Strategic Global Intelligence Brief for July 10, 2019

Short Items of Interest—U.S. Economy

What Would Prompt a Cut?

There are three factors the Fed watches right now. They are not new issues, but they are the three that seem most in flux these days. The first is inflation. This is the most important of the central bank mandates as a rule. The thing the Fed is best at is controlling inflation, but there is not much to control these days and that opens the door to a rate cut. The next big worry is trade. That has been top of mind for months. If the tariff and trade wars accelerate, the impact on the global economy gets worse and the U.S. suffers along with everybody else. The third issue is related to trade as well. It is the overall rate of growth in key markets for the U.S.—such as Europe and Japan. The Fed is also worried that Canada and Mexico have been slowing down.

Another Swipe at Mexico and China Over Steel

There has been a constant back and forth as far as steel and Mexico. When the first tariffs were announced a year ago, they were to cover all the nations that exported steel to the U.S. Right away, exemptions were given to Canada and Mexico and a few others. Later, these exemptions were taken away and then they were back as part of the negotiating over the USMCA. Now, the Mexicans are facing another set of steel restrictions under a new rationale. This one asserts that Mexican structural steel is too heavily subsidized and therefore subject to controls. China is also a target in this effort, but little has been coming from China anyway. The U.S. has backed away from the broad attack on trade with Mexico, but pressure is still being applied.

Oil Prices Rise

The price per barrel of oil has started to rise; it's about what one would expect for this time of year. This is the summer driving season and the pattern has been the same for decades. The demand for fuel goes up and so do prices. This year that rise was muted and still is. The latest increase has been minor (at least thus far) and is related to the reduction of U.S. stockpiles and the worries about increased tension in the oil producing Middle East. The demand has been about as expected and producers are about where they wanted to be. The Middle East worries would have been far more worrisome a few years ago, but now, they only cause a blip on global markets.

Short Items of Interest—Global Economy

EU Worries About Eurozone Growth

The performance of the eurozone economy has not been great this year, but it has been better than expected. The problem is this growth was based on factors that will not likely be in play the rest of the year. The U.K. has been stockpiling in anticipation of the Brexit break, but companies have invested about all they are able. The unusually benign winter weather allowed more construction, but now the heat waves are affecting agriculture and business in general. The assessment by the EU is that growth will falter badly through the rest of this year.

U.K. Ambassador to U.S. Resigns

The leaked memos on the Trump government have now become part of the Brexit debate and an issue in the British Tory Party election. The reaction by Trump was predictably furious. That severely compromises the ability of the ambassador to function. Ambassador Kim Darroch not being backed by MP Boris Johnson sealed his fate. It also created a rift with the Conservatives as it now appears that Trump can pick and choose who the U.K. selects as ambassador. That deeply offends the more nationalist among the Tories.

Clean Energy Investment Drops

The global investment in clean energy projects dropped by 14% in the last several months. Almost all of this decline has been due to the fact that China is walking away from many of these efforts. The Chinese have struggled to make wind and solar work as well as hoped. They are now returning to coal as a dominant fuel.

What Is China Today and How Should U.S. React?

This is a subject that has inspired a great deal of attention of late and certainly can't be dealt with in any sort of detail here, but some references are worth noting. Janos Kornai is a prominent global economist who hails from Harvard and Hungary's most prestigious university. He has been an advisor to the Chinese government in the past and is now sounding the alarm over what he calls the China monster. He has equated this to the Frankenstein story—a case of having created something that cannot be controlled. In the simplest of terms, China's President Xi Jinping has presided over a transformation within a transformation. When Deng Xiaoping ushered in the era of "to get rich is glorious," there was a strong desire to emulate the success of capitalism, but also a certain willingness to embrace some other elements of the west—individual freedoms and democracy. The efforts were cautious but there was progress. Today, the vision is starkly different. The reach of the communist party has expanded beyond what it was under Mao Zedong. Ideology is of paramount concern and everyone is expected to adhere to it. Persecution of minorities and dissidents is profound and deadly. Xi has set himself as leader for life. Anybody who challenges him will soon vanish. It is as brutal a dictatorship as exists in the world today.

Analysis: At the moment, the U.S. is focused on China as trade threat. The fact is that bringing China into the global economy did little to change the way China conducts its business affairs, but rather the global trade system was changed to accommodate the Chinese. The U.S. (and every other nation) has reason to oppose the way China does business. There is technology theft, worker exploitation, currency manipulation, protectionism and flagrant violation of most global trade rules. China is in a rivalry with the U.S. for regional and global influence. That rivalry is getting more focused and intense every year. At the same time, China has developed a dependence on the U.S. consumer market and has to tread more lightly than it would prefer.

Trump has adopted a hostile stance towards the Chinese, but it has been inconsistent. On the one hand, there have been serious threats to disrupt trade between the two largest economies on the planet. The tariffs suggested would cripple major sectors of the Chinese economy, but there would be corresponding damage to the U.S. system as well. There have been statements from the White House that criticize the Chinese on several fronts, but each of these attacks has been abandoned later as the two countries dance around the trade issue. The U.S. was highly critical of China's Hong Kong policy, but now Trump has chosen to back off from that critique. Major pressure was being brought to bear on Huawei due to national security concerns, but now the U.S. is softening its stance as part of the trade talks.

As has been pointed out many times, the U.S.-China relationship is the most awkward in the world today. In most every respect, the two nations are hostile to one another. The political systems are different, the military goals are different and the two both strive for at least regional domination if not global hegemony. At the same time, the two economies are locked in an embrace that is nearly impossible to break. Somehow, China has to be held to account and made to conform to those global rules it now flaunts, but it is unclear whether the U.S. has the leverage needed or the strength to employ that leverage.

Mexican Finance Minister Resigns

At the beginning of Andres Manuel Lopez Obrador's (AMLO's) term there was a question as to what kind of leftist leader he would become. The broad options seemed to be for him to emulate the radical policies of Hugo Chavez or the more pragmatic approach of former president "Lula" in Brazil. For a while it seemed that the Lula option was pursued as he appointed a number of technocrats to key posts in his government. One of the most important was Finance Minister Carlos Urzua. He is a Harvard-trained economist and well respected in global circles. The resignation of Urzua has been a real blow to the credibility of the government as the resignation came with a stinging rebuke of AMLO's policy decisions. There was no veneer or attempt to help the president save face as Urzua accused AMLO of ignoring the advice of his experts and appointing cronies and incompetents to key finance posts.

Analysis: Mexico under AMLO is pursuing a leftist and populist agenda. Those early moves towards pragmatism have been largely abandoned. Development projects (such as the new airport in Mexico City) have been halted. Taxes hiked on business have stunted job growth. Nationalism has emerged as the dominant ideology of the country. That has discouraged foreign direct investment from the U.S. as well as from Europe. The inflation rate is rising, the peso is falling and the debt is growing. Not good signs.

Any Change Expected at Fed Meeting Today?

In a word: "no." The Fed meets today. It is an opportunity for the Open Market Committee to alter their strategy as far as interest rates, but it most likely will not. The Fed is no longer interested in the tactics pursued by Alan Greenspan and some of his predecessors. Those were the days of surprise moves designed to keep the investment world on its toes—the days of trying to puzzle out "the sphinx" by gauging the bulk of his briefcase. Today's Fed is all about transparency, predictability and the need to keep everyone informed so any interest rate adjustment would have been telegraphed weeks and perhaps months ahead. This doesn't mean there will be nothing of interest at this get together. As is usually the case, there will be a lot of commentary and explanation regarding why the Fed has continued the current policy. In fact, there has been quite a lot of change over the last several months. The investment community as well as the general business community is eager to hear the latest opinions.

Analysis: At the start of the year—all of six months ago—there was a view that economic growth in the U.S. was healthy enough to warrant an increase in the interest rate. Granted, the growth was not as robust as it had been at the start of 2018, however. In many respects the growth towards the end of last year and the start of this one was somewhat disappointing. The tax cuts were stimulating but not for all that long—something of a "sugar rush" as many have characterized it. Still, there was growth of over 3%, enough to start people thinking about inflation. Conditions started to change by the beginning of the second quarter. It is not as if the bottom was falling out of the economy, but the momentum was fading. The Fed stopped talking about an interest rate hike—at least not in the short term. It has not yet indicated it is looking to cut them, but in recent weeks there have been conversations regarding under what circumstances such a move would be considered.

To begin with, the Fed has made it clear no amount of public pressure from Trump (or any other politician) will affect its decision. There have been unprecedented threats issued by the White House—everything from firing or demoting Fed Chairman Jerome Powell to packing the Fed with people who are Trump allies. These candidates have been rebuffed as both of his recent selections were forced to resign their candidacy. The two latest suggestions are slightly more mainstream, although Judy Shelton is not held in high regard due to her adherence to the gold standard argument. The other name floated is Chris Waller—the head of research at the St. Louis Fed. He can be unorthodox as regards inflation, but has a decent reputation. The Senate (including many in the GOP) has declared that getting rid of Powell is not going to happen.

The issue that had the Fed changing its tune on interest rates is global growth. The U.S. has been holding its own as far as growth is concerned—3.1% in Q1 and likely near that level in Q2. The estimate for the remainder of the year is that growth will be between 2% and 2.3%. Not great, but certainly better than the Europeans at less than 1%, or Japan as they fall back below that 1% rate. China is slowing and so is India and other emerging-market nations. The U.S. is dependent on exports for over 15% of its GDP (Japan is only 14% dependent). This means the U.S. relies on foreign markets for $3 trillion dollars. Obviously, a problem in those economies will become a problem for the U.S. sooner than later.

To add to the Fed angst about the state of the global economy, there is the issue of the trade and tariff war. The Fed has concluded that the U.S. economy is at serious risk if these tariff threats are carried out. Thus far, they have mostly been bluffs and threats. The assertion that trade would be cut off between Mexico and the U.S. was so much political hyperbole. The threats to expand tariffs on China have been delayed and so have the threats against European exports. The counter threats to limit U.S. exports have also been delayed, but the possibility of escalation remains. That is what worries the Fed. Its assessment is these trade wars coupled with the slowdown in global growth could trim as much as a point or two off U.S. growth. That would require Fed reaction in the way of a rate cut. The overarching issue is that cutting rates when they are already this low will accomplish very little. It is not as if there are companies champing at the bit waiting for rates to fall from 2.5% to 2.25%

More Jobs than People to Fill Them

The number of jobs exceeds the number of unemployed people by 1.4 million. This is unprecedented. Even if every single eligible person took a job, there would still be over a million available positions. What is worse is that most of these are very good and often high-paid jobs. They are not going unfilled because they are unpopular or even because they are in the wrong place. There are no people with the skills and experience to take them.

Analysis: There are those who offer a simplistic solution—offer more money or hire people to train. That assumes companies have the ability to put an expensive person on the payroll who will not be productive for months or maybe years. Hiring an unqualified worker and paying them more will infuriate the existing workforce and it will demand pay hikes and may even leave to work for somebody else. The company that can't find the right people has no choice but to limit itself to what its workforce can handle. It will have to turn down new clients and additional work if the company can't handle it. That means less revenue and lower profits. What these companies need is a pipeline of qualified workers. That is something that has to come from the educational system—trade schools and practical, applicable majors at community colleges as well as four-year schools and graduate schools. It is not a problem that will be simply solved, but a start has to made very, very soon.

Why Economists Love Meteorologists

There is that old joke about the two professions and what they have in common. We both can be wrong much of the time and people still listen to us! Yesterday, I had coffee with a guy who was a weather forecaster for local TV station for many, many years. It turns out that his "hobby" for much of that time was following economics. I also have been fascinated with weather for most of my life. The appeal of both meteorology and economics is roughly the same. Both the economist and meteorologist are charged with the same mission—predict the future. The wedding planner wants to make sure it doesn't rain on that important date and investors want to make sure they are selling high and buying low. The problem is that few areas of human interest are more complex and have more variables to consider. That is what makes it vexing and also what makes it fascinating.

There are other common elements as well. Everybody complains about the weather and everybody complains about the economy as there is no such thing as an ideal that pleases everybody. The gardener wants rain, the softball tournament doesn't. The consumer loves a real low price, but the producer would much rather see that price go up. A distant change can have profound local impact for both weather and the economy. The temperature of the ocean affects the rainfall in Kansas, a decision in Saudi Arabia or Nigeria affects the vacation plans of a family thinking of that drive to Disney World.

I think we should borrow each other's terminology. From now on, I will describe the economy as partly cloudy with a 40% chance of severe storms in the extended forecast. The weather forecaster can assert that sun and rain are currently within expected range and a change in weather policy is not yet called for.

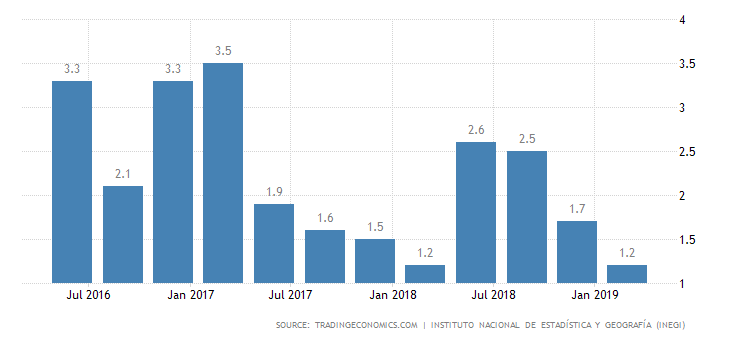

Mexico's GDP Growth

There has long been a certain amount of volatility when discussing the Mexican economy. Its fortunes tend to coincide with what is happening in the U.S. economy. That can be a good or bad thing. The latest trend in Mexico is not a healthy one as GDP growth has again fallen well below 2%. This comes after a nice little surge in the middle of last year. The sense is that the decline will extend through the bulk of this year. The trade tensions between the U.S. and Mexico have not gone away. With the U.S. election coming up, the immigration battle will only get more intense and nastier.