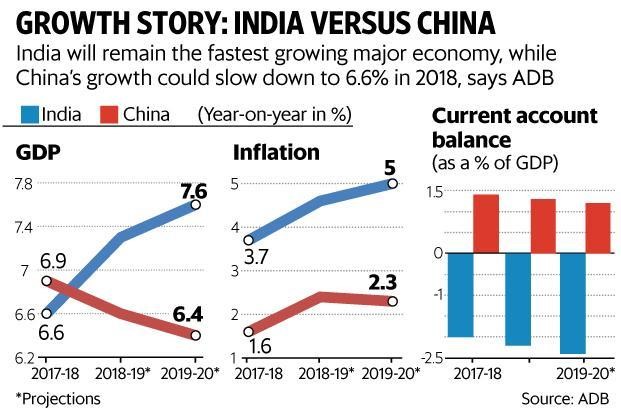

India vs. China

The potential remains for India to supplant China at some juncture—especially if the trade hostility between the U.S. and China continues to build, but there are many issues that India will have to overcome—not the least of which is that tendency towards higher inflation. The rate has been a problem for the Reserve Bank of India and it has kept their rates high—adding to the general lack of capital. It is a dilemma. If the Reserve Bank lowers rates to spur growth, the inflation issue gets worse. If it hikes rates to stave off inflation threats, the growth rate slows.