Strategic Global Intelligence Brief for January 4, 2019

Short Items of Interest—U.S. Economy

Momentum Shift

There is more evidence that 2019 will not be the repeat of 2018 that many had been hoping for. The latest edition of the Purchasing Managers' Index (PMI) fell sharply to 54.1. This was after a reading of 59.3 in November. A five-point loss is not common and comes as a result of far weaker export numbers than has been the case. It is important to remember, however, that any reading over 50 indicates expansion and the PMI is still a long way from the low point of 47.8 set back in January of 2016. The most distressing part of this decline is its connection to exports. The demand for U.S. goods is down sharply as the global economy slows, but there is also evidence that countries have been spooked by the trade and tariff wars and the strength of the U.S. dollar. It has simply become harder to do business with the U.S.

Key Issue in Today's Labor Report

By the time you read this, the December data from the Department of Labor will be out. We will know if there is a reason to remain calm or to start worrying a little more. The data from ADP suggested that private sector hiring was solid this month. If the official data shows that some 250,000 jobs have been added, there is reason to think the economy is continuing to grow. If the numbers fall to 150,000 or lower, this will be more proof that economic slowdown is underway and will reinforce the notion that a recession or at least a downturn is in the offing by the end of the year.

Why Presidents Stay Out of Fed Business

The criticism leveled at the Federal Reserve by President Trump is highly unusual and has been decried by economists and analysts as wholly inappropriate. One of the reasons the Fed should be left to act independently will be somewhat obvious soon. The slowdown noted in the economy has prompted the investment community to think that there will be no interest rate hikes in the coming year despite the assertion of the Fed at their last meeting that at least two more hikes were likely. If the Fed should decide that this slowdown is enough to cause a halt to the hikes, it now has to deal with the assumption that the Fed bowed to pressure from Trump. That is the very last message it wants to send. It is entirely likely the Fed will hike rates again even as the justification is not there as a means by which to assert their independence.

Short Items of Interest—Global Economy

Catholic Church Pushes for Fair Count

The election in the Democratic Republic of the Congo (DRC) is over and the vote count is scheduled for release this weekend. There is always deep concern that former President Joseph Kabila will twist the outcome to favor his hand-picked successor. After all, he has delayed that vote for over three years. The Catholic Church is very strong in the DRC. It deployed over 40,000 election monitors. They assert they know who won the election, but will not reveal this until the official count. It is their way of insuring that the official election team reports accurately.

Mexican Central Bank Worries About Inflation

The Mexican central bank pushed interest rates up to the highest point since January of 2009 despite the fact that there has been some faltering in the Mexican economy the past year. The reason for the push to 8.25% is a very stubborn rate of inflation and the expectation that this rate will get even worse. The rate has now hit 5% again and looks to soar higher. The major factor has been a push to hike the minimum wage dramatically—16% across the country and double the current rate along the border. This has driven costs up quickly.

Border Wall Fallacy

There may be emotional reasons to build a wall and there may be reasons that relate to appeasing the base, but the wall has nothing to do with border security—according to research by the Border Patrol. It urges more spending on manpower and surveillance and more attention to people who overstay their visa.

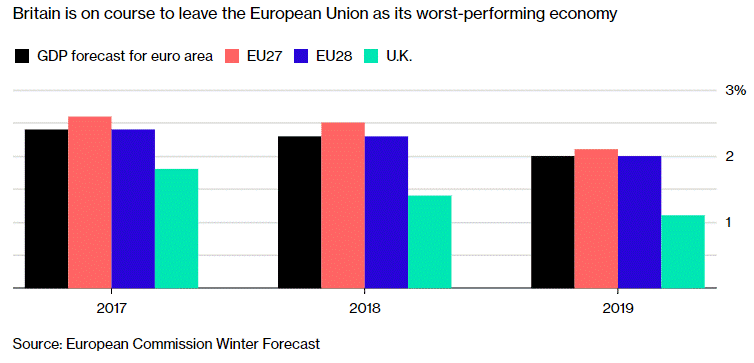

British Prospects for 2019 Not Good

The optimism that accompanied the initial decision to exit the EU has completely faded and has been replaced with varying levels of doom and despair. Even those who still think Brexit is a good idea have conceded they did not expect the impasse that now exists. It looks more and more likely there will be a hard exit—one that leaves almost the entirety of the U.K. isolated from the EU and leaves the fate of Ireland in limbo. Even if there is a last-minute deal of some kind, the expectation is that 2019 will be a very weak economic year. If the break is as dramatic as now appears likely, the country is going to sink into a full-fledged recession.

Analysis: The future for the U.K. economy has rarely been this uncertain. It is just 100 days before the U.K. leaves the EU and there is nothing approaching a real deal in sight. Prime Minister Theresa May negotiated the best deal available with an EU that was angry with the British and fully prepared to deal with a very hostile breakup. It is the opinion of the EU members that Britain has far more to lose in this breakup than they do. They have been unwilling to give the British any sort of economic edge.

The consensus view among economists is that the U.K. economy will struggle to reach 1.5% growth in 2019 and only if there is some kind of deal on Brexit. If there is a chaotic ending, the growth in the U.K. could well enter negative territory. The future of the economy will come down to how willing the government and the Bank of England will be to stimulate the moribund economy in a significant way. The problem is that much of the British economy remains tied to Europe—in terms of both exports and imports. It had been hoped that the U.S. would substitute for the Europeans, but the U.S. today is an isolationist and protectionist country with no interest in sacrificing anything for the U.K. There had been hope that Commonwealth nations might offer a substitute market, but these nations know that the U.K. is in a bind and there are no good deals on offer.

Imports will rise in price as the pound falls in value, but exports will not see a corresponding increase as Britain is not a consumer-export nation. The demand for the industrial goods that Britain produces has been sagging as the world economy starts to slow. There will likely be an exodus of British expatriates from the various European nations now that their tax status has altered. They will be the population the British least covet—the elderly and retired.

Perhaps the most worrisome issue is Ireland. If nothing is worked out, it will become necessary to impose formal border controls between Ireland and Northern Ireland. They will cut straight through towns and villages as well as farms and residents. The Irish on both sides of the border are furious. Britain as a whole worries that this brings back all the tension and violence from past years as there will be even greater pressure to unite. At the same time, the British will want that unity to stay intact so as not to invite the resumption of activity around independence for Northern Ireland or unification with the rest of Ireland.

What Happened to Macron?

It seems like only yesterday that President Emmanuel Macron of France was being hailed as the torch bearer for progressive and fair politics. His shocking victory in the presidential race was celebrated as a victory for the thinking French over the bullies and brutes that supported the neo-fascist policies of Marine Le Pen and the National Front. Today, he is the least-liked leader in Europe and has half the support President Trump has. Those who seek to challenge President Trump are looking at Macron to see what went wrong and what can be learned.

Analysis: At the heart of the issue is the fact there are very few real centrists left in any electorate. Appealing to that vanishing center is a largely inept policy. Macron promised everything to everybody, but that is impossible to deliver. When Macron failed to provide what some faction wanted, it felt betrayed and turned on him. The advantage that a President Trump has is that he never promises anything to any group other than his base and he sticks to that promise regardless of the outrage.

Those who are setting up to run against President Trump face the same pitfalls that Macron fell into. Macron promised steps to protect the worker and the common man so when he does anything that contradicts that promise, the workers turn on him. The Macron campaign promised an emphasis on green and reduction of climate change impact, so it was decided to reduce driving with higher fuel taxes. The people hurt by the higher prices are not interested in climate change and have been rioting in the streets for weeks.

Self-Fulfilling Prophecy?

The investment community has long had a problem that stems from the "observation effect." This is a situation in which the very fact that something is observed will change behavior. Those who study people in the workforce and their productivity found it really didn't seem to matter what innovation was tried, everything led to higher levels of productivity. More light, less light, colored lights, natural light—they all seemed to work equally well. Once the study was over, the productivity levels fell back to what they had been before—no matter what light was chosen. It seems that the very fact that people were being observed was the key. Some worked harder for fear of getting in trouble and others just seemed to appreciate the attention. The investment world works much the same way. As soon as investors start to respond to a belief or make assumptions, they tend to alter the world they have been observing and make it more likely their beliefs will prove accurate.

Analysis: Just two weeks ago, the Federal Reserve statements regarding 2019 were upbeat and confident. The assessment was there would be growth that would be close to that which had taken place in 2018. The statements suggested that unemployment would remain low, inflation would remain under control and growth would continue to stay close to that 3% level averaged last year. For a variety of reasons, the investment community has abruptly changed its mind and now assumes that economic progress in the coming year will be much less than in 2018. It has further concluded the Fed will not raise interest rates any further than they already are and perhaps will even lower them again by the end of the year. There has been nothing to suggest that the Fed shares this gloomy outlook—at least not yet.

It is not easy to pinpoint just what has investors nervous as there will be differing motivations for every kind of investor, but there are four issues that seem to come up most often. Two of them have been concerns for some time and are likely behind the volatility that has beset the markets of late. The other two concerns are newer and may be motivating the emerging assertion that the Fed will not hike interest rates as planned.

The first two concerns have been roiling the markets from the start of the Trump term—trade wars and debt/deficit. The trade and tariff wars seem to run hot and cold. One day there is a desire to impose strict tariffs on all imported steel and aluminum and the next day there is a move to give exemptions to nearly all the nations that ship these metals to the U.S. The Europeans are threatened with strict tariffs on cars and then the matter is dropped. The U.S. and China do seem headed for a series of confrontations that will negatively affect both the nations as well as the rest of the world. The issue of debt and deficit doesn't seem to motivate the politicians any longer, but the investment community has been affected by the staggering debt levels maintained by the U.S. There is ongoing concern that ever-larger debts will force the sale of more treasuries. That crowds out the private sector.

The latest new issue that has spooked investors and the business community as a whole is the confrontational approach Trump and the leaders of Congress have taken. There was some faint hope that President Trump would react to the new balance of power with deal-making—looking for common ground in order to advance parts of his agenda. There was an equally faint hope that the incoming Democrats would decide to table some of their most ardent criticisms of President Trump in order to build a record of getting things accomplished. That faint hope has been dashed with the fight over the border wall and government shutdown. It now appears that both sides are going to fight to the death on every issue. That will result in near total gridlock. A whole host of business and economic issues will be left in limbo.

The other new issue that has made investors more than a little uneasy is geopolitical in nature. The confrontations between the U.S. and its former allies in 2018 looks set to accelerate into the new year. The U.S. has picked fights with Canada, the U.K., France, Germany and Japan. Mexico now has a very left-leaning president while Brazil has a very right-leaning one. Elections in Israel may unseat or severely weaken Prime Minister Netanyahu. Britain seems likely to undergo a hard Brexit that could have far reaching implications for the U.S. In short, the global economy seems to be in flux. There is little faith in President Trump's ability or even interest in what happens in these nations.

Whether these are fair assessments or not, they have affected the mood of the investment community in a negative way. This is not to say attitudes can't change as there have been many positive developments in the U.S. over the last few months. The retailers had a very solid Christmas and consumer confidence has remained high. The majority of the objective numbers for the economy are still strong—everything from employment to capacity usage, durable goods activity and so on. Granted, there are many of these measures that are slightly less robust than they had been, but in general, they remain positive. This could be enough to shift the mood of the investor, but these shifts will have to come fast if the downward spiral is to be halted.

Mid-Sized Business Drives Job Growth

According to the latest data from ADP, the economy added another 276,000 jobs in the private sector last month. This is higher than had been expected given the fact that qualified people are in short supply and the retail hiring season has ended. The majority of these jobs have been provided by small- and medium-sized business as opposed to the larger corporations.

Analysis: The majority of the hiring has been in the service sector—health, business services and education-related occupations.

Friendships and Legacies

I got a very nice and thought-provoking note from a reader/friend the other day. She was commenting on my resolutions and was sharing some of the things she has focused on over the years, such as thanking strangers for what they are doing and acknowledging the work of the unsung. The one idea that struck me was making a point to make new friends especially among the older population.

I have an opportunity to speak to several groups with older attendees and I have noticed something about the cycle of life. It has started to happen in my life as well. As we age, we start to lose people. Our parents pass away. Then we start seeing our friends and colleagues pass on as well. Our friendship circle begins to contract. The older we get, the smaller it becomes. I have treasured the opportunities to talk to people who have lived full lives. I welcome the opportunity to share their memories and to become a new friend. I want to make a point of reaching out to those who may have seen their friendship circle diminish so that I can expand mine and theirs. I also hope that as I age there are those who still want to be a new friend. This applies to those who have left their home culture behind to start a new life in a strange land. Also, there are younger people who want to share their dreams and aspirations and people with very different interests who are willing to share them with me as I share mine with them. The idea is to keep broadening that friendship circle as long as possible.

Brexit

At the time of the Brexit vote there was an assumption made by many in the U.K. that turned out to be very inaccurate. It was thought the U.K. was a strong economy and one with which Europe would want to stay connected. It was assumed EU members would eagerly accept an arrangement that kept the U.K. economy in their orbit. This chart shows that Britain has the weakest economy in the region. The fact is that Britain has little leverage. It appears Europe can get along quite well without the Brits, and worst of all, the Europeans seem to know this all too well.