By Chris Kuehl, Ph.D., NACM Economist—

Short Items of Interest—U.S. Economy—

Durable Goods Orders Surprise

The expectation had been there would be a 0.3% decline after a similar decline the month prior. Instead, there was a nice jump of 2.4% in the demand for goods designed to last three or more years. The one caveat to be aware of is that almost all of this gain was due to the increased demand for defense goods. If one looks at the other levels of business investment, there was not much movement. The news on the manufacturing front has not been all that encouraging, but it has not been miserable of late either.

Moving in Two Directions at Once

The Fed moved to try to address two issues at once this week. On the one hand, it entered the repo market again with a nearly $50 billion repo agreement that involved $31.5 billion in Treasuries, $1.5 billion in agencies and $16.9 billion in mortgages in exchange for central bank money. At the same time, it engaged in a reverse repo with money market funds that took about $15.6 billion of liquidity out of the system. This has been yet another attempt to engage in some fine tuning and adds to the desire to get a policy in place for further Fed action. This has now become the main focus.

Case-Shiller Index Shows Gains in House Pricing

There have been predictions for the past few years regarding the future of the housing market. Thus far, they have not played out as expected. It was assumed by now there would be a decline in the price of homes due to expected changes in factors such as mortgage rates, unemployment and inflation. Yet, none of these have developed as expected and house prices keep rising. The latest Case-Shiller Index reading shows a 3.5% gain in November; this rise has been taking place in every large city and most of the smaller ones.

Short Items of Interest—Global Economy

Return to Power for Fianna Fáil in Ireland?

A few years ago, voters crushed the Fianna Fáil government in a fury over the collapsed economy. The party that had dominated Ireland for years was held responsible for the financial sector crisis and the subsequent humiliation of the bailout. Ireland had become part of the PIIGS (Portugal, Italy, Ireland, Greece and Spain), which was not where people were used to being. Now, it looks like Micheál Martin and the centrist party are poised to make a comeback as the population has become disenchanted with the Irish Fine Gael party and Leo Varadkar over the Brexit issue and the future of Northern Ireland.

Virus Spreads in China

Despite a relatively rapid response and a more forthcoming response from Beijing, the coronavirus continues to spread. China has been forced into more draconian steps such as banning travel within China itself. This has been nearly impossible to enforce given this is Chinese New Year, but it seems many people are unwilling to chance these trips even as they are forced to ignore tradition. The impact on the economy is unclear at this point, but estimates hold that growth may dip by as much as .05% due to the outbreak.

Points System in the U.K.?

One of the primary motivations for British popular support for Brexit was the issue of immigration. Many in the U.K. resented the significant increase in migration from Eastern Europe and other parts of the world through Europe. This remains a very sticky issue in the Brexit talks. It now appears there are plans for an Australian-style points system that grants migrants the opportunity to relocate to the U.K. based on points. The aim is to encourage the arrival of those with needed skills and talents while rejecting those that lack them. There will also be an opportunity for those who have money to invest in the U.K.

Threat of Stagflation in China and India

The existence of stagflation—a period of both slow growth (stagnation) and higher costs and prices (inflation)—was once thought to be almost impossible by economists as it seemed the two issues would never be present at the same time. Inflation is a scourge triggered by growth out of control. It means there is such demand for commodities and workers and other inputs that prices inevitably rise in response to shortages and bottlenecks. If there is no, or slow, growth it would seem unlikely there would be too much demand and therefore the threat of inflation should be limited. Stagflation should be an aberration. This was a problem for many developed nations in the 1980s, but has since become less common. Today, the problem has started to loom in China and India—two nations that have been fast growers, but which are now slowing drastically.

Analysis: It was only a few years ago that China sported a double-digit pace for growth and India was nipping at their heels in terms of growth potential. China started to slip even before the trade war with the U.S., but since this confrontation, the pace of growth in China has fallen to half of what it was and into what looks like recession. There has been a decline in employment and revenue has slipped for many companies in China—especially those aimed at the export market. India had been expected to take advantage of China's issues, but the nation has been getting in its own way as Hindu nationalism has preoccupied the Modi government. That has slowed the economic reforms he promised as he came to office.

The emergence of stagflation can be a real crisis as there are no solutions that adequately deal with both issues at the same time. If the focus is on inflation, the tools tend to slow the economy. The central bank can hike interest rates and the government can try to pull back on the economy with spending cuts and higher taxes, but these will compromise growth as that is what they are designed to do. If the decision is made to deal with the stagnation issue, the central banks will lower rates and the government can add spending and lower taxes. That is a stimulus and one that will inevitably make inflation worse. The decision has to be made to address one or the other. If inflation is ignored, the population soon gets overwhelmed by high prices. If growth is ignored, there will be far higher rates of unemployment to contend with.

Given the history of the two nations and their traditional sensitivities, it is likely that China will elect to tackle inflation as opposed to slower growth. In past years, it has been the inflation spike that has infuriated and galvanized the public. In India, the issue is jobs over higher prices. The nation can't ignore a rising rate of unemployment for long. Watch for steps to bring prices down in China at the expense of growth and expect India to push faster growth even as it brings high rates of inflation.

Japan Remains Committed to Stimulus

The economic policy that has been dubbed "Abenomics" has had its share of critics over the term of Prime Minister Shinzo Abe. The goal has been to shake the decades of deflation and to get Japan growing. The Bank of Japan (BOJ) has been pushing rates lower and lower for years in an attempt to get the overall rate of inflation up to at least 2%; there have been suggestions it would tolerate rates even higher. That is not an issue at the moment as the inflation rate is nowhere near that goal despite the policies in place. In addition to those lower interest rates, there have been massive purchases of government bonds, negative overnight interest rates and caps on 10-year bonds at zero. There are those who assert this policy is driving potential inflation in the not too distant future, but thus far there has been little sign of it.

Analysis: The current board for the BOJ is made up of those who take a more or less neutral position on the stimulus plan and those who are described as "aggressive reflationists." They want to keep pushing harder and harder towards stimulating the economy. The latest nominee to the BOJ is another reflationist to replace the one who is stepping down.

The biggest challenge to the policy outlined by Abenomics is the Japanese consumer and to a degree the business community. It is very hard to get the consumer to spend in Japan. This is a culture of savers. When faced with any kind of financial threat, the first instinct is to save even more. The business community is not as reticent to spend, but they have been fighting a pronounced decline in demand from the export markets on which they depend. China has slowed, which takes a big bite out of demand and the U.S. is not the reliable trade partner it once was. There is a mounting trade war with South Korea, while Europe has been reducing demand as it struggles with its own issues of recession. It is simply not clear that easier access to money will make much difference.

What Makes One Community Grow Faster than Others?

This is clearly the billion-dollar question for those who are engaged in economic development or any sort of community planning. There are many reasons for growth or the lack thereof in a given city or community and there are many strategies and tactics employed by the development community. Even if there is a determination made regarding what would promote growth, it is not always easy to do what would seem to be indicated as these differing motivations can be highly mercurial. In general, there are three prime motivations for people to move to a given place and then stay there.

Analysis: At the very top of the list is employment. The U.S. remains a very mobile society. It is estimated that around 70% of relocations are based on employment—moving to where a new job has been offered. This is a very high number, but is actually a little less than was the case even a decade ago. There are more options for people that would allow them to stay in their original communities and take a new job. This has been in reaction to the fact that it has become harder for people to move in recent years. The most important inhibitions include the need to stay close to elderly parents and other family members, the impact of blended families and the requirements of child custody, difficulty selling a house and that a spouse may not want to relocate.

The second motivation has grown in importance in the last few years. It has been most important to the millennial generation. Roughly speaking, it is the "cool" factor. There are places that have an appeal rooted in entertainment or lifestyle or some other draw. These growth patterns can be vexing in the extreme as there is an element of a fad where a given place is considered very hot until it isn't. Often, it is the very growth itself that causes these communities to lose their popularity. The rapid growth overwhelms the infrastructure and it becomes harder to live there. If the draw was beauty or some kind of local charm, it can be destroyed by overuse and overcrowding and the popularity fades.

The third motivation is small as compared to the other two, but it can be very significant in a given place. It is based on cultural affinity and motivates many who immigrate into the U.S. If one is new to a nation, there is a strong desire to be close to those who have similar histories and backgrounds. This has always manifested in the creation of enclaves of people of like history. There are still many such communities in the U.S. They gain population as people in the original homelands elect to join their friends, neighbors and relatives in their new home. This is the origin of all those "neighborhoods" of Italians, Irish, Chinese, and more recently of Vietnamese, Mexican, Russians, Indians and so on.

Delicate Moves Called for at the Fed

The Fed's Open Market Committee (FOMC) has all but declared it will not be messing with interest rates this year. There are several reasons for this position—everything from the lack of data to indicate a move would accomplish much to the balance between hawks and doves on the FOMC. This does not mean the Fed will be idle—it just means attention will be focused elsewhere. The most likely set of immediate decisions will revolve around the actions taken last year and early in 2020 to stabilize the overnight markets. The question is whether the Fed will continue to take these actions.

Analysis: The most important question is whether these steps are responsible for the market rally that has been seen thus far this year. It is obvious the actions played a role—that was the whole reason for the decision to pump in the money. The real issue is what happens if the Fed decides it has done enough and lets the system settle into a pattern. Does that end the market rally or worse yet, does this mean a correction? The sense at this stage is the Fed will step back a little, but will not abandon the plan altogether. It would also be willing to pump more cash into those overnight markets if the need arose again.

Easing Volcker Rule Restrictions

The debacle in the financial community that led to the recession in 2008 has been the trigger for a great deal of frantic activity designed to ensure "this will never happen again." The problem is that after a decade nobody is really sure what "this" is. There is more than enough blame to spread around—irresponsible lending practices, speculation by banks, foolish consumers, poor government decisions and just plain stupidity and greed. There have been many attempts to identify culprits and many new regulations imposed, but as is so often the case, some of these regulatory moves have done more harm than good.

Analysis: One of the new rules limited banks to owning less than 3% of a venture fund they would offer to their clients. It was assumed this investment would push banks to offer these funds to clients regardless of the health of the fund and in some cases, it was assumed that banks would even be willing to use that client money to bail out these funds in which they were heavily invested. Restrictions on hedge funds and private equity funds would remain. Those who want this change point out this rule has limited the ability of banks to support entrepreneurs as they are limited in their engagement with the venture funds that support these start-ups. The banks already engage in start-up support with no restrictions so it would seem that supporting them via a venture fund would be little different and no riskier.

Discovery

We can all agree that we lead busy lives and that it gets harder and harder to keep up with what is going on with our friends and neighbors. It is not that we are not interested, but the pressure of the day can be distracting. That is why I value those opportunities to finally have a few moments to just visit and catch up. In the last couple of weeks, there have been some rare opportunities while I have been on the road. Last night, it was in Orlando with a friend and his wife. We keep in touch through the year with the occasional email and I can count on him for the latest joke or funny meme. What I did not know was that this last year has been harrowing for his family. His latest grandson was an extreme premature baby—weighing just over a pound at birth. He spent the better part of four months in the hospital. That meant they spent the better part of their time in that same hospital.

All is well now and his grandchild is recovering from that rough start. It just reminds me that so many of us are dealing with very trying times. For the most part, we keep this to ourselves for fear of burdening others. I did not share much of my cancer battle a few years ago as I didn't want people to worry. There have been major tragedies in our lives and we often fail to ask for help. It is not that we expect people to do anything other than be there—in thoughts, in prayers, in spirit. We also tend to forget to share the good news and the good times. Just to get that latter ball rolling, there is the good news that my friend's grandson is going to be one handsome boy. There is also the news that my oldest grandson and wife will be having their first child any day now. I am sure he will be the perfect combination of both parents.

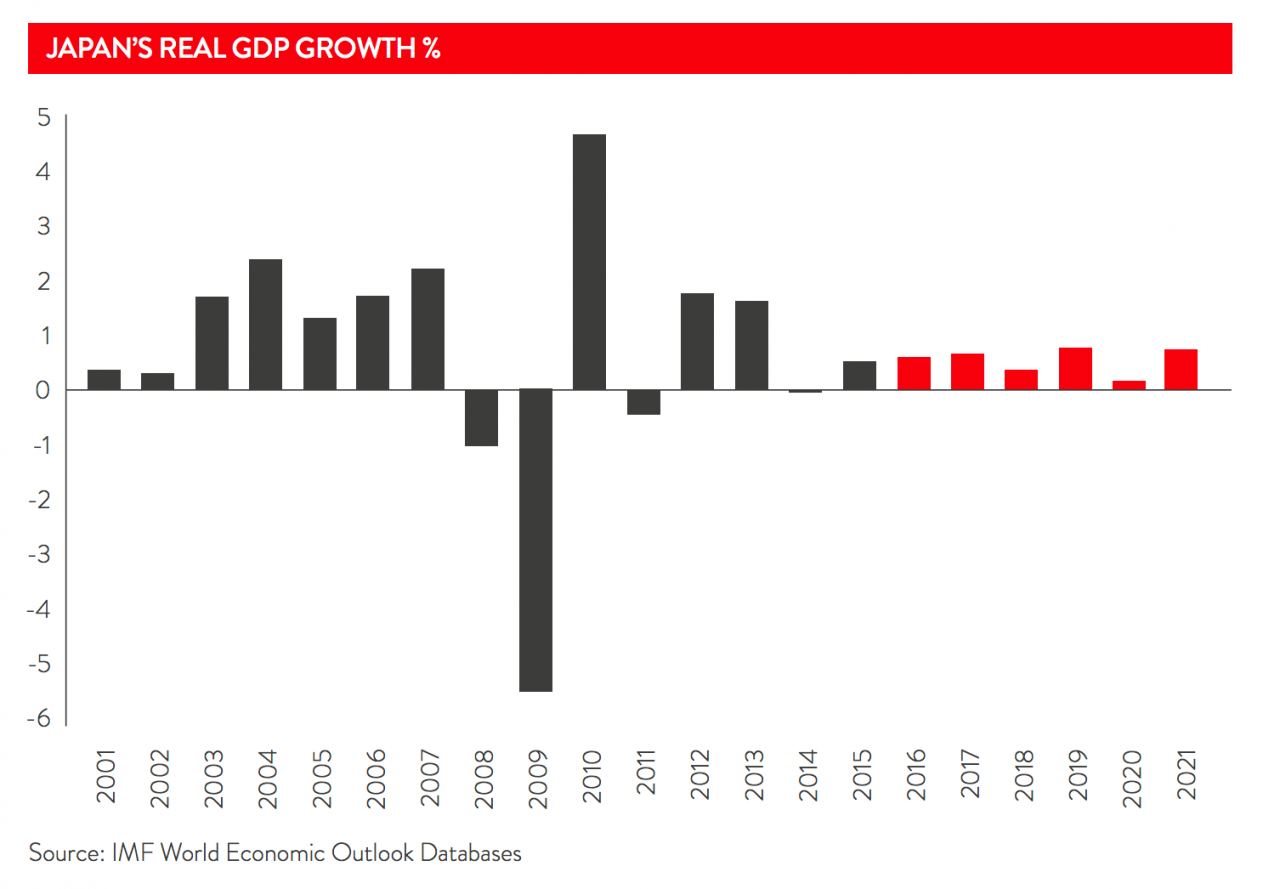

Japan's Real GDP Growth

The Japanese economy has managed to settle down in the last few years, but not at a particularly robust pace. The wild gyrations have ended for the most part. That is the expectation going forward, although it could change if the various trade issues are solved in a way that benefits Japan. The biggest gains would be made if the Chinese economy recovered and demand for Japanese exports rebounded along with it.