Strategic Global Intelligence Brief for July 12, 2019

Short Items of Interest—U.S. Economy

No Inflation Fear from PPI

The latest iteration of the Producer Price Index (PPI) showed a very slight increase in the rate of inflation, but nothing to suggest there is a problem developing. As a matter of fact, the investment community has all but abandoned their fears regarding inflation and instead shifted to anticipating the arrival of a recession. There has been a dramatic sell-off of various junk bonds and a move away from risk in general. This has been seen in the growth of the bond market as well—despite the very low yields. The sense is that prices will not rise much and producers will be worried about losing market share as consumers get more cautious.

Speaking of Inflation and Commodities

Once again, there is a reminder of just how different the oil markets have become from just a few years ago. The tropical storm churning through the Gulf of Mexico has forced the evacuation of dozens of oil platforms—the new protocol since the oil disaster of a few years ago. This means a drastic reduction in output for a couple of weeks at least. In past years, that would have spiked the price per barrel, but this time the rise was minor and short lived. Nothing seems able to boost prices for long these days—not geopolitical tension, not weather, not even decisions to reduce output by OPEC and Russia.

Fed Reacts to All This

The major conclusion one could reach from the Fed meetings this week is that there is a willingness to cut the interest rate, and relatively soon. The statements from Fed Chair Jerome Powell and others suggest they are not impressed with the good news that still comes from the economic readings. The big worry is trade wars are about ready to bite. The tariffs have yet to have the impact expected, but it only seems a matter of time. Part of the issue is the policy has been very inconsistent. That has stymied the business community in terms of how to react to them. That uncertainty is what will drag the economy down in the second half of the year. In addition to this fear, the Fed is now unconcerned about the impact of inflation.

Short Items of Interest—Global Economy

Chinese Trade Data Shows Impact of Trade War

The tariffs and trade barriers are affecting China and have caused slowdowns in manufacturing across the board. The trade dispute with the U.S. is not the only factor affecting Chinese growth. China is also suffering from the slowdown that has taken hold in Europe and Japan. It needs robust consumer populations in the developed world and these are hard to come by these days. The U.S. market remains the most important to China and losing even a little access creates an immediate problem. Chinese companies are trying to avoid hitting their foreign consumers with price hikes by swallowing the cost of those tariffs, but that has affected the bottom line.

Latest Move in Mexico Worries Many

The first blush interpretation of Mexico's new president, Andrés Manuel López Obrador (AMLO), was cautiously optimistic from the perspective of the business community. It seemed he was willing to be more pragmatic and willing to work with both foreign and domestic business interests. The resignation of his finance minister in frustration with AMLO's policies has changed that perception in a hurry. The radical, leftist side of the president is now on display and those anti-business views have started to emerge and dominate again.

Confrontation in Gulf

Everyone appears to be ready to engage in brinkmanship when it comes to Iran. The Iranian Navy has been engaged in harassing oil tankers—the latest was a British-flagged vessel. The Royal Navy intervened to drive the Iranians away, but it is apparent that Iran is testing the resolve of both the Europeans and the U.S. Tensions are very high and a miscalculation will have serious consequences.

Latest Look at the Collection of Indicators

Each month, we look at a collection of indicators of interest to those in the manufacturing community for two organizations—the Chemical Coaters Association International and the Industrial Heating Equipment Association. What follows is the executive summary of that report along with some of the specific area write-ups.

Analysis: The economic news of late has been more confusing than usual. The easy answer to the question of why this is the case would be that the economy is in some kind of transition period, but isn't it always? The argument at the moment is that the growth that dominated the conversation last year has started to fade or at least one can see trouble spots emerging that will be a bigger factor as the year goes on. It also has to be noted that many assumed these issues would have manifested by now and there is some surprise that growth has not faltered as much as was anticipated. Some have equated the economic situation to that old Road Runner cartoon where Wile E. Coyote has run off the cliff, but hasn't yet realized it. The good news is that employment numbers are up and confidence remains high. The stock market keeps hitting new highs (although there are many who worry this is a precarious situation dependent on low interest rates). This month's collection of indices is mostly positive—eight of the 12 trending up. The movements have been slight however and some of the leading indicators are weaker than would be preferred.

Given there are not many of them, we can start with the four negatives. The most worrisome of which is the Purchasing Managers' Index (PMI) new orders index which is now sitting squarely at 50—heading towards the contraction zone. This is a predictive index and that causes no small amount of concern for the future, especially when it is noted the transportation index is also down. The transportation sector has always been a harbinger of things to come, and it is struggling. The other two negative readings came with metal prices and factory orders. The metals sector has been volatile all year and lately has been affected by all the problems besetting Boeing. The price of aluminum has been all over the place. It has trended down despite the fact there have been tariff barriers erected by the U.S. The issues with factory orders are a bit more serious as this suggests consumers are slowing down a little. This is borne out by the retail numbers—far below what would be expected for this time of year. Consumers are still talking a good game in their confidence levels, but are not acting as confident as they assert.

The positive readings outnumber the negatives, but the changes have been very minor. The sales of vehicles have been flat for the bulk of the year—not what was expected by either the optimists or the pessimists. There is still demand, but weaker than has been the case prior. New home starts are up sharply, but the worry here is new home construction is being dominated by the higher-end activity, which is far more dependent on the performance of the stock market. An abrupt fall in the markets will affect the demand for these high-end homes. The level of steel consumption is up. This is somewhat surprising as there had been worry about the auto sector as well as construction. Both of these sectors have been able to hold their own.

Three related indices are all up, but not by much. There has been a little recovery in the index for capacity utilization, but it has remained about where it has been for the last year or so. The level of capital investment has recovered a little of its momentum as well, although the numbers are not back to previous highs as yet. Durable goods orders are up despite the problems with Boeing. That suggests machinery purchases are solid. It appears many companies are investing more heavily in machines and technology as they continue to struggle with finding the labor force they need. The sectors that seem to be buying most aggressively are energy and health care. The boom in energy prices has been an obvious factor and health care has become increasingly dependent on technology and robotics—for everything from treatment to assessment and management. There has been a narrowing of the gap in appliances between demand and supply, a good signal as well. The Credit Managers' Index (CMI) has risen as the Purchasing Managers' Index has faltered. In past months, the CMI has predicted the PMI. That may mean an improvement in the PMI may occur down the road, but that can be a delayed connection. The good news for the CMI is the favorable factors all remain very strong and there has been a little progress in the unfavorable factors.

New Automobile and Light Truck Sales

The automotive sector has essentially gone flat. That basically surprises both optimists and pessimists. For most of the last couple of years, there have been two schools of thought as far as the future of the automotive sector. The dominant school was the more pessimistic of the two. It held there would be a sharp decline in the demand for new vehicles as there was an assumption that various headwinds would start to have an impact. Prices were getting higher, while car loans were starting to get more challenging and consumers starting to cool. The optimists held that these factors were not looming as the threats they promised to be. They assumed consumer demand would reflect the security of the job market and the boost that came with the stimulus and tax cuts. It turns out that neither of these assumptions have played out as expected. Demand has fallen a bit, but not enough to cause a real crisis. The consumer has continued to be enamored of the larger vehicles such as SUVs and trucks. The demand for fuel sippers has fallen dramatically—a 25% drop in demand in just the last year. Meanwhile, the demand for the bigger vehicle is up by 20%. The end result is a flat year as far as sales have been concerned—no immediate crisis, but no propelling the economy either.

New Home Starts

The new home sector of the housing market is by far the smaller as compared to the existing home arena, but in terms of the impact on the greater economy, the new home activity is the more important as it involves dozens of other sectors in terms of supply and labor—production of lumber, appliance manufacturing, construction equipment and the myriad of support people engaged in sales and financing. It is a vital cog in the overall economy and has been pushing much of the growth over the last few years. The sector has separated dramatically in the last year and is now responding to different motivators than was the case before. The new home builders are far more interested in the larger home than in the smaller starter home. That means the performance of the stock market is of more interest than mortgage rates and unemployment numbers.

The latest data from the housing sector has been volatile. The Case-Shiller index has been dropping overall, but certainly not in all cities. The country now seems very divided between the hot markets such as Austin, Seattle and Nashville versus the declining markets in places like Detroit, Cleveland and many of the suburban cities that surround big metroplex communities such as Chicago and Los Angeles.

Steel Consumption

The consumption of steel was another one of those sectors that has not behaved quite as expected. There were expectations tied to the debate over which nations would be subject to steel tariffs and which would not. The assumption was steel prices would shoot sky high and likely stay there. There was an initial price hike that averaged around 40%, but after a few months, the hikes settled down to around 20%—roughly the amount of the tariff. Those that import into the U.S. found ways around the restrictions and domestic producers stepped up output. The surprising development has been the steady demand from automotive as well as some construction. It is expected that oil field demand will stay robust and will offset the reduction in demand from the agricultural sector. The biggest market for domestic and imported steel is still construction. That has been slow in both the commercial and public sectors. The latest salvo in the tariff war has been directed at Mexican and Chinese structural steel. Very little now comes from China, but Mexico has been a big supplier. The reason for the tariff is ostensibly a reaction to steel subsidies, but most see this move as a way to pressure Mexico on the immigration issue.

PMI New Orders

The decline of the Purchasing Manager's Index has been a major concern of late. This has long been considered a "canary in the coal mine" indicator—something that starts to react very quickly to changes in the business environment and economy. These are the purchases that companies are making on a monthly basis—the commodities, raw materials, machinery and parts they expect they will need to meet their consumer demand. Given that every company seeks to manage that spend as closely as possible, the resulting report on what has been or has not been purchased gives a solid indication of what is happening in the overall economy. The new orders index is a sub-index of the total PMI and reflects plans for expansion. It is obvious that expansion has not been on the minds of many businesses over the last several months as the index has now fallen to the point that it teeters on the edge of contraction territory. Anything under 50 in this index signals contraction. At the moment, the reading sits at exactly 50.

Durable Goods Shipments

The boost in durable goods orders was not expected given the travails of Boeing of late. If one separates aerospace from the data, there has been more progress. The fact that orders have fallen like a stone for the 737 Max has affected numbers. Part of what makes this interesting is there has been relatively little incentive from the Purchasing Manager's Index readings, although there was an improvement in capital expenditure. The sectors that seem to be sustaining durable goods include the energy sector and health care. There has been a dramatic increase in medical manufacturing over the last decade as this sector truly embraces technology. The addition of larger computer systems alone has been a major factor.

Transportation Activity Index

The behavior of the transportation sector is another of those early warning signs for the economy. If there is reduced activity in terms of manufacturing, retail, import-export and so on, there will be reduced need for the trucks, trains, planes and other means by which to move freight. The transportation activity index has tailed off again and is flirting with the lower 50s. The biggest impact has been felt in ocean cargo as there has been uneasiness as far as imports and exports are concerned. The rail sector has been affected by the spring floods—both in terms of damage to tracks and in the limitations that have been placed on the farm sector. Air cargo remains slow as there is not much demand for expedited delivery outside the most-time-sensitive products

Another on My List of Perplexing Things

The other day, I was ranting about how few people seemed to be able to sort through the opinions of others—equating the statements from some athlete or actor with a scholar who has devoted their life to the understanding of an issue. One might assume this inability to distinguish between ignorance and expertise would be a universal phenomenon, but it seems this isn't so. I recently listened to a couple of guys discussing sports coverage. They were mightily upset over the opinionating of a person who had not steeped themselves in the nuances of the game. Had they played it? Had they studied it? Had they been engaged in the sport for years? If the answer was no, their opinion was judged to be utterly useless.

I don't understand why knowledge has lost support over the years. The anti-intellectual strains of modern-day populism seem to have penetrated the majority of the population. Skepticism is expressed when a scientist or analyst voices an interpretation, but there is none of that skepticism when some random person posts on Facebook. The opinion of a Kardashian counts more than that of a scholar with decades of experience and understanding. Baffling to me.

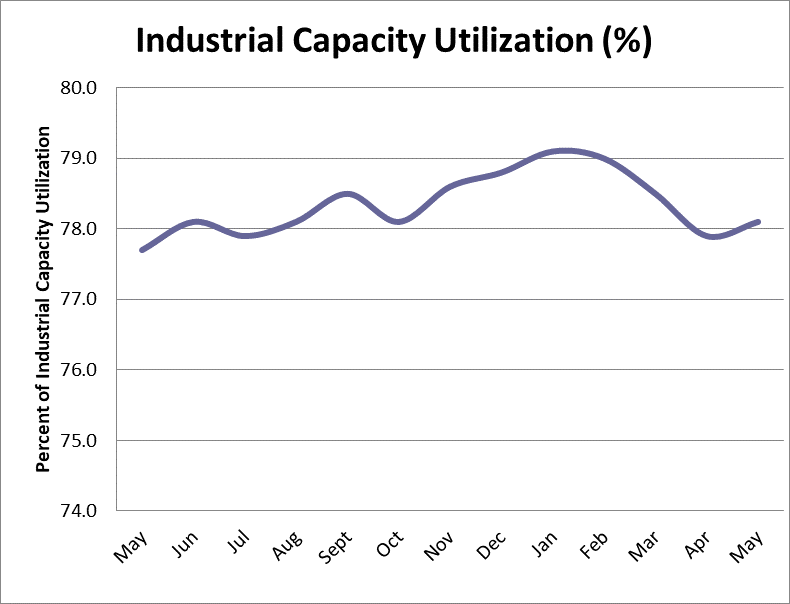

Industrial Capacity Utilization

The level of capacity utilization is one of those indicators that rarely move all that much or all that fast. Most companies know full well what their capacity is and they understand the balance between capacity and productivity. If they have too much capacity for the demand, they are wasting resources, but if they have too little available capacity, they limit their opportunity to grow. The ideal level varies quite a bit from one company to another, but in general it is assumed that 80% to 85% capacity utilization is close to ideal. There have been periods when capacity utilization has been as low as 60% and times when it has been close to 90%. The levels now have been consistent and hover between 78% and 79%—very close to the "ideal" but leaning towards too much slack. If one breaks this down, there is far more excess capacity in terms of machines than there is with people. Most companies are short of the labor they need.