By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Do Tax Incentives Work?

There is no subject that generates more controversy within economic development circles than the effectiveness of the tax incentive. The logic seems sound enough at first glance. A city or state wants to attract a major employer to choose them. To lure this investment, the company is offered a tax break of some kind. The loss of revenue from the tax break is supposed to be offset by the income generated by having those new jobs. It is further assumed that other companies will be attracted so they can be close to the "anchor" company. The problem has been that most of these investments have not panned out. The tax loss is not offset and the company getting the break often moves away once the breaks expire.

Fed Continues to Add Liquidity

The overnight markets are still stressed. The Fed has been dumping money into the repo markets in order to preserve needed liquidity. Yesterday, the injection came from the New York Fed in two parts. The first was a repo of $63.9 billion and the second part was a 14-day repo of $34 billion. These moves are essentially a short-term loan by the Fed as it takes bonds from the eligible banks which are collateralized by these securities. It allows the banks to have the cash on hand required for their day-to-day interactions. There has been a steady demand on that liquidity as business and investors have been unusually nervous of late.

Layoffs on the Rise?

There will be more detail on this subject later in the week when the Labor Department releases the latest jobs data, but anecdotally, there has been a lot more layoff activity than has been the case. Much of this has been in the retail sector—not unusual this time of year. If there was a less than successful holiday season, those retailers will have to retrench. In addition, there has been some reaction to the issues of global trade. It doesn't appear to be a major crisis as yet, but the trends are worth watching. At the moment, there is still an acute labor shortage so the person laid off is likely to find another job in less than two weeks.

Short Items of Interest—Global Economy

Spain Might Have a Government

The voters in Spain have been deeply divided and unable to put a single party into position as the government. The right and left are nearly equal in terms of support, but there has been little room for cooperation among the parties. The Socialists have now managed to combine with the more radical Podemos party to create a coalition with a two-vote margin in parliament. It is a very fragile arrangement, but at least it is a start. Now it comes down to these two groups to work with one another.

AMLO's Policies Create Mexican Slump

In his first year, Andres Manuel Lopez Obrador (AMLO) has been more than challenging to figure out. His populist leanings caused him to radically increase the amount of money devoted to social programs, but at the same time he has pursued a frugal policy when it comes to the size of the government. Radical wage cuts were introduced and thousands of workers resigned. He now has a very inexperienced group that has not even been able to disperse the assigned cash. The economy of the country has crashed from near 3% growth to recession in just a year.

Europe—Africa Free Trade Agreement?

There is certainly nothing imminent, but many in Europe and Africa are actively discussing a continent-to-continent deal. There is little doubt Africa is developing fast and has the potential to be the "next big thing," but that has been asserted for years. There has always been too much turmoil and too much risk involved, limiting the kind of investment needed. The logic now is that the EU needs Africa more than ever as other global markets struggle. It is also asserted that development in Africa would be a solution to the immigration problem.

Global Market Reactions

The confrontation between Iran and the U.S. is in its very early stages and few have a grip on where this goes from here. The scenarios range from war to a series of limited attacks designed to save face more than to accomplish any strategic or tactical goals. The impact on the world in general is limited at this point, although that could change if the conflict spreads or intensifies. The market reaction is how most people will be affected.

Analysis: The most immediate reaction was in the oil markets, as one would expect. In the hours after the assassination of General Soleimani, the price per barrel for crude jumped into the 70s, but within a day or two these prices dropped a little. The expectation is they will be bouncing up and down for weeks and months, but it is significant they did not ratchet up higher than they did. The U.S. is greeting this rise with mixed feelings. It will certainly mean higher prices for fuel—at least in the short run. At the same time the U.S. is now an oil exporter and a higher price for oil will be good for the producers in the U.S. as they contend with a slump in demand for oil.

The overall market reaction has been mixed and somewhat subdued as the expectation is that an all-out war is not likely. There has, however, been worry over the airline sector due to fuel costs and restrictions on where people can fly. The farm sector is worried that sales to the Middle East will suffer. The farm community can ill afford to lose access to another market. The sector that is booming is gold as investors scramble to find a safe haven. Commodities other than oil and gold have not been seriously affected yet.

The mood is one of caution rather than panic. The first round of Iranian retaliation was about as expected—a missile attack on U.S. bases in Iraq. This is the least provocative reaction anticipated—as opposed to attacking U.S. naval vessels in the area or carrying out terror attacks throughout the region or even in western nations. U.S. allies such as Saudi Arabia and Israel were not targeted. None of this is to say that there will not be an escalation in the days and weeks to come. Much will depend on how the U.S. now responds. The "best-case" scenario is that both sides limit their attacks to each other's military facilities and that after a few rounds of saber rattling, the confrontation becomes one of angry rhetoric and symbolism.

Trade Deficit Narrows Dramatically

This trade gap narrowed to levels not seen in three years—down 8.2% to a total of $43.09 billion. The major factor in this decline has been a sharp reduction in imports from China. The tariffs and other trade restrictions imposed by the U.S. have done what they were designed to do—make Chinese goods more expensive and thus discourage U.S. consumers from buying them. The goods most affected by the tariffs have been electronics—everything from computers to cell phones and components. Some of the decline in purchasing from China has been due to the restrictions, but there has been an overall reduction in consumer demand for many of these products. If this decline in imports continues through the remainder of the year, the U.S. may see a reduction in the annual trade deficit for the first time in six years.

Analysis: On the other hand, there has been an initial agreement reached between the U.S. and China (the so-called "phase one"). It is not yet clear this agreement will hold as there have been similar promises made by both China and the U.S. in the past and one or the other nation ended up reneging on the deal. If it holds, the U.S. will be selling a lot more farm output to China and tariffs on Chinese goods will be reduced, while new ones are not added.

Even as the trade deficit with China is reduced, the U.S. is running bigger deficits with other nations trying to step in to take that Chinese market share. The U.S. consumer is still interested in the less expensive goods that can be obtained through importing. The U.S. is already taking a great deal more from nations such as Vietnam, Brazil or Malaysia. The U.S. export numbers improved a little last month, but as long as most of the major trade partners are in some economic distress, the U.S. will struggle to see big gains in the export sector.

USMCA Works Its Way Through Senate

The pact that is supposed to replace NAFTA is making its slow journey through Congress, but not without some criticism from both the left and right. In truth, the revised pact looks more and more like the pact it was supposed to replace. After nearly 30 years, the NAFTA agreement had evolved to pretty accurately reflect the reality of trade between the U.S., Mexico and Canada.

Analysis: The opposition to USMCA from the left has been rooted in demands for tighter labor protections in Mexico and more attention to environmental protection. The right has asserted there is not enough protection for domestic industry in the U.S. and that it is too easy to ship jobs to Mexico. They also object to some of the cultural protections the Canadians have put in place over the years. The support for the USMCA remains substantial, however. It is likely to be ratified, but there is still an opportunity to alter the pact and there is no guarantee the Mexican government will sign off on the revised version. They are not happy with the fact that U.S. inspectors will be in Mexico to ensure compliance.

Have Central Banks Lost Power?

Not that the world's central bankers are predicting a recession in the next year, but they are worried that if there was to be one, the current tools at their disposal would not be enough. The recession threat is still seen as distant, but events of the last few days indicate how quickly a situation can develop. Spiking oil prices and real panic among investors would be enough to send many nations into recession. In the event of a downturn, there are two sets of responses—one from the monetary side and the other from the fiscal side. The assessment of many in the central banking community is there is not much that can be done with traditional monetary policy.

Analysis: The three primary tools of the central bank are altering interest rates, establishing a policy of quantitative easing and using communication to inform the investment community regarding future interest rate movements. There are also more limited moves such as setting interest rates for banks depositing money at the central bank and the reserve ratio that banks would be required to maintain. There have been many critics of the quantitative easing policy as it has been argued that it is far less effective as a stimulus tool. Of the three rounds of quantitative easing by the Federal Reserve, only the first iteration seemed to have much impact on the U.S. economy. In the majority of cases, the most effective tool for growing the economy or for slowing it has been then manipulation of interest rates.

The basic assertion being made by many in the central banking community is that rates have been too low and for too long. There is just not enough room to maneuver now. If there was a recession in the offing, the best that central banks could do would be to slightly reduce already low rates. That would not be enough to encourage business to start borrowing and expanding. The bottom line is there is a liquidity trap—a situation where monetary authorities have lost most of their influence.

If the monetary options are ineffective or limited, the burden falls on the fiscal side of the equation and that presents another set of problems. The majority of the legislatures in the world are facing the same dilemma. They already have substantial debts and deficits. That makes spending money to get out of a recession more challenging. The U.S. already has a debt close to 110% of its GDP—$22 trillion. The deficit is running close to 4.5% of the GDP. This is a number that should not exceed 3% at most. The U.S. has no surplus to draw from should there be a recession so any spending or tax cuts will simply add to an already staggering debt load. The U.S. is far from the only nation facing this reality. That makes reacting to a global recession even more difficult.

Middle East Decoupling

The U.S. was once one of the most important players in the Middle East, but those days seem thoroughly in the past. The U.S. hostility towards Iran has been in place for a long time, but there were plenty of other nations the U.S. could count as allies in one form or another. Today, that is not the case. Trump has threatened highly punitive tariffs and other restrictions on Iran—a nation the U.S. has been actively engaged with for the last two decades. The U.S. is desperately unpopular with Syria, Lebanon, Libya and several of the Gulf oil states. Relations with Saudi Arabia and Egypt are strained and Turkey is clearly more rival than ally these days. The U.S. has lost almost all credibility in the region and has only force to rely on. Does this matter?

Analysis: It can be argued the only reason the U.S. has continued a relationship with the tumultuous region is oil. This has certainly been the driver for decades—especially when the U.S. depended on the oil exports from this region. As the U.S. has developed into the world's largest oil producer, the connection to the Middle East has lost some of its importance. There are other reasons to stay engaged, however.

At the top of the list is the need to protect and defend Israel. The U.S. remains the most important ally Israel has. It has been U.S. influence over some of the states in the region that has kept them from attacking Israel. An isolated U.S. means an even more isolated Israel. The U.S. may not need the oil from the region as was once the case, but the rest of the world does. Many of the most dependent are key U.S. allies. The U.S. needs to keep that oil flowing to Europe and Asia (especially Japan). Then there is the thorny issue of terrorism. The U.S. needs support from the governments in the area if it intends to thwart terrorism. It is overlooked that the U.S. worked with Iran and General Soleimani to fight ISIS just a year ago. Without the intelligence and military support provided by allies in the region, the U.S. would be far more vulnerable to the threats posed by Islamic terrorism. Beyond all this, there is the commercial aspect. There is a great deal of economic development in the area and many U.S. companies wish to maintain their share of that market.

On the Road Again

There is not a lot that differentiates one hotel experience from another, or so it would seem. When it comes to my travel, I have pretty basic needs as I am not generally in one place for more than a night and am unlikely to avail myself of the amenities such as the pool or massage services or even the bar. I just want a decent bed, a place to work in the room and a decent shower. Given the simple demands, it is amazing how often these are not on offer.

For the most part, the beds are acceptable. The showers are OK, but I am always amazed at how cramped many bathrooms are. I can't imagine my wife dealing with the lack of counterspace and bad lighting. My biggest issue is the desk. I often get rooms with no work area at all. Even if there is a desk, there is no lamp. The chairs are generally miserable and not at all conducive to work. Ironically, the cheaper hotels have far better work setups than the expensive resort hotels. The high-dollar place apparently assumes one is there to play and not work.

In the great scheme of things, these complaints are immensely petty and hardly worthy of attention. The part that is of interest is that solving these problems would seem to be awfully easy. It is a matter of noticing what is really needed and valued by the customer. That said, I just have to remember my more unexpected and memorable hotel visits—such as the one where my room backed up to a horse ranch—allowing me to feed several very friendly equine pals from my window (room service menu included raw carrots).

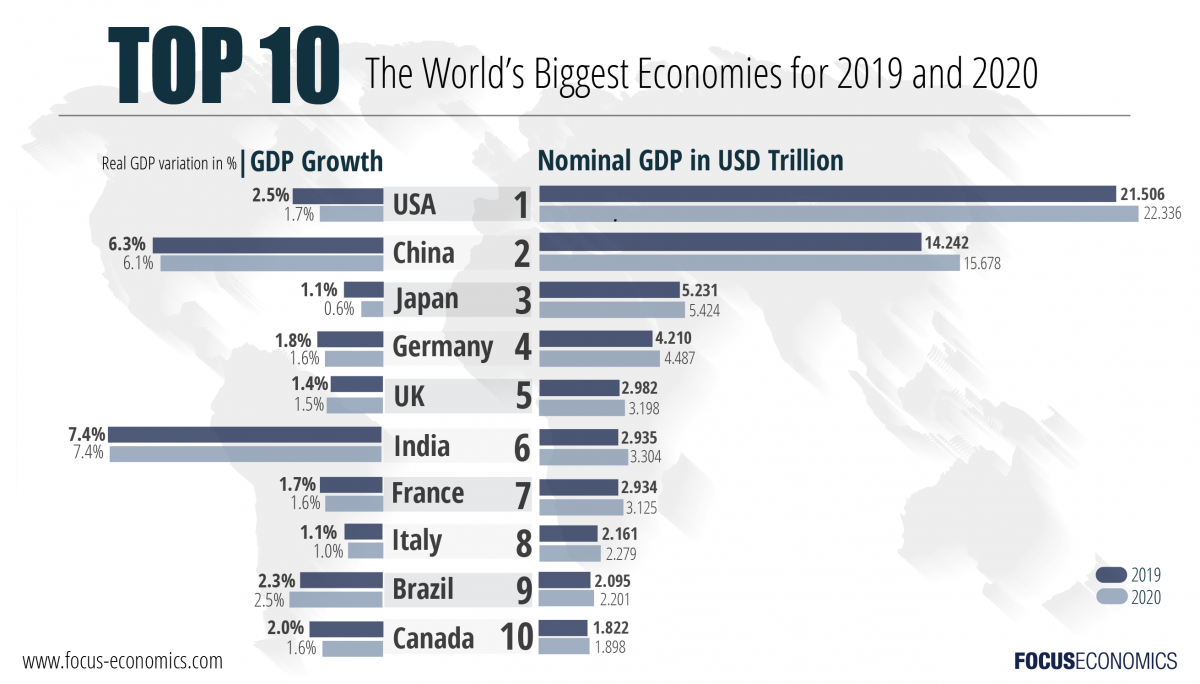

World's Biggest Economies

The big five has not changed in quite a while, but there may be a change taking place this year. If the estimates hold, the U.K. economy will falter due to the Brexit decision. That may be enough for India to leap into that fifth position. Some argue that France will overtake the U.K. as well—shoving Britain to number six or seven. The U.S. still maintains a dominant position with a GDP of $22 trillion—the other four in the top five add up to around $26 trillion collectively.