Strategic Global Intelligence Brief for January 18, 2019

Short Items of Interest—U.S. Economy

Jobless Claim Still Low

In the next few weeks, the jobless numbers are going to be very hard to interpret. This may be about the last week that claims can be assessed as an accurate indication of the state of the U.S. workforce. The government shutdown is dumping hundreds of thousands of federal workers into the unemployment lines—at least until the impasse is resolved. This means the number of jobless claims will rise sharply and it will appear that the job market has suddenly weakened. These workers will have to be separated out from those who are losing their jobs for more traditional reasons. The latest numbers show that the job market remains very strong as there have been very few layoffs. The real challenge in terms of employment is in hiring the wrong people.

Hiring the Wrong People

The addition of some 300,000 people to the rolls of the employed last month was a surprise as it was expected that no more than 100,000 would be added. The majority of those who were being hired were people who had been classified as discouraged workers. They are just now starting to enter the workforce—the reason that the U-3 unemployment rate crept up a bit at the same time the U-6 rate improved. The problem is that most of those who got jobs are basically unskilled and have been hired with the knowledge they will have to be trained. Based on past experience, about a third of them will wash out and fail that training, another third will get trained and then leave the original employer for another job. That leaves only a third staying with the job. The danger to watch for this year is a sudden drop in productivity as these are not the employees the company would have preferred to add.

The Real Danger of Student Debt

We have all heard the horror stories regarding mounting student debt. We know that this debt has slowed the housing market and has left a whole generation in financial distress, but the nuances are important here. There are basically two kinds of student debt. One is a great deal more dangerous than the other. Those students who used debt to pursue a solid education in a field that is in demand and completed their education will face very little difficulty in the longer run as they will get jobs that will allow them to pay off these loans. The students who started and failed to finish or those who enrolled in schools of questionable value will not get the jobs they need. They will be burdened by this debt through most of their working lives.

Short Items of Interest—Global Economy

Another Summit with Kim?

There have been new overtures from North Korea as Kim Jong Un seems to need another bout of global attention. The White House has been far less enthusiastic about this meeting and has been labeling the North Korean government a threat. It seems that the skeptics were right as they asserted that there would be no real concessions by Kim. The incentives were offered and delivered, but Kim has not engaged in any of the actions promised and has instead beefed up some of his military capabilities.

Migrant Family Separations

A government watch dog group has been reviewing the policy of separating migrant children from their families and found that the actual number of separations was close to three times the stated number of 2800. It seems the statistics in use only counted separations that took place after a June 2017 court ruling that required tracking. There remain thousands of minor children held in detention facilities; some for well over a year.

Global Caregiving Crisis

For many years, the issue was child care and employers were tasked with trying to accommodate parents. Now, the issue is the elder parent who has to be taken care of. These caregiving employees are often in much more crucial positions in a company.

What Next With the China Negotiations?

There are lots of issues that are vexing the U.S. economy as the year begins. The majority of what has been grabbing the latest headlines can only be described as self-inflicted wounds. The government shutdown has started to impact the GDP as it is peeling almost $200 million a day from companies that do business with the government. They will not be seeing any sort of reimbursement. The 800,000 employees will presumably be paid at some point and that money will then enter the economy, but the businesses they support with their consumption will not be getting that cash back. The clash between President Trump and the Democrats is a power play and personal. It could easily get worse. Meanwhile, there are much larger issues that are starting to heat up. One of those is the trade conflict with China.

Analysis: It is almost as if the domestic antics have distracted attention from what had been an intractable issue just a few weeks ago. Prior to the beginning of 2019, the status of the negotiations was best described as tense. Few had any confidence in the ability of either China or the U.S. to resolve the many differences that had emerged. What was predicted was a series of tit-for-tat threats. The U.S. would impose more tariffs on Chinese imports and China would immediately retaliate with tariffs on U.S. goods. The U.S. would step it up again and so forth. There was a sense that President Trump really just wanted China as an enemy to show that he was paying attention to his political base. Real economic issues and real trade implications seemed unimportant. That assessment may have been a little premature as there now seems to be some movement in the trade dispute. As is often the case, the motivation for this movement may be that both the U.S. and China have been experiencing pain from the confrontation and have an incentive to settle some of these differences. It is also entirely possible that these supposed overtures and compromises may be rejected by one or both sides and the whole conflict will emerge again—angrier than ever.

The issue that the U.S. has with China has come down to two broad areas. The first and arguably most important is the protection of U.S. intellectual property. The second issue is that the U.S. wants the Chinese to buy more from the U.S., and in more diverse sectors. There is reason to think China may be willing to budge a bit on both issues, but that will depend on whether the U.S. gives China any of what it wants. The Chinese are starting to suffer from the erosion of the U.S. market it has depended on for many years. The brutal fact is that there is no replacement for the U.S. consumer. China is well aware of this and it wants that access restored. It also wants the U.S. to back off on threats to impose more tariffs and to label China a currency manipulator. There are reasons to think the U.S. wants some of this as well. It has become obvious to any but the most economically naïve that the U.S. will never be in a position to produce the bulk of the goods it now imports from China and elsewhere. Not if there is a desire to keep consumers comfortable in their current lifestyle. The reality is the U.S. will import these goods from somewhere and it might as well be China provided the U.S. gets what it wants from the Chinese.

The Chinese now have considerable intellectual property of their own as witnessed by their placement of an object on the far side of the moon. These companies are preyed upon by the same groups in China that try to steal foreign technology. China will be developing tools to protect their own high-tech operations. Now it becomes a matter of demanding that these tools be used to protect U.S. companies (among others). There are, in other words, allies within the Chinese leadership that can be rallied to support some of the U.S. positions. The issue of buying from the U.S. is somewhat stickier, but progress seems to have been made here as well. The Chinese already buy a lot of U.S. farm output as well as machinery, but far less in terms of value than the U.S. buys from China. The U.S. wants to sell more food, but more importantly, there is a desire to sell more technology and machinery—provided there are those protections of intellectual property.

That the real issues have been explored is a good initial step, but there is nothing automatic about the process from this point. There are economic issues and there are political issues. President Trump gets a great deal of political mileage with his base when he engages in demonizing China. There are those in the Chinese leadership that despise the U.S. and want nothing more than to humiliate and defeat the U.S. in any way they can.

Brexit and the Wall

Both the U.S. and the U.K. are at an impasse. It is damaging both nations every day that the disputes drag on. In both cases, the issues have been essentially been taken hostage by symbolism and political gamesmanship with very few attempting to even seek a compromise position. Both issues are rooted in emotion and bias. This has made discussion of a solution next to impossible while leaving the leaders of both nations looking weak and petty.

Analysis: The partial government shutdown is starting to actually damage prospects for growth in the U.S. this year. It has been noted that $200 million is being lost every day. Businesses that contract to provide services and products to the government are going unpaid and 800,000 employees are without their pay. There are reports every day of irreparable damage to national parks and millions have been locked out of government institutions. The people charged with providing national security are going unpaid in the name of national security. The battle has begun to feel like toddlers fighting in their playpen as Democrats threaten Trump's State of the Union speech while he threatens to cancel Nancy Pelosi's travel plans.

In Britain the parliament has rejected the deal that Prime Minister Theresa May negotiated with the EU. The facts are about as clear as they can be made—Europe holds the cards here. They need the U.K. far less than the U.K. needs Europe. Those who backed Brexit poked the EU in the eye and rejected the core notions of the organization—free movement of European citizens and the expansion of regulatory authority to Europe as a whole. The U.K. has never been comfortable with that regulatory approach, but the issue that motivated the vote in the national referendum was immigration. In the U.K.'s case, it was objection to the arrival of the East Europeans seeking work. The EU remains angry at the U.K. and rejects the immigrant hostility. They are in no mood to give much ground to the British. Yet the pro-Brexit elements demand that May get a better deal. There is not one to be had.

The time for compromise was months and perhaps years ago. Now the issues have become so emotionally fraught that anyone who gives in will be facing the effective end of their political influence. President Trump has to break the Democrats on this issue or will have to face the prospect of losing a lot more such fights as the Democrats will have demonstrated what they can do if they stay unified. If the Democrats back down, they will have handed a victory to Trump and will weaken their positions on other issues. Most understand that the wall along the border is a boondoggle that even the Border Patrol doesn't want. Border security is not accomplished with a wall.

Losing on this battle damages either side. Brexit is the same. There were opportunities at the beginning to create a trade relationship between the EU and the U.K. that would look similar to Norway's, but it was rejected by the hard-core Brexit supporters who aim to create a hard withdrawal. It does not seem to matter that a hard exit from the EU will create a serious recession in the U.K. as it loses access to its largest trading partners. But the same political considerations are at play in the U.K. Giving in on Brexit is a capitulation in the eyes of the hard core as they are still motivated by anti-immigrant attitude and by their resistance to European regulatory influence. The anti-Brexit group is equally adamant and wants nothing less than a new referendum to reverse the decision that was made.

DRC Vote Declared Fraudulent

The fact that Felix Tshisekedi was named the winner of the vote in the Democratic Republic of the Congo (DRC) been challenged by a wide variety of groups. The latest to weigh in might have the most clout. The African Union (AU) has expressed "serious doubts" as to the outcome and has demanded an investigation into allegations of massive vote fraud. The Catholic Church in the DRC has already indicated their poll watchers found Martin Fayulu to have been the clear winner. The outgoing government of Joseph Kabila had delayed the vote for over two years and picked Tshisekedi as his successor. The assertion by the Fayulu campaign is that the election was totally rigged.

Analysis: What makes the AU statement that much more significant is that the head of the AU is Paul Kagame of Rwanda. His status among African states is very high. The DRC has had many border skirmishes with Rwanda in the past. It is a state that has vast resources that many would like to develop, but it is also in permanent crisis with internal and external wars. The nations that border the DRC desperately want some measure of stability in that country and had hoped that a relatively clean election would have provided that. There now seems to be a longer road to that hoped for stability.

How Well Did the Tax Cuts Work?

It has been said that if one lined up all the economists from end to end, they still would not reach a conclusion. That has rarely been as true as when discussing the impact of the 2018 tax cuts. There was most definitely an immediate and positive reaction to the cuts at first as there was additional capital investment and consumers spent more, but the impact was short lived. By the end of the year, the influence had largely faded. This was what worried many economists about the timing of the cuts.

Analysis: It is not unusual for government to use tax cuts to boost a sagging economy—it is part of the recession playbook. What is unusual is instituting these cuts when the economy was already starting to grow. The better time for a move like this would have been in 2014 or 2015. The fear was that this tax cut would look like a sugar rush—a boost of energy for a short period of time. That would be followed by a return to normalcy, which seems to be what has been happening. There is one more opportunity for the tax cuts to stimulate as the taxpayer will be getting the benefit of those changed tax rules this year as they file. It may well be that many more people will be spending those tax refunds.

Decency

It is an intangible. What exactly is decency—how would one describe a decent person? The dictionary definition is "behavior that conforms to accepted standards of morality and respectability." Some of the words that are associated with the concept are dignity, decorum and propriety. I have known many decent people in my life and have been lucky enough to have them as role models in my own family. My father and my grandfather were decent men—dignified and upstanding. My charming wife is a woman of decency and decorum. It means my life is surrounded with that quiet dignity. There was a time when many of those in public service could be described as decent people as well. I am from the part of the country that brought us the U.S. leaders such as Harry Truman, Dwight Eisenhower, Bob Dole and Jack Danforth [retired senator from Missouri]. I struggle to find people in politics that live up to that tradition.

It goes beyond the leaders we now find lacking in basic decency—too many of the rest of us also fall far short. Too many seem to reject all of those societal norms that allow us to live side by side. We have lost respect for each other and for the institutions on which we used to depend. Decent people respect others and they comport themselves in a way that shows they respect themselves as well.

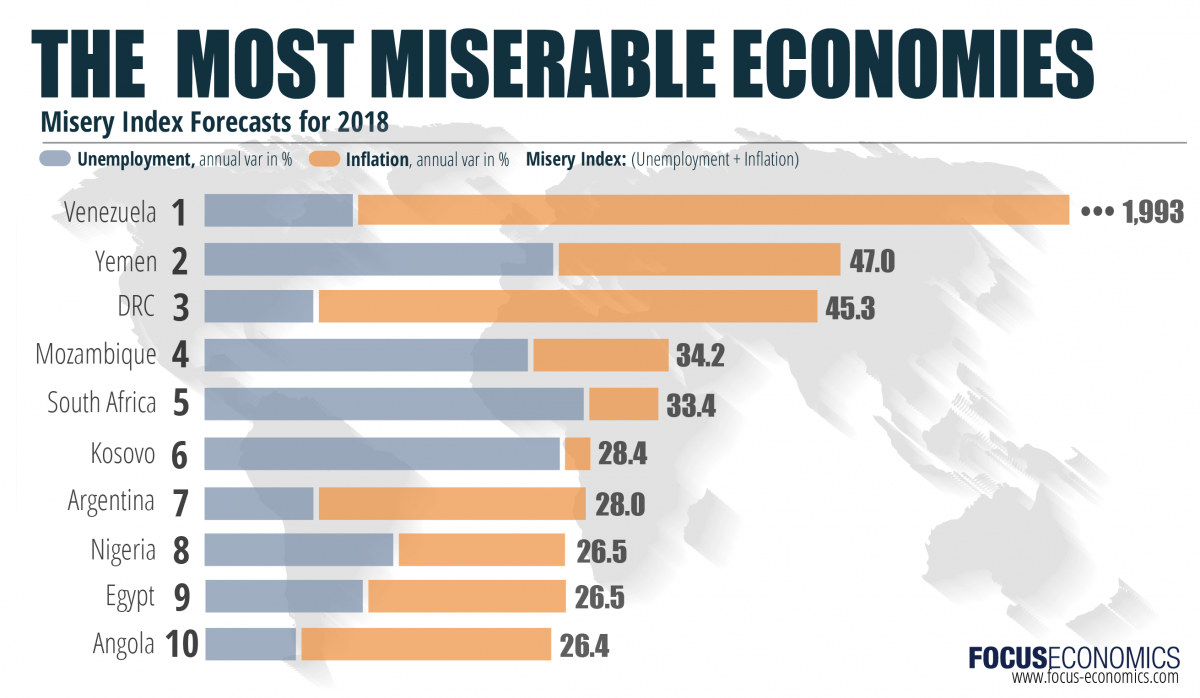

The Most Miserable Economies

The misery chart lists the DRC as the third-most miserable economy in the world—behind only the shattered states of Venezuela and Yemen. As with the tragic leadership of Nicolas Maduro, the issue in the DRC is runaway inflation that cripples any vestige of a banking system. The country essentially survives on barter and smuggled foreign currency. Corruption is deep and endemic and affects every aspect of the country as survival is impossible without it.